Get the free Deposit Account Application for Trusts, Charities, Clubs, ...

Get, Create, Make and Sign deposit account application for

Editing deposit account application for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deposit account application for

How to fill out deposit account application for

Who needs deposit account application for?

Deposit Account Application for Form: A Comprehensive Guide

Overview of deposit accounts

A deposit account is a financial account held at a bank or other financial institution that allows individuals to deposit, withdraw, and manage their funds. These accounts come in various forms, offering tailored benefits to meet diverse financial needs.

The three main types of deposit accounts include savings accounts, checking accounts, and money market accounts, each catering to different financial strategies.

Having a deposit account is crucial not only for safe storage of money but also for establishing a financial foundation. Benefits include interest earnings, easy transactions, and a secure place for savings.

Importance of a deposit account application

Applying for a deposit account is the first step toward managing your finances effectively. You need to apply to ensure your funds are safe and to gain access to the various banking products and services that can help you grow your wealth.

Understanding the application process is essential. Generally, it involves submitting personal and financial information to the bank for verification before approval.

Account rejection can occur due to various reasons, including a poor credit history or insufficient identification. Understanding these factors can prepare you for a successful application.

Preparing for your deposit account application

Preparation is key to a successful deposit account application. Ensure you have all required documents handy to facilitate the process.

Additionally, be prepared to provide details about your finances, such as income information and employment history, which will help approve your application more swiftly.

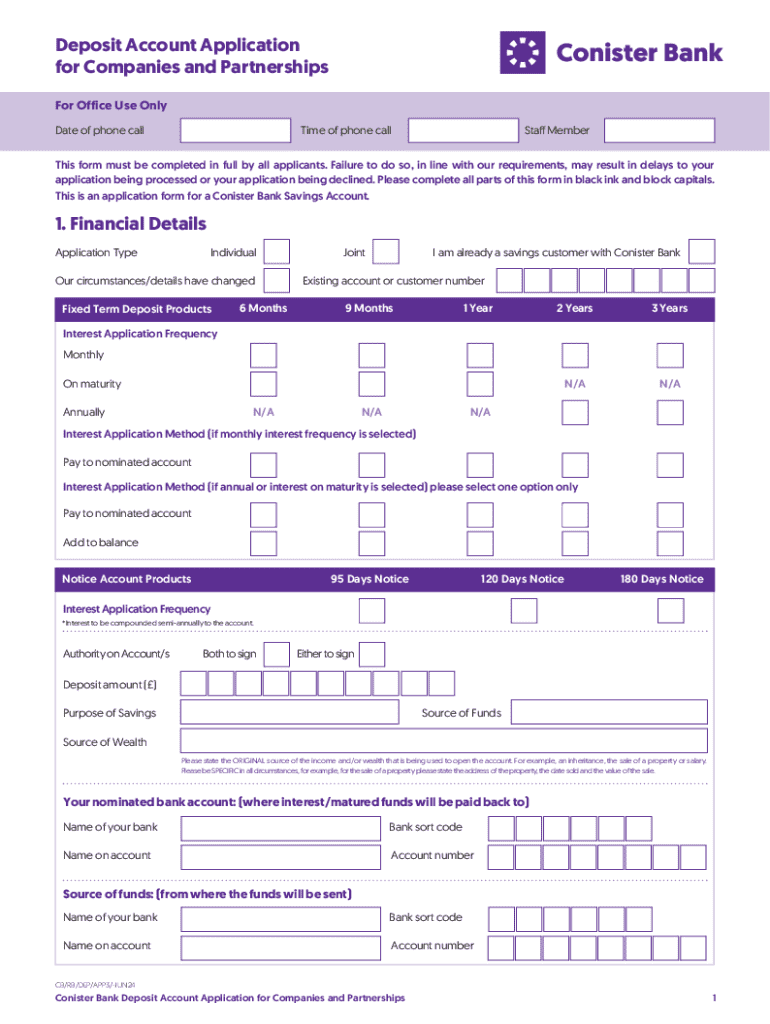

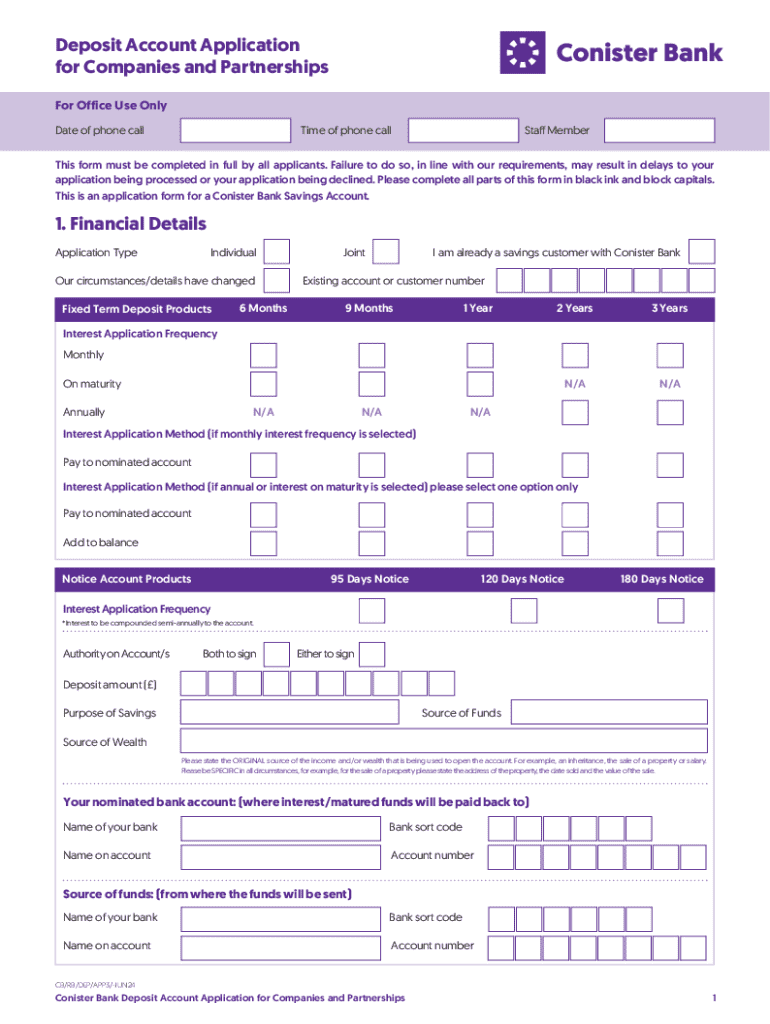

Step-by-step guide to completing the deposit account application form

Accessing the deposit account application form is straightforward on pdfFiller, where you can fill out and edit your form seamlessly.

The following sections will guide you through completing the application form:

Make sure to read through each section carefully and fill out each field accurately to avoid delays.

Utilizing pdfFiller tools to enhance your application

pdfFiller provides incredible tools designed to enhance your deposit account application experience, making the process simpler and more efficient.

These tools not only streamline your application process but also ensure that your documentation is easily managed and accessible.

Common mistakes to avoid in your application

When filling out your deposit account application, several pitfalls can lead to unnecessary complications. Being aware of these can save you time and frustration.

Take your time to review the entire application form thoroughly before hitting submit to mitigate these common mistakes.

After submission: what to expect

After submitting your deposit account application, expect an initial confirmation from the bank regarding receipt of your application. This typically occurs via email or text notification.

Processing times can vary widely, but most institutions aim to review applications within one to three business days.

Being patient and prepared for follow-up communications is key during this waiting period.

Frequently asked questions (FAQs)

Having questions about the deposit account application is normal, and understanding the answers can assist you greatly.

Knowing these answers can help smooth out potential concerns throughout the application process.

Resources for further assistance

If at any point during your deposit account application you require assistance, banks often provide customer support channels for inquiries.

Taking advantage of these resources can empower you to tackle any questions along the way.

Interactive tools on pdfFiller

pdfFiller provides interactive tools that not only simplify the deposit account application process but also enhance your overall financial management experience.

Using these interactive tools empowers you to make informed financial decisions beyond just applying for a deposit account.

User insights: experiences with deposit account applications

Hearing from others who have gone through the deposit account application process can provide valuable insights. Many users have shared their experiences, highlighting both successes and challenges faced during the application.

Learning from the experiences of other users can help you maneuver through your deposit account application process more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete deposit account application for online?

How do I complete deposit account application for on an iOS device?

How do I complete deposit account application for on an Android device?

What is deposit account application for?

Who is required to file deposit account application for?

How to fill out deposit account application for?

What is the purpose of deposit account application for?

What information must be reported on deposit account application for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.