Get the free Revenue of Top 5000 Companies FromPDF

Get, Create, Make and Sign revenue of top 5000

How to edit revenue of top 5000 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out revenue of top 5000

How to fill out revenue of top 5000

Who needs revenue of top 5000?

Understanding the Revenue of Top 5000 Form

Overview of the revenue of top 5000

The revenue of top 5000 form plays a crucial role in assessing the performance of large corporations globally. This metric not only highlights the financial health of these entities but also provides insights into market dynamics and trends. Tracking these revenues offers a clear perspective on which sectors are thriving, as well as how well companies are adapting to changing conditions. Investment decisions, policy implications, and economic forecasting are all significantly influenced by understanding these revenue patterns.

Analyzing trends in revenue generation among the top 5000 companies unveils critical insights. Recent data indicates that while some industries have seen stagnation, others continue to flourish due to technological innovations and shifts in consumer behavior. A keen understanding of these trends equips stakeholders with the information necessary to strategize for future investment and operational enhancements.

Understanding the criteria for top 5000 ranking

To qualify for inclusion in the top 5000 ranking, companies must meet specific revenue thresholds, generally defined by total annual revenue. These metrics gauge a company's ability to generate income over a fiscal year. Factors influencing the ranking include not only the gross revenue but also profitability margins, growth potential, and market capitalization.

Key factors influencing positioning within this elite list also extend to operational efficiencies and diversified revenue streams. For instance, companies that effectively leverage innovative business models are more likely to surge up the ranks as compared to those relying on traditional practices. Understanding these criteria is essential for businesses aiming for inclusion in the top 5000.

Industry breakdown of revenue distribution

A deep dive into the revenue distribution among key industries represented in the top 5000 reveals significant disparities. Major sectors like technology, healthcare, and finance lead the charge, consistently demonstrating robust revenue figures. For instance, the tech industry has seen unprecedented growth, fueled by advancements in AI, cloud computing, and eCommerce.

Comparatively, traditional manufacturing and agriculture sectors often lag behind, grappling with challenges from globalization and environmental concerns. Noteworthy trends such as sustainability initiatives are reshaping revenue patterns, allowing more adaptive sectors to gain ground. The ongoing focus on digital transformation will also heavily influence revenue dynamics across industries.

Regional analysis of revenue generation

The geographical distribution of revenue generated by top 5000 companies reveals distinctive patterns. North America continues to dominate, driven by high-performing tech giants and pharmaceutical companies. However, Europe is not far behind, showcasing significant revenues from automotive and luxury goods companies, while Asia is rapidly growing, particularly through emerging markets in India and Southeast Asia.

Regions like Silicon Valley in the USA exemplify successful business environments, fostering innovation and attracting global talent. Case studies of companies such as Apple and Google illustrate how regional factors contribute to exceptional revenue generation, paving the way for regional growth narratives.

Breakdown by country/territory

Leading the charge in the revenue of top 5000 companies are countries like the United States, China, and Japan, which exhibit high levels of capital investment and consumer spending. Revenue comparisons among these nations underscore the influence economic conditions significantly wield, shaping corporate growth trajectories.

For instance, economic turbulence in regions may lead to varying performance outcomes among companies. During recent global downturns, businesses in more resilient economies showed notable profitability, while those in emerging markets struggled. A comprehensive understanding of these dynamics can inform future investment strategies and revenue projections.

Leadership by sector

Sector leaders within the top 5000 ranking exemplify excellence through a combination of innovative practices and strategic positioning. Tech giants such as Microsoft and Amazon lead with pioneering solutions and extensive market reach. Their capacity to adapt to rapid changes in consumer preferences and technological advancements sets them apart.

A deeper analysis into these companies reveals that their organizational culture, investment in R&D, and agility in operations significantly contribute to their leader status. These factors collectively enhance their competitiveness in an increasingly complex global marketplace.

Breakdown by industry

A thorough overview of major industries present in the top 5000 forms reveals diversified challenges and unique opportunities within each sector. For instance, the automotive industry is grappling with a shift toward electric vehicles, while the retail sector faces pressures from eCommerce expansion. Each industry navigates its own hurdles, such as supply chain disruptions or compliance with environmental regulations.

Looking ahead, projections indicate that industries focused on sustainability and digital transformation are poised for significant revenue growth. Strategic investments in innovative technologies and consumer-centric approaches will be vital for industries to sustain their growth trajectories.

The role of services in revenue generation

In the context of the revenue of top 5000 form, innovative services play a critical role in driving growth. Service-oriented companies like Airbnb and Uber have reshaped their respective industries by leveraging technology and capitalizing on changing consumer preferences.

Digital transformation has also had profound effects on service revenue models. This evolution allows for personalized offerings and streamlined operations, enhancing customer experiences and revenue streams. As companies adopt these models, they set the stage for sustained competitive advantages in the marketplace.

Interactive tools for revenue analysis

An array of interactive tools exists to facilitate in-depth revenue analysis among top 5000 companies. Platforms are equipped with features that allow users to visualize trends, breakdown performance metrics, and generate insightful reports. For example, using data analysis tools like Tableau or Microsoft Power BI can significantly enhance understanding of revenue dynamics.

To use these tools effectively, follow a simple guide: start by compiling your data sources; then, utilize the software to create engaging visual representations; finally, interpret the data to gain actionable insights. Successful case studies have illustrated how companies leveraged these tools for strategic revenue maximization.

Tips for maximizing revenue potential

To maximize revenue potential, companies within diverse industries should consider several strategic recommendations. Understanding customer needs and preferences enables targeted offerings, enhancing engagement and satisfaction. Additionally, investing in employee training fosters a culture of innovation and efficiency.

Implementing best practices in financial management is equally vital, ensuring effective cash flow management and cost control. Collaboration with strategic partners can also unveil new revenue opportunities through shared insights and resources.

Challenges faced in revenue generation

Despite the potential for high revenues, companies often encounter formidable challenges. Economic fluctuations and market dynamics pose common obstacles that can affect revenue generation significantly. Issues such as regulatory changes and shifting consumer behaviors can hinder even the most established corporations.

Understanding these challenges is crucial for businesses aiming to thrive. Case studies of companies that have successfully navigated these hurdles highlight the importance of resilience and adaptability. By analyzing their tactics, organizations can craft their response strategies to mitigate risks and enhance revenue.

The future of the top 5000's revenue landscape

Looking forward, the revenue landscape for the top 5000 is sure to evolve, shaped by emerging trends and technological advancements. Projected trends indicate that companies focusing on sustainability and inclusivity will likely experience robust growth. Moreover, the rise of automation and AI will fundamentally change operational structures, leading to new revenue opportunities.

Companies must plan meticulously for sustainable revenue streams by investing in research and development and understanding market demands. The revenue of top 5000 firms must adapt to these changes to stay relevant and competitive in an ever-evolving landscape.

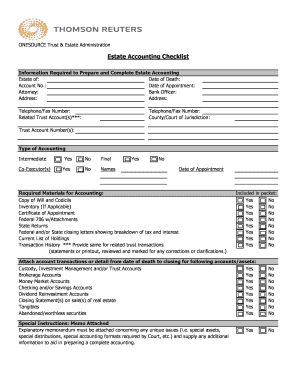

Engaging with pdfFiller for document solutions

Utilizing pdfFiller for managing financial documentation, particularly the revenue of top 5000 forms, can enhance operational efficiencies. The platform allows users to prepare, manage, and share documents seamlessly, ensuring timely information sharing across teams.

Customer testimonials frequently highlight pdfFiller's ease of use and comprehensive features, empowering organizations to improve their documentation processes. With capabilities for editing PDFs and eSigning documents, pdfFiller stands out as a robust solution for streamlining document management.

FAQs on revenue of top 5000

Many individuals have questions about the formulation of revenue metrics and how to interpret data points. Understanding how various factors contribute to overall revenue health is paramount for effective analysis. Key areas of interest often include the methods for calculating revenue and insights into industry comparisons.

For additional information, companies may find valuable resources online, including financial reports and industry analyses. Engaging with these resources can provide deeper insights, enabling organizations to make informed decisions regarding recognition and strategy formation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my revenue of top 5000 directly from Gmail?

How can I modify revenue of top 5000 without leaving Google Drive?

How do I complete revenue of top 5000 online?

What is revenue of top 5000?

Who is required to file revenue of top 5000?

How to fill out revenue of top 5000?

What is the purpose of revenue of top 5000?

What information must be reported on revenue of top 5000?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.