Get the free Cyber Coverage Increased Limit Supplemental Application ...

Get, Create, Make and Sign cyber coverage increased limit

How to edit cyber coverage increased limit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cyber coverage increased limit

How to fill out cyber coverage increased limit

Who needs cyber coverage increased limit?

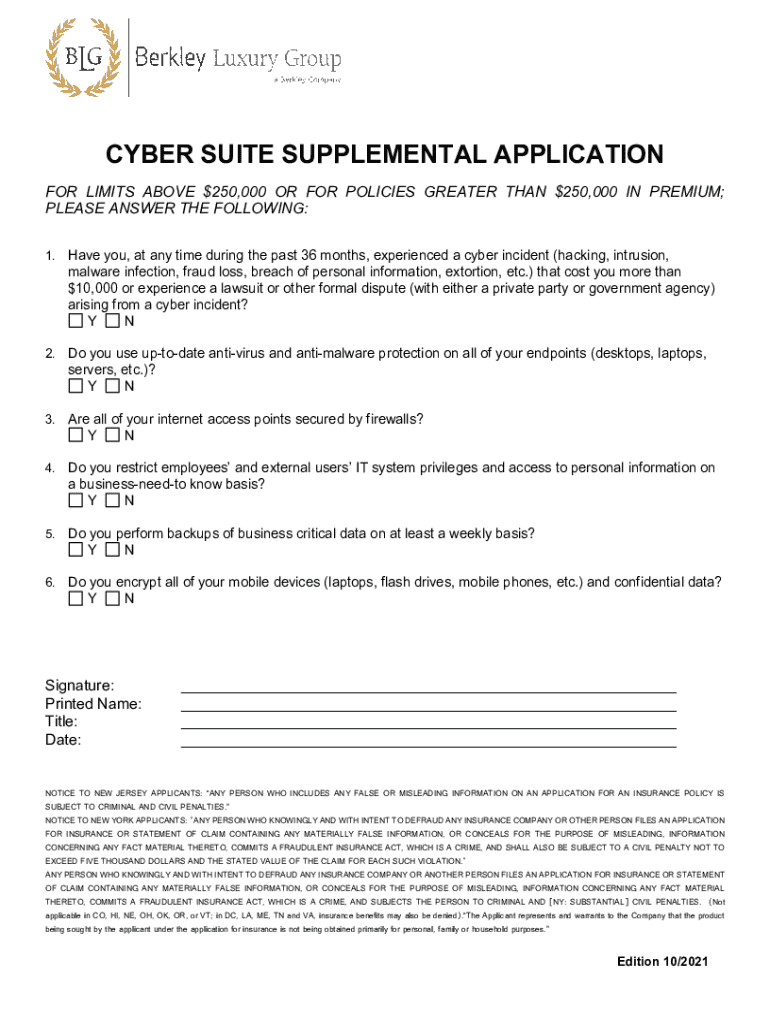

Understanding the Cyber Coverage Increased Limit Form

Understanding cyber coverage

Cyber coverage refers to an insurance policy designed to protect individuals and organizations from financial losses related to cyber incidents such as data breaches, ransomware attacks, and other cyber threats. In the age where digital interactions dominate, having adequate cyber coverage is no longer optional; it’s a necessity. Cyber incidents can result in significant financial damage, reputational harm, and legal liabilities, making it essential for every user, be it an individual or a large organization, to understand their coverage needs.

The importance of cyber coverage can’t be overstated. Cyberattacks happen frequently, and they can disrupt services, lead to data loss, and incur recovery costs that may far exceed initial expectations. Increased limits provide a safety net, ensuring that in the unfortunate event of a cyber incident, sufficient funds are available to handle the aftermath. Many consider increasing their cyber coverage limits to ensure they remain protected against evolving threats.

Eligibility criteria for increased limits

When considering applying for increased limits on cyber coverage, it’s important to understand who qualifies. Both individual users and organizations can apply, with criteria varying based on the provider. Individuals typically possess basic coverage and can request increased limits to protect against personal data breaches or identity theft. On the other hand, organizations must evaluate their practices, risk management strategies, and any previous cyber incidents to determine their coverage needs.

Assessing your current coverage needs involves analyzing existing protections against the likelihood of incidents. Factors influencing coverage decisions include the nature of your activities, the sensitivity of data handled, your industry, previous incidents, and regulatory requirements. Organizations with frequent or severe cyber incidents should prioritize increasing their limits to adequately mitigate risks.

Detailed overview of cyber coverage increased limit form

The cyber coverage increased limit form is a crucial document designed to facilitate the request for expanded insurance limits. Its primary purpose is to capture necessary information about your current coverage and your desired coverage levels. By filling this form accurately, individuals and organizations can set the stage for greater financial security.

This form typically includes several key sections. The personal information section collects data such as names, contact information, and type of coverage. Following this, you will outline your current coverage details, including policy numbers, existing coverage limits, and any past claims. Finally, the form allows you to specify your desired increased limits, giving the insurer a clear understanding of your needs.

Step-by-step guide to filling out the increased limit form

To effectively complete the cyber coverage increased limit form, start by gathering all required documents. Recommended documents may include your current insurance policy, previous claims reports, and any relevant risk assessments. These will provide necessary context and support for your application.

Filling out the form involves several key steps: First, you'll begin with your personal or business information, ensuring accuracy. Next, detail your current cyber coverage, including limits and any claims history that could impact your new application. Specify your desired increased limits, reflecting on both financial needs and potential risks. Lastly, submit any additional supporting information that can strengthen your application, such as risk management practices and cybersecurity training protocols.

Editing and managing your cyber coverage increased limit form

pdfFiller provides excellent tools to edit your cyber coverage increased limit form easily. With pdfFiller’s user-friendly platform, users can edit text and fields as necessary to reflect changes in coverage needs. Additionally, adding signatures and initials to the form is straightforward, streamlining the entire process.

Once your form is complete, saving it in the cloud offers significant benefits. Cloud storage ensures easy access from anywhere, vital for users constantly on the go. Moreover, pdfFiller allows you to manage versions and track history, streamlining collaboration with your team or stakeholders.

Submitting the cyber coverage increased limit form

Submission of the cyber coverage increased limit form can be conducted through multiple methods. Most often, online submission is preferred, as it allows instant tracking and easier communication with your insurance provider. Alternatively, manual submission may be necessary for certain users, particularly in cases where additional documentation is required.

Key considerations during submission include ensuring all information is complete and accurate. Incomplete submissions may lead to delays or denial of your request. Understanding the submission confirmation processes is also critical, as it allows you to follow up on your application if needed.

Follow-up actions post-submission

After submitting your cyber coverage increased limit form, you should prepare for what comes next. Expect a timeline for approval, which can vary based on the insurer's workload and the complexity of your application. It's advisable to keep track of this timeline to remain proactive in your cyber coverage.

If the insurer reaches out with feedback or requests additional information, responding promptly can foster a better relationship and expedite the process. Always keep your cyber coverage up-to-date, especially in response to significant changes in your business or personal circumstances.

Frequently asked questions (FAQs)

When navigating the cyber coverage increased limit form, users often have a range of questions. Common queries include what information is essential to include, how long the approval process takes, and whom to contact for further assistance. Addressing these common concerns is vital for a smooth experience.

For any unresolved issues or specific inquiries, guidance can be found through customer support channels. pdfFiller offers dedicated support to help users navigate their forms and understand their coverage options better.

Best practices for cyber coverage

Regularly reviewing and updating your cyber coverage is a best practice that helps ensure ongoing protection against new threats. With the cyber landscape evolving continually, it’s critical to reassess coverage limits, review potential risks, and integrate changes into your policies promptly.

Incorporating cybersecurity awareness and training programs for teams enhances overall security posture. Training educated teams about safe practices and potential threats can significantly reduce risk. Additionally, pdfFiller offers interactive tools to manage documents efficiently, helping teams collaborate effectively on document management.

Resources for further learning

Staying informed is crucial in the rapidly evolving world of cybersecurity and coverage. Finding articles on best practices in cybersecurity can help you adopt effective strategies. Participating in webinars and learning sessions can also provide in-depth insights into cyber coverage nuances, helping you stay ahead of the curve.

Furthermore, keeping abreast of relevant news and updates on cyber insurance trends ensures you maintain informed about your coverage environment. These resources can include industry reports, opinion pieces, and important statistics that can guide your coverage decisions.

Related services and tools by pdfFiller

pdfFiller provides a variety of services that are relevant to managing your cyber coverage documentation effectively. For instance, other document templates tailored for cyber coverage ensure that users can find what they need with ease. Collaboration tools allow teams to manage their cyber coverage forms seamlessly, encouraging communication and efficient completion of required documentation.

Moreover, pdfFiller's eSignature features and compliance standards ensure that all forms adhere to legal requirements, facilitating easy sign-offs and maintaining the integrity of the document management process. By utilizing these services, users can significantly streamline their document handling efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cyber coverage increased limit in Gmail?

Where do I find cyber coverage increased limit?

How do I fill out the cyber coverage increased limit form on my smartphone?

What is cyber coverage increased limit?

Who is required to file cyber coverage increased limit?

How to fill out cyber coverage increased limit?

What is the purpose of cyber coverage increased limit?

What information must be reported on cyber coverage increased limit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.