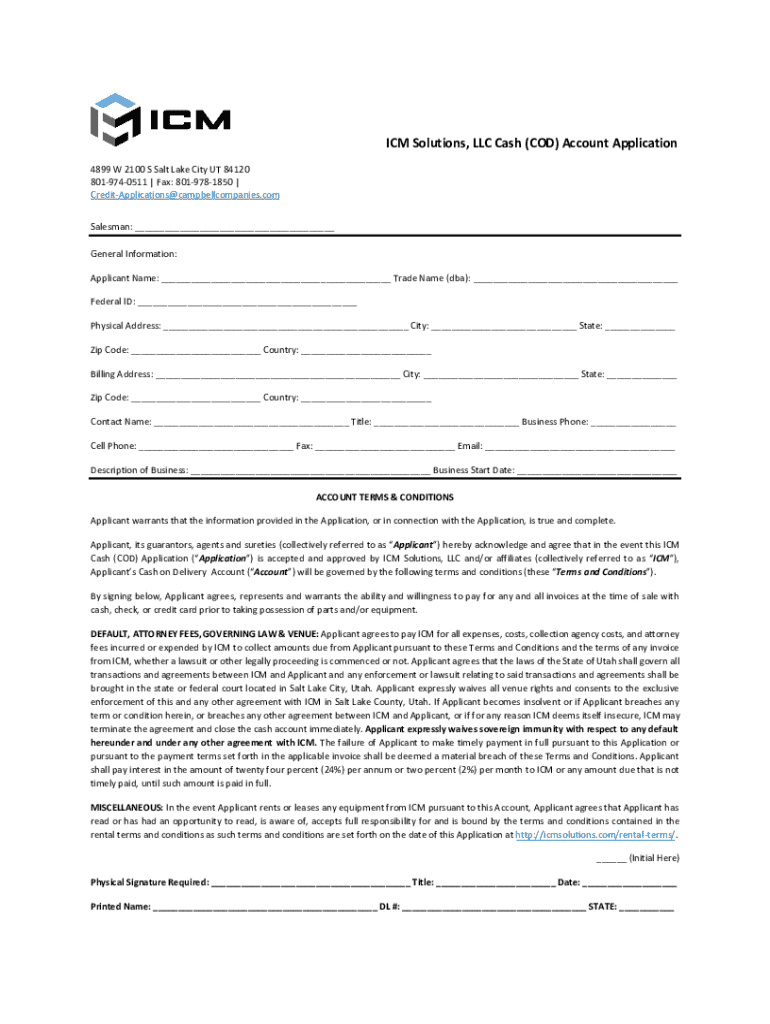

Get the free 4899 W 2100 S Salt Lake City UT 84120

Get, Create, Make and Sign 4899 w 2100 s

How to edit 4899 w 2100 s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 4899 w 2100 s

How to fill out 4899 w 2100 s

Who needs 4899 w 2100 s?

4899 W 2100 S Form: A Comprehensive How-to Guide

Understanding the 4899 W 2100 S Form

The 4899 W 2100 S Form is designed for specific administrative purposes, often related to state or federal documentation processes. This form is commonly used in various contexts, such as tax reporting, regulatory compliance, or district-specific requirements. Its significance lies in its ability to accurately capture essential data needed for legal and administrative procedures.

Key uses include situations where individuals must report financial information, qualifications for benefits, or details relating to asset management. Each field within the form serves a unique purpose that contributes to the overall objective of clarity and compliance.

Each section of the form is crafted to extract relevant information, so it's crucial that users fill it out accurately to avoid delays or compliance issues.

Pre-filling considerations

Before diving into filling out the 4899 W 2100 S Form, it's essential to gather all necessary information. Required documents may include personal identification, financial statements, or previous filings that inform the data you need to input. Without these, filling the form correctly becomes a challenge.

Common pitfalls can be avoided by ensuring that you have double-checked the required fields. Missing information often leads to submission rejections. As you prepare to fill out the form, consider setting up in a distraction-free environment. A quiet space devoid of interruptions can boost your focus, enhancing accuracy.

Step-by-step instructions for filling the 4899 W 2100 S Form

Starting the filling process for the 4899 W 2100 S Form can seem daunting, but the steps are straightforward. First, access the form through pdfFiller's user-friendly interface, which allows you to locate the document with ease.

Once you have the form, move to entering your personal and relevant information. Each section has specific requirements, so follow the guidelines provided. For example, when filling personal details, ensure your name and address match those on your official documents.

After completing the form, take the time to review your entries against the checklist provided by pdfFiller. This ensures that all fields are complete and accurate, reducing the likelihood of errors.

Editing the 4899 W 2100 S Form

Once you have filled out the 4899 W 2100 S Form, you may find the need to make corrections or adjustments. pdfFiller offers robust editing tools that make this process simple. You can modify any section without the fear of losing the integrity of the original document.

Utilizing features like text editing, annotation, and the ability to insert images can enhance the overall quality of your document. Make sure that any changes retain clarity and ensure that the document remains professional and easy to read, as this plays a significant role in how your submission is perceived.

Electronic signature options

The move towards electronic signatures has revolutionized the way we handle important documents. Signing the 4899 W 2100 S Form electronically through pdfFiller is not just convenient; it's also secure and legally binding. This means you can complete the signing process without the hassle of printing out the form.

To eSign the form, navigate to the signing section within pdfFiller and follow the prompts. The entire process is quick, requiring just a few clicks to insert your signature digitally. This feature ensures that you can finalize documents on the go without compromising on security.

Sharing and collaborating on the form

pdfFiller excels in facilitating collaboration on forms such as the 4899 W 2100 S Form. Its sharing capabilities allow users to distribute the form to others for review or co-filling. Whether you’re working with colleagues or needing input from stakeholders, pdfFiller's tools allow for seamless collaboration.

Real-time collaboration features enable multiple users to interact with the document simultaneously, optimizing group workflow. Feedback and changes can be easily monitored, making it a breeze to implement suggestions or corrections made by collaborators.

Saving and storing the 4899 W 2100 S Form

Effective document management is pivotal when it comes to handling forms like the 4899 W 2100 S Form. With pdfFiller, users can save their forms securely in the cloud. This ensures that you can retrieve them anytime, from anywhere, making it a great solution for those on the go.

It’s important to implement best practices for organizing your documents. Use folders and tags to categorize different form types, which enhances searchability and efficiency. Additionally, pdfFiller's mobile app provides the flexibility to manage your documents while away from your desk.

Common issues and troubleshooting

As with any administrative process, users may encounter challenges when filling out or submitting the 4899 W 2100 S Form. Some common issues include misinterpreting field requirements or struggling with technical aspects of the submission process.

Utilizing pdfFiller's comprehensive support features can help troubleshoot these issues effectively. Their extensive FAQ section, combined with customer support, ensures that users have the assistance they need to navigate any obstacles.

Conclusion & next steps

Mastering the 4899 W 2100 S Form and understanding how to leverage pdfFiller’s features will significantly enhance your document management experience. This powerful tool simplifies the complexities of form handling, ensuring that users can focus on what truly matters — completing and submitting their forms efficiently.

Explore additional features of pdfFiller that will further streamline your document processes, allowing you to create, edit, and manage forms seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the 4899 w 2100 s form on my smartphone?

Can I edit 4899 w 2100 s on an iOS device?

How can I fill out 4899 w 2100 s on an iOS device?

What is 4899 w 2100 s?

Who is required to file 4899 w 2100 s?

How to fill out 4899 w 2100 s?

What is the purpose of 4899 w 2100 s?

What information must be reported on 4899 w 2100 s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.