Get the free When I look back on all these worries, I rememb...

Get, Create, Make and Sign when i look back

How to edit when i look back online

Uncompromising security for your PDF editing and eSignature needs

How to fill out when i look back

How to fill out when i look back

Who needs when i look back?

When Look Back Form: A Comprehensive Guide

Understanding the look-back form

The look-back form is a critical document in the realm of taxation, designed to address discrepancies in payments made over previous tax periods. It serves as a mechanism for taxpayers and business owners to reconcile past tax obligations, ensuring accuracy and compliance with the IRS regulations. The purpose of the form is to facilitate the reporting of overpayments or underpayments, enabling taxpayers to either adjust their previous filings or claim refunds. This process is particularly relevant for contractors and businesses handling variable contracts, as it aids in maintaining proper tax assessment.

For taxpayers and business owners alike, the look-back method is vital. It can reveal errors in past tax returns that, if left uncorrected, could lead to hefty fines or missed opportunities for refunds. The form is essential for accurately calculating tax liabilities while ensuring fair treatment within the tax system. Understanding when and how to utilize the look-back form can significantly impact financial outcomes—good or bad.

Key features of the look-back form

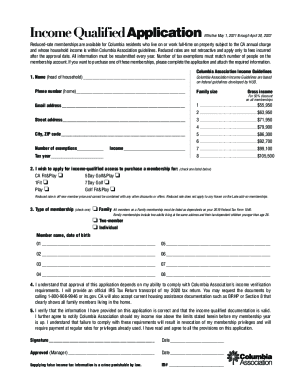

Completing the look-back form requires understanding its key features, which include specific data requirements and eligibility criteria. Collecting the necessary information is paramount to navigating the filing process effectively.

Step-by-step guide to completing the look-back form

Completing the look-back form can seem daunting, but breaking it down into manageable steps can simplify the process.

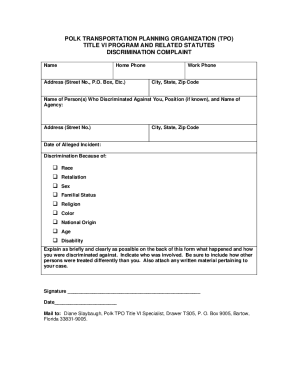

Special cases in filing the look-back form

While the look-back filing process follows general rules, certain unique situations may necessitate exceptions. Understanding these nuances can prevent costly mistakes.

The role of pdfFiller in managing the look-back form

In the age of digital documentation, pdfFiller simplifies the complexities associated with the look-back form. Utilizing this versatile platform can streamline the completion and submission process.

Looking ahead: preparing for future tax obligations

Tax regulation is ever-evolving, and staying ahead of the curve by preparing for future obligations is crucial. Proper documentation and proactive record-keeping are foundational to minimizing surprises come tax time.

Related insights and resources

Understanding the broader impact of tax laws, especially international changes, can provide valuable context to your look-back filing. Engaging with various resources can help clarify incentives available to contractors, enhancing tax compliance.

Frequently asked questions (FAQs)

Many common questions arise surrounding the look-back form, primarily concerning its accuracy and impact on tax strategies.

Additional services offered by pdfFiller

Beyond the look-back form, pdfFiller provides a comprehensive suite of services aimed at easing various aspects of document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send when i look back to be eSigned by others?

Can I sign the when i look back electronically in Chrome?

Can I create an electronic signature for signing my when i look back in Gmail?

What is when I look back?

Who is required to file when I look back?

How to fill out when I look back?

What is the purpose of when I look back?

What information must be reported on when I look back?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.