Get the free SINDH MICROFINANCE BANK

Get, Create, Make and Sign sindh microfinance bank

Editing sindh microfinance bank online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sindh microfinance bank

How to fill out sindh microfinance bank

Who needs sindh microfinance bank?

Sindh Microfinance Bank Form: A How-to Guide

Overview of Sindh microfinance bank forms

The Sindh Microfinance Bank form serves as a vital tool for individuals and small businesses seeking financial services tailored to their needs. These forms are crucial for a variety of banking processes, including loan applications and account openings. By utilizing the correct forms, clients can facilitate smooth interactions with the bank, ensuring their applications are processed efficiently without unnecessary delays.

Understanding the purpose and importance of these forms is imperative for anyone looking to engage with Sindh Microfinance Bank. Incorrectly filled forms or inappropriate selections can hamper the banking experience and lead to delays or rejections. Therefore, using the accurate Sindh microfinance bank form is essential for a positive banking experience.

Understanding the types of forms available

Sindh Microfinance Bank offers different types of forms suited for various financial services, each designed to cater to unique needs. The major categories include:

Accessing the Sindh microfinance bank forms

Accessing the required forms from Sindh Microfinance Bank is a straightforward process. Customers have the ability to download forms or access them online, making it convenient to initiate their banking processes.

To download forms, users can follow these simple steps on the pdfFiller website:

For those who prefer using mobile applications, the SMFB Digital Mobile Application allows users to access forms directly from their devices. This approach offers the added advantage of convenience and flexibility, making banking tasks manageable on the go.

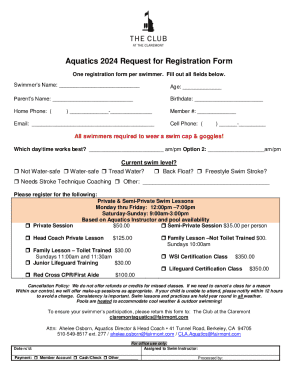

Step-by-step instructions for filling out the Sindh microfinance bank form

Properly filling out a Sindh microfinance bank form requires adherence to specific guidelines. Here are some essential tips to ensure accuracy and completeness in your submissions:

The core sections of the form typically include personal information, financial information, and a verification and consent section. Providing comprehensive and honest details in these sections enhances the processing of your application.

Editing and modifying your form

Utilizing tools like pdfFiller enhances the user experience when it comes to editing Sindh microfinance bank forms. pdfFiller provides various editing features that allow users to modify their forms prior to submission.

Key capabilities for editing include:

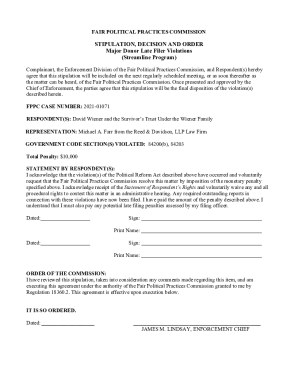

Signing and submitting the form

Once the Sindh microfinance bank form is accurately completed, it is essential to sign and submit it properly. The process for electronic signatures is straightforward, as outlined below:

After submission, clients should receive confirmation of receipt and can inquire about their application status through the bank’s customer service if needed.

Managing the form post-submission

Tracking the status of your application post-submission is crucial for ensuring timely follow-up and action. Clients can easily check the status by contacting Sindh Microfinance Bank's customer service or using their dedicated portal.

FAQs about Sindh microfinance bank forms

Clients often have questions regarding the Sindh microfinance bank forms, especially concerning submission procedures and associated processes. Common inquiries include information about eligibility, documentation requirements, and how to follow up.

Here are some frequently encountered issues and tips for troubleshooting:

Additional considerations

Accuracy in completing Sindh microfinance bank forms significantly impacts your chances of loan approval and overall account functionality. Incorrect information may not only delay processing but could also lead to outright rejections.

To navigate these challenges, leveraging customer support is vital. Sindh Microfinance Bank offers various channels through which clients can seek assistance, such as phone support, live chat, and dedicated email support. Making use of these resources can substantially ease the process of filling out and managing forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sindh microfinance bank online?

How do I fill out sindh microfinance bank using my mobile device?

How do I complete sindh microfinance bank on an iOS device?

What is Sindh Microfinance Bank?

Who is required to file Sindh Microfinance Bank?

How to fill out Sindh Microfinance Bank?

What is the purpose of Sindh Microfinance Bank?

What information must be reported on Sindh Microfinance Bank?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.