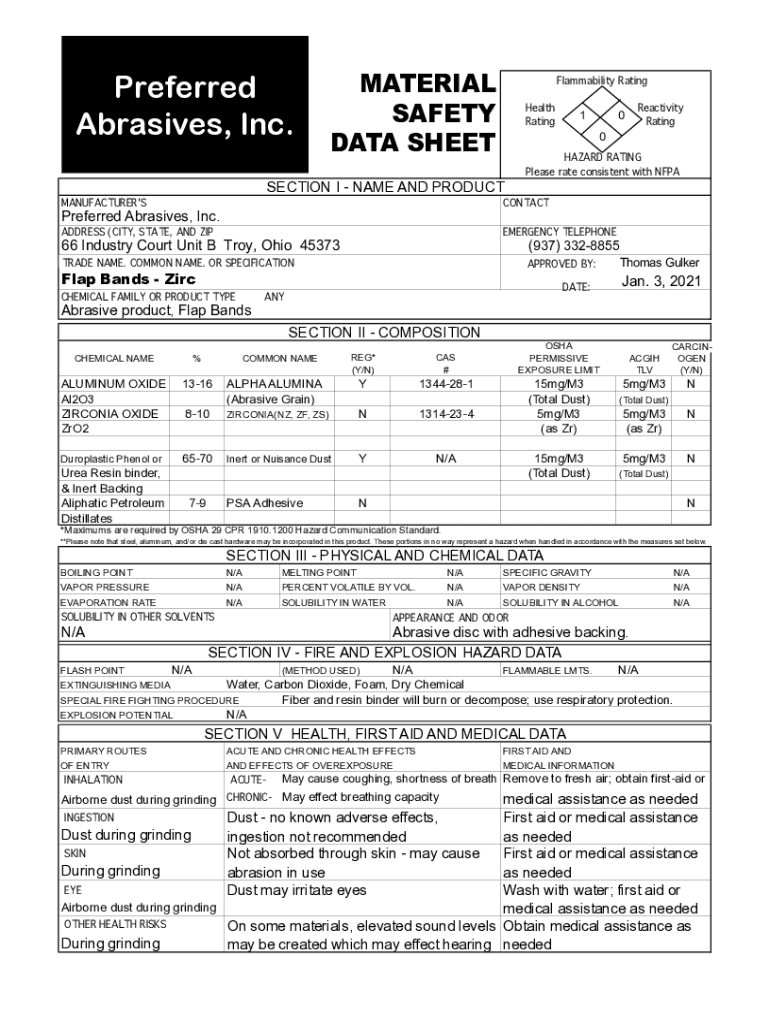

Get the free 66 Industry Court Unit B Troy, Ohio 45373

Get, Create, Make and Sign 66 industry court unit

How to edit 66 industry court unit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 66 industry court unit

How to fill out 66 industry court unit

Who needs 66 industry court unit?

Your Complete Guide to the 66 Industry Court Unit Form

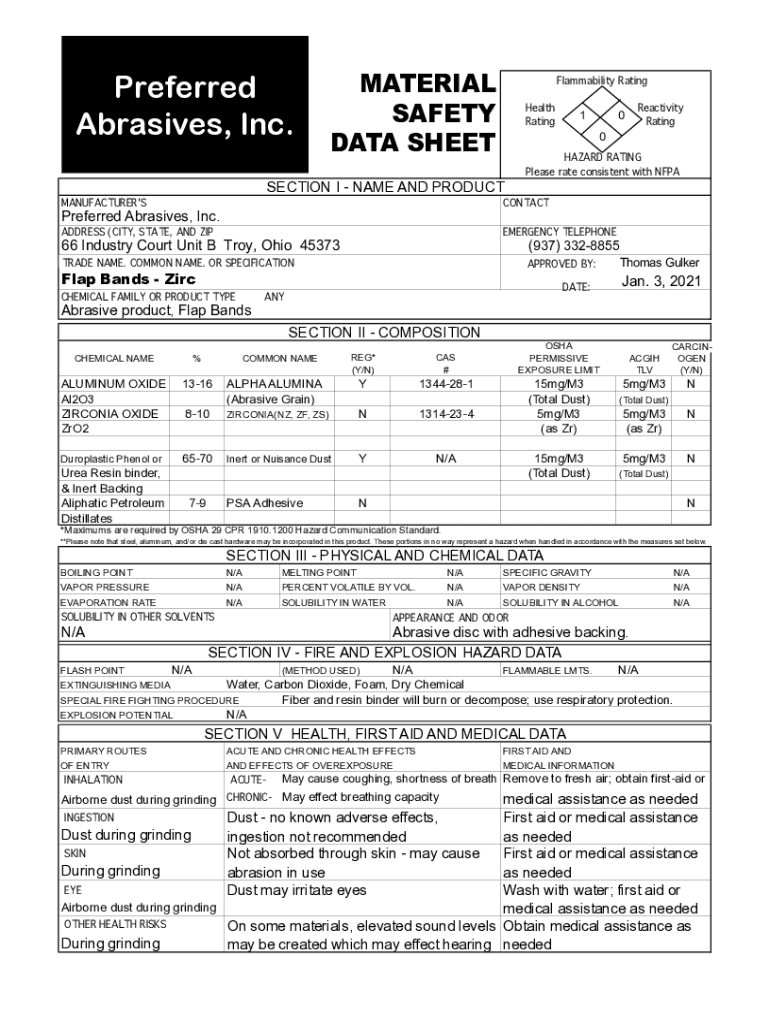

Understanding the 66 Industry Court Unit Form

The 66 Industry Court Unit form is a specialized document commonly utilized within various sectors like real estate and finance. Its primary purpose is to facilitate the submission and processing of applications related to property tax exemptions or related assessments, particularly within business centers. Accurate completion of this form is crucial as it directly affects the assessment of an entity's financial obligations.

Key use cases for the 66 Industry Court Unit form include securing tax benefits for businesses, ensuring compliance with local regulations, and managing the property tax obligations of business taxpayers. Therefore, providing precise and complete information is vital to prevent any delays or rejections of applications.

Collecting necessary information

Before diving into the completion of the 66 Industry Court Unit form, it’s essential to gather all necessary information. This starts with identifying the required documentation, which generally includes financial records, legal documents, and personal identification. Having these documents ready not only speeds up the process but also helps ensure accurate entries.

Key documentation elements typically required for the form include proof of identity such as a government-issued ID, recent financial statements or business tax returns, and any legal papers pertinent to property ownership, like deeds or lease agreements.

To gather information efficiently, create a checklist and allocate specific time slots for collecting each type of document. This organized approach minimizes stress and enhances accuracy, ensuring you do not overlook crucial documents.

Step-by-step guide to completing the 66 Industry Court Unit form

Completing the 66 Industry Court Unit form can seem daunting, but breaking it down into manageable steps can help. Follow this guide to ensure you cover all necessary aspects.

Step 1: Review the form layout

Begin by reviewing the form layout. Each section of the form will require distinct information. Familiarize yourself with these sections to understand what is needed.

Common pitfalls to avoid include skipping sections or misinterpreting instructions. Each entry is vital; so focus is key.

Step 2: Fill out personal information

Next, you will need to fill in your personal information, including your full name, business name, address, and contact details. Ensure every field is completed accurately to avoid processing delays.

Specific instructions for each field often indicate what format is acceptable for entries such as mailing addresses or phone numbers.

Step 3: Submit relevant documentation

Once your form is filled out, it’s crucial to attach all relevant documentation. This includes financial statements, tax returns, and any other supporting documents that reinforce your application for exemptions.

Ensure that these are clear, legible, and comply with the designated requirements to avoid rejection.

Step 4: Review your submission

Before submitting your application, take the time to review your submission thoroughly. Check for completeness and accuracy—errors can lead to delays or denial of your application.

Interactive tools to assist in form completion

Whether you are tech-savvy or new to online forms, interactive tools can streamline the process. pdfFiller, for instance, offers robust editing features that allow you to modify your form directly online.

The advantages of using such interactive tools include ease of use, accessibility from any device, and integration of features that facilitate the completion process.

Incorporating electronic signatures

An important aspect of submitting your 66 Industry Court Unit form is incorporating electronic signatures. eSigning is straightforward with pdfFiller; you can easily sign the document digitally, which is accepted in most jurisdictions.

To eSign, simply follow these steps: upload your completed form, add your signature in the designated area, and save the document.

Managing your submission

After submitting your 66 Industry Court Unit Form, it's critical to manage your application effectively. Keeping track of your application status can alleviate concerns and help you prepare for any follow-up requirements.

You can typically check the status through the corresponding governmental or financial office's e-portal or by contacting them directly via phone or email.

What to expect after submission

Expect a response timeframe to vary depending on the complexity of your application and current processing times at the department of finance. Typically, responses can range from a few weeks to several months.

Being patient is important, but follow-ups can be beneficial if you’ve not heard back within the expected time.

Common FAQs about the 66 Industry Court Unit form

Many users have questions about the 66 Industry Court Unit form, especially regarding mistakes and amendments. A common query is: 'What if I make a mistake on my form?' In such cases, it's generally advisable to contact customer support for specific guidance on how to proceed.

Another frequent question is, 'How can I amend my submission?' This process can differ by jurisdiction; thus, it's crucial to verify protocols with your local office.

Contacting support for assistance

If you need further clarity or assistance with the 66 Industry Court Unit form, reaching out to customer support can be beneficial. Several modes of communication are available for prompt support.

For immediate help, live chat options are useful and available during business hours. Alternatively, emailing support with detailed queries guarantees a thorough response, while phone support allows for real-time conversation.

User testimonials and success stories

Real-life experiences often highlight the efficiency of processes involving the 66 Industry Court Unit form. Many users have reported that utilizing pdfFiller’s features not only simplified their experience but also expedited the filing process.

Testimonials depict how form manipulation, eSigning, and direct submission led to quicker resolution times, enhancing user satisfaction.

Legal considerations

Understanding compliance requirements is essential when filling out the 66 Industry Court Unit form. Referencing legal standards specific to your area, whether it’s for a property tax exemption or other applications, helps ensure your submission is valid.

Non-compliance can lead to penalties, rejected applications, or additional scrutiny from financial authorities. Therefore, familiarizing yourself with the appropriate legal guidelines is paramount.

Best practices for future form submissions

Developing best practices for filling out forms like the 66 Industry Court Unit form saves time and promotes accuracy for future submissions. Start by creating a document retention system that organizes relevant files and past submissions.

Utilizing tools like pdfFiller for document management ensures that all future form submissions are streamlined and hassle-free, allowing you to focus on other business priorities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 66 industry court unit directly from Gmail?

Can I sign the 66 industry court unit electronically in Chrome?

Can I create an electronic signature for signing my 66 industry court unit in Gmail?

What is 66 industry court unit?

Who is required to file 66 industry court unit?

How to fill out 66 industry court unit?

What is the purpose of 66 industry court unit?

What information must be reported on 66 industry court unit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.