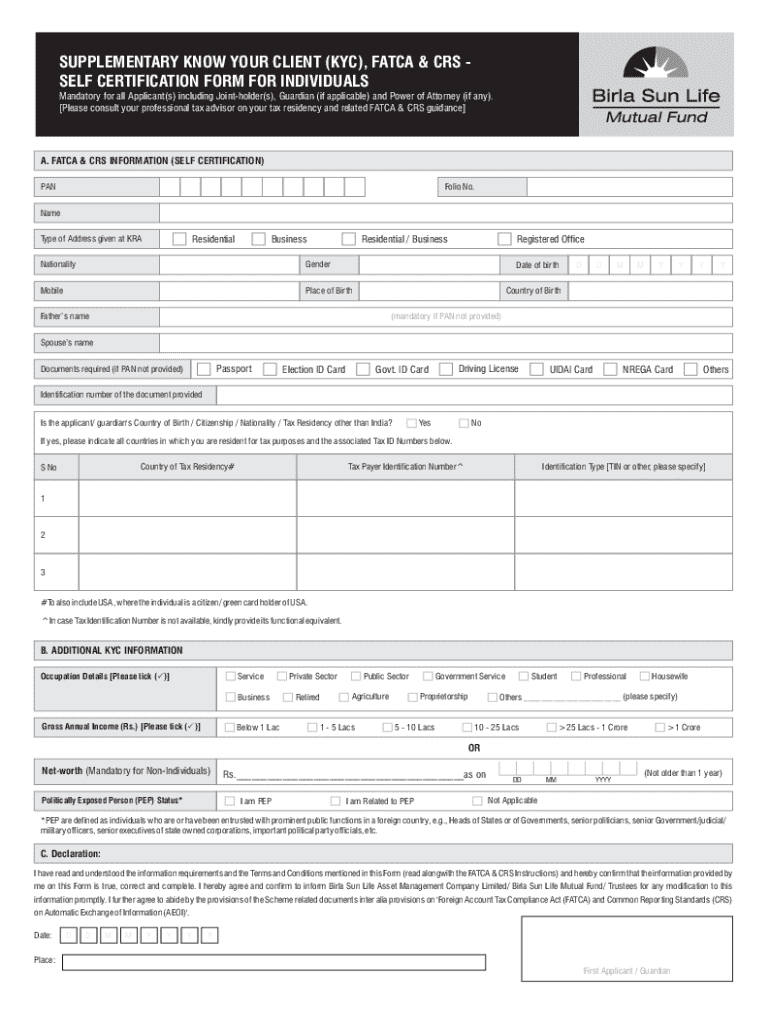

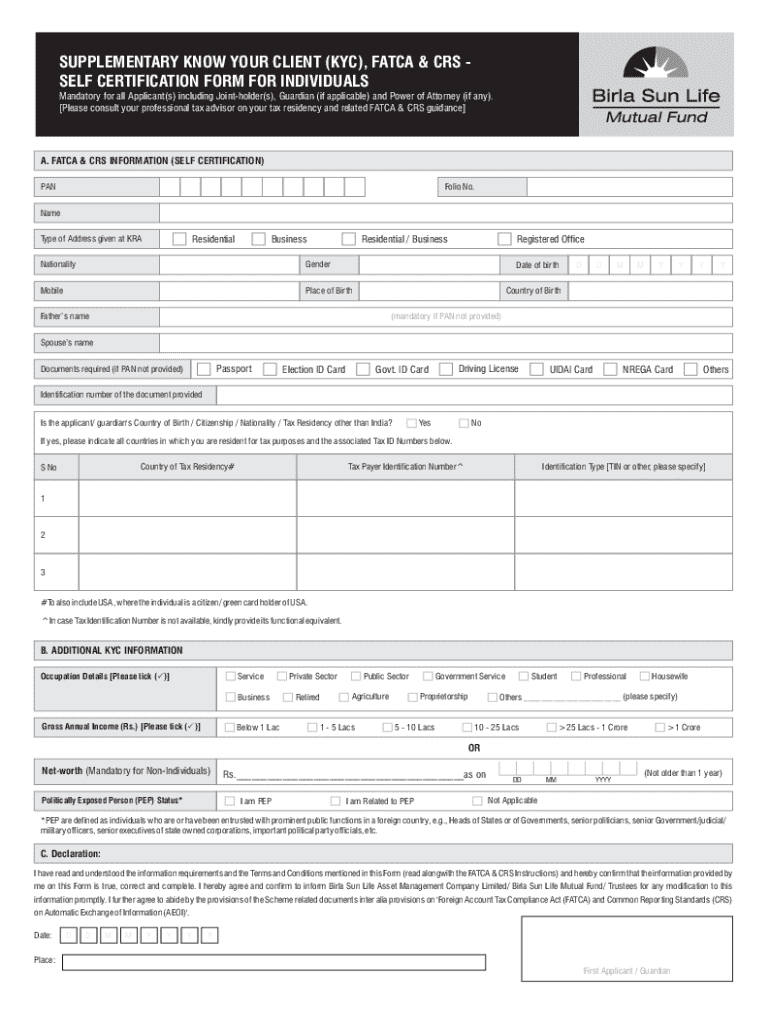

Get the free (kyc), fatca & crs - self certification form for individuals

Get, Create, Make and Sign kyc fatca amp crs

How to edit kyc fatca amp crs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kyc fatca amp crs

How to fill out kyc fatca amp crs

Who needs kyc fatca amp crs?

Your Guide to KYC, FATCA, and CRS Forms: Compliance Made Easy

Understanding the basics of KYC, FATCA, and CRS

KYC, FATCA, and CRS are critical compliance frameworks aimed at combating financial crime. Knowing these can significantly streamline the documentation process for both individuals and institutions.

What is KYC (Know Your Customer)?

KYC stands for Know Your Customer, a process that financial institutions use to verify the identity of their clients. Its primary importance lies in preventing fraud, money laundering, and terrorist financing. KYC ensures that institutions gain critical insights into their customers' risk profiles.

The KYC process typically involves collecting personal identification information, verifying documents, and ongoing monitoring of client transactions. Proper KYC practices protect both consumers and financial institutions.

Introduction to FATCA (Foreign Account Tax Compliance Act)

FATCA is a U.S. law aimed at preventing tax evasion by U.S. taxpayers holding accounts outside the United States. It mandates that foreign financial institutions report assets held by U.S. taxpayers, significantly impacting global compliance processes.

Key requirements under FATCA include the identification of U.S. account holders and the annual reporting of their financial holdings to the IRS. Failure to comply can result in hefty penalties for financial institutions.

Overview of CRS (Common Reporting Standard)

The Common Reporting Standard (CRS) is an initiative developed by the OECD to combat tax avoidance. It establishes a framework for the automatic exchange of financial account information among countries globally.

Under CRS, financial institutions are obligated to identify account holders and report specific information automatically to their local tax authorities, which are then shared with other jurisdictions. This initiative reinforces global transparency and accountability.

The intersection of KYC, FATCA, and CRS

The relationship between KYC, FATCA, and CRS is foundational in the financial compliance ecosystem. KYC processes lay the groundwork for accurate reporting under both FATCA and CRS.

Customer identification through KYC supports the data collection required for FATCA and CRS compliance. Without robust KYC practices, maintaining compliance with these laws becomes significantly more complex.

Comparative analysis of KYC, FATCA, and CRS

While KYC, FATCA, and CRS share the common goal of improving transparency in financial transactions, they differ in application. KYC focuses primarily on identifying clients, whereas FATCA and CRS emphasize reporting to tax authorities.

KYC requirements are ongoing, while FATCA and CRS obligations may center around specific reporting windows. Understanding these differences is crucial for effective compliance.

The importance of accurate data collection

Accurate data collection through KYC processes is essential not only for compliance with FATCA and CRS but also for maintaining trust in the financial system. Non-compliance can lead to penalties, legal issues, and harm to institutional reputation.

Organizations must prioritize precise KYC data management to safeguard against potential repercussions. This highlights the need for effective document management systems.

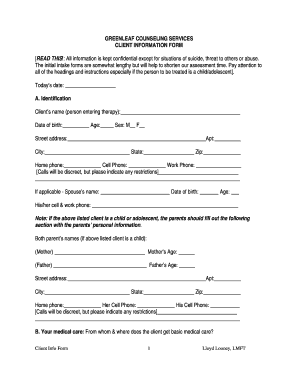

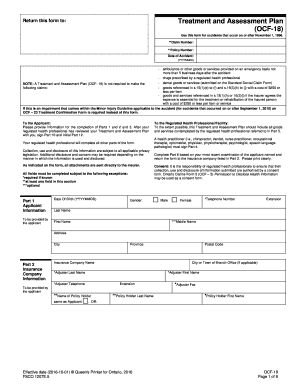

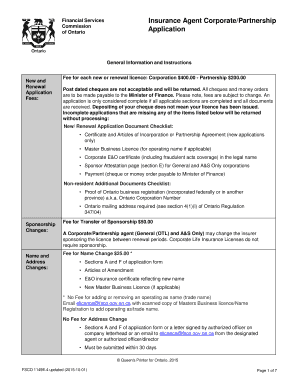

Filling out the KYC FATCA CRS form

Completing the KYC FATCA CRS form requires careful attention to detail to ensure compliance and prevent errors. Proper preparation can significantly ease this process.

Preparing for completion

Before filling out the form, ensure you have the necessary documents at hand. This typically includes identification documents, tax identification numbers, and proof of address.

Understanding the terminology in the form is equally important. Familiarize yourself with terms like 'U.S. Taxpayer Identification Number' and 'Certification of Foreign Status' to avoid confusion.

Step-by-step instructions for the KYC form

Completing the FATCA form

Submitting the CRS form

For the CRS form, make sure to include all necessary details such as account information and the appropriate entity type. Double-check your entries to avoid submission delays.

To validate your submission, consider requesting a confirmation receipt from your financial institution.

Editing and managing your forms

Once you've filled out your KYC, FATCA, and CRS forms, managing them effectively is crucial. Utilizing cloud-based solutions can simplify this process leading to more efficient document handling.

Utilizing pdfFiller's features for easy editing

pdfFiller allows users to upload and edit their KYC, FATCA, and CRS forms quickly. With an intuitive interface, users can add information, signatures, and annotations with ease.

Collaborating with your team

Collaboration can be enhanced using pdfFiller’s sharing features. You can share documents for review, allowing a multi-user environment for real-time collaboration.

Secure storage solutions

Managing and storing your filled forms on pdfFiller provides a secure, cloud-based solution that keeps important documents organized and easily accessible.

This ensures that sensitive information is protected while still being readily available for compliance checks when needed.

Overcoming common challenges

Form completion can often present pitfalls, leading to frustration or mistakes. Recognizing common errors can save time and effort.

Common pitfalls during form completion

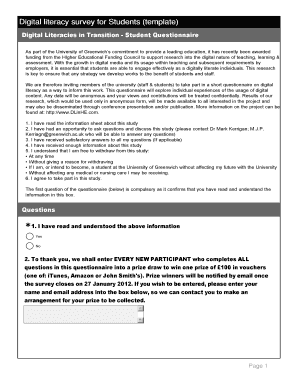

FAQs regarding KYC, FATCA, and CRS

Users frequently inquire about timelines for KYC updates, the necessity of providing foreign tax identification numbers, and how to handle discrepancies in submitted forms.

Tips for maintaining compliance

Regular updates to your KYC information are essential alongside periodic audits of FATCA and CRS submissions to avoid potential discrepancies.

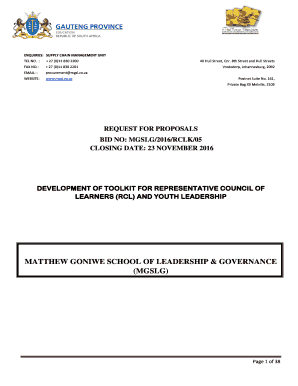

Expert insights and best practices

Financial compliance experts emphasize the importance of thorough training on KYC, FATCA, and CRS within organizations. Knowledge is key to navigating the complexities of these frameworks.

Keeping up-to-date with changing regulations

Ongoing compliance awareness is necessary due to the frequent changes in regulations surrounding KYC, FATCA, and CRS. Subscribing to industry newsletters and engaging in training can help.

Additional interactive tools and resources

Utilizing pdfFiller’s interactive tools can significantly enhance your document management experience. Interactive forms enable efficient completion and edits, thus simplifying compliance.

Accessing support and guidance

If you encounter challenges, pdfFiller provides robust support that can assist you in navigating through complex requirements.

Key takeaways for KYC FATCA CRS form management

Managing KYC, FATCA, and CRS forms does not have to be an arduous task. Best practices involve ensuring all information is accurate, maintaining timely updates, and leveraging a reliable document management solution like pdfFiller.

Investing time in understanding these compliance requirements pays off in reducing errors and enhancing efficiency. Using pdfFiller's cloud-based platform enables seamless editing, collaboration, and storage of these critical documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify kyc fatca amp crs without leaving Google Drive?

Can I create an electronic signature for the kyc fatca amp crs in Chrome?

How do I edit kyc fatca amp crs on an iOS device?

What is kyc fatca amp crs?

Who is required to file kyc fatca amp crs?

How to fill out kyc fatca amp crs?

What is the purpose of kyc fatca amp crs?

What information must be reported on kyc fatca amp crs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.