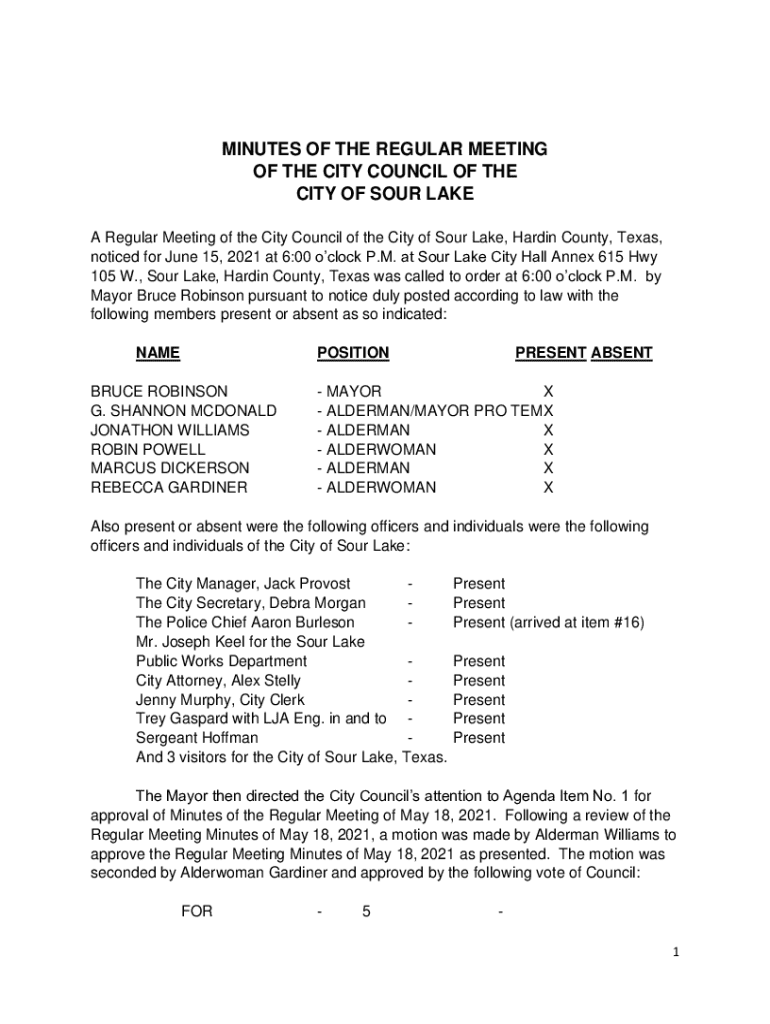

Get the free noticed for June 15, 2021 at 6:00 oclock P

Get, Create, Make and Sign noticed for june 15

How to edit noticed for june 15 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out noticed for june 15

How to fill out noticed for june 15

Who needs noticed for june 15?

Comprehensive Guide to the Noticed for June 15 Form

Understanding the 'Noticed for June 15' form

The 'Noticed for June 15' form plays an essential role for individuals and organizations needing to meet specific submission deadlines by June 15. This form often pertains to tax submissions, official applications, or regulatory notifications that mandate a clear acknowledgment of timely compliance. Understanding this form is critical to avoid penalties and ensure validation of submissions.

Key features of the 'Noticed for June 15' form

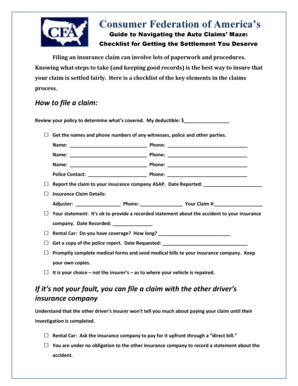

When it comes to filling out the 'Noticed for June 15' form, certain core pieces of information are required. This includes personal identifiers like your name and address, as well as the purpose of the form, such as the specific action being taken or information being submitted.

The form is structured to facilitate precision and clarity in documentation. Typically, it contains multiple sections, each dedicated to a different aspect of the submission, helping ensure all necessary information is captured promptly.

Preparing to fill out the 'Noticed for June 15' form

Before diving into the form, it’s crucial to prepare. Gathering all necessary documents is a vital step in ensuring a smooth filling process. For instance, having your previous filings, identification documents, and any relevant correspondence can provide clarity and context.

Organize your information by creating a checklist. This preparation phase helps streamline your efforts and avoid blank fields that could lead to delays or rejections in your submission.

Step-by-step guide to filling out the 'Noticed for June 15' form

Filling out the 'Noticed for June 15' form can seem daunting, but breaking it down section by section makes the process manageable. Start with personal information at the top of the form, ensuring accuracy as this information is crucial for identification.

After personal details, move on to specify the purpose of your submission. This section is often where people make mistakes, so take care to be clear and precise in your wording. Lastly, review that you have signed the document at the end, as an unsigned form is often rejected.

Submission process for the 'Noticed for June 15' form

Once your form is filled out, the next step is submitting it. Depending on the requirements, you may have several options for submission, including online, by mail, or in person. For online submissions, be sure to follow the electronic filing instructions carefully, as some platforms may have specific protocols.

If you're submitting via mail or in person, ensure that you have copies of all documents for your records and that they are sent to the correct address. Tracking the submission is also highly advisable, as it confirms receipt and keeps you informed about its status.

Modifying and amending the 'Noticed for June 15' form

There may be instances after submission where you realize updates are necessary. Common situations prompting amendments include changes in contact information or corrections of errors in the original form. Preparing to amend the form quickly can prevent potential penalties or compliance issues.

To modify the 'Noticed for June 15' form, contact the relevant agency to understand their update process and any forms required. Keep in mind that there may be costs associated with filing amendments, and adherence to specific protocols is essential.

Frequently asked questions (FAQs)

Many questions arise around the 'Noticed for June 15' form, particularly relating to deadlines and submission penalties. It’s vital to be informed about due dates and the implications of late submissions, which can include fines or rejected applications.

Additionally, for those seeking assistance, it’s beneficial to have contact information for agencies or organizations that can provide support. Knowing where to turn for help can alleviate the stress associated with navigating forms.

Leveraging pdfFiller's tools for managing the 'Noticed for June 15' form

pdfFiller provides various tools that streamline the process of managing the 'Noticed for June 15' form. Editing your document is seamless, allowing users to make changes directly on the platform, significantly reducing the time spent on revisions.

In addition, pdfFiller's eSigning capabilities simplify adding a legal signature to the form electronically, without the need for printing. After submission, you can also manage and archive your documents conveniently, providing easy access for future needs.

Comparative insights: Alternatives to the 'Noticed for June 15' form

While the 'Noticed for June 15' form serves specific needs, various other forms or documents may cater to similar purposes, depending on your situation. For example, when filing business taxes, you might be required to submit a different form; however, the process will typically resemble that of the June 15 form.

Understanding when to choose an alternative over the 'Noticed for June 15' form is essential in making informed decisions about your submissions and compliance. Different scenarios ranging from domestic partnerships to business applications often determine which documents take precedence.

Future revisions and updates

The regulatory environment often leads to changes in form guidelines, including the 'Noticed for June 15' form. Staying informed on potential updates or revisions is crucial for anyone using this document regularly, whether for tax planning or compliance.

Set reminders for yourself or utilize newsletters and legal updates from relevant agencies to keep abreast of new regulations or changes in submission processes. This preparedness can save you from compliance issues down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my noticed for june 15 directly from Gmail?

Can I edit noticed for june 15 on an iOS device?

How do I complete noticed for june 15 on an iOS device?

What is noticed for June 15?

Who is required to file noticed for June 15?

How to fill out noticed for June 15?

What is the purpose of noticed for June 15?

What information must be reported on noticed for June 15?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.