Get the free Donation Receipt.doc

Get, Create, Make and Sign donation receiptdoc

How to edit donation receiptdoc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out donation receiptdoc

How to fill out donation receiptdoc

Who needs donation receiptdoc?

Comprehensive Guide to the Donation Receipt Document Form

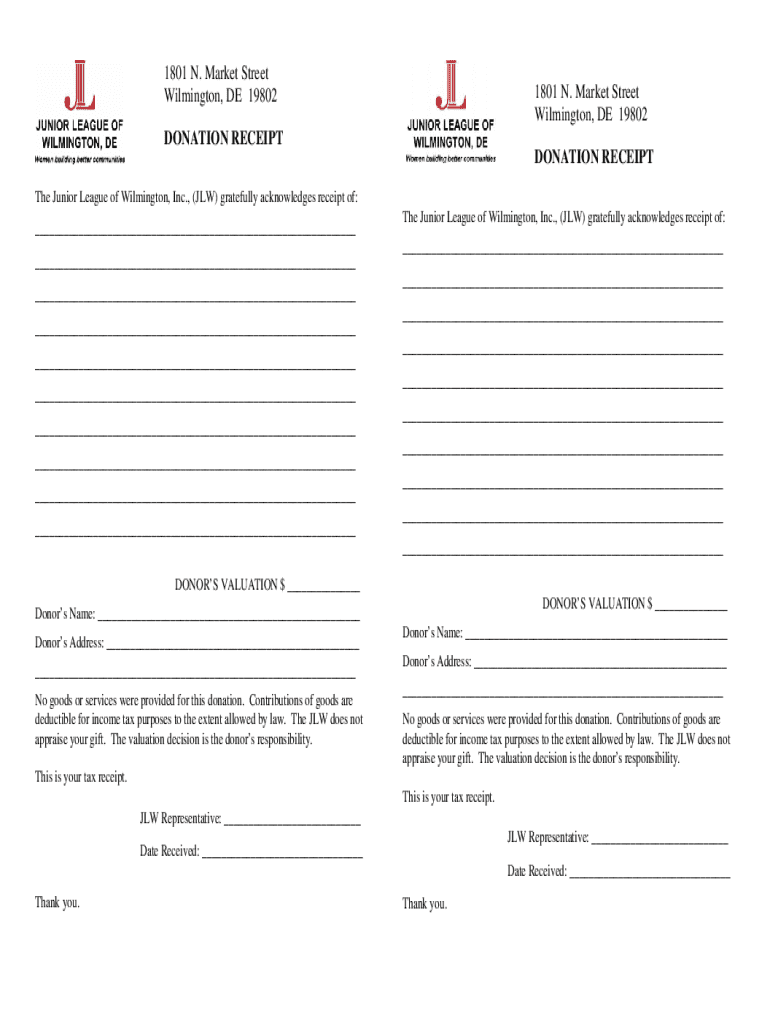

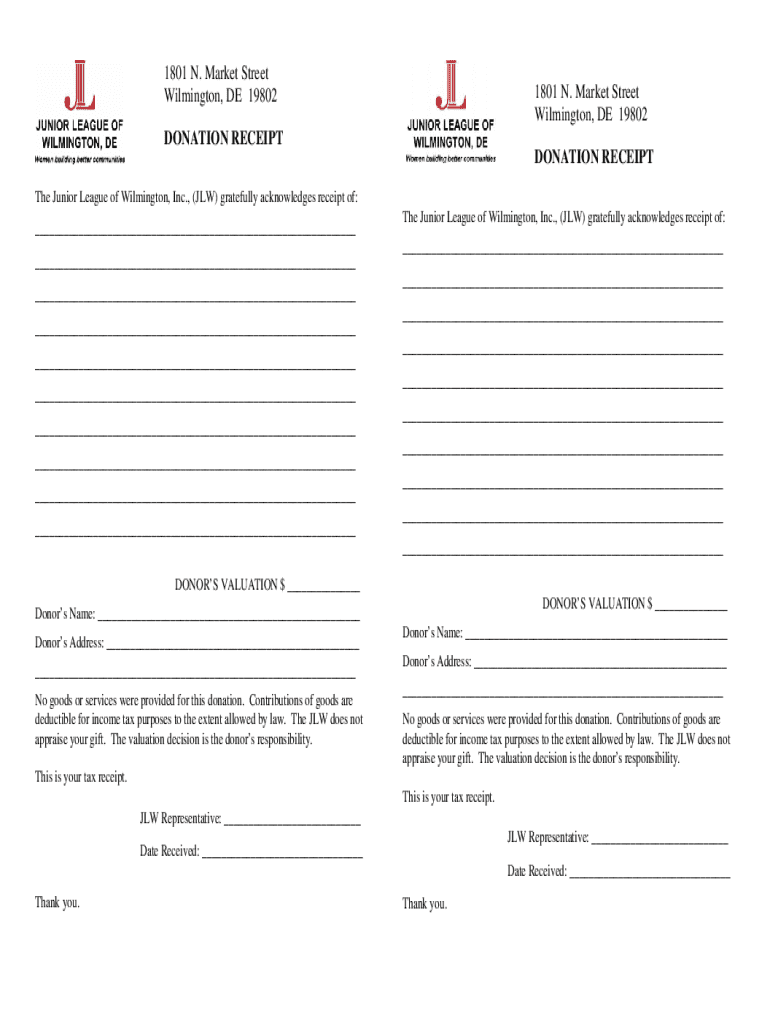

Understanding the donation receipt document form

A donation receipt document form is an essential tool used by charitable organizations to acknowledge contributions made by donors. This document serves as proof of a donation, providing both the giver and the receiver with important details necessary for tax and record-keeping purposes.

For donors, a donation receipt is crucial as it not only legitimizes their charitable efforts but also allows them to claim tax deductions on their income tax returns. For charities and nonprofit organizations, issuing these receipts is integral to maintaining credibility, transparency, and compliance with IRS regulations.

Legal requirements for issuing donation receipts vary by jurisdiction, but many places require that specific information be included for the receipt to be considered valid. This can include the organization’s tax identification number, a description of the donated items, and the date of the contribution.

Key components of a donation receipt document

A well-structured donation receipt should include the following key components to ensure clarity and compliance:

Types of donation receipt document forms

Donation receipts come in various formats, depending on the type of donation and the circumstances surrounding it. Here are some common types:

Creating your donation receipt document form

Designing an effective donation receipt is straightforward if you follow a systematic approach. Here’s a step-by-step guide to crafting your personalized receipt:

Leveraging templates effectively can streamline the process, allowing you to easily edit and update information as needed.

Maximizing efficiency with pdfFiller

pdfFiller offers a range of features that can enhance your ability to create and manage donation receipts effectively. Here's how you can make the most of this platform:

Utilizing pdfFiller not only boosts efficiency but also enhances the overall donor experience by providing timely and professional documentation.

Best practices for managing donation receipts

Managing donation receipts meticulously is vital for both operational efficiency and compliance with tax laws. Here are some best practices to consider:

Adhering to these practices can help foster trust between donors and organizations, encouraging future contributions.

Common questions and troubleshooting

Navigating the process of issuing and managing donation receipts often raises several questions. Here are some common concerns and their solutions:

Being proactive and informed about common issues can enhance your credibility and improve the donor experience.

Explore other related templates and tools

In addition to donation receipts, numerous related templates are available that can streamline finances and accounting for organizations. Here’s a look at other useful options:

By expanding your toolkit, you can create a more effective and efficient documentation strategy for your organization.

Related articles and further reading

Additional readings can provide context and insights into the broader implications of donation receipts and their impact on charitable giving. Consider exploring the following topics:

These articles can deepen your understanding of the broader context in which donation receipts operate, empowering your organization for future engagements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get donation receiptdoc?

How can I edit donation receiptdoc on a smartphone?

How do I fill out the donation receiptdoc form on my smartphone?

What is donation receiptdoc?

Who is required to file donation receiptdoc?

How to fill out donation receiptdoc?

What is the purpose of donation receiptdoc?

What information must be reported on donation receiptdoc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.