Get the free Monthly Statement Disclosure and Reconciliation Form

Get, Create, Make and Sign monthly statement disclosure and

Editing monthly statement disclosure and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly statement disclosure and

How to fill out monthly statement disclosure and

Who needs monthly statement disclosure and?

Monthly Statement Disclosure and Form: A Comprehensive Guide

Overview of monthly statement disclosures

Monthly statements serve as essential financial documents that offer a snapshot of an individual's or entity's financial standing over a specified period. These statements typically summarize account activity, providing a clear view of transactions, fees, and balances.

The importance of monthly statement disclosures cannot be understated. They not only help consumers track their spending and monitor their accounts but also assist businesses in maintaining accurate records for accounting and compliance purposes. Such statements are pivotal in ensuring transparency in financial transactions.

Common uses of monthly statements span various industries, including banking, utilities, insurance, and telecommunications. For example, financial institutions often provide detailed monthly statements that include interest earned, fees charged, and overall account balances. This allows consumers and businesses alike to manage their finances more effectively.

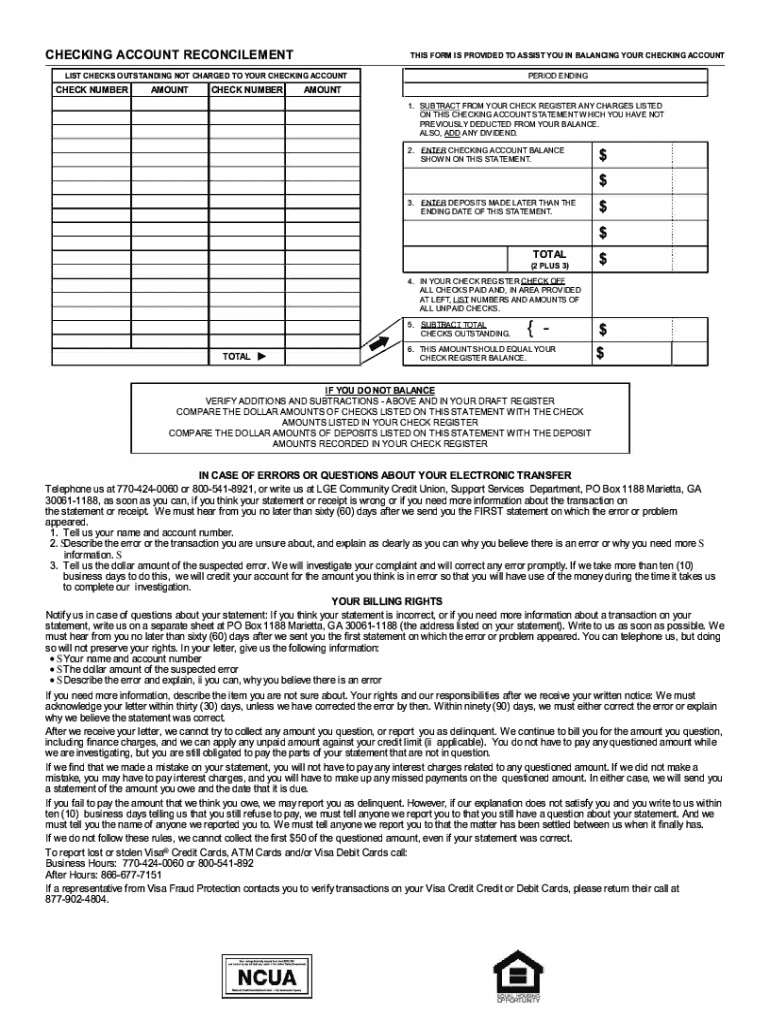

Key components of monthly statements

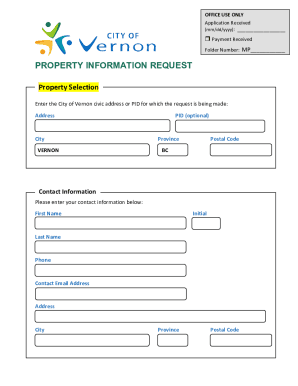

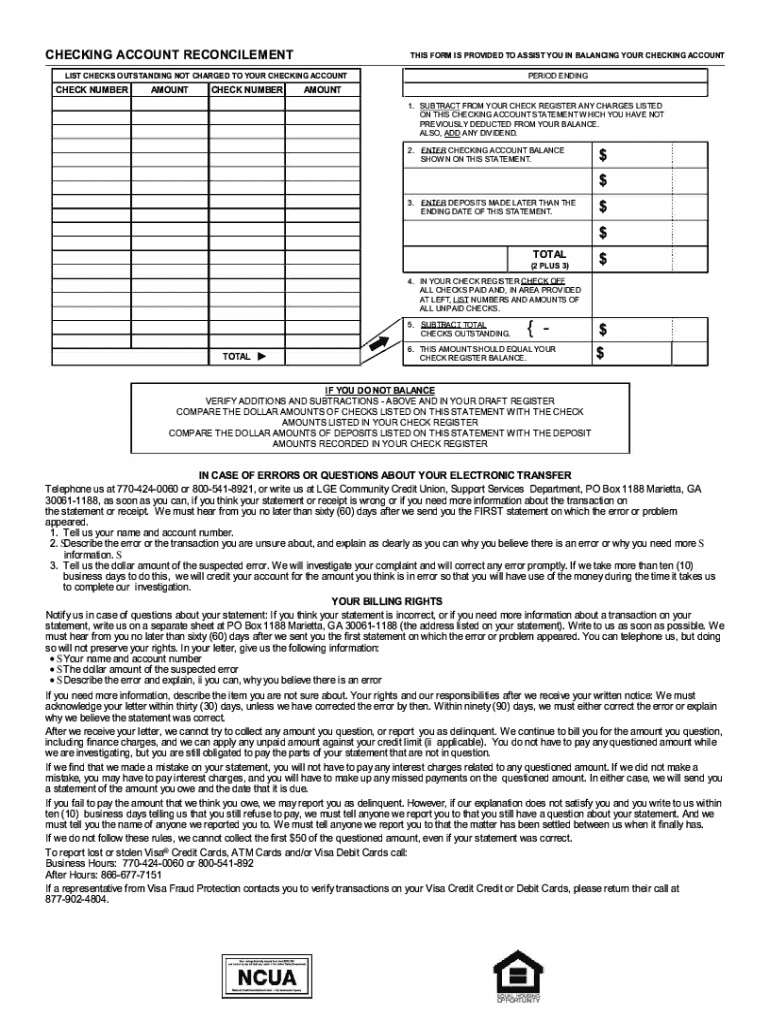

Understanding the key components of a monthly statement is crucial for both individuals and businesses. Required information typically includes basic account details, transaction history, and a summary of any charges or fees incurred during the period.

The basic account details provide essential identification information, including account numbers and contact information. Transaction details outline the dates, amounts, and descriptions of all activities on the account. Importantly, a summary of charges and fees allows users to see where their money goes, highlighting any recurring charges or one-time fees.

Regulatory compliance also plays a significant role in monthly statement disclosures. Institutions must adhere to specific laws and regulations, such as § 1026.5, which governs how disclosures are presented to consumers. Compliance not only fosters trust but also ensures that consumers receive the necessary information to make informed financial decisions.

Understanding the monthly statement disclosure form

The monthly statement disclosure form serves as a formal document that summarizes financial activity and ensures users are informed of their account status. It typically includes details that are critical for maintaining transparency and accountability.

Common areas of confusion can arise surrounding various elements of the form, such as interpreting the types of charges or understanding how to report errors. Users often find themselves perplexed by terminologies or formatting that differ between organizations.

Notably, the format and requirements of the monthly statement disclosure form can differ greatly across organizations. Banks, for instance, may structure their statements differently from utility providers or credit card companies. Familiarizing oneself with these variations is vital for effective interpretation.

Step-by-step guide to completing your monthly statement disclosure form

Completing your monthly statement disclosure form can seem daunting, but breaking it down into steps can simplify the process. Below is a step-by-step guide aimed at helping you navigate this form seamlessly.

Editing and customizing your monthly statement disclosure

Editing your monthly statement disclosure form allows you to tailor information to specific needs, whether for personal tracking or business purposes. Tools such as pdfFiller empower users to refine their documents with ease and precision.

To customize disclosures for compliance, it’s essential to adhere to industry standards. Ensure that any modifications maintain the integrity of the financial information and do not detract from clarity.

eSigning your monthly statement disclosure

The rise of electronic signatures has revolutionized the way monthly statement disclosures are finalized. eSigning offers a convenient, secure, and efficient method for both individuals and organizations to authenticate documents.

The eSigning process can be straightforward when using platforms like pdfFiller. Users can upload their documents, review the form, and securely sign it with just a few clicks.

Security is paramount when it comes to eSignatures. Reputable platforms like pdfFiller implement stringent security measures to protect users’ information, ensuring the authenticity and privacy of your documents.

Collaborating on monthly statement forms

When managing monthly statement disclosures within a team, collaboration plays a critical role in maintaining accuracy and efficiency. Effective collaboration ensures that all input is utilized and the document reflects the comprehensive knowledge of all stakeholders.

Best practices for team collaboration include designing a clear review process and utilizing tools that allow real-time editing and commenting. This can significantly improve communication and reduce the chances of errors.

Managing archived monthly statement disclosures

Proper document management is crucial for retaining historical data, especially for individuals and businesses that need to reference past monthly statement disclosures. Archiving these documents enables easier access during audits or for personal financial tracking.

To store and organize disclosures effectively, adopting systematic filing methods is essential. Using digital solutions like pdfFiller can facilitate easy access and retrieval.

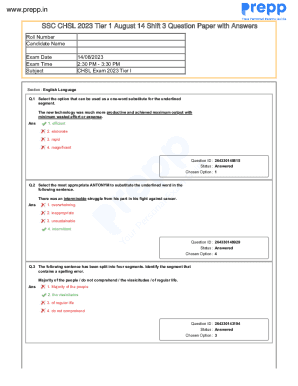

Frequently asked questions about monthly statement disclosures

Understanding monthly statement disclosures often raises questions among consumers and businesses alike. This section addresses several common inquiries to clarify potential confusion surrounding disclosures.

If you discover an error in your statement, contact your financial institution immediately to dispute the charges or correct inaccuracies. Understanding your rights regarding disclosures is essential, and institutions are required to address legitimate queries in a timely manner.

Special considerations for business vs individual statements

The disclosure requirements for businesses may differ significantly from those for individual statements. Businesses often require more detailed information to comply with regulatory standards and internal policy frameworks.

Compliance considerations for businesses include regulations enforced by the Securities and Exchange Commission (SEC) and industry-specific guidelines. Tailoring forms to meet specific business needs is crucial to ensure that all stakeholders have access to relevant financial data.

Helpful tips for navigating monthly statement disclosures

Navigating monthly statement disclosures can be streamlined by employing certain best practices. Keeping track of disclosures is vital for personal finance management and business accounting.

Utilizing digital tools to enhance efficiency is also beneficial. For example, pdfFiller's capabilities can simplify the disclosure process, making it easier to manage and coordinate documents.

Linking your monthly statement to broader financial management

Monthly statement disclosures play an integral role in broader financial management. By monitoring these statements, individuals and businesses can identify spending trends and adjust their financial strategies accordingly.

Moreover, integrating information from monthly statements into budgeting tools provides deeper insights into financial health. Regular reviews of disclosures could lead to long-term benefits, such as improved savings or more effective investment strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify monthly statement disclosure and without leaving Google Drive?

How can I send monthly statement disclosure and to be eSigned by others?

How do I edit monthly statement disclosure and online?

What is monthly statement disclosure?

Who is required to file monthly statement disclosure?

How to fill out monthly statement disclosure?

What is the purpose of monthly statement disclosure?

What information must be reported on monthly statement disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.