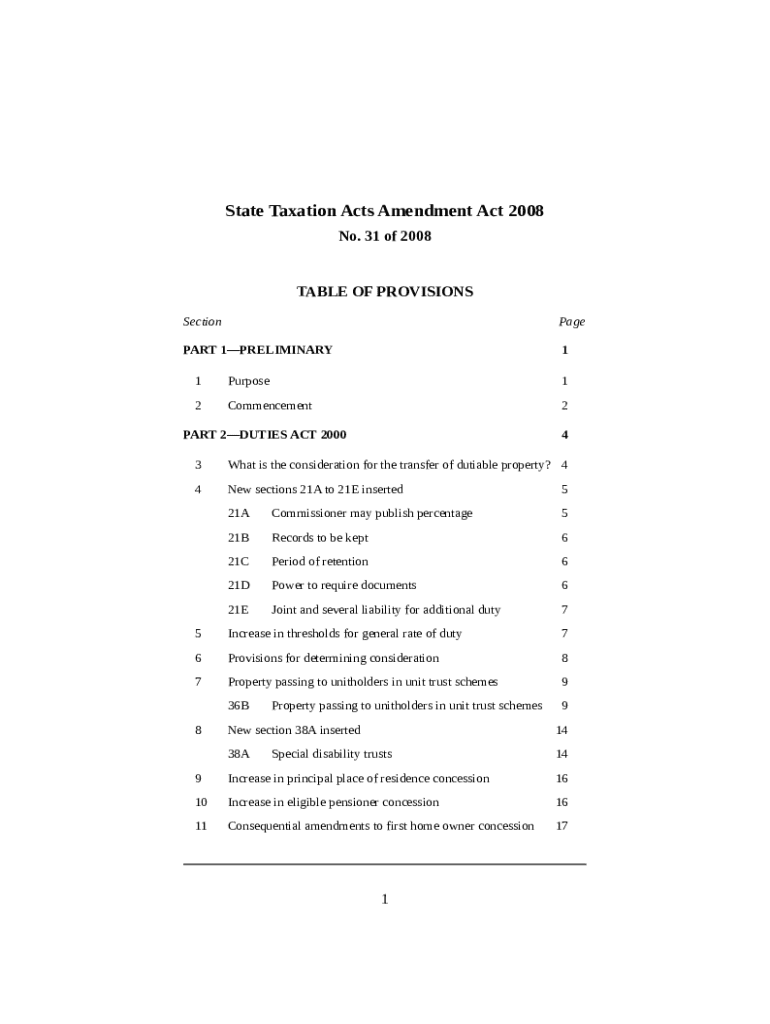

Comprehensive Guide to the State Revenue Legislation Amendment Form

Understanding state revenue legislation amendments

State revenue legislation forms the backbone of how a state operates financially and ensures that it can fund essential public services. These laws encompass various aspects such as taxation, allocation of funds, and the distribution of resources for community projects. Amendments to these laws play a crucial role in keeping the legal framework responsive to changing economic conditions and societal needs.

The importance of amendments in the legislative framework cannot be overstated. They allow for modifications in existing laws to address new challenges, enhance clarity, and improve compliance with federal requirements or economic trends. The key objectives of the amendment form include providing a standardized process for proposing changes and ensuring transparency in how state revenue laws evolve.

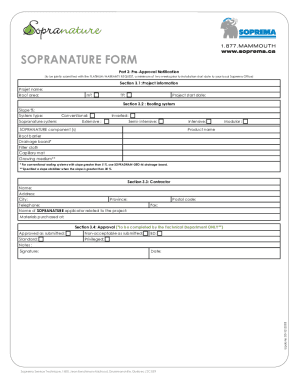

Key features of the state revenue legislation amendment form

Designed with user experience in mind, the state revenue legislation amendment form is not only comprehensive but also accessible to everyone. Its layout simplifies the process of entering data, ensuring that users can navigate seamlessly without feeling overwhelmed by complex legal jargon.

User-friendly design ensures that even those unfamiliar with legal documents can complete the form.

Interactive elements facilitate easy navigation, allowing users to jump to different sections as needed.

Real-time collaboration tools enable multiple users to work on the form simultaneously, streamlining the editing process.

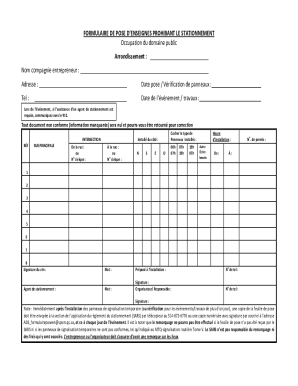

Step-by-step guide to completing the amendment form

Completing the state revenue legislation amendment form involves several straightforward steps. Each step is designed to guide you efficiently through the process.

Initial preparation

The first step is preparation. Gather all relevant documents, including tax records, business licenses, and previous correspondence related to your taxes. Understanding what information is required before you begin filling out the form will save you time and reduce errors.

Filling out the form

Next, fill out the form section by section. Start with your personal and business information, ensuring accuracy in every detail. Pay special attention to tax details and calculations, as these are critical to your submission.

Include all required supporting documents, as specified in the form instructions. These may include tax filings, identification documents, or financial statements.

Reviewing the form

Review your completed form to ensure all information is accurate and complete. The importance of accuracy cannot be overstated; even a small mistake can delay the process or result in penalties. Be mindful of common submission errors to avoid common pitfalls, such as missing signatures or incorrect tax amounts.

Finalizing and submitting the form

Once you've reviewed your form, finalize it. Utilize eSigning features for authenticity, which not only speeds up the submission process but also ensures compliance with legal standards. Choose your submission method—whether online, via mail, or through designated drop-off locations—and don’t forget to track your submission status electronically for peace of mind.

Editing and modifying your submission

Life is dynamic, and situations can change post-submission. If necessary, you can make changes to your amendment form after submission. However, timely action is crucial. Ensure that you understand the guidelines for making modifications, as different states may have varying rules.

Documentation is essential for resubmission. Keep records of any changes you wish to implement, and note the deadline for amendments to avoid complications.

Tools and resources for state revenue legislation compliance

Utilizing the right tools can significantly enhance your experience when dealing with the state revenue legislation amendment form. pdfFiller offers various interactive tools tailored for effective document management.

Document management features that simplify keeping track of your amendments and submissions.

Filing deadline reminders helping you stay updated with critical dates related to tax submissions.

You can also access useful links related to state taxation insights that provide detailed guidance. This includes resources from the Queensland Revenue Office and a comprehensive FAQ section on revenue legislation amendments.

Engaging with experts in state revenue legislation

If you encounter difficulties, do not hesitate to contact legislative support teams who specialize in state revenue legislation. Their expertise can clarify complex issues and help you navigate the amendment process with confidence.

Utilizing professional services can be beneficial, especially for businesses facing intricate compliance issues. They can provide insights tailored to your specific situation which could prove invaluable.

Contact information for relevant support teams across various states.

Frequently asked questions that can direct you toward common concerns.

Navigating assistance for different languages

Understanding that language can be a barrier, many resources are available in multiple languages to assist non-English speakers. It's crucial that all individuals have access to essential information about the amendment process.

Utilizing available resources can significantly improve understanding and ensure everyone can participate in the legislative process without hindrance due to language barriers.

The bigger picture: the impact of revenue legislation on state services

State revenue legislation impacts numerous aspects of community life, such as education, healthcare, and infrastructure development. Taxes, levies, and grants are vital sources for funding these essential services. By understanding revenue legislation, businesses and individuals alike become aware of their responsibilities and the positive implications of their contributions to state services.

Ultimately, compliance is not just a regulatory requirement; it is an investment in the community's future. The revenue generated supports state services essential for the well-being of its citizens.

Continuous updates in state taxation laws

State taxation laws are not static; they evolve continuously. Staying informed about new developments in the State Taxation Acts Amendment Act is imperative for compliance and strategic planning.

Subscribe to newsletters or mailing lists for legislative updates.

Follow dedicated channels that provide real-time updates on policy changes.

Feedback and improvement: share your experience

Your experiences with the amendment process are invaluable. By providing feedback, you can help drive improvements in legislation and the forms that support it. Sharing your input ensures that future changes reflect the needs of constituents.

Encouraging open dialogue around legislative processes creates a more responsive and effective governance structure that benefits everyone.