Get the free Form S-8 - Securities to be offered to employees in ... - ADVFN

Get, Create, Make and Sign form s-8 - securities

Editing form s-8 - securities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form s-8 - securities

How to fill out form s-8 - securities

Who needs form s-8 - securities?

Form S-8 - Securities Form: A Comprehensive Guide

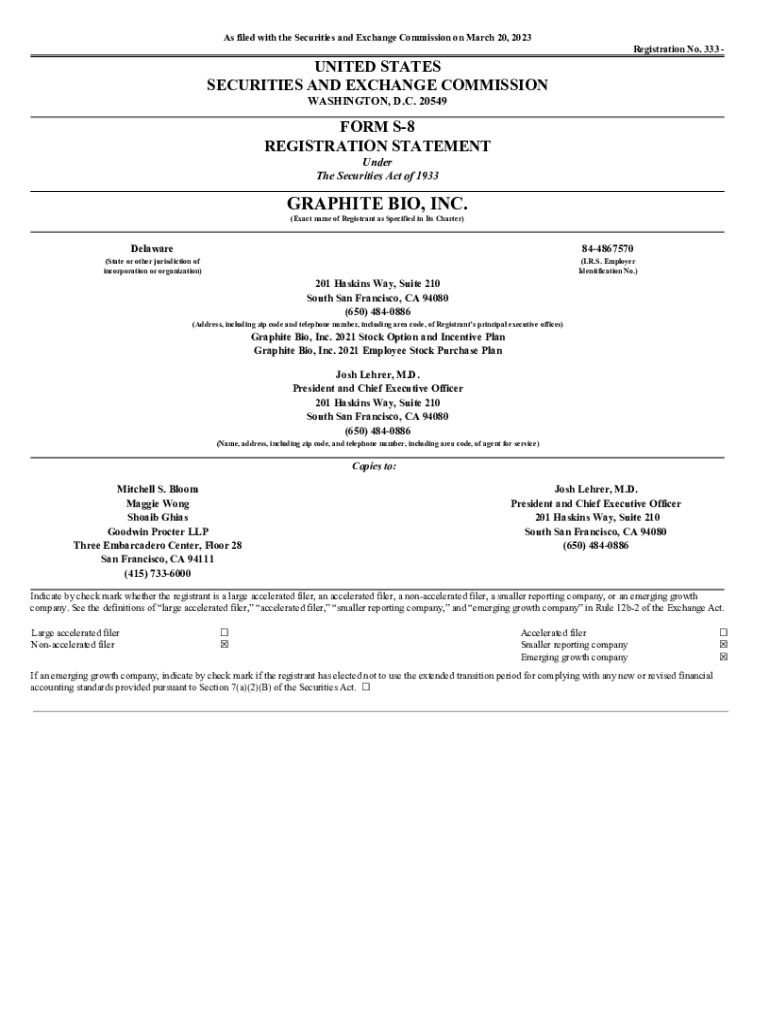

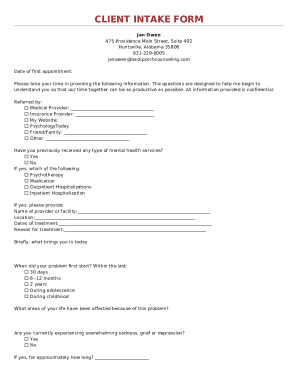

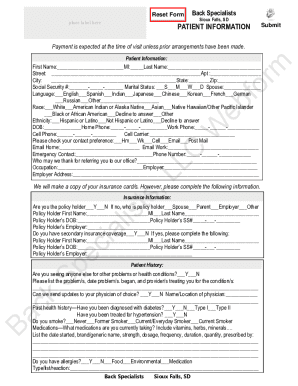

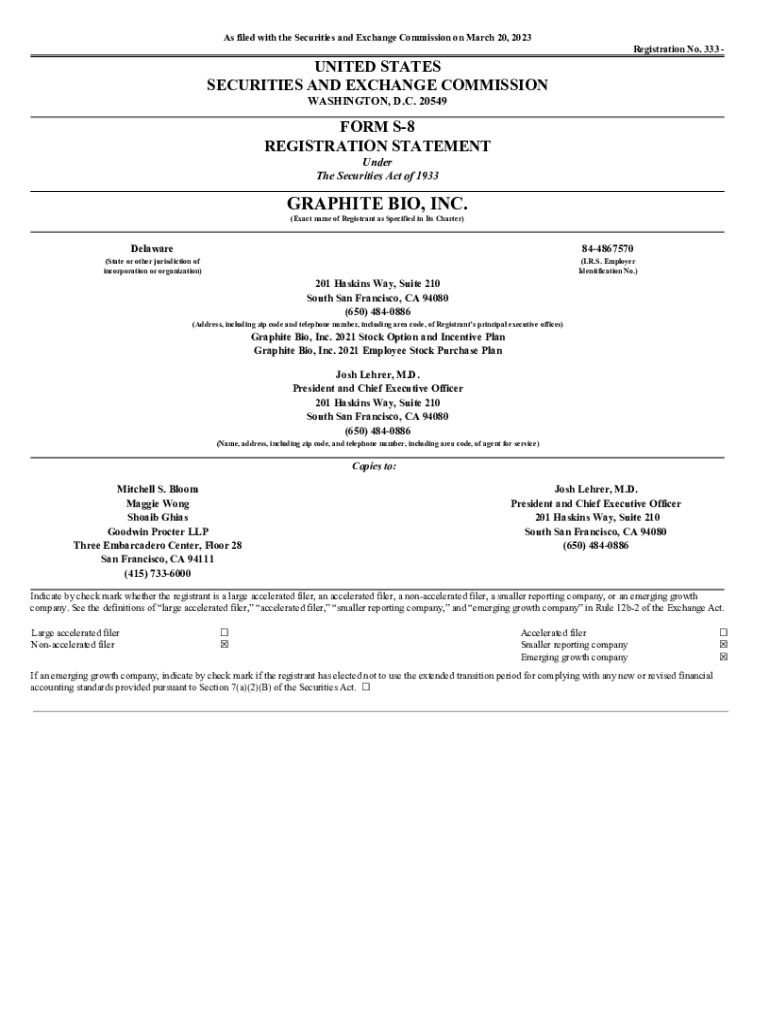

Understanding Form S-8

Form S-8 is a registration statement utilized by companies to register securities related to employee benefit plans, such as stock option plans and profit-sharing plans. The purpose of this form is to simplify the filing process, allowing for more efficient issuance of shares as part of employee compensation.

The significance of Form S-8 lies in its capacity to facilitate compliance with securities law while promoting employee ownership in companies. By enabling issuers to provide stock options and similar benefits without the onerous requirements typically associated with public offerings, Form S-8 helps attract and retain talent in organizations.

Importance of Form S-8 in employment and benefits plans

Form S-8 plays a vital role in ensuring that employee stock options and other benefits can be offered without intensive regulatory demands. This form facilitates the issuance of equity compensation, empowering employees to benefit from their contributions to the company's success.

In addition to employee stock options, companies can leverage Form S-8 to raise capital through employee benefit plans. This dual advantage reinforces the connection between a firm's financial health and employee satisfaction, which can ultimately enhance productivity and retention rates.

The Form S-8 filing process

Before filing Form S-8, issuers must prepare several key aspects. Gathering necessary information, such as the plan's specifics, employee eligibility criteria, and associated issuer details, ensures compliance with SEC requirements. Familiarizing oneself with the SEC's specific regulations can significantly ease the filing process.

To properly complete Form S-8, follow a step-by-step approach starting with detailed issuer information, plan names, and the number of shares being registered. The form includes sections requiring data on the plan's terms and the inclusion of required legal opinions. Incomplete filings are a common mistake that can delay processing.

Once the form is completed, it must be submitted electronically through the SEC's EDGAR system. Companies should adhere to submission deadlines to avoid penalties and maintain compliance.

Form S-8 considerations and best practices

Filing Form S-8 requires careful attention to detail. Compliance with SEC regulations is paramount, as inaccuracies could lead to challenging legal consequences. Issuers should double-check all entries for correctness and ensure that all necessary documentation is annexed to the filing.

Best practices include maintaining an organized record of all filings and schedules for renewals or amendments. Companies are encouraged to have an internal team review filings to confirm adherence to regulations. Regular updates to the filing based on plan changes will keep the issuer in good standing with the SEC.

Common pitfalls with Form S-8 filings

Filing Form S-8 can be a straightforward process if done with care, but many companies fall into common traps. Inaccuracies due to missing information or logistical oversights in completion are frequent issues. This not only complicates the filing process but can also taint the issuer's credibility.

The consequences of incorrect filings encompass legal ramifications, such as fines and refiled forms, which demand both time and resources. Companies need to prioritize education about the filing process to equip their teams against these pitfalls, emphasizing that vigilance in the filing process is essential.

SEC Form S-8 filing solutions

Utilizing tools like pdfFiller can enhance the experience of filing Form S-8. With capabilities for securely editing PDFs and eSigning documents, pdfFiller streamlines the filing process significantly. Collaboration features also allow teams to work together efficiently, avoiding miscommunication.

Interactive tools and online templates provided by pdfFiller give users quick access to necessary forms and offer guidance through the various steps of completion. These resources can significantly reduce the time needed to file and improve overall accuracy.

Real-life examples and case studies

Numerous companies have harnessed Form S-8 to align employee goals with organizational performance. For instance, tech firms have successfully implemented employee stock option plans that have not only increased employee motivation but have also driven company growth.

These case studies highlight lessons learned in leveraging Form S-8, showcasing the importance of transparency and cooperation between management and employees. Key takeaways include the necessity of clear communication and exhaustive training about equity compensation.

Frequently asked questions about Form S-8

As organizations prepare to file Form S-8, several common questions arise. Many newcomers to the process wonder about the specific information required and how it will be used by the SEC. Understanding what to include is vital to facilitate a smooth filing experience.

Additionally, clarifications regarding SEC regulations often come up. First-time filers may seek advice on where to begin and how to ensure compliance. Establishing a robust filing process from day one is essential to mitigate stress down the line.

Engage with our experts

For assistance navigating Form S-8 filings, pdfFiller offers specialized support. Engaging with our experts can provide you with personalized guidance throughout the filing process, ensuring that all aspects are covered and compliant.

With options to schedule consultations, teams can benefit from tailored advice specifically suited to their unique needs. Our experts are here to help you take control of your document management.

Stay informed with related resources

Explore additional resources offered by pdfFiller to enhance your experience with document management. Our suite of tools not only simplifies Form S-8 filings but also encompasses a broader realm of document handling solutions tailored for businesses.

Check out our blog for informative content on navigating the complexities of regulatory forms, compliance strategies, and document management best practices. Continuous learning can significantly benefit your organization as you adapt to evolving regulations.

Footer menu - pages

For quick navigation, explore the following links which provide easy access to key areas of interest related to Form S-8 and its filings. Connect with pdfFiller on social media, and subscribe to our updates for the latest information and tools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form s-8 - securities directly from Gmail?

Can I create an eSignature for the form s-8 - securities in Gmail?

How do I complete form s-8 - securities on an iOS device?

What is form s-8 - securities?

Who is required to file form s-8 - securities?

How to fill out form s-8 - securities?

What is the purpose of form s-8 - securities?

What information must be reported on form s-8 - securities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.