Get the free certificate of fuel tax exemption exempt sales of gasoline and ...

Get, Create, Make and Sign certificate of fuel tax

How to edit certificate of fuel tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of fuel tax

How to fill out certificate of fuel tax

Who needs certificate of fuel tax?

Certificate of Fuel Tax Form: How-to Guide Long-Read

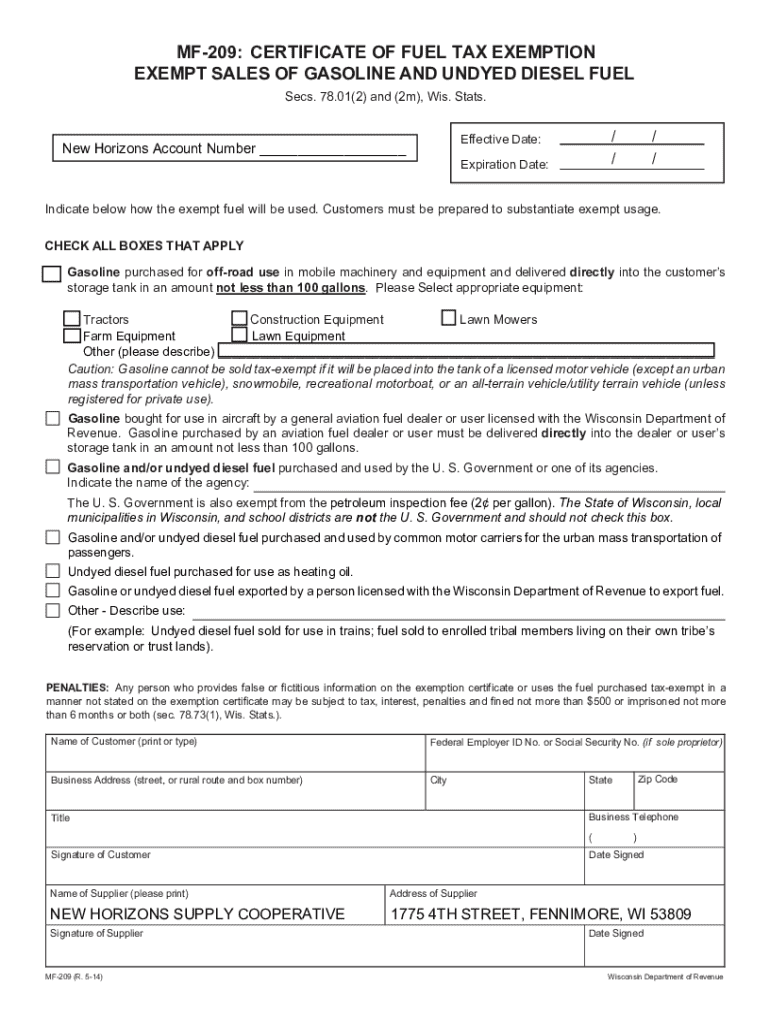

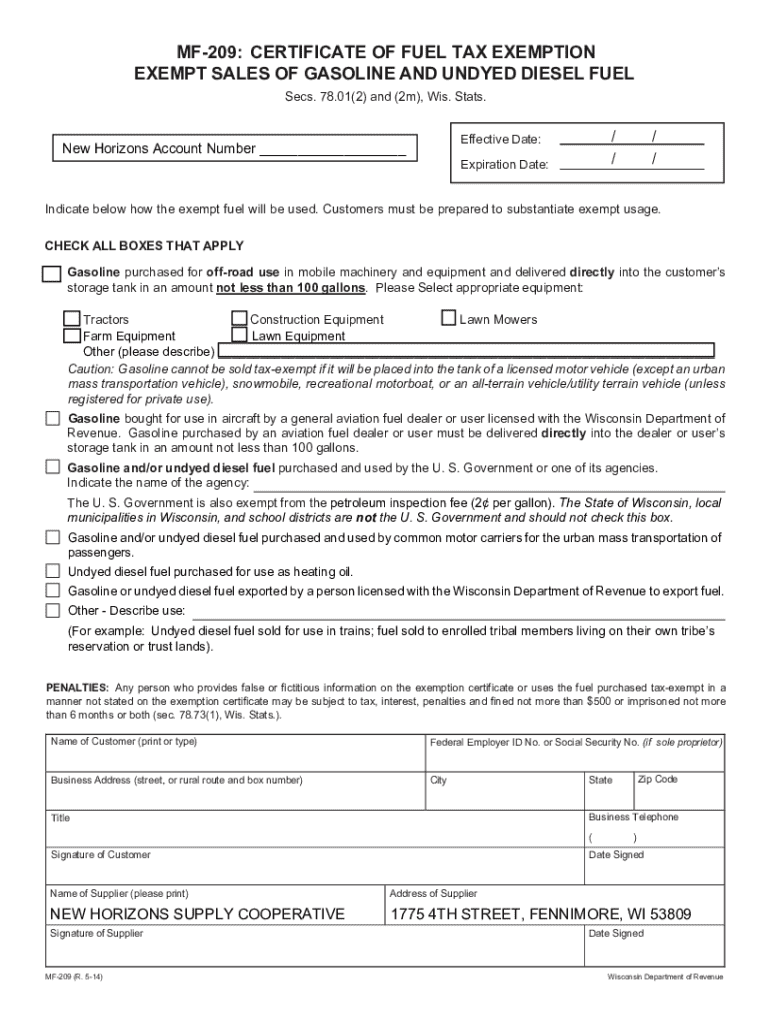

Overview of the certificate of fuel tax form

The certificate of fuel tax form serves as a critical document in the realm of fuel taxation, specifically designed to support taxpayers in claiming fuel tax credits, refunds, or exemptions. It provides essential information that helps in tracking the use and taxation of fuels across various sectors. Understanding this form is fundamental for ensuring compliance with tax regulations, whether for individuals or businesses.

Compliance with fuel taxation laws is not only a legal requirement but also a vital financial strategy. Failing to understand or properly complete this form can result in unclaimed credits or penalties from tax authorities. This certificate plays a pivotal role in various uses, including reporting fuel purchases, claiming tax credits, and applying for refunds on fuel taxes paid.

Understanding fuel tax regulations

Fuel tax regulations are a complex landscape of laws that vary significantly between states and federal jurisdictions. At the federal level, fuel taxes contribute to financing transportation infrastructure, while states impose additional taxes which can differ widely. For businesses operating in multiple states, awareness of these variations is crucial, as compliance requirements can swiftly impact operational costs.

Different fuel types—such as gasoline, diesel, and alternative fuels—are subject to distinct regulations and tax structures. For example, some states may offer specific exemptions on alternative fuels to encourage usage and mitigate environmental impact. Understanding these nuances enables taxpayers to maximize their benefits and minimize liabilities.

Types of fuel tax forms

Navigating fuel tax documentation can be daunting without knowing which forms to use. The certificate of fuel tax form is part of a larger suite of relevant fuel tax forms, each serving specific purposes. It’s essential to discern which form to use in various situations to ensure compliance and optimize tax credits.

Step-by-step guide to completing the certificate of fuel tax form

Successfully completing the certificate of fuel tax form demands attention to detail and an understanding of the requirements. The first step involves adequate preparation. This includes gathering necessary documentation, such as fuel purchase receipts, previous tax returns, and any relevant identification numbers. Moreover, identifying the correct form based on your specific situation—be it for personal claims or business-related expenses—is crucial.

Next, filling out the form requires careful attention to each section. Start with personal information, ensuring accuracy in names, addresses, and tax identification numbers. Follow this with fuel purchase details, articulating the quantity and type of fuel purchased. Finally, it's important to calculate any tax credits or refunds available, based on accurate records. Common mistakes such as providing inaccurate information or failing to sign and date the form can lead to delays or denials, so double-checking these details holds significant importance.

Interactive tools for efficient form completion

Utilizing interactive tools can enhance the experience of completing the certificate of fuel tax form. Services like pdfFiller offer features that streamline this process, transforming how users approach their documentation needs.

Managing and submitting your fuel tax forms

Once you’ve completed the necessary form, the next step revolves around effective management and submission. With the increase in digital documentation, using a digital document storage solution can alleviate the risk of losing vital information. Tools like pdfFiller provide secure storage options for users, facilitating easy retrieval and organization of forms.

Submission methods vary, accommodating both electronic submissions directly to tax authorities and traditional mail options. Tracking the status of your submission is critical; it can inform you of any issues that may arise post-submission. Additionally, being prepared to respond to inquiries from tax authorities is essential, as this reflects your proactive approach to compliance.

Tax credit and refund opportunities

Tax credits and refunds are significant incentives for individuals and businesses that incur fuel expenses. To determine eligibility for fuel tax credits, it’s crucial to understand the criteria involved. Various factors come into play, including the type of fuel used and its application, such as for commercial vehicles or specific industrial functions.

The process for claiming refunds demands meticulous documentation of all fuel purchases and taxes paid. Situations vary greatly; for instance, agricultural use of diesel fuel may qualify for distinct tax credits compared to fuel used for day-to-day operations. Thus, familiarity with common scenarios allows for better navigation through the complexities of tax claims while ensuring compliance with the necessary regulations.

FAQs regarding the certificate of fuel tax form

Frequently asked questions surrounding the certificate of fuel tax form often center on understanding its specific requirements and regulations. Common concerns include identifying whether a certain type of fuel qualifies for a refund and the timeframe for processing submitted forms. Clarity in these areas allows taxpayers to mitigate anxiety around compliance and foster a sense of control over their tax obligations.

It’s advisable to reach out to tax professionals or utilize resources available through tax authority websites for comprehensive assistance. These resources often provide guidelines tailored to various forms, ensuring that users comprehend the nuanced landscape of fuel tax regulations.

Additional considerations for special situations

Fuel tax regulations exhibit notable differences when comparing individual taxpayers to businesses. Consequently, businesses may face more rigorous scrutiny due to their larger fuel expenditures and the complexity of their operations. Factors such as state requirements can further complicate compliance, particularly for businesses operating across multiple states.

Moreover, handling discrepancies and potential audits from tax authorities demands a proactive approach. Keeping detailed receipts, logging fuel usage meticulously, and ensuring accuracy are paramount strategies for managing compliance and preparedness in the face of possible audits.

Conclusion: Maximizing your fuel tax form efficiency

Understanding and managing the certificate of fuel tax form lays the foundation for successful fuel tax compliance. Key points discussed throughout this guide emphasize the importance of detail, organization, and the utilization of interactive tools to facilitate the process.

Encouragement to take advantage of platforms like pdfFiller for document creation, management, and submission is crucial for optimizing your efforts. By streamlining the process and ensuring meticulous adherence to regulations, users empower themselves to navigate the complexities of fuel tax forms effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my certificate of fuel tax in Gmail?

How do I execute certificate of fuel tax online?

How do I edit certificate of fuel tax straight from my smartphone?

What is certificate of fuel tax?

Who is required to file certificate of fuel tax?

How to fill out certificate of fuel tax?

What is the purpose of certificate of fuel tax?

What information must be reported on certificate of fuel tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.