Get the free Outgoing Domestic Wire

Get, Create, Make and Sign outgoing domestic wire

Editing outgoing domestic wire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out outgoing domestic wire

How to fill out outgoing domestic wire

Who needs outgoing domestic wire?

Outgoing Domestic Wire Form: A Comprehensive Guide

Understanding outgoing domestic wire transfers

Outgoing domestic wire transfers are electronic funds transfers that move money from one bank account to another within the same country. They are essential for individuals and businesses looking to send money quickly and securely, with funds typically made available to the recipient within the same business day.

The importance of outgoing domestic wire transfers lies in their reliability and speed, making them a favored choice for various transactions, such as real estate purchases, vendor payments, and personal remittances. Unlike checks or cash, wire transfers offer immediate processing, reducing the risk of delays.

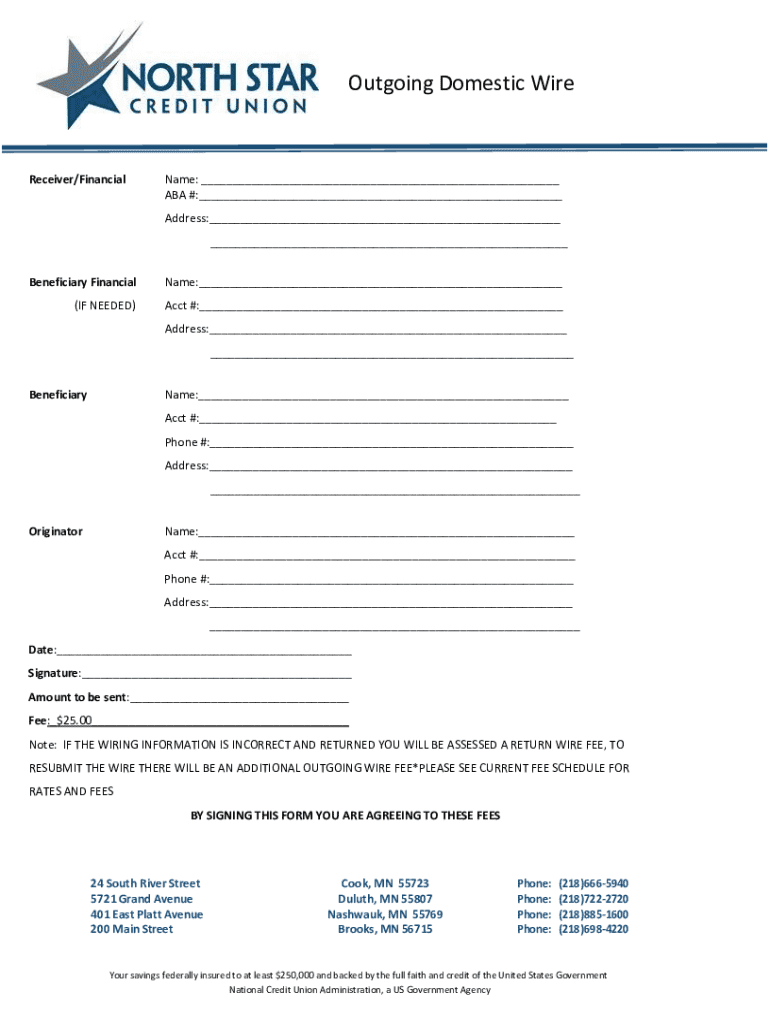

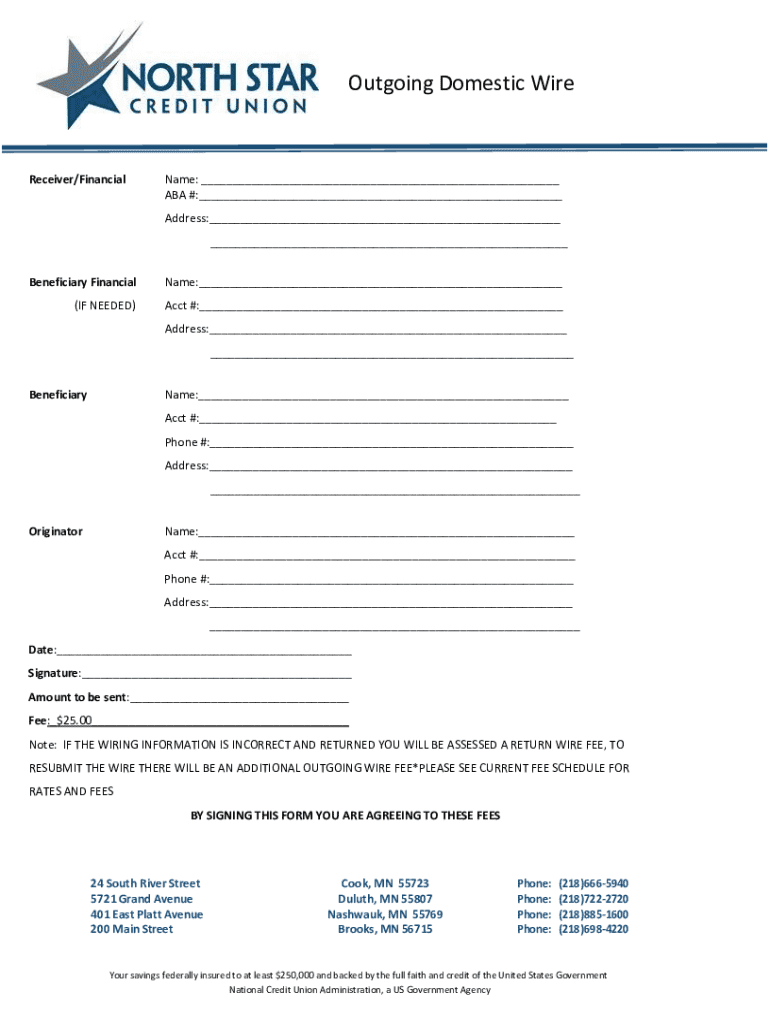

Overview of the outgoing domestic wire form

The outgoing domestic wire form is a standardized document used to initiate wire transfers. This form collects essential information from both the sender and recipient, ensuring a smooth transaction process. Typically available at banks and financial institutions, this form guides the sender in providing the necessary details to facilitate the transfer.

Key components of the outgoing domestic wire form include:

Most traditional banks, credit unions, and online financial institutions accept wire transfers, ensuring a wide range of options for users.

Step-by-step instructions for filling out the outgoing domestic wire form

Filling out the outgoing domestic wire form accurately is crucial for completing a successful transfer. Start by gathering the necessary information. Confirm that you have your bank account details and personal identification ready.

For the sender information section, provide:

Next, fill out the recipient information, which includes:

Finally, confirm the amount and currency of the transfer. Double-check this information to avoid any mistakes, as errors can result in delays or failed transactions.

Common mistakes to avoid while filling out the form include providing incorrect recipient information or entering the wrong amount. Ensuring accuracy here is vital to ensure your wire transfer is processed smoothly.

Submission process for the outgoing domestic wire form

Once the outgoing domestic wire form is completely filled out, you can submit it. There are two primary methods: online submission and in-person submission.

For online submission, log into your bank’s online platform, navigate to the wire transfer section, and follow the on-screen instructions to upload your completed form. Conversely, if submitting in person, visit your bank branch and present the form at the service desk.

Verification processes typically involve the bank confirming your identity and the transaction before processing. Expect a confirmation notification once your transaction is submitted and being processed.

Processing times for outgoing domestic wire transfers can vary according to financial institutions, but most transfers are completed within a single business day.

Additional information relevant to outgoing domestic wire transfers

When sending large transfers, certain banks may require additional documentation, such as proof of identification or explanation of the funds being transferred. This requirement helps combat fraud and ensures compliance with financial regulations.

It's essential to be aware of the fees associated with sending wire transfers, which usually range from $15 to $50, depending on the institution. Furthermore, each bank will have its own transaction limits and restrictions, so it’s advisable to inquire about these before initiating a transfer.

Tracking your wire transfer is typically straightforward, as most banks offer online tracking through their portal. For a successful transfer, always double-check the recipient’s information before submission to minimize errors.

Addressing specific use cases for outgoing domestic wire transfers

Outgoing domestic wire transfers can serve multiple purposes, each having its unique requirements and nuances.

Helpful resources

There are various resources available to assist with outgoing domestic wire transfers. Financial institutions typically provide interactive tools for calculating transfer costs that can help you determine the most cost-effective options.

Additionally, you can find links to commonly used outgoing domestic wire forms on bank websites. For those considering multiple options, comparing the wire transfer services of different banks may help in selecting the right fit for your needs.

In the case of delayed or missing transfers, your bank should have a specific protocol in place for addressing these issues. Maintaining open communication with your financial institution is essential to resolving any problems swiftly.

Frequently asked questions (FAQs)

Queries about outgoing domestic wire transfers are common among users. Important questions include service hours, security measures, cancellation policies, and how to amend a submitted wire transfer.

Contacting support for outgoing domestic wire transfers

If you encounter complications during the wire transfer process, reaching out to customer support is advisable. Each financial institution provides various channels for assistance, including phone support, email inquiries, and live chat options.

Before reaching out, ensure you have all relevant details and documentation on hand. This will facilitate a more efficient resolution process. Collaborating with your bank or financial service provider through their official forums can also offer immediate help or valuable resources.

Best practices for securely managing your outgoing domestic wire transfers

Managing outgoing domestic wire transfers securely involves vigilance and proactive measures. Begin with keeping your financial information safe; avoid disclosing sensitive information and use secure networks when completing transactions.

Regular monitoring of your bank account for unrecognized transactions will enable prompt action in case of unexpected issues. Utilizing tools like pdfFiller can streamline document management—allowing easy editing, eSigning, and organizing of important forms related to wire transfers.

By adopting these best practices, you can enjoy the convenience and efficiency wire transfers offer while minimizing risks associated with financial transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get outgoing domestic wire?

How do I make edits in outgoing domestic wire without leaving Chrome?

How do I fill out outgoing domestic wire using my mobile device?

What is outgoing domestic wire?

Who is required to file outgoing domestic wire?

How to fill out outgoing domestic wire?

What is the purpose of outgoing domestic wire?

What information must be reported on outgoing domestic wire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.