Get the free Hays County Small Estate Affidavit Checklist

Get, Create, Make and Sign hays county small estate

How to edit hays county small estate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hays county small estate

How to fill out hays county small estate

Who needs hays county small estate?

Understanding the Hays County Small Estate Form: A Comprehensive Guide

Overview of small estate procedures in Hays County

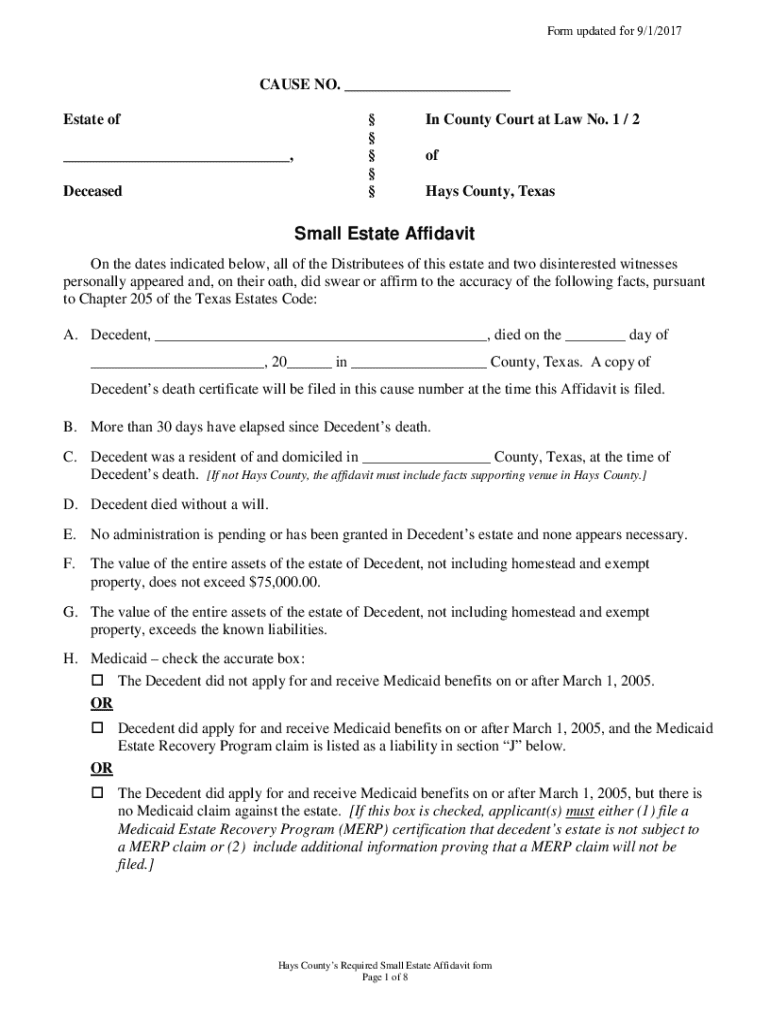

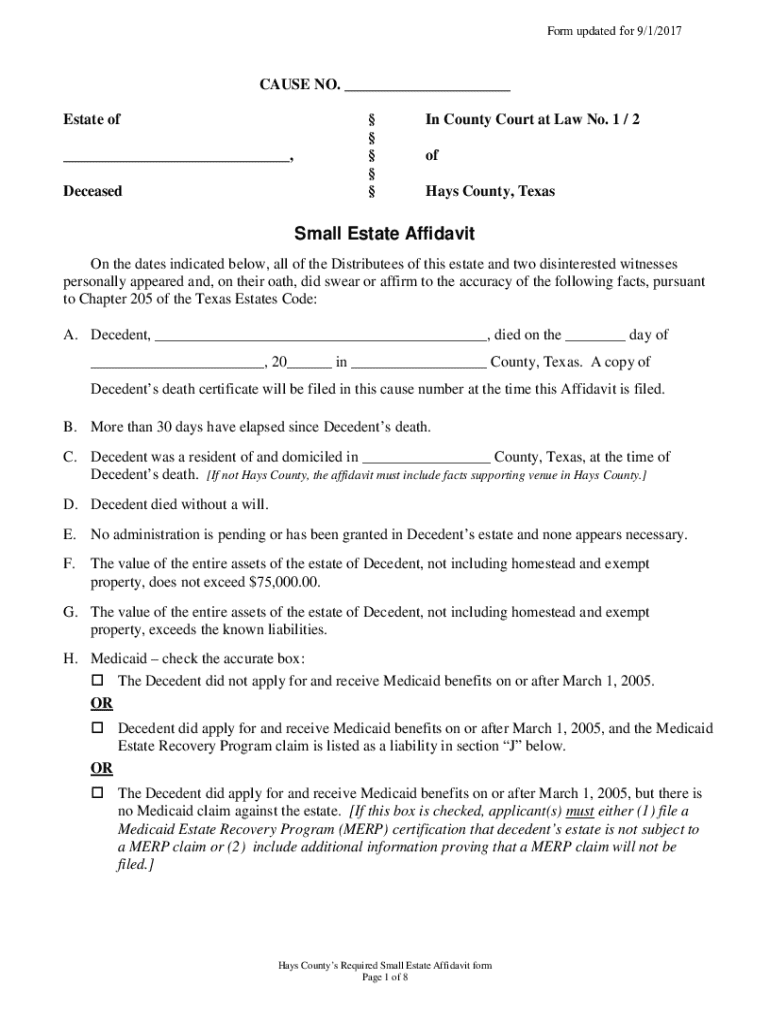

In Hays County, Texas, the concept of a small estate allows for a more straightforward and expedited process of settling a decedent's affairs, particularly when their estate falls below a certain value threshold. A small estate is defined by Texas law as the total value of all non-exempt assets not exceeding $75,000, excluding specific exemptions such as a homestead or certain personal property.

The benefits of utilizing a small estate affidavit are significant. Primarily, it allows heirs to bypass the cumbersome probate process, saving both time and money. This streamlined approach not only facilitates quicker access to assets but also reduces the emotional burden often associated with traditional probate proceedings. Understanding local regulations is crucial, as each county may have specific nuances in the process.

Understanding the Hays County small estate form

The Hays County Small Estate Form is a legal document that simplifies the distribution of a decedent's assets when they qualify as a small estate. By completing and filing this affidavit, heirs can assert their right to inherit without undergoing the full probate process. This form is specifically designed for Texas residents, making it distinct from small estate procedures in other states, which may have different laws, thresholds, and filing requirements.

For example, while the small estate limit in Texas is $75,000, other states may have higher or lower thresholds, affecting who qualifies for this expedited process. Understanding these differences helps ensure that heirs make informed decisions that align with local and state laws.

Eligibility criteria for using the small estate form

Not everyone is eligible to file a small estate affidavit. Typically, those who can file must be either an heir or a legal beneficiary of the decedent's estate. In Hays County, to qualify as a small estate, the estate's total value must not exceed the $75,000 threshold, excluding any exempt property. This threshold includes all types of assets owned by the decedent at their passing, such as bank accounts, vehicles, and personal property.

It's also essential to understand the decedent's situation. If the decedent owned real property, co-owned assets, or designated a beneficiary for specific accounts, these factors can influence whether the estate qualifies as a small estate. Therefore, a thorough inventory of the decedent's assets and liabilities is critical to ensure compliance with Hays County and Texas laws.

Step-by-step instructions for completing the Hays County small estate form

Completing the Hays County Small Estate Form requires careful attention to detail. Following these steps can ensure that you fill out the form correctly and efficiently.

Common questions about the Hays County small estate process

One of the most frequently asked questions about the Hays County small estate process is whether court attendance is necessary. In most cases, filing a small estate affidavit does not require a court appearance—this saves time and makes the process less intimidating for heirs. However, there may be exceptions if disputes arise among heirs.

Another common question pertains to the duration of the process. Once the affidavit is filed, heirs can typically access the decedent's assets within a few weeks, depending on the backlog at the courthouse. When dealing with complex estates or when clarity regarding the estate's value is needed, hiring a lawyer may be prudent to navigate potential legal challenges effectively.

Related legal documents and forms

In addition to the Hays County Small Estate Form, there are other legal documents that may be pertinent when settling an estate. For instance, the Order Approving Small Estate Affidavit is a document filed once the affidavit is accepted, formally recognizing the heirs' claims to the estate. Additionally, an Affidavit of Heirship may be necessary to establish the legal heirs, especially if there is no will.

These forms can often be accessed online. Platforms like pdfFiller provide efficient ways to locate these documents, reducing the time spent searching for essential forms, ultimately easing the burden on those managing the estate.

Case studies and real-life examples

In Hays County, many individuals have successfully used the small estate affidavit process to expedite their inheritance. One notable example is of a family who underwent a long and difficult probate process with a larger estate. In contrast, another family with similar asset values but qualifying as a small estate completed their affairs in less than a month, illustrating the efficiency of this process.

Challenges can arise, such as disputes among heirs over asset distribution. However, utilizing the small estate affidavit often simplifies these matters, as it delineates clear claims based on the stated value of the estate and the applicant's relationship to the decedent.

Interactive tools and resources

Taking advantage of online document creation tools is crucial when dealing with the Hays County Small Estate Form. Platforms like pdfFiller offer features that allow users to fill out, sign, and collaborate on small estate forms securely and efficiently. This makes it easier for individuals to manage their documents without needing extensive legal knowledge.

Additionally, an eSignature guide can simplify the signing process, allowing multiple parties to review and sign documents remotely, which is invaluable in today's digital age.

Navigating the next steps after filing

Once the Hays County small estate form is submitted, heirs should prepare for the next steps in managing the estate. Expect to receive official communication regarding the acceptance of the affidavit, which may take a few weeks. It's crucial to have a checklist that includes tasks such as notifying creditors, liquidating assets, and filing any necessary tax returns, to ensure a smooth transition of estate management.

Staying organized is key to managing remaining estate affairs effectively. Maintain meticulous records of all transactions and communications related to the estate to safeguard against potential disputes.

Educational resources and support

Individuals looking for further information on estate planning or the small estate process can benefit from educational resources such as quick guides and e-books. These materials often cover fundamental topics like the importance of estate planning, how to effectively draft a will, and the implications of intestate succession in Texas.

Community resources in Hays County, such as legal aid clinics or estate planning workshops, can offer valuable support. Consulting with an estate lawyer is advisable when complexities arise or there are significant financial implications related to the estate.

Additional topics of interest

It's essential for anyone involved in estate management to understand broader topics like how to avoid probate in Texas. Engaging in proactive estate planning, including creating wills, can greatly reduce the likelihood of a lengthy probate process. Understanding intestate succession is equally vital, especially for those who wish to ensure their heirs receive their intended inheritance.

Additionally, recognizing the importance of estate planning can lead to more organized affairs, making it easier for heirs to navigate the complexities of estate administration without unnecessary complications.

Frequently accessed services via pdfFiller

When it comes to managing the Hays County small estate form, pdfFiller provides a comprehensive solution for document management. It allows users to create, edit, and personalize forms to meet individual needs. With its user-friendly interface, managing these important documents becomes a seamless experience.

The platform also offers tips for efficient online filing and e-signing, ensuring that users complete their forms correctly and securely from the comfort of their home or office.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit hays county small estate on a smartphone?

How do I complete hays county small estate on an iOS device?

How do I edit hays county small estate on an Android device?

What is hays county small estate?

Who is required to file hays county small estate?

How to fill out hays county small estate?

What is the purpose of hays county small estate?

What information must be reported on hays county small estate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.