Get the free GOODS AND SERVICES TAX-II

Show details

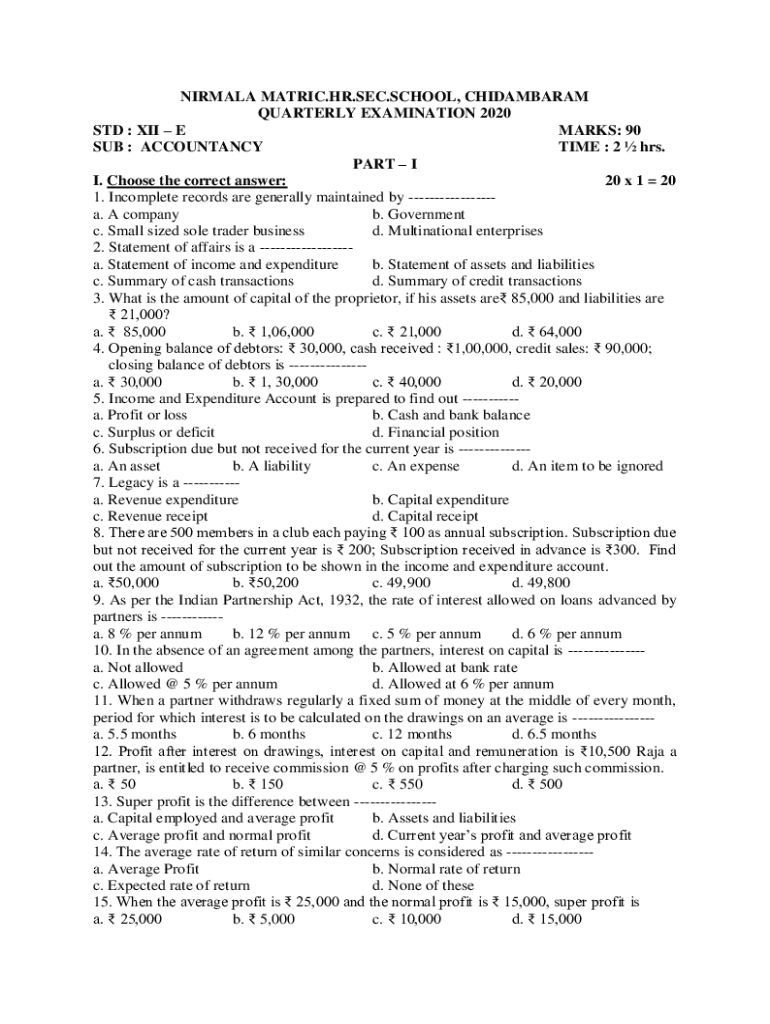

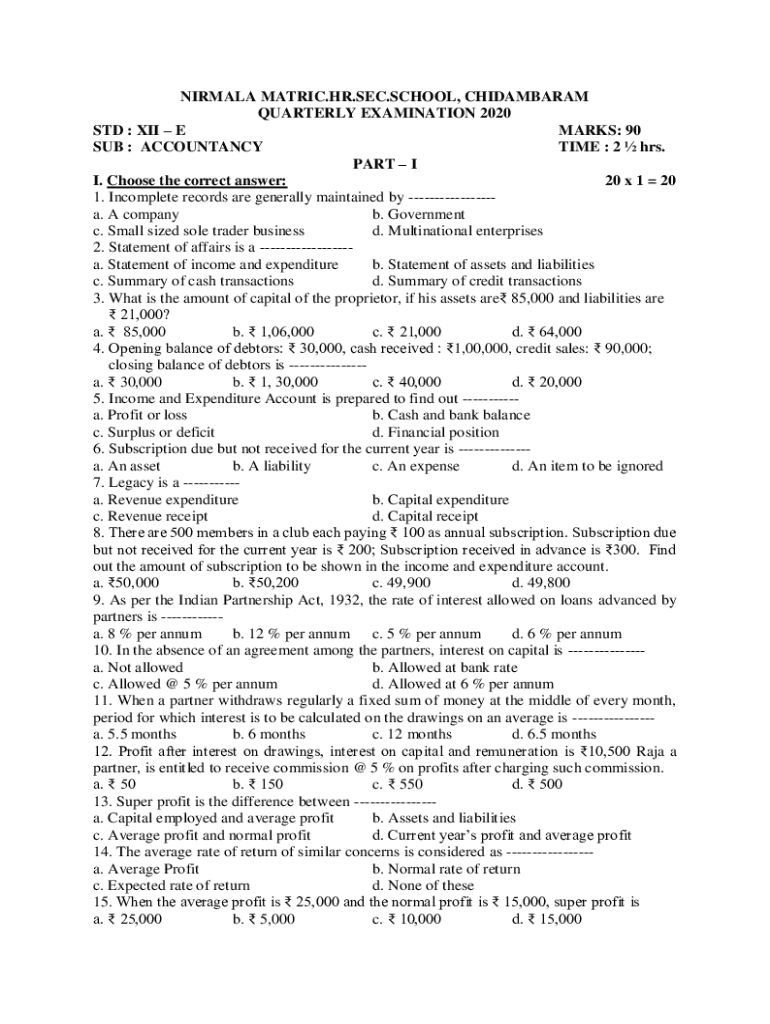

NIRMALA MATRIC.HR.SEC.SCHOOL, CHIDAMBARAM QUARTERLY EXAMINATION 2020 STD : XII E MARKS: 90 SUB : ACCOUNTANCY TIME : 2 hrs. PART I I. Choose the correct answer: 20 x 1 20 1. Incomplete records are generally maintained by a. A company b. Government c. Small sized sole trader business d. Multinational enterprises 2. Statement of affairs is a a. Statement of income and expenditure b. Statement of assets and liabilities c. Summary of cash transactions d. Summary of credit transactions 3

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign goods and services tax-ii

Edit your goods and services tax-ii form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your goods and services tax-ii form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit goods and services tax-ii online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit goods and services tax-ii. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out goods and services tax-ii

How to fill out goods and services tax-ii

01

Gather all necessary financial documents, including sales invoices, purchase bills, and expense receipts.

02

Determine the relevant GST slabs applicable to your goods and services.

03

Fill out the GST-II form with the required details, ensuring accuracy in the information provided.

04

Input total sales and purchases during the tax period.

05

Calculate the total GST collected on sales and total GST paid on purchases.

06

Subtract the total GST paid from the total GST collected to determine net GST payable.

07

Review the completed form for any errors or omissions before submission.

08

Submit the GST-II form by the due date, along with any payment if applicable.

Who needs goods and services tax-ii?

01

Businesses registered under the Goods and Services Tax (GST) regime.

02

Individuals or companies making frequent taxable supplies of goods and services.

03

Service providers who are required to pay GST on their service charges.

04

Anyone interested in claiming input tax credits on their business purchases.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my goods and services tax-ii directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your goods and services tax-ii and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for the goods and services tax-ii in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your goods and services tax-ii in seconds.

How do I fill out goods and services tax-ii on an Android device?

Use the pdfFiller mobile app and complete your goods and services tax-ii and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is goods and services tax-ii?

Goods and Services Tax-II (GST-II) is a tax system implemented in various countries that levies a tax on the supply of goods and services. GST-II is typically aimed at streamlining the taxation process, enhancing compliance, and reducing tax evasion.

Who is required to file goods and services tax-ii?

Businesses and individuals who supply goods and services that are taxed under GST-II are required to file this tax return. This includes registered taxpayers whose turnover exceeds a specified threshold, as well as those who voluntarily register.

How to fill out goods and services tax-ii?

To fill out GST-II, one must gather relevant financial data regarding sales, purchases, input tax credit, and output tax liability. The form typically includes sections for reporting taxable sales, exempt supply, and total tax payable. It should be filled accurately and submitted within the prescribed deadlines.

What is the purpose of goods and services tax-ii?

The primary purpose of Goods and Services Tax-II is to create a unified tax framework that simplifies tax collecting processes, ensures compliance, reduces cascading taxes, and promotes fair competition among businesses.

What information must be reported on goods and services tax-ii?

The information required includes details of sales and purchases, the total tax collected and payable, input tax credits claimed, exempt supplies, and any adjustments related to previous tax periods.

Fill out your goods and services tax-ii online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Goods And Services Tax-Ii is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.