Get the free Life and AD&D insuranceSun Life U.S.

Get, Create, Make and Sign life and adampd insurancesun

How to edit life and adampd insurancesun online

Uncompromising security for your PDF editing and eSignature needs

How to fill out life and adampd insurancesun

How to fill out life and adampd insurancesun

Who needs life and adampd insurancesun?

Life and AD& Insurance Sun Form: A Comprehensive Guide

Understanding life and AD& insurance

Life insurance provides a financial safety net for your loved ones in the event of your death, allowing them to maintain their quality of life and cover essential expenses, such as mortgage payments and college tuition.

The two primary types of life insurance are term and whole life. Term life insurance covers you for a specific period, typically 10, 20, or 30 years, and is usually more affordable. Whole life insurance, in contrast, provides coverage for your entire lifetime and builds cash value over time.

What is accidental death & dismemberment (AD&) insurance?

AD&D insurance offers additional protection. It pays benefits in the event of an accidental death or if you suffer a severe injury resulting in dismemberment – loss of limbs or functions. Typically, AD&D insurance covers specific situations outlined in the policy, such as accidents occurring at work, on the road, or in recreational activities.

Key coverage details usually include cash benefits for accidental deaths, varying amounts for losses of limbs or eyesight, and sometimes provisions for specific types of accidents, ensuring broader protection.

The importance of life and AD& insurance

Choosing life insurance ensures financial security. If you've dependents relying on your income, a life insurance policy provides peace of mind. In the event of an untimely death, it ensures that your loved ones are not burdened with financial instability due to lost income.

Beneficiaries are crucial in this aspect. Life insurance allows you to designate who receives the benefits, enabling you to plan your financial legacy and protect your family’s future.

AD&D insurance plays a critical role in safeguarding against unforeseen events that can result in significant financial consequences. Accidents can happen anytime, and having this additional layer of protection ensures that you and your family can cope with injuries or fatalities that stem from such unfortunate occurrences.

For instance, if you were to suffer a serious injury while driving to work, AD&D insurance could offer compensation for medical bills and lost wages, relieving immediate financial pressures.

Overview of the 'Life and AD& Insurance Sun Form'

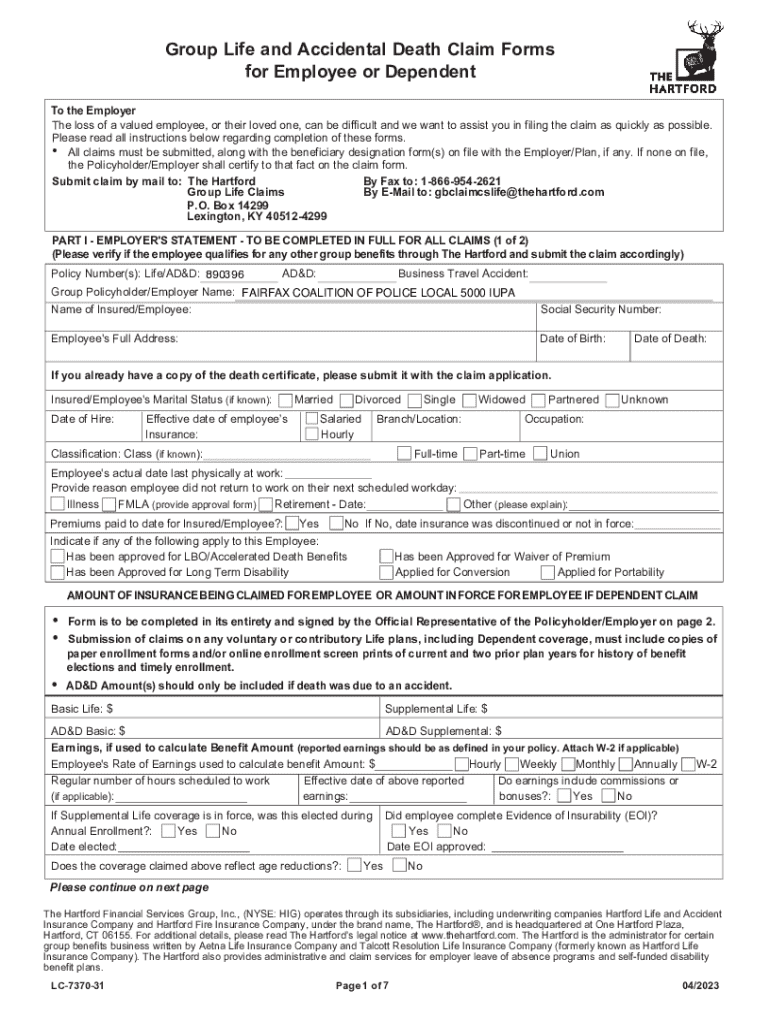

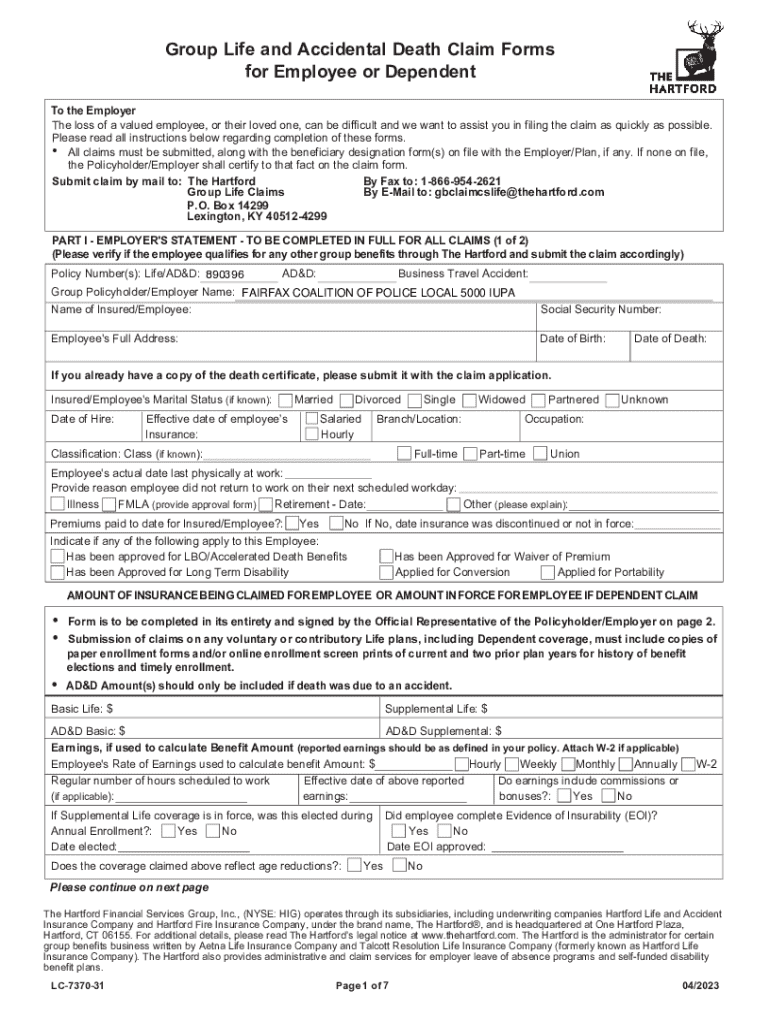

The 'Life and AD&D Insurance Sun Form' is a crucial document in the policy application process. Its purpose is to gather necessary information about the applicant to assess eligibility and determine coverage options. Properly completing this form is vital for a smooth application process.

Required information on the form includes personal details such as name, address, and date of birth, along with financial disclosures that outline income sources and debts. Health disclosures are equally important, providing insurers with insight into any pre-existing conditions that might affect coverage.

Step-by-step guide to filling out the Life and AD& Insurance Sun Form

Preparing to fill out the form is essential. Begin by gathering documents such as your ID, proof of income, and health records. Understanding the importance of accuracy can prevent delays in processing your application.

When filling out the form, pay close attention to each section. Start with personal information, ensuring that all details are spelled correctly.

Common mistakes to avoid include providing incorrect information or omitting signatures. Double-checking these details can save you time and hassle during the processing of your form.

Editing and managing your Life and AD& Insurance Sun Form

Digital solutions can streamline form management. Platforms like pdfFiller allow for easy editing and handling of your forms. You can update, save, and organize your documents seamlessly with their cloud-based platform, ensuring that you always have access to your forms whenever needed.

Equipping yourself with collaboration features enables you to share your form with team members or financial advisors for feedback before submission. pdfFiller allows you to leave comments and request input, improving the quality of your submission.

Signing your Life and AD& Insurance Sun Form

Electronic signature requirements have become increasingly accepted in the insurance industry. Using eSignatures provides a legal validation equivalent to a handwritten signature.

To eSign your form using pdfFiller, follow these steps: Upload your completed form, click on the signature section, and choose to create or use an existing electronic signature. Finally, place your signature and save the document.

After submission: Next steps

After submitting, confirming your application has been received is essential. You can do this by checking any acknowledgment emails or tracking the form status through pdfFiller.

Expect varying processing times from your insurer, which typically range from a few days to weeks. Understanding how the policy issuance works can help manage your expectations during this waiting period.

Frequently asked questions about life and AD& insurance

Common queries revolve around coverage limits and exclusions. It's vital to understand the specifics of what is included or excluded in your policy. This knowledge helps prevent surprises when filing a claim.

Specific to the Sun Form, people often seek clarifications on how to fill out certain sections. Always refer to guidelines provided with the form for accurate completion, and reach out to your insurer if in doubt.

Tips for choosing the right life and AD& insurance policy

Assessing your coverage needs involves several factors, such as your financial responsibilities, dependents’ needs, and existing debts. Tools like insurance calculators can help estimate how much coverage might be appropriate for you.

Comparing providers is also crucial. Look for factors like their financial reliability, customer service ratings, and the specifics of policy documents. Reading the fine print ensures you fully understand the terms of coverage.

Feedback and enhancements

User experience insights play an important role in improving document management processes. Collecting user feedback helps identify areas for enhancement, ensuring that pdfFiller remains user-friendly and efficient.

Future enhancements on pdfFiller may include advanced integrations and additional features for document management, optimizing workflows for individuals and teams managing life and AD&D insurance forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find life and adampd insurancesun?

How do I make changes in life and adampd insurancesun?

How do I complete life and adampd insurancesun on an Android device?

What is life and ad&d insurance?

Who is required to file life and ad&d insurance?

How to fill out life and ad&d insurance?

What is the purpose of life and ad&d insurance?

What information must be reported on life and ad&d insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.