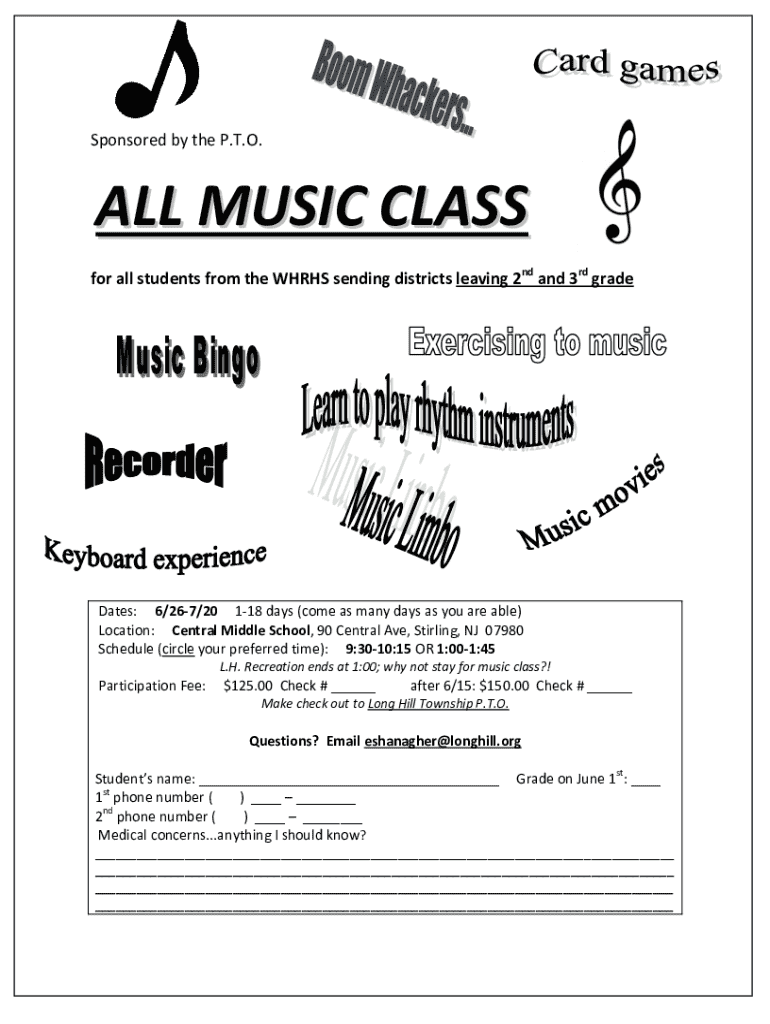

Get the free Sponsored by the P

Get, Create, Make and Sign sponsored by form p

Editing sponsored by form p online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sponsored by form p

How to fill out sponsored by form p

Who needs sponsored by form p?

Sponsored by Form P Form: The Complete How-To Guide

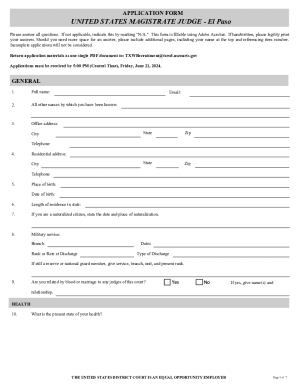

Understanding the Form P

Form P is a critical document used for various purposes, particularly in tax reporting and legal documentation. This form serves to collect essential data that is relevant in financial and legal contexts, ensuring compliance with regulations and allowing individuals or teams to effectively manage their obligations. Its relevance spans across personal finance, business operations, and legal processes, showcasing its versatility.

For individuals and teams alike, mastering the use of Form P is vital. It streamlines the process of gathering necessary data and ensures that all necessary information is accurately presented. Failure to properly complete or submit Form P can lead to complications, making it critical to understand its components and best practices.

Detailed breakdown of Form P components

The structure of Form P is designed to facilitate ease of use while collecting important information. Familiarizing oneself with the key components of this form is essential for accuracy and completeness. Let's explore the essential sections that make up Form P.

Completing Form P can be straightforward, but there are common pitfalls. Missing information, incorrect values, and misunderstanding instructions can all lead to issues that could complicate tax filings or legal situations. It’s paramount to pay careful attention to each section to avoid such errors.

Step-by-step guide to completing the Form P

Having a systematic approach to filling out Form P significantly eases the process. Preparation is key; gathering all necessary documentation ahead of time can prevent last-minute scrambles.

Once prepared, begin filling out the form section by section. Pay thorough attention to each part: start with your personal information, then detail your financial data and finally attach supporting documents. After completing your Form P, review it meticulously.

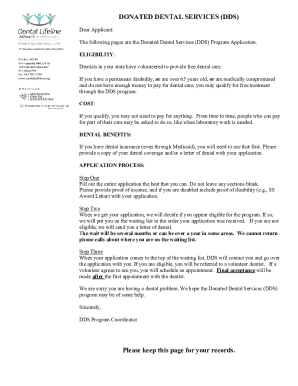

eSigning and managing your Form P

In today’s digital age, eSigning has become a crucial part of the documentation process. Signing Form P electronically not only saves time but also offers a layer of security.

Once eSigned, managing your completed Form P is next. Storing documents securely is vital to protect sensitive information. Utilize cloud-based storage options for easy access and enhanced security.

Interactive tools for Form P

Today, many online platforms enhance the Form P experience, making it easier to edit, collaborate, and manage forms effectively. pdfFiller, in particular, provides an array of features that simplify the form-filling process.

Tracking changes in Form P is equally important. By maintaining a log of edits and utilizing the revision history, users can ensure that all modifications are documented, which is particularly useful for future reference or audits.

Frequently asked questions about Form P

One of the best ways to clarify your understanding of Form P is through frequently asked questions. These inquiries often highlight the concerns individuals face regarding the form.

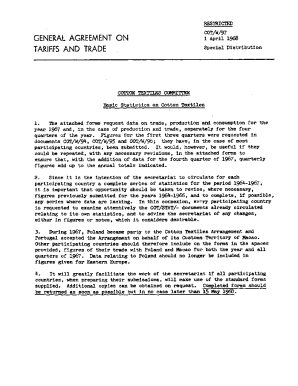

Related forms and templates

Familiarizing oneself with related forms can enhance your understanding of Form P. Comparing it with other forms, such as Form E, can elucidate differences and enhance your expertise.

Real-world applications of Form P

Illustrating the practical applications of Form P can shed light on its importance. Numerous case studies showcase how individuals and organizations have successfully navigated tax and legal challenges using this form.

Additional considerations

When working with Form P, it’s also essential to consider broader implications, including security concerns and potential updates to the form itself. As digital documentation continues to evolve, so do the requirements and best practices for forms like Form P.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sponsored by form p directly from Gmail?

How can I modify sponsored by form p without leaving Google Drive?

How do I complete sponsored by form p on an iOS device?

What is sponsored by form p?

Who is required to file sponsored by form p?

How to fill out sponsored by form p?

What is the purpose of sponsored by form p?

What information must be reported on sponsored by form p?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.