A comprehensive guide to credit card authorization template forms

Understanding credit card authorization forms

A credit card authorization form is a vital document that allows a business to charge a customer’s credit card for products or services. This form serves multiple purposes, primarily ensuring that the customer has given explicit permission for the business to process a transaction. In various industries such as hospitality, retail, and eCommerce, these forms are indispensable in managing finances and securing payment information.

Payment processing: Used to securely authorize transactions before charging.

Service agreements: Required for subscription-based services to confirm recurring payments.

Event bookings: Ensures that a customer's credit information is saved for reservation purposes.

The importance of credit card authorization forms cannot be overstated. They function as a protective measure for both businesses and consumers, reducing the risks of fraud and chargebacks. By obtaining proper authorization, companies establish trust, ensuring that clients feel secure in their transactions.

When to use a credit card authorization form

Knowing when to utilize a credit card authorization form is crucial for startups and established businesses alike. This form is particularly helpful in various scenarios, including one-time transactions where immediate payment confirmation is needed, or for recurring payment arrangements like subscriptions, where an ongoing authorization is essential for continued service.

One-time transactions: Ideal for single purchases or services.

Recurring payments: Needed for maintaining subscription services.

Virtual transactions: Especially important in eCommerce to verify identity.

Sellers should consider using an authorization form whenever they encounter card-not-present situations, as these transactions present higher risks for fraud. Implementing these forms not only mitigates financial risk but also bolsters customer trust by emphasizing security.

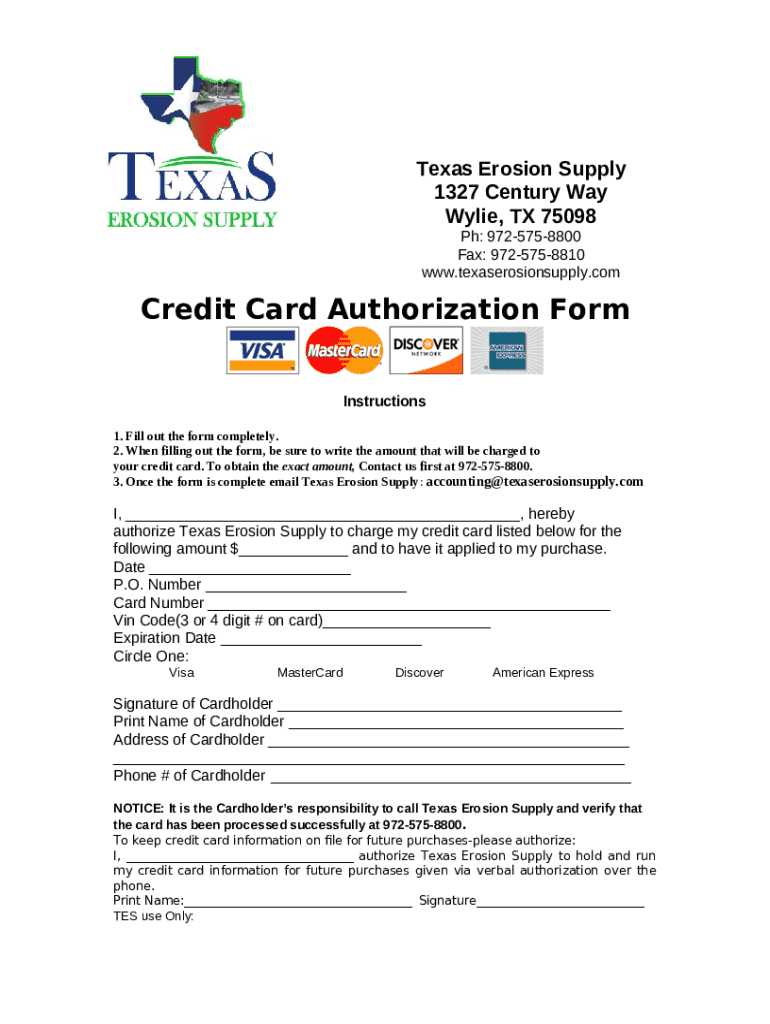

Components of a credit card authorization form

An effective credit card authorization form includes several key elements necessary for maintaining a secure transaction process. The customer information section typically gathers basic details such as the customer's name, billing address, and contact information. Payment details, including the credit card number and expiration date, are also vital for transaction authorization.

Customer information: Essential for identifying the payer.

Payment details: Card number and expiration date are critical for processing.

Terms and conditions: Should outline usage and handling of card information.

Optional sections can enhance the security of the form. For example, including a space for the CVV helps add a layer of security, while allowing room for electronic signatures can streamline the process. Each of these components works together to create a robust authorization document that protects all parties involved.

How to create your own credit card authorization form

Creating your own credit card authorization form can seem daunting, but following a step-by-step approach simplifies the process. Start by determining the necessary information you need to collect—this includes customer name, card details, and payment amounts. Next, consider using a pre-existing template or design your own customized layout.

Determine the necessary information: Clearly identify what data you need.

Choose a template: Utilize existing designs for efficiency.

Include instructions: Provide clear steps for customers to fill it out.

Add security measures: Consider encryption for storing card details.

Share digitally: Save the form in a shareable format for easy access.

Utilizing tools like pdfFiller saves time and enhances the form creation experience. With the platform’s interactive options, users can customize forms easily and integrate essential features like digital signatures for a seamless authorization process.

Best practices for handling credit card authorization forms

Once you have your credit card authorization forms ready, it's essential to implement best practices for handling them securely. Storing these forms in a secure environment is imperative. Transitioning to digital management systems reduces the risk of physical theft while ensuring that sensitive information is encrypted and accessible only to authorized personnel.

Store securely: Keep forms in encrypted digital folders.

Data protection: Regularly update security measures and protocols.

Comply with regulations: Stay informed about the laws governing payment processing.

It's also crucial to be aware of legal considerations when holding credit card information. Understanding compliance with payment processing regulations governs how long you can retain documents and dictates secure ways to dispose of them when no longer needed.

FAQs on credit card authorization forms

Addressing common questions regarding credit card authorization forms can provide clarity for users. A common query is whether it is legally necessary to use these forms. While it isn't mandatory, businesses are strongly encouraged to do so to protect themselves legally and financially.

Am I legally obligated to use credit card authorization forms? Not legally required, but highly recommended.

Why might a form not include a space for CVV? Some businesses may not need it for specific transactions.

What is 'Card on File'? A system where a business securely stores customer card information for future transactions.

With expert insights, it’s clear that misconceptions about credit card authorization forms often stem from a lack of understanding of their benefits. These forms are not merely bureaucratic hurdles; they are vital safeguards in today’s financial transactions.

Additional features to enhance user experience

Integrating eSignatures into credit card authorization forms can greatly increase efficiency and convenience for both businesses and customers. Electronic signatures streamline the authorization process, allowing customers to complete transactions more swiftly, which can significantly enhance customer satisfaction.

Benefits of electronic signing: Speeds up the approval process and reduces paperwork.

How to add signature fields: Use pdfFiller’s tools to insert interactive eSignature fields.

Additionally, collaborative editing options within platforms like pdfFiller allow teams to work together on document management. This feature enables multiple stakeholders to contribute to the form’s content, fostering better communication and ensuring that all necessary information is included.

Accessing downloadable templates

pdfFiller offers a diverse collection of customizable templates for credit card authorization forms. When selecting a template, it’s important to choose one that best fits your business needs and therapy processes. Each template is designed to be easy to edit and integrate, helping you maintain a professional standard in your documentation.

Explore our collection: View various templates that can be customized.

How to select the right form: Identify which features are necessary for your application.

By delving into our sample templates, users can gain insight into what a well-structured credit card authorization template should include, ensuring that their forms meet both operational and security requirements.

Related topics of interest

Expanding knowledge about financial transactions is essential in today’s marketplace. Understanding payment processing and gateways gives a greater context to the importance of credit card authorization forms. When developing secure methods for online transactions, these documents play a crucial role.

Understanding payment processing: Gain insight into how payments are processed securely.

Best practices for secure online transactions: Measures to take to protect customer information.

For further reading, consider exploring articles focusing on fraud prevention in eCommerce, as these insights can bolster knowledge about why credit card authorization forms are a critical element in preventing loss.

Popular resources and tools

For those looking to dive deeper into the realm of document management, pdfFiller offers popular templates and guides designed to enhance the user experience with credit card authorization forms. By reviewing user testimonials, you can learn about the platform's effectiveness in improving document interactions.

Most popular templates: Quick access to frequently used resources.

User reviews: See what others are saying about pdfFiller features.

Subscribing for updates can also prove beneficial, ensuring that you stay current with the latest trends and resources delivered straight to your inbox.