Get the free Form 8868 - Extension for Tax-Exempt Organizations

Get, Create, Make and Sign form 8868 - extension

How to edit form 8868 - extension online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8868 - extension

How to fill out form 8868 - extension

Who needs form 8868 - extension?

Form 8868 - Extension Form: A Comprehensive How-to Guide

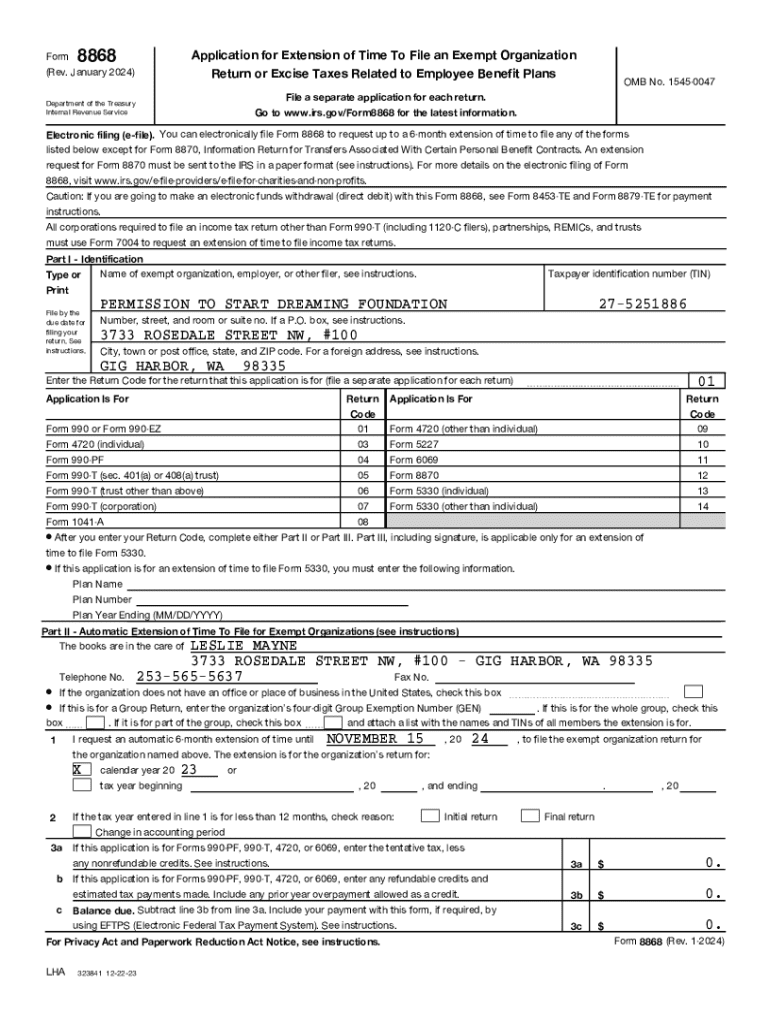

Overview of Form 8868

Form 8868 is an essential document utilized by tax-exempt organizations in the United States to request an automatic extension of time to file their annual returns. This form is particularly significant for organizations such as charities, foundations, and other non-profit entities required to report their financial activities to the IRS. By filing Form 8868, organizations can ensure they meet compliance requirements while also providing themselves additional time to prepare their returns accurately.

The purpose of Form 8868 is to facilitate the management of deadlines for tax-exempt organizations that may be struggling to complete their filings on time. This guide will delve into the specifics of the form, explaining its importance, eligibility criteria, filing timelines, and the overall process required to successfully submit the form.

Understanding the importance of Form 8868

Filing for an extension using Form 8868 is crucial for many organizations that experience complexities in their financial operations, which can lead to delays in filing. These delays could range from comprehensive accounting reports to unforeseen organizational changes. By allowing additional time for filing, organizations can avoid penalties and ensure accuracy in their submissions.

The benefits of using Form 8868 extend beyond simply avoiding penalties; they include better preparedness, reduced stress, and the opportunity to gather necessary documents for accurate reporting. By requesting an extension, tax-exempt organizations can reflect their financial activities more precisely, which ultimately fosters trust and transparency with their stakeholders, including donors and members.

Who is eligible to file Form 8868?

Eligibility to file Form 8868 is primarily restricted to tax-exempt organizations recognized under Section 501(c)(3) and others that fall under various sections of the Internal Revenue Code. This includes charities, religious organizations, and numerous social welfare groups. However, certain criteria must be met to utilize this form effectively.

Specifically, an organization must be up to date on all filing requirements for prior years. This includes having filed all necessary forms for previous years as required by the IRS. Organizations that fail to comply with this prior filing obligation may not be permitted to file for an extension through Form 8868.

Timeline for filing Form 8868

Understanding the timeline for filing Form 8868 is critical for organizations seeking an extension. The IRS generally requires Form 8868 to be submitted by the original due date of the organization’s tax return. For most tax-exempt organizations, this date is typically the 15th day of the 5th month after the end of the organization’s tax year.

An automatic extension of six months can be obtained by timely submitting Form 8868, allowing organizations to take their time during what can often be a challenging and busy filing period. Importantly, organizations that file Form 8868 will receive an extension for their Form 990, regardless of whether they meet all the specific filing criteria required for other extensions.

Information required to complete Form 8868

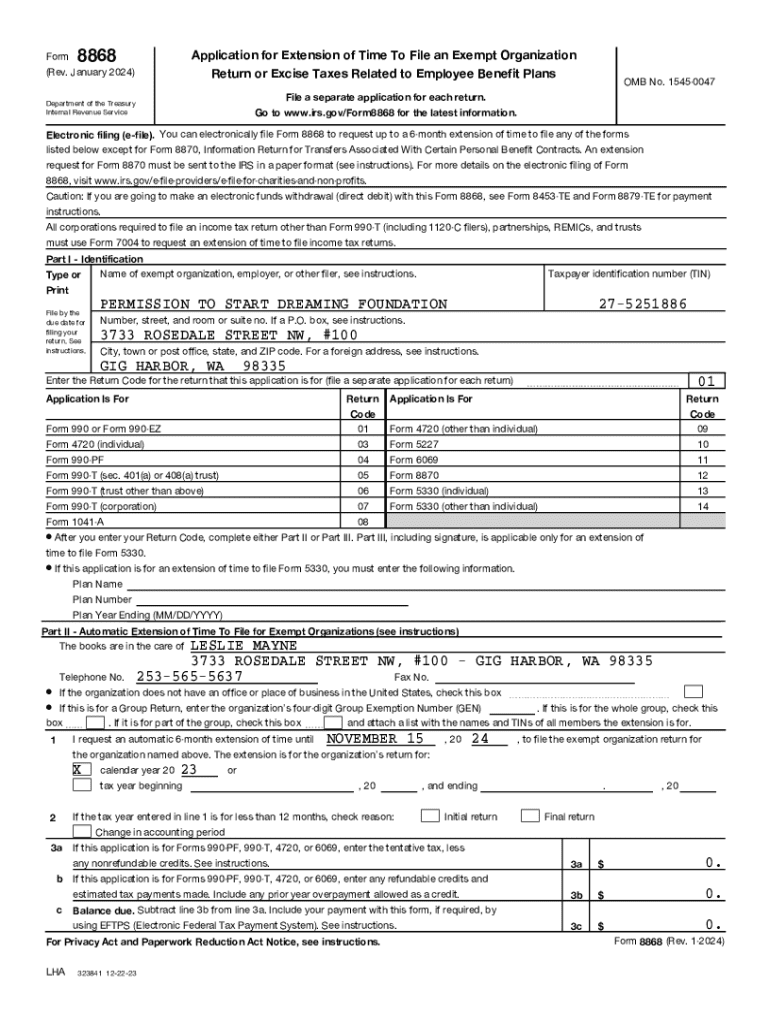

Completing Form 8868 necessitates several critical pieces of information to ensure a smooth submission process. First and foremost, organizations must provide identifying details, including their name, address, and Employer Identification Number (EIN). Additionally, information regarding the tax year for which the extension is being requested must also be included.

Organizations should also specify whether this is their first extension request. This is important as it informs the IRS about any previous extensions that might affect the current filing status. Ensuring all these details are accurate is essential to avoid delays or rejections in the process.

Steps to complete Form 8868

Completing Form 8868 can be efficiently organized into a series of clear steps. These steps are as follows:

Detailed instructions on filling out specific sections

Filling out Form 8868 involves several distinct parts that require careful attention. Each portion requires specific information that plays a crucial role in the filing process.

Part : Identification

In Part I, you must provide the full name of the organization, the mailing address, and the EIN. These identifications are vital for verifying the organization’s tax records and maintaining accurate correspondence with the IRS.

Part : Automatic extension of time to file

This portion explains the conditions under which an organization can receive an automatic extension. It’s crucial to indicate if this is the first extension; if not, organizations must include all previously filed extensions to avoid complications.

Part : Extension of time to file Form 5330

This part is reserved for organizations seeking additional time specifically to file Form 5330, which relates to certain excise taxes. Detailed instructions for filling out this section can significantly streamline the filing process.

Changes to Form 8868 for the 2024 tax year

As with any tax-related form, changes may occur based on annual updates from the IRS. Notably, for the 2024 tax year, organizations should anticipate potential updates that could affect various sections of the form. Keeping abreast of these changes is not merely recommended; it’s vital to ensure that filings remain compliant.

Organizations can usually access information regarding these updates directly through IRS announcements or by consulting tax professionals. Understanding the implications of these updates also aids in the timely and accurate completion of Form 8868.

Common errors to avoid when filing Form 8868

Filing Form 8868 is not without its pitfalls, and avoiding common errors is essential for a successful extension request. One prevalent mistake includes providing incorrect identifying information, such as the EIN or mailing address, which can lead to delays or rejections.

Additionally, failing to indicate whether it's the first extension can result in confusion. Organizations should also ensure that they are up to date on previous filings, as any lapses can prohibit the ability to file for an extension. Meticulously checking the form before submission can significantly reduce the likelihood of encountering these issues.

Frequently asked questions about Form 8868

Many organizations have questions regarding the specifics of Form 8868. Common inquiries include timelines for submission, eligibility for extensions, and what to do if filing deadlines are missed. It's essential for organizations to consult IRS resources or tax professionals to clarify these queries.

Understanding the implications of filing Form 8868 will help organizations maintain compliance, alleviate stress associated with filing errors, and foster greater confidence in their tax practices.

Utilizing pdfFiller for your Form 8868 needs

pdfFiller is an invaluable tool for managing the completion and submission of Form 8868. The platform empowers users to edit PDFs seamlessly and eSign documents with ease, making it a preferred choice for individuals and teams managing complex forms.

With features designed for collaboration, pdfFiller allows organizations to work together efficiently on their filings. Users can share forms with team members, set permissions, and ensure everyone is on the same page during the document management process. This level of integration reduces errors while enhancing accuracy and compliance.

Important reminders and final tips

A few crucial reminders for organizations looking to file Form 8868 include double-checking deadlines and ensuring all necessary details are included in the submissions. If filing electronically, be certain to save a digital confirmation for your records.

Additionally, consider setting internal reminders for future filings to streamline the process and manage compliance proactively. All of these practices contribute to the overall efficiency of tax management for tax-exempt organizations.

Future developments related to Form 8868

As the regulatory landscape evolves, organizations should remain vigilant for any future developments concerning Form 8868 and the filing requirements associated with it. IRS guidelines may shift, impacting timelines, fees, and filing requirements.

Staying informed about these potential changes will enable organizations to adapt their filing processes proactively, minimizing disruptions and ensuring compliance remains seamless.

Data privacy considerations for Form 8868 submissions

In managing sensitive forms like Form 8868, understanding data privacy rights is of utmost importance. Organizations must ensure compliance with regulations such as the Privacy Act, which safeguards personal information provided to federal entities, including the IRS.

For organizations submitting Form 8868, abiding by the Paperwork Reduction Act Notice also helps in managing the data efficiently, enhancing security protocols tied to document management. This focus on data privacy not only protects organizations but also reassures their stakeholders about the integrity of shared information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8868 - extension to be eSigned by others?

How do I edit form 8868 - extension straight from my smartphone?

Can I edit form 8868 - extension on an Android device?

What is form 8868 - extension?

Who is required to file form 8868 - extension?

How to fill out form 8868 - extension?

What is the purpose of form 8868 - extension?

What information must be reported on form 8868 - extension?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.