Get the free Local Business Tax Receipt (BTR) and Certificate of Use ( ...

Get, Create, Make and Sign local business tax receipt

How to edit local business tax receipt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out local business tax receipt

How to fill out local business tax receipt

Who needs local business tax receipt?

Your Comprehensive Guide to the Local Business Tax Receipt Form

Understanding local business tax receipts

A Local Business Tax Receipt (LBTR) is an official document required by local governments that grants permission for individuals or businesses to operate within a specific jurisdiction. This license is essential for compliance with local regulations, allowing businesses to function legally and helps in contributing to the local economy.

Obtaining a Local Business Tax Receipt is important for various reasons. Firstly, it legitimizes your business operations, making it easier to secure funding, establish business bank accounts, and attract customers who prefer certified businesses. Moreover, it serves as a way for local governments to monitor businesses for health, safety, and zoning compliance.

Typically, businesses ranging from retail shops to home-based enterprises, and even freelance contractors, need a Local Business Tax Receipt. It's crucial to understand the specific requirements and regulations governing your locality to avoid potential penalties or business disruptions.

Every locality has its own unique set of regulations, so familiarity with your local government’s compliance standards is crucial for business owners. This underscores the importance of the Local Business Tax Receipt within the larger framework of business operation legality.

Preparing to apply for a local business tax receipt

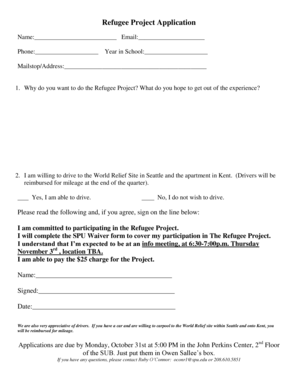

Before diving into the application process, gather all necessary documentation to ensure your application for the Local Business Tax Receipt is complete and accurate. Key documents typically include proof of business name filing, which can be achieved through a DBA (Doing Business As) registration or corporation documentation.

To make your application process smoother, avoid common mistakes such as neglecting to review eligibility requirements, missing signature fields, or submitting incomplete documentation. Meticulous attention to detail can save you time and frustration.

Step-by-step guide to completing the LBTR application form

Access the LBTR application form online through your local government’s website. The form is typically available in PDF format, making it easy to download and fill out. For those who prefer a digital solution, pdfFiller provides tools to manage PDF files effectively.

When completing the form, pay attention to each section:

Double-check all entries for accuracy and clarity. Unclear or incorrect information can lead to processing delays. Use tools available on pdfFiller for error-checking and adjustments as necessary.

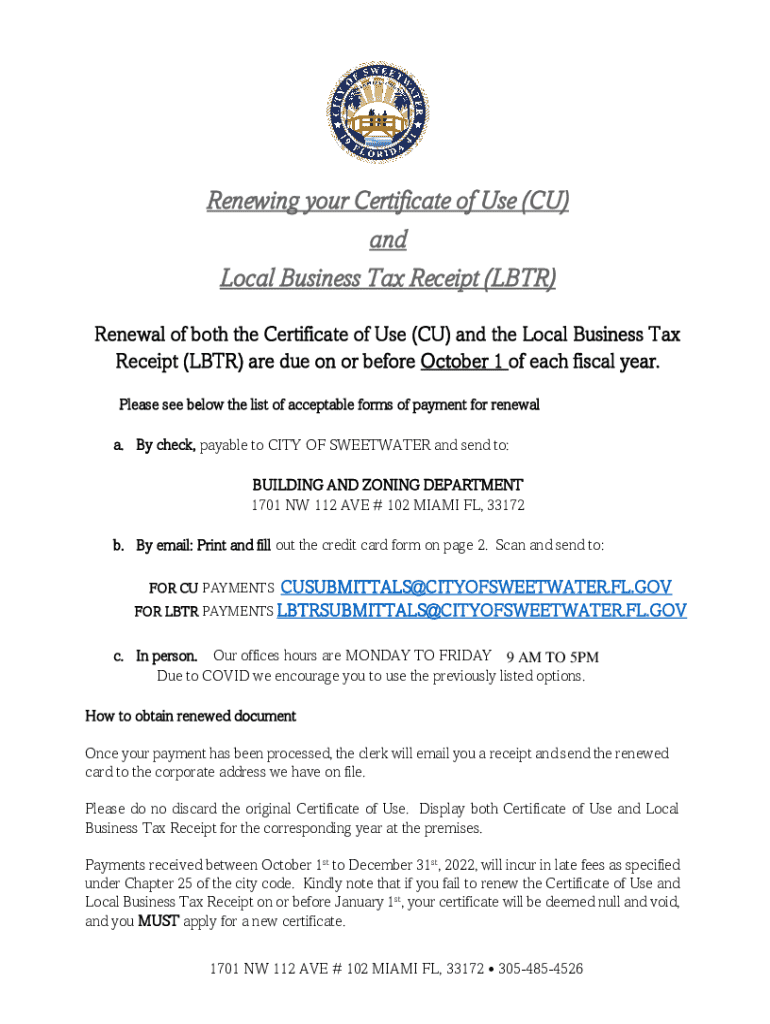

Submitting your application

After completing your LBTR application, you have several options for submission. The most straightforward method is through online submission via your local government's website, which often provides immediate confirmation.

If you prefer traditional methods, you can submit your application in-person or via mail. If mailing, ensure you use a reliable method to track delivery. Payment for the application fee varies by locality, so review the payment options and be prepared to pay online or include your payment with a mailed application.

Choosing the right submission method can expedite your application’s approval process. Be sure to keep copies of all submitted documents.

Following up on your application

Once you've submitted your LBTR application, it's essential to know what to expect. Generally, processing times can vary, ranging from immediate approval to several weeks depending on your locality’s policies.

To track the status of your application, either check online through the local government’s application portal or contact their office directly. If additional information is requested or issues arise, adhering to their requests promptly can help prevent delays.

Maintaining open communication with the tax office can facilitate a smoother approval process.

Receiving and maintaining your local business tax receipt

Once approved, your Local Business Tax Receipt will be issued for display at your place of business. Ensure you understand any stipulations associated with the receipt, such as operational limits or conditions.

An important aspect to remember is the need for annual renewal. Many localities require businesses to renew their tax receipts every year to remain compliant with local laws. This process can often be streamlined through the use of online tools or platforms like pdfFiller to manage your documents efficiently.

Managing your business documentation

Effective document management is vital for any business. Establish a system to keep your Local Business Tax Receipt alongside other important documents, such as insurance, contracts, or compliance certifications. This not only ensures accessibility but also helps you stay organized during audits or inspections.

If you’re considering digital management, pdfFiller can be a game changer, allowing users to easily edit, store, and share their documents securely. Utilize its eSigning feature for quick approvals and its collaborative tools for sharing documents with partners or co-owners.

FAQs about local business tax receipts

As business owners navigate the LBTR process, many frequently asked questions arise. Understanding when a Local Business Tax Receipt is required is essential; typically, any entity engaging in business activities or transactions must obtain one.

If you operate multiple businesses, each location may require a separate LBTR, depending on local regulations. Moreover, operating without an LBTR can lead to penalties, fines, and even forced closure until compliance is established.

Additional resources for local business tax receipt applicants

Navigating local regulations can be daunting, but knowing where to turn for support can ease the process. Contact your local tax office for guidance and clarity regarding your specific LBTR requirements.

Additionally, several online resources can further assist applicants in understanding the nuances of local business registration, documentation, and compliance, including websites dedicated to small business resources.

Engaging with your community

Building networks within your community can significantly impact your business's success. Engage with local business organizations, chambers of commerce, and community events to stay informed about changes to local business regulations.

Being socially connected also encourages local support, vital for small business sustainability. Leverage social media platforms to keep customers informed and invite local patrons to events featuring your offerings.

Important notices

Being aware of seasonal alerts that may impact business operations is crucial. For instance, hurricane season can prompt specific local government advisories related to preparedness for businesses. Understanding these can help you mitigate risks associated with natural disasters.

Prepare your business for emergencies by creating contingency plans and ensuring compliance with local regulations concerning safety and security.

Legal disclaimer

The information provided in this guide is intended for educational purposes and should not be considered legal advice. For matters concerning compliance and legalities surrounding the Local Business Tax Receipt, we recommend consulting with a professional who specializes in local business law.

Navigating local regulations can be complex; seeking guidance from experts can ensure you understand every aspect of your obligations and rights as a business owner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in local business tax receipt without leaving Chrome?

How do I edit local business tax receipt on an Android device?

How do I fill out local business tax receipt on an Android device?

What is local business tax receipt?

Who is required to file local business tax receipt?

How to fill out local business tax receipt?

What is the purpose of local business tax receipt?

What information must be reported on local business tax receipt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.