Get the free Estate Planning 101The Proper Way to Structure Your Estate ...

Get, Create, Make and Sign estate planning 101form proper

Editing estate planning 101form proper online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate planning 101form proper

How to fill out estate planning 101form proper

Who needs estate planning 101form proper?

Estate Planning 101 Form Proper Form: A Comprehensive Guide

Understanding estate planning

Estate planning is the process of preparing for the transfer of your assets and responsibilities upon your death or incapacitation. This includes determining how your property will be distributed, who will manage your affairs, and ensuring that your medical and financial wishes are respected. Estate planning is critical for individuals of all ages and financial situations, as it helps mitigate conflict and confusion among heirs.

The importance of having an estate plan cannot be overstated. It provides peace of mind, ensures your wishes are followed, and protects your loved ones from difficult decisions at an emotionally challenging time. Furthermore, it can potentially save heirs from facing expensive legal battles.

What is the estate planning 101 form?

The Estate Planning 101 Form serves as a foundational document that captures essential information necessary for establishing an efficient estate plan. This form is particularly beneficial for those initiating their estate planning journey, providing a structured way to think through and document various aspects of their estate.

The primary components of the Estate Planning 101 Form include personal identification details, an inventory of assets, beneficiary designations, and specific instructions regarding the distribution of those assets. Individuals who possess assets of any kind—whether real estate, bank accounts, or personal belongings—should consider using this form.

Key elements of an effective estate plan

An effective estate plan includes several critical components. Primary among these are wills and trusts, which outline how your assets will be distributed. A will provides a public record of your last wishes, while trusts can offer more control and privacy over your estate. Trusts can also help avoid probate, a lengthy legal process that can cost heirs time and money.

Additionally, establishing powers of attorney and healthcare directives is vital. A power of attorney allows someone you trust to make financial decisions on your behalf if you become incapacitated. Healthcare directives, or living wills, articulate your preferences regarding medical treatment and end-of-life care.

Navigating the estate planning 101 form

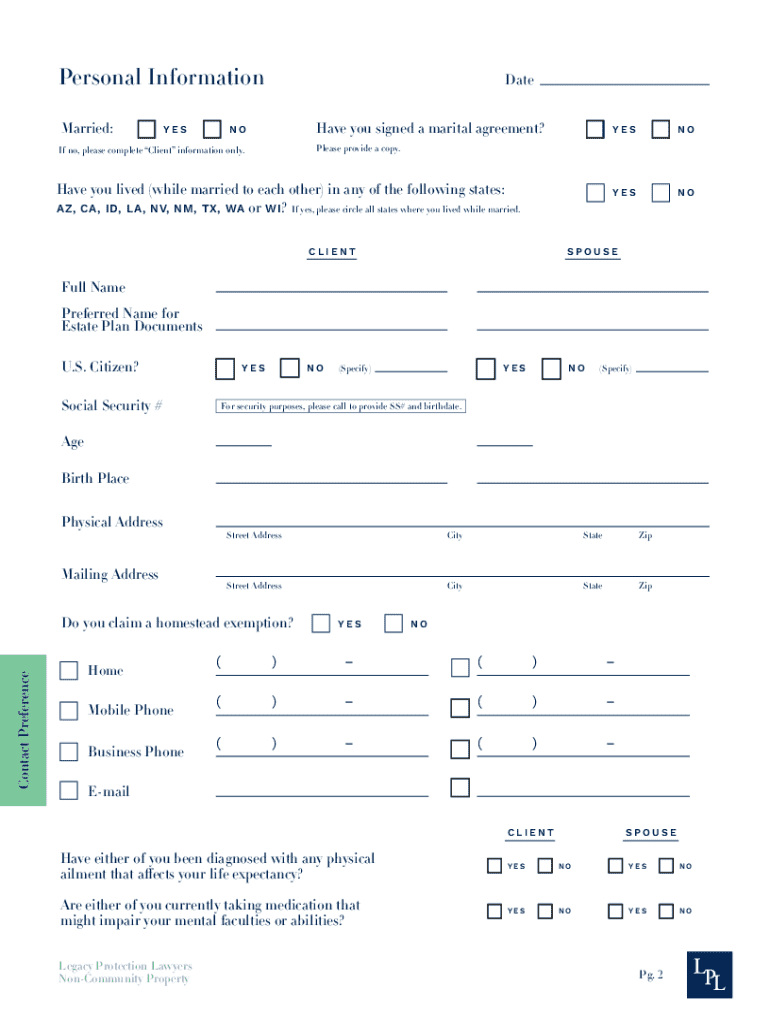

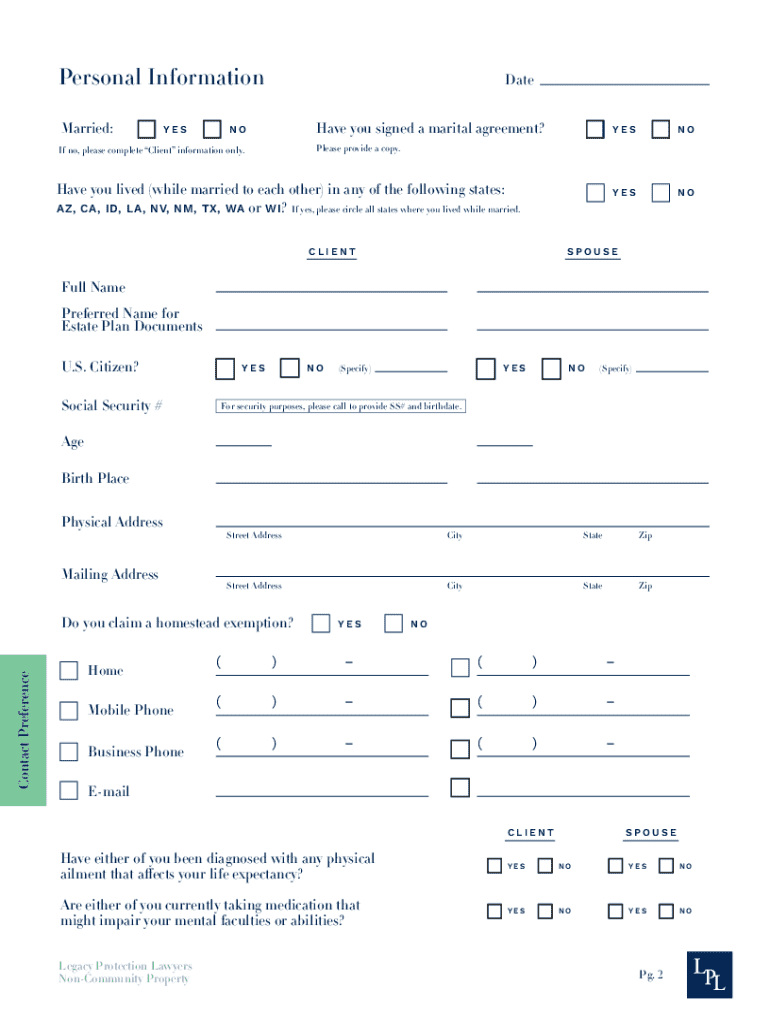

Completing the Estate Planning 101 Form involves several key steps. The form typically starts with personal information, including full names, addresses, and contact details. This section establishes the foundation upon which the rest of your estate plan is built.

Next, the asset inventory section allows you to list all your valuable possessions, including real properties, bank accounts, investment portfolios, and personal items. It is crucial to provide accurate values for these assets to avoid disputes later. The next section pertains to beneficiaries, where you'll designate who receives what, allowing you to express your wishes explicitly.

Step-by-step instructions for completing the estate planning 101 form

To successfully complete the Estate Planning 101 Form, begin by gathering essential information. You'll need personal details such as your full name, address, and date of birth. Next, compile details about your assets, including any real estate, vehicles, bank accounts, investments, and collectibles. Accurate valuations are imperative, as they will determine how your estate is managed.

Once you have your information ready, move onto filling out each section of the form methodically. As you complete the personal information section, ensure your data is correct and current. Then, when detailing your asset inventory, don't overlook any items—you might be surprised by how quickly they add up. Finally, in the beneficiary and distributions section, make your selections clear to avoid confusion.

Common mistakes to avoid when filling out the form

When completing the Estate Planning 101 Form, it’s essential to avoid common pitfalls. First, ensure that you provide accurate and complete information. Incomplete forms can lead to additional disputes or complications down the line. Another common mistake is misunderstanding or misapplying legal terminology, which may lead to unintended consequences.

Neglecting to update your estate plan is another frequent oversight. Life circumstances—such as marriage, divorce, or the birth of a child—can drastically change your estate planning needs. Finally, consider tax implications; some assets may be subject to estate taxes that could significantly impact the value of what you leave behind.

Important considerations when reviewing your estate plan

Reviewing your estate plan should be a regular process rather than a one-time task. It’s advisable to review your estate plan every few years or following significant life events, such as marriage, divorce, or relocating to a new state. Different states have varying estate laws that might impact your planning, so staying informed is crucial.

Family dynamics can also change, influencing your estate plan. Involving family members in the conversation can ensure everyone is on the same page. Open communication minimizes misunderstandings and can help reduce conflict over your wishes when the time comes.

The role of professionals in estate planning

While some individuals opt to handle their estate planning independently, the support of professionals can provide significant advantages. Consulting an attorney specializing in estate planning can help ensure your documents comply with state laws and are structured correctly. This professional guidance can prevent costly mistakes and provide peace of mind.

Alongside legal counsel, financial advisors can help you examine your financial strategy holistically. They can assist in optimizing the tax implications of your estate and suggest strategies for asset growth and protection. Additionally, utilizing workshops and online tools can enhance your understanding and provide clarity as you navigate the estate planning process.

Utilizing pdfFiller for estate planning needs

pdfFiller offers multiple features that streamline the estate planning process. With pdfFiller, users can edit, eSign, and collaborate on documents from any location, making it accessible for individuals and teams alike. The platform simplifies filling out forms and allows users to maintain a central repository for their estate planning documents.

Specifically for the Estate Planning 101 Form, pdfFiller provides tools to edit the form easily, collaborate with family members and advisors, and securely store your completed documents. The ease of signing and sharing via the platform makes pdfFiller an invaluable resource for anyone navigating estate planning.

Frequently asked questions about estate planning

Frequently, individuals have questions regarding the consequences of not having an estate plan. Dying without a will, known as dying intestate, can lead to state law determining how assets are distributed, often against your wishes. It’s also common to wonder how often to review the estate plan. Ideally, plan reviews should occur every few years or when major life events unfold.

Some may wonder about making changes without legal help; while it is permissible, it is often advisable to seek guidance to ensure compliance with relevant laws. Lastly, many people mistakenly believe that estate planning is only for wealthy individuals. In reality, everyone can benefit from an estate plan, regardless of financial status.

Practical tips for effective estate planning

Effective estate planning involves a proactive approach. Start by organizing your financial records, which include bank statements, insurance policies, and property deeds. Keeping these documents in order will streamline the process and help your heirs understand your financial landscape without confusion. Communication is equally crucial; ensure that your loved ones know your wishes to prevent any discrepancies when the time comes.

Anticipating unexpected situations through your estate plan is vital. Reserve a portion of your estate for unforeseen expenses, and clearly list alternatives regarding healthcare if your preferred choices cannot be met. Finally, prioritize safety by keeping your documents in a secure yet accessible place, ensuring that trusted individuals can easily access them when necessary.

Real-life scenarios: understanding the importance of proper estate planning

Understanding the potential consequences of absence in proper estate planning can be illustrated through various scenarios. Consider a family that faced complications after the sudden death of a parent who had not established a will; the heirs were left with disputes about property distributions and guardianship without clear directives left by their deceased parent. This highlights the essential nature of estate planning.

Moreover, unique assets like digital properties present complications when navigating estate planning. Their value can be vague, and without clear instructions, they may be lost forever. Additionally, parents with minor children must prioritize their guardianship within their estate plan to ensure their kids are taken care of in line with their wishes.

Navigating the legal landscape of estate planning

Understanding the local laws and regulations regarding estate planning is crucial, as each state has different requirements. Staying updated on any changes in these laws ensures that your estate plan remains valid and effective. Local resources, including state bar associations and legal websites, can provide essential updates on estate planning laws.

Working with local professionals who are familiar with the nuances of estate planning in your jurisdiction can provide clarity and bolster your confidence in the planning process. These professionals can help adapt your estate plan to changes in local legislation, ensuring you’re always in compliance.

Case studies of successful estate plans

Examining case studies of successful estate plans can provide valuable insights into the practical application of estate planning strategies. For instance, a well-planned estate can speed up the process of asset transfer to beneficiaries. This not only ensures that their wishes are followed but also minimizes emotional strain on grieving family members.

Moreover, learning from complex cases where families faced challenges due to poor planning can guide others. Evaluating the successful elements from these examples can inspire individuals to create robust estate plans that can withstand changing circumstances.

Appendix

To further your understanding of estate planning, refer to the glossary of key terms that often appear in estate documents. Additionally, reviewing a sample Estate Planning 101 Form can highlight how to structure your own form effectively, and don’t overlook the importance of accessing helpful online tools and resources available through pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in estate planning 101form proper?

Can I create an electronic signature for the estate planning 101form proper in Chrome?

How can I edit estate planning 101form proper on a smartphone?

What is estate planning 101 form proper?

Who is required to file estate planning 101 form proper?

How to fill out estate planning 101 form proper?

What is the purpose of estate planning 101 form proper?

What information must be reported on estate planning 101 form proper?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.