Get the free CSA Credit Card Authorization Form

Get, Create, Make and Sign csa credit card authorization

Editing csa credit card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out csa credit card authorization

How to fill out csa credit card authorization

Who needs csa credit card authorization?

A Comprehensive Guide to the CSA Credit Card Authorization Form

Understanding the CSA credit card authorization form

The CSA credit card authorization form is a pivotal document that allows merchants to gain permission from a cardholder to charge their credit card for specific services or products. This form is not merely a formality; it serves as a safeguard for both parties involved in the transaction. By providing explicit consent for charges, the cardholder protects their financial interests, while the merchant gains assurance against potential disputes.

The importance of the CSA credit card authorization form in financial transactions cannot be overstated. It plays a critical role in establishing trust between consumers and businesses, particularly in environments where card-not-present transactions are prevalent, such as online shopping. Merchants who utilize this form minimize their risk of chargebacks and fraud, ultimately leading to healthier transactional dynamics.

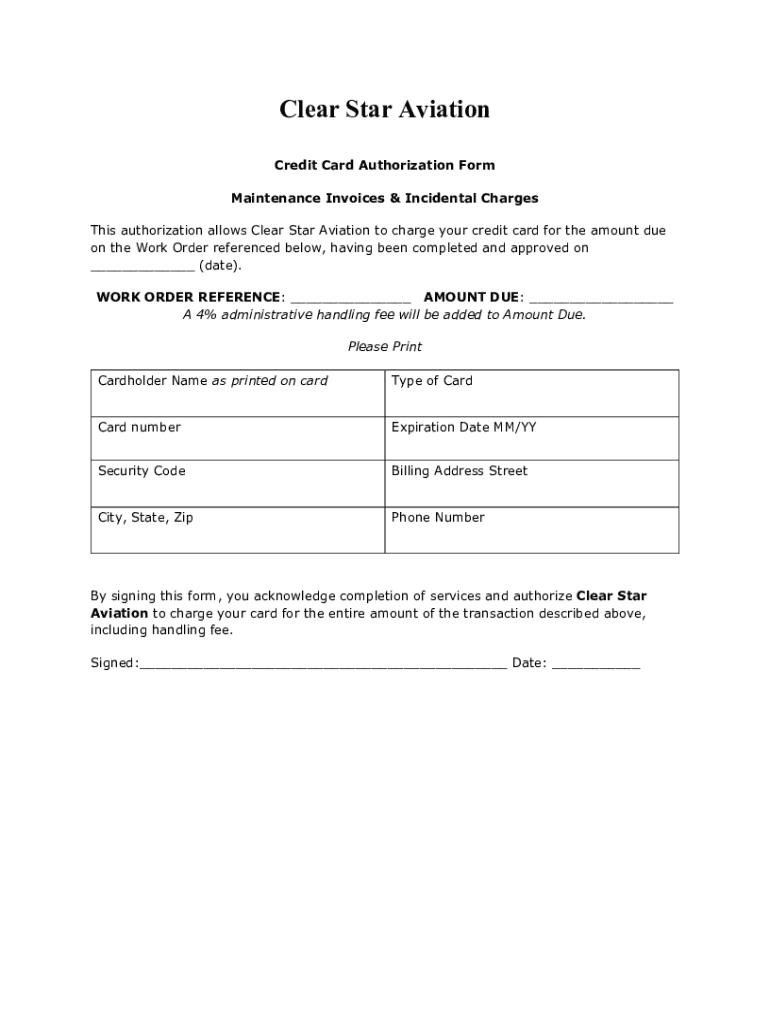

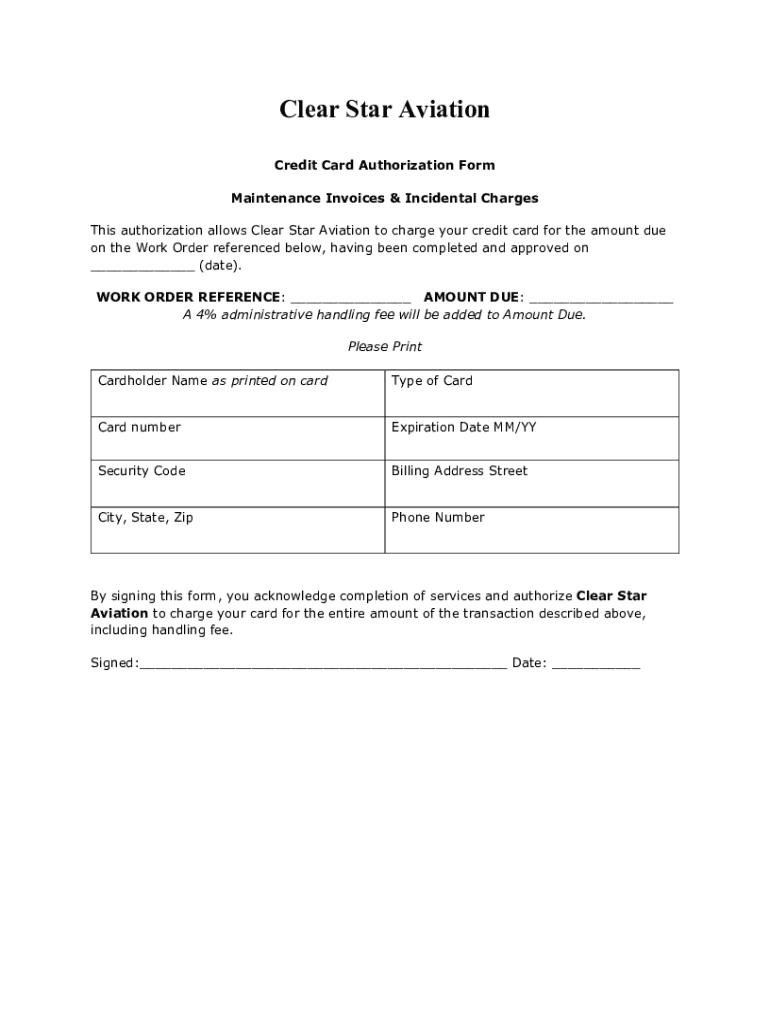

Key elements of the CSA credit card authorization form

To create an effective CSA credit card authorization form, several key elements must be included to ensure clarity and compliance. The required information generally covers the cardholder's details and transaction specifics. Each field needs precise input to create a trustworthy authorization process.

The primary components of the CSA credit card authorization form include the cardholder's name, card number, expiry date, billing address, and amount authorized. Additional clauses may also be employed to address cancellation policies, terms of use, and specific authorizations needed for recurring transactions. Compliance with security regulations is vital, ensuring all data provided is protected under applicable guidelines.

Step-by-step guide to filling out the CSA credit card authorization form

Filling out the CSA credit card authorization form accurately is crucial for preventing delays and ensuring smooth transactions. Gathering all necessary information beforehand will expedite the process. Begin by collecting identification, card details, and the specific amount authorized for the transaction.

When filling out the form, follow these detailed instructions to ensure clarity:

Interactive tools for managing the CSA credit card authorization form

Utilizing modern tools like pdfFiller enhances the experience of creating and managing the CSA credit card authorization form. pdfFiller offers a wide range of interactive features that allow users to edit, sign, and store documents efficiently. Another significant advantage is the accessibility of cloud storage, making it easy for teams to collaborate from any location.

With pdfFiller, users can easily edit the CSA credit card authorization form, ensuring all details are correct before submission. The eSignature feature simplifies the signing process, allowing cardholders to sign directly on the document via a secure platform. Additionally, teams can collaborate by sharing forms for review, making real-time updates, and maintaining version control.

Common mistakes to avoid when completing the CSA credit card authorization form

Despite its importance, errors during the completion of the CSA credit card authorization form can lead to financial discrepancies and disputes. Recognizing common pitfalls can help avoid these issues. One prevalent mistake is providing incomplete information; ensuring all required fields are filled is paramount.

Another common error is misaligned signatures. The cardholder’s signature must match the one on the credit card to maintain consistency and authenticity. Lastly, many users neglect to carefully read the terms and conditions before signing, which can lead to misunderstanding the scope of authorization granted.

Frequently asked questions (FAQs) about CSA credit card authorization forms

The following FAQs address common concerns regarding the CSA credit card authorization form that users often encounter.

Real-life scenarios: The practical use of a CSA credit card authorization form

To illustrate the usefulness of the CSA credit card authorization form, consider various case studies where this form facilitated smooth transactions. For instance, a local plumber effectively used the CSA credit card authorization form to streamline payments for recurring repairs, ensuring customers understood both the service rendered and the payment expected.

Testimonials from users highlight the significance of the form in preventing disputes over charges. One business owner remarked on how using this form helped minimize chargebacks, enhancing their cash flow and customer relationships. However, challenges still arise—for example, some customers may initially oppose signing the form, necessitating clear communication of its purpose.

Importance of using a cloud-based solution like pdfFiller

In today's fast-paced business environment, leveraging a cloud-based solution like pdfFiller for managing the CSA credit card authorization form offers undeniable advantages. Employees can access forms anytime, which is particularly beneficial for businesses operating on a global scale. This cloud-accessibility fosters team collaboration, enabling multiple users to work on the same document seamlessly.

Security features inherent in pdfFiller ensure compliance with the highest standards in document management. The platform safeguards sensitive information through encryption and compliant data storage practices. Additionally, users benefit from streamlined workflows, allowing for efficient document management without the hassle of paper files, enhancing overall productivity.

Tips for maintaining compliance and best practices

Maintaining compliance while managing the CSA credit card authorization form is crucial for businesses to protect against potential legal implications. Regularly updating and reviewing forms to align with changing regulations is essential. This ensures ongoing protection for both the business and clients involved.

Understanding the legal implications of signed authorizations helps clarify the extent of responsibility for both merchants and consumers. Moreover, staying informed about the latest payment industry standards provides additional assurance that your processes align with best practices, ultimately fostering a secure transactional environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my csa credit card authorization directly from Gmail?

Where do I find csa credit card authorization?

How do I fill out the csa credit card authorization form on my smartphone?

What is csa credit card authorization?

Who is required to file csa credit card authorization?

How to fill out csa credit card authorization?

What is the purpose of csa credit card authorization?

What information must be reported on csa credit card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.