Get the free Beneficial OwnershipForm, Rules, FAQs - Central Bank

Get, Create, Make and Sign beneficial ownershipform rules faqs

How to edit beneficial ownershipform rules faqs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficial ownershipform rules faqs

How to fill out beneficial ownershipform rules faqs

Who needs beneficial ownershipform rules faqs?

Beneficial Ownership Form Rules FAQs

Understanding beneficial ownership

Beneficial ownership refers to the real person or entity that ultimately owns or controls an asset, even if it is held in another name. This concept is crucial in corporate governance and financial transparency, ensuring that the identity of those with actual control is disclosed. In the corporate world, recognizing the beneficial owner helps mitigate issues related to fraud, money laundering, and tax evasion.

The importance of beneficial ownership stretches beyond legal definitions; it affects investors, regulators, and the broader economy. A transparent system allows stakeholders to assess risks associated with ownership structures, thus fostering trust in markets. Due to these implications, governments worldwide have established beneficial ownership regulations to increase accountability.

Regulatory framework for beneficial ownership

Beneficial ownership regulations are governed by a mix of international standards and local laws. Key legislation includes the Financial Action Task Force (FATF) recommendations, which guide member countries to implement robust mechanisms for identifying and disclosing beneficial ownership. In the United States, the Corporate Transparency Act (CTA) specifically mandates reporting by corporations and limited liability companies.

Regulatory bodies, including the Securities and Exchange Commission (SEC) and Financial Crimes Enforcement Network (FinCEN) in the U.S., play pivotal roles in overseeing compliance. These agencies require both individuals and entities to disclose their beneficial ownership to prevent misuse of corporate structures. Non-compliance can lead to severe penalties, making it crucial for businesses to keep abreast of their obligations.

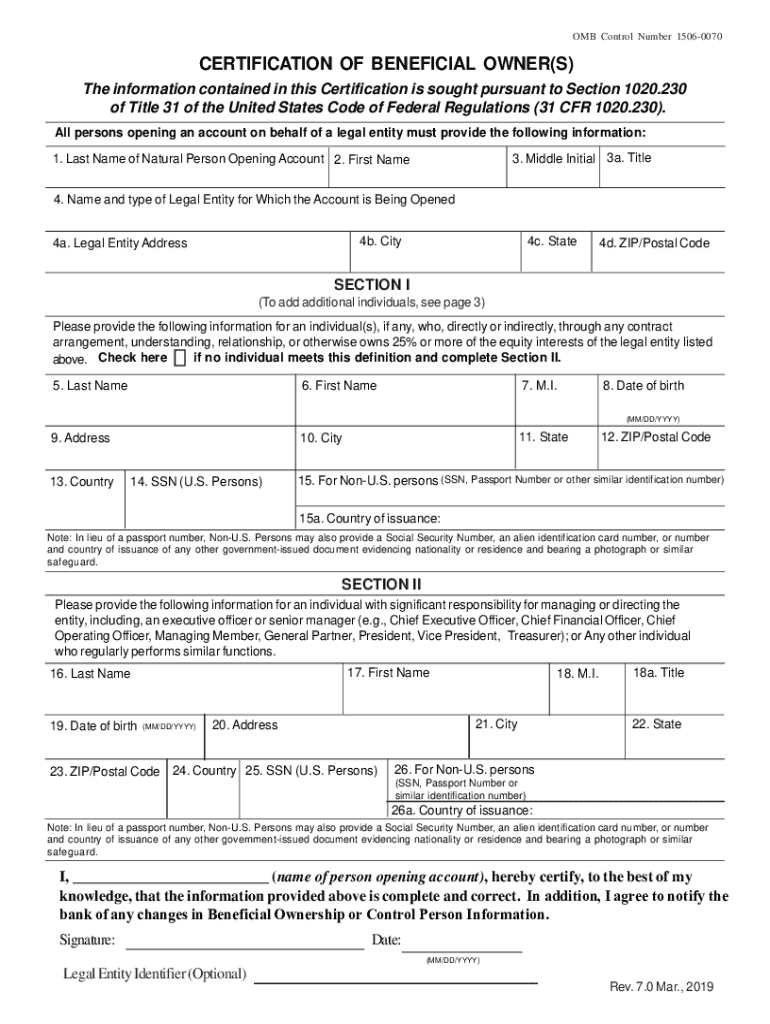

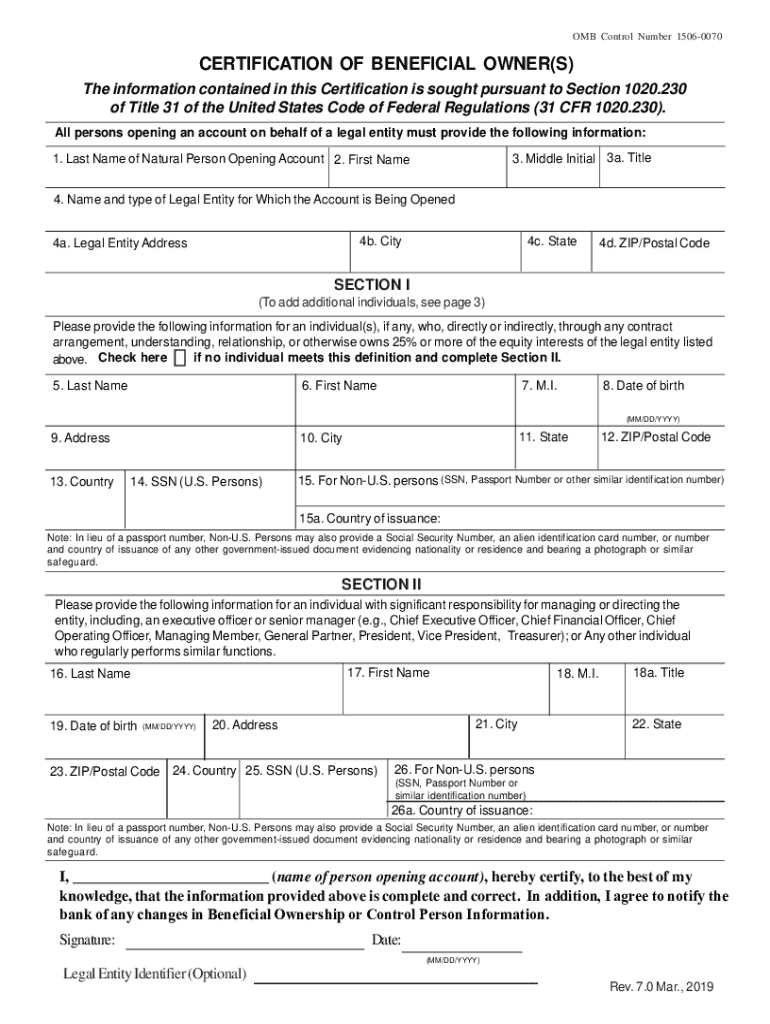

What is a certification of beneficial ownership?

A certification of beneficial ownership is a pivotal document used to verify the individuals or entities that own or control a legal entity. It is crucial for regulatory compliance and is often required to open bank accounts, secure financing, or engage in contractual obligations. This certification assures institutions and regulators that they have accurate information on the true owners behind a business.

Not all entities need to complete this certification—typically, corporations, partnerships, and LLCs must comply, while sole proprietorships may not have this requirement. Key components of the form usually include the name, address, date of birth, and the extent of ownership held by each beneficial owner.

Filling out the beneficial ownership form

Completing the beneficial ownership form requires careful attention to detail. Begin by gathering necessary information about all beneficial owners, including legal names, addresses, and any relevant identification numbers. This step is crucial for ensuring accuracy.

As you complete each section of the form, ensure clarity and consistency to avoid common pitfalls such as typos or incomplete entries. Here are some tips for guarantee accuracy and compliance:

Common FAQs about beneficial ownership

Understanding beneficial ownership can raise many questions. Here are some common inquiries and their answers:

Interactive tools for managing beneficial ownership forms

Using a platform like pdfFiller greatly simplifies the management of beneficial ownership forms. With features tailored for effective document management, users can easily edit and customize forms as needed. The platform's eSigning options facilitate quick processing, allowing for seamless workflows when collaborating with multiple stakeholders.

Additionally, pdfFiller's collaborative features enable teams to work simultaneously on documents, ensuring efficiency and accuracy. Users can access completed forms from anywhere, making document management effortless whether in the office or working remotely.

Best practices for maintaining beneficial ownership records

Maintaining accurate beneficial ownership records is not just a regulatory requirement; it is a best practice that protects organizations from legal repercussions. Regular updates should be conducted whenever there's a change in ownership or control, and a system for monitoring these changes should be established.

Secure storage solutions for sensitive beneficial ownership information are essential. Organizations should ensure that all records are kept in a secure environment, both physically and digitally, to prevent unauthorized access and breaches of confidentiality.

Navigating complex situations in beneficial ownership

Complexity in beneficial ownership often arises when multiple owners are involved or when dealing with trusts and corporations. Organizations must ensure that they identify all beneficial owners accurately, understanding how each person contributes to overall control.

For trusts, special considerations may include beneficiaries who do not hold legal ownership of assets. The role of control persons—individuals with significant influence over a company, even without formal ownership—must be regarded carefully to ensure compliance with regulations.

Resources for further assistance

For more information on beneficial ownership, various resources are available online. The pockets of expertise from legal firms and government agencies can provide further insights into specific queries regarding beneficial ownership reporting requirements. Engaging with experts can also help clarify obligations and support in completing forms accurately.

Recent developments in beneficial ownership reporting

Staying informed about recent developments in beneficial ownership reporting is crucial for compliance. Updates in legislation, such as enhanced disclosure requirements amid increasing calls for transparency, have been emerging. Such updates can often require organizations to revise previously submitted forms to meet new standards.

Case studies illustrate how various businesses have adapted to legislative changes through improved reporting practices, often leveraging tools like pdfFiller to streamline their processes. Future trends may include greater collaboration between countries to standardize beneficial ownership disclosures, creating a more cohesive framework globally.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit beneficial ownershipform rules faqs online?

Can I create an electronic signature for signing my beneficial ownershipform rules faqs in Gmail?

Can I edit beneficial ownershipform rules faqs on an Android device?

What is beneficial ownership form rules FAQs?

Who is required to file beneficial ownership form rules FAQs?

How to fill out beneficial ownership form rules FAQs?

What is the purpose of beneficial ownership form rules FAQs?

What information must be reported on beneficial ownership form rules FAQs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.