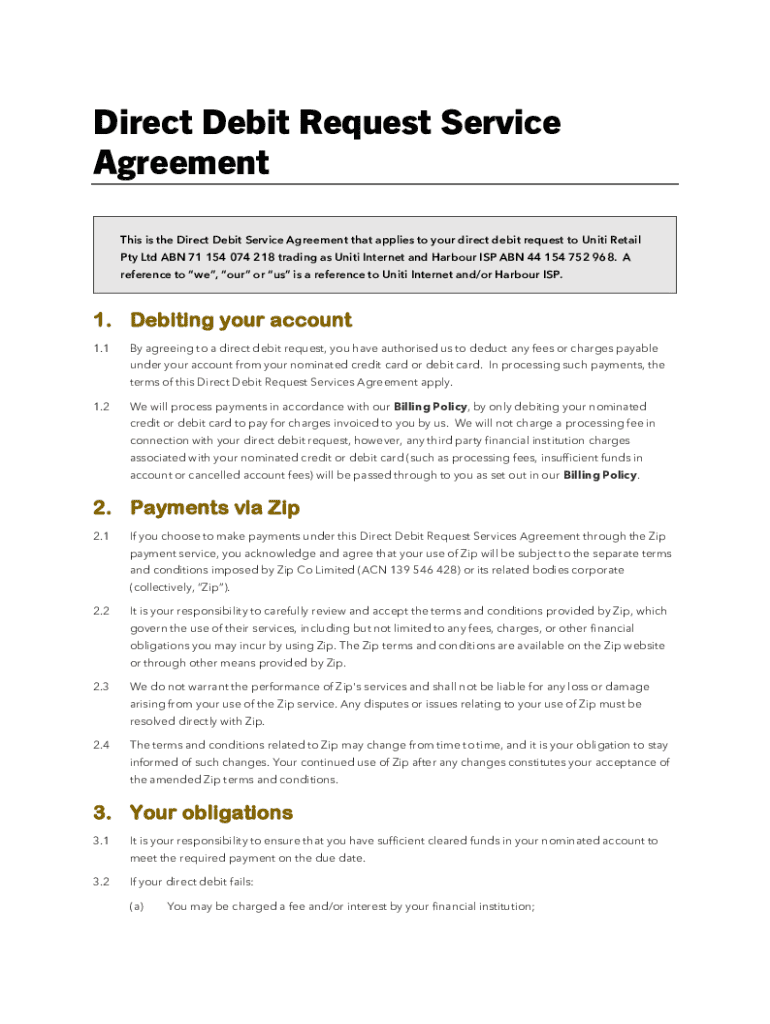

Get the free Direct Debit Request Service Agreement Ocwen Energy ...

Get, Create, Make and Sign direct debit request service

How to edit direct debit request service online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct debit request service

How to fill out direct debit request service

Who needs direct debit request service?

Comprehensive Guide to Completing a Direct Debit Request Service Form

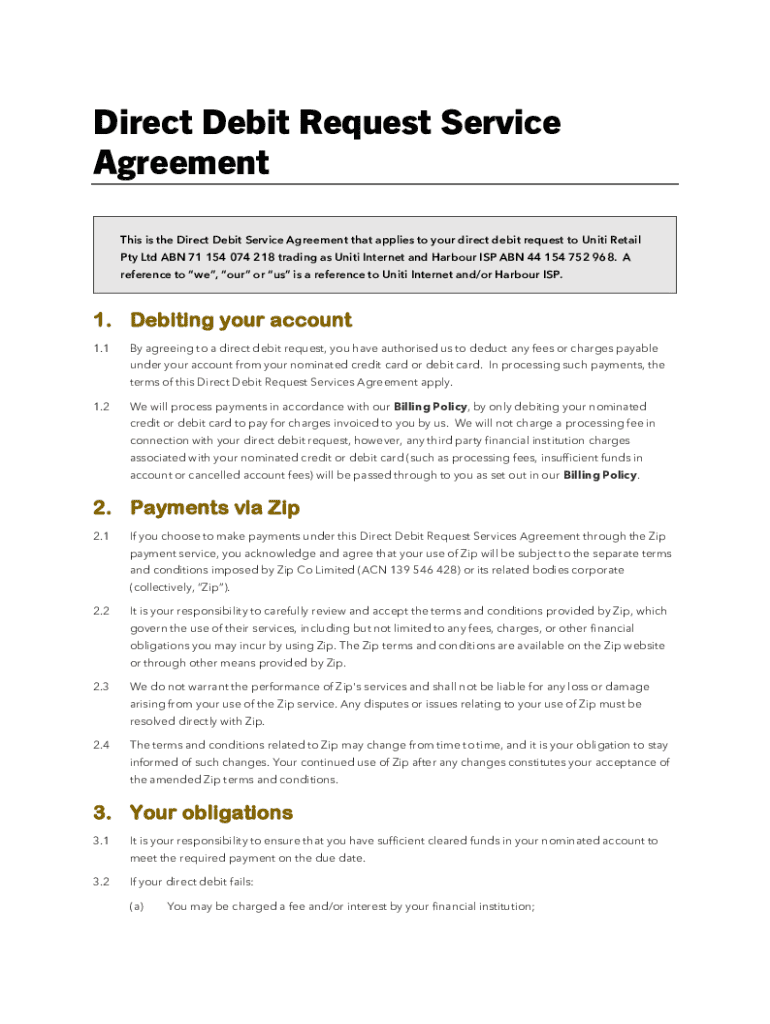

Understanding direct debit

Direct debit is a financial arrangement where a debtor authorizes a creditor to draw funds directly from their bank account on an agreed-upon schedule. This method simplifies recurring payments, such as utility bills or subscriptions, ensuring that payments are made on time without manual intervention.

The importance of direct debits in financial management lies in their ability to streamline cash flow. Once set up, the concerns of missed payments or late fees are significantly reduced, as funds are automatically transferred. This arrangement also provides a clear budget framework, allowing better financial planning.

Here's a simple step-by-step explanation of how direct debits work: First, the debtor completes a direct debit request service form to authorize the creditor to deduct payments from their account. Next, the creditor processes this request and notifies the bank. Finally, on the specified dates, the agreed amounts are automatically withdrawn.

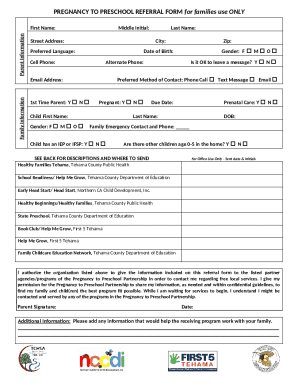

Direct debit request service form overview

The direct debit request service form serves to provide authorization for a creditor to withdraw funds from a debtor's bank account. This form is essential for both parties, ensuring that payments follow a clear and agreed-upon structure. The information contained within the form is crucial for safeguarding both the debtor's and creditor's interests.

Key components of the direct debit request service form typically include personal information, bank account details, and consent authorization. This serves not only to facilitate transactions but also to comply with regulatory requirements.

Anyone who makes regular payments, such as for bills, loans, or subscriptions will need to fill out this form to set up their direct debit arrangements.

Preparing to fill out the direct debit request service form

Before you begin filling out the direct debit request service form, it’s crucial to gather all required information. This preparation minimizes mistakes and ensures a smooth process.

Common mistakes when gathering this information include incorrect account details, missing signatures, or providing outdated contact information. Double-checking each entry can save time and prevent delays.

Step-by-step guide to completing the form

Completing the form accurately is integral to ensuring payments can be processed on time. Here’s a breakdown of the sections you need to fill out.

Section 1: Personal details

Start by providing your full name, current address, and contact information. Ensure there are no spelling mistakes and that your contact details are accurate for any follow-up communication.

Section 2: Bank account details

When entering your bank account details, be careful to input the correct BSB and account numbers. Errors in this section can lead to failed transactions, unnecessary fines, or payment rejections.

Section 3: Consent and authorization

This section involves your signature, which authorizes the creditor to withdraw payments from your account. It's essential to ensure this is signed and dated correctly; otherwise, the authorization may be invalid.

Section 4: Additional requirements (if applicable)

Check for any additional documentation or requirements that may be specific to your creditor. Some may require identification or verification documents to validate your request.

Editing and customizing your direct debit request form

Utilizing online tools such as pdfFiller can make editing the direct debit request service form incredibly user-friendly. This platform allows you to fill in fields easily, check for errors, and make adjustments as necessary without needing to print and rewrite.

By leveraging these tools, you ensure your submission meets all necessary standards and looks professional.

Submitting your direct debit request form

Once your direct debit request service form is complete, the next step is to submit it. Depending on your creditor's requirements, there are several options for submission.

After submitting, tracking your submission status is important. Many creditors will provide confirmation once your authorization is processed, but patience is key as this can take several days to finalize. Expect to receive notifications about the established payment schedule.

Troubleshooting common issues

Even with careful preparation, issues may arise concerning your direct debit authorization. Common problems include rejected payments or the need to change your banking information.

Document any communication related to your direct debit and keep an eye on your bank statements to confirm that payments are being made as planned.

Important considerations

When setting up a direct debit, it’s paramount to understand your rights and responsibilities as a debtor. This includes knowing how to dispute a transaction or what to do if you encounter difficulties with services.

Being informed helps foster a healthy relationship with your creditors and can prevent misunderstandings.

Helpful tools and resources

Various resources are available to help you manage your direct debit requests more effectively. pdfFiller offers interactive tools designed to streamline this process.

Using these resources can enhance your understanding and management of direct debit arrangements.

Final tips for managing direct debits effectively

To ensure your direct debits are managed effectively, it's important to stay vigilant about your financial transactions. Monitoring them regularly can help you catch errors early and keep your budget on track.

By staying proactive about your direct debits, you can ensure smooth operations in your financial commitments.

Contacting support

Whenever you encounter issues related to your direct debit request service form or need support, contacting customer service is a valuable option. pdfFiller offers multiple ways for users to seek assistance.

Being equipped with the right information can enhance your experience and minimize potential frustrations with direct debit management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my direct debit request service directly from Gmail?

How can I send direct debit request service to be eSigned by others?

How do I complete direct debit request service on an Android device?

What is direct debit request service?

Who is required to file direct debit request service?

How to fill out direct debit request service?

What is the purpose of direct debit request service?

What information must be reported on direct debit request service?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.