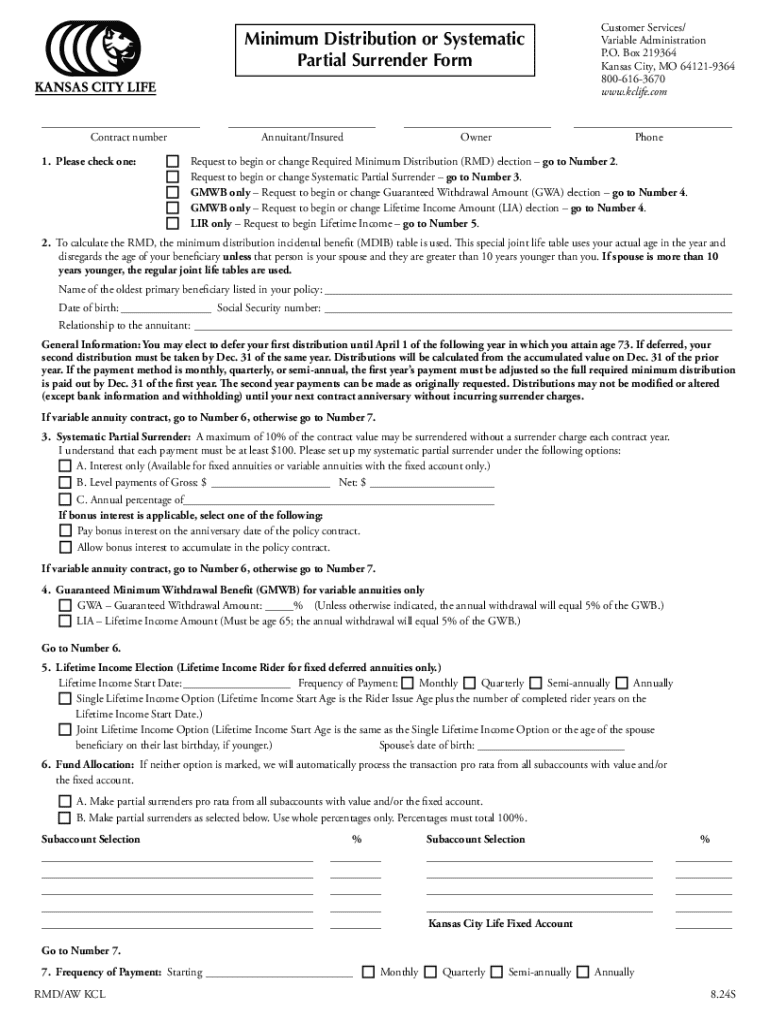

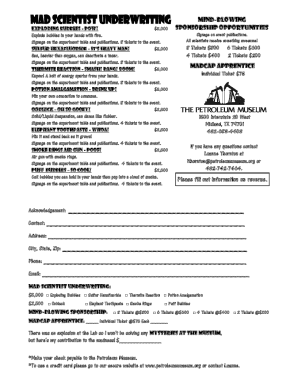

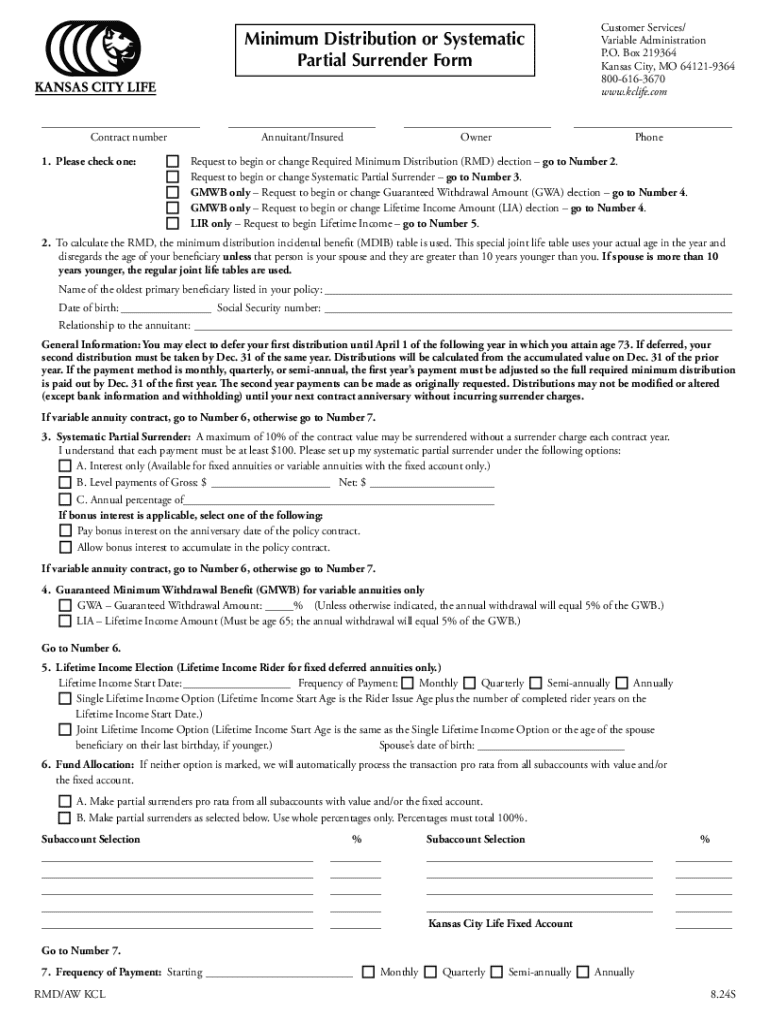

Get the free Minimum Distribution or Systematic Partial Surrender Form

Get, Create, Make and Sign minimum distribution or systematic

Editing minimum distribution or systematic online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minimum distribution or systematic

How to fill out minimum distribution or systematic

Who needs minimum distribution or systematic?

Minimum Distribution or Systematic Form: A Comprehensive Guide

Understanding minimum distributions

Minimum distributions are essential components of financial planning, especially as you transition into retirement. These distributions ensure that you withdraw necessary funds from your retirement accounts, which can include IRAs and 401(k)s, among others. The two primary types of minimum distributions are Required Minimum Distributions (RMDs) and systematic withdrawals. Understanding the differences and nuances of each can aid in effective financial management during retirement.

Required Minimum Distributions (RMDs) are mandatory withdrawals from retirement accounts starting at a certain age, while systematic withdrawals are more flexible and can be set up according to personal financial needs. Both strategies are crucial for adhering to tax regulations and managing income during retirement.

Required Minimum Distributions (RMDs)

RMDs kick in once you reach a specific age, typically 72 years for most retirement accounts. However, some exceptions apply, such as for certain inherited IRAs. RMDs are calculated based on the account balance and your life expectancy, following guidelines established by the IRS. Missing an RMD can lead to severe penalties, making it crucial to be aware of when and how to withdraw.

To calculate your RMD, you would first need to determine your account balance at the end of the previous year and then use the IRS life expectancy table to figure your necessary distribution period. This straightforward formula allows you to meet government requirements effectively.

Calculation of RMDs

Calculating your RMD is central to ensuring you don't incur tax penalties. The process involves two key steps: determining your account balance as of December 31 of the previous year and dividing it by a distribution period from the IRS's life expectancy table. For example, if your traditional IRA balance was $100,000 and your life expectancy factor is 25.6, your RMD would be approximately $3,906.

It's essential to stay updated on IRS guidelines, as the tables for life expectancy can be updated over the years, affecting your distribution calculations.

Reporting and withholding taxes on RMDs

When it comes to RMDs, proper reporting to the IRS is critical. Financial institutions are responsible for communicating these distributions, but the ultimate responsibility lies with you. Ensuring that your RMDs are reported properly helps avoid unnecessary tax penalties.

Additionally, when taking your RMD, you can choose to withhold taxes from your distributions. This is particularly beneficial if you want to avoid a larger tax bill when tax season arrives. To streamline your tax management, consider working with a financial advisor who can advise on the best withholding strategies based on your overall financial situation.

Systematic withdrawal plans

A systematic withdrawal plan (SWP) offers a distinct approach to taking funds from your retirement savings. Unlike RMDs, which mandate specific withdrawal amounts based on IRS rules, an SWP allows you to withdraw a predetermined amount, at regular intervals, to create a steady income stream. This flexibility can be advantageous as it aligns more closely with your lifestyle and financial needs.

Benefits of adopting a systematic withdrawal strategy include the ability to tailor your withdrawals to match your spending needs, potential for more effective tax management, and the capability to adjust the frequency and amount based on market conditions or personal goals.

Establishing a systematic withdrawal plan

Creating a systematic withdrawal plan involves several considerations. First, determine the frequency and amount of your withdrawals to ensure they align with your overall financial goal without depleting your assets too quickly. Regular review and adjustment of this plan are imperative to adapting to changing market conditions or shifts in personal circumstances.

Consider the tax implications of your withdrawals, as different retirement accounts can have varied tax impacts. For instance, distributions from traditional IRAs are taxed as ordinary income, whereas qualified withdrawals from Roth IRAs are tax-free. Tailoring your systematic withdrawal plan to leverage these tax benefits can enhance your financial stability.

Tax implications of systematic withdrawals

Understanding tax implications is crucial for retirement planning. Systematic withdrawals can influence your tax situation significantly. It's essential to be aware that non-qualified accounts may be taxed differently than qualified retirement accounts. For instance, capital gains tax may apply when withdrawing from taxable investments, whereas traditional IRAs will incur ordinary income tax.

Additionally, keeping an eye on the overall impacts of your withdrawals on Social Security benefits is important, as excessive income can lead to taxation on your benefits.

Managing distributions from multiple accounts

For those with several retirement accounts, managing distributions can feel overwhelming. Combining distributions from various IRAs requires extensive knowledge to ensure compliance with tax regulations while addressing your financial needs effectively. Keeping track of all account balances and understanding the associated tax implications is pivotal.

Coordinating RMDs across different account types adds another layer of complexity. For instance, RMDs from traditional IRAs are mandatory, while Roth IRAs do not have RMD requirements during the owner's lifetime. Understanding these rules helps streamline your withdrawal strategy and mitigates potential penalties.

Advanced strategies for distributions

For those looking to optimize their distribution strategy further, Qualified Charitable Distributions (QCDs) can be a beneficial tool. A QCD allows you to transfer funds directly from your IRA to a qualified charity, potentially reducing your taxable income and fulfilling your charitable giving goals simultaneously.

It's equally essential to handle under- or over-distributions appropriately. Missing your RMD can result in a substantial penalty of 50% of the required amount, while over-distributions may lead to tax burdens you weren't prepared to manage. Therefore, maintaining a dynamic approach to your withdrawal strategy, adjusting based on market performance, is critical.

Tools and resources for managing distributions

One versatile tool for managing the documentation involved in RMDs and systematic withdrawals is pdfFiller. This cloud-based platform empowers users to create, edit, eSign, and manage financial documents seamlessly from any location, making financial administration far less cumbersome.

Using pdfFiller, you can keep your records organized and accessible, improving efficiency when submitting necessary documentation to financial institutions. Whether it's IRS forms or withdrawal requests, pdfFiller simplifies the documentation process, ensuring you remain focused on your retirement goals.

Best practices for record keeping

Maintaining detailed records is a cornerstone of effective financial management, particularly when it comes to RMDs and systematic withdrawals. Using tools like pdfFiller for document management not only ensures thorough record-keeping but also facilitates review and audits by keeping everything accessible and organized.

Best practices for keeping track include regularly updating your accounts and records after each withdrawal, tracking any changes in tax law that might affect your distributions, and setting reminders for key distribution dates to maintain compliance and avoid penalties.

FAQs about minimum distributions and systematic withdrawal plans

Understanding the nuances of RMDs and systematic withdrawal plans often raises several questions. For example, many individuals wonder what happens if they miss their RMD deadline. The IRS imposes dire penalties, so it's crucial to prioritize these withdrawals. If you find yourself in a bind, it's advisable to consult a tax advisor for potential corrective measures.

Similarly, questions about how withdrawals can impact Social Security benefits are prevalent. Essentially, while the withdrawals themselves do not directly affect your Social Security, the resulting increase in income could lead to higher taxes on those benefits. It's wise to strategize your distributions carefully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit minimum distribution or systematic from Google Drive?

How do I make edits in minimum distribution or systematic without leaving Chrome?

How do I fill out minimum distribution or systematic on an Android device?

What is minimum distribution or systematic?

Who is required to file minimum distribution or systematic?

How to fill out minimum distribution or systematic?

What is the purpose of minimum distribution or systematic?

What information must be reported on minimum distribution or systematic?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.