Get the free Crisil Ratings Limited

Get, Create, Make and Sign crisil ratings limited

How to edit crisil ratings limited online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crisil ratings limited

How to fill out crisil ratings limited

Who needs crisil ratings limited?

CRISIL Ratings Limited Form: A Comprehensive Guide

Understanding CRISIL Ratings

CRISIL, a subsidiary of S&P Global, is a leading global analytical company that provides ratings, research, and risk and policy advisory services. Its ratings are pivotal in the financial markets, influencing institutional and individual investment decisions. The reliability of CRISIL ratings stems from a thorough analysis that incorporates various factors, ensuring stakeholders can assess creditworthiness effectively.

In the realm of financial markets, CRISIL ratings offer transparency and reliability. They help investors gauge the risk associated with an investment, thereby promoting informed decision-making. The CRISIL ratings system categorizes entities and instruments based on their ability to meet commitments efficiently.

Types of CRISIL Ratings

CRISIL employs a structured rating system that categorizes ratings into investment grade and non-investment grade classifications. Investment grade ratings signal a lower risk of default and a stable financial condition, suitable for conservative investors seeking safety in their portfolios.

On the other hand, non-investment grade ratings imply higher risk levels and potential volatile returns. These ratings are crucial for entities seeking to identify their standing in the financial landscape and for investors looking for higher returns despite the risks.

CRISIL Rating Criteria

CRISIL's rating methodology encompasses a broad analysis framework, focusing on financial health and business management. This process begins with an in-depth financial analysis that evaluates key financial ratios such as profitability, liquidity, and leverage. Historical performance metrics provide insights into an entity's stability over time, assisting CRISIL in identifying trends that can impact future performance.

Moreover, the assessment of business and management is vital. Entities within competitive industries must showcase their industry positioning and management experience. Factors such as market conditions and the regulatory framework are also considered, ensuring that the rating reflects real economic challenges and opportunities.

How to Obtain CRISIL Ratings

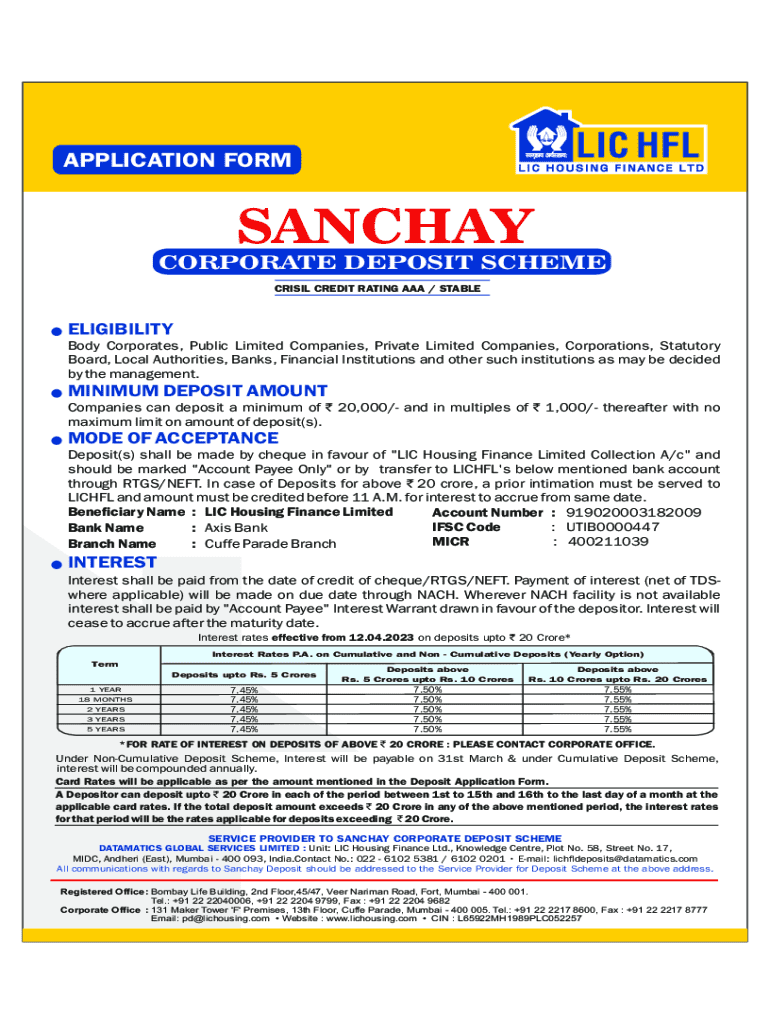

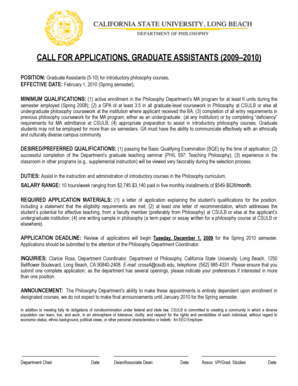

If you are seeking a CRISIL rating for your organization, it's crucial to understand the eligibility criteria first. Generally, entities such as corporations, financial institutions, and others can apply, provided they meet specific financial benchmarks and regulatory requirements.

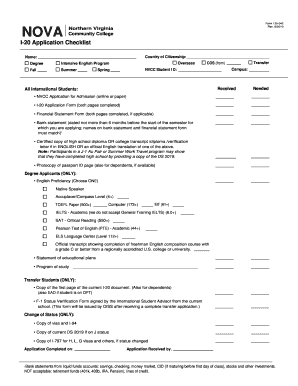

Documentation is critical during this process. You will need financial statements, a filled-in application form, and potentially other supporting documents that provide a snapshot of your organization’s financial health. Preparing these documents with precision can streamline your submission process.

CRISIL Ratings Application Form

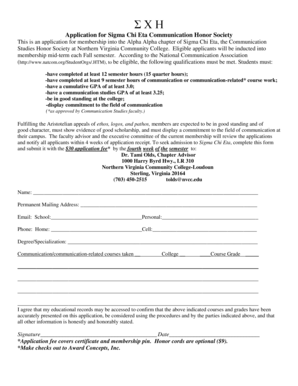

The CRISIL ratings application form is essential for initiating the rating process. This form requires specific information that helps CRISIL evaluate your organization's creditworthiness effectively. The sections within the form are designed to capture comprehensive details concerning your financial health and business operations.

The first section usually encompasses basic applicant information, including entity type and contact details. Following that, financial information highlights key metrics, while the last part focuses on essential facts and figures relevant to the business's credit history. Ensuring that each segment is filled adequately will aid in obtaining an accurate rating.

Common mistakes to avoid include incomplete information and submission of outdated financials, which can lead to inaccuracies in your rating assessment.

Tips for successfully filling the CRISIL form

Correct documentation and meticulous preparation are essential for a successful CRISIL form submission. Start by ensuring that all financial documents are current and accurately reflect your organization's status. Utilize templates that help standardize information presentation, making it easier for CRISIL to evaluate your form.

Moreover, establish a checklist of required documents that you will need to submit alongside your form. Double-check for any discrepancies or missing pieces of information that could hinder the process.

How to check your CRISIL rating

Once you've submitted your CRISIL application, it's crucial to know how to check your rating. Accessing the CRISIL ratings portal allows users to view their ratings and assess their current standing. By logging into the portal with your credentials, you can navigate to the rating report section, where your entity’s rating is displayed with detailed analytics.

Understanding your rating report is equally important. Each rating is accompanied by an in-depth explanation of the assigned category, including factors that influenced the decision. By familiarizing yourself with this report, you can gain insights into your financial position, areas of strength, and risk factors.

Frequently Asked Questions (FAQs)

Addressing common concerns can significantly help demystify the CRISIL rating process. Often, applicants wonder what they can do if they disagree with their rating. CRISIL provides avenues for feedback and re-evaluation, emphasizing the importance of open communication.

Moreover, the frequency of checking ratings should depend on market conditions and organizational changes. Regular reviews ensure that your rating remains an accurate reflection of your financial health. Understanding the implications of rating changes on borrowing costs and investment decisions is essential for stakeholders.

User experience: success stories

Many businesses have significantly improved their CRISIL ratings through proactive measures and strategic planning. Success stories abound where companies meticulously worked to enhance financial health and align operations with market expectations. Such efforts exemplify the benefits of gaining a higher rating—better access to financing and greater investor confidence.

Insights from financial experts highlight the importance of maintaining transparency with stakeholders and readiness for necessary adjustments in response to market feedback. Building a narrative around your financial journey can also enhance your standing in the eyes of investors and rating agencies alike.

Interactive tools for managing ratings

Managing your CRISIL ratings effectively can be simplified through various interactive tools available at pdfFiller. Financial calculators enable organizations to gauge potential scenarios based on current market conditions, aiding in better decision-making.

Templates for necessary documentation can streamline the preparation of reports, ensuring that all required information meets CRISIL's standards. Additionally, eSignature solutions help in achieving a faster turnaround for required signatures, further enhancing the efficiency of the rating process.

Conclusion

Understanding CRISIL ratings and the application process is crucial for any organization intent on enhancing its financial standing. By effectively utilizing the tools and insights provided by pdfFiller, businesses can streamline their document management and ensure compliance with requirements.

As you embark on this journey towards obtaining a CRISIL rating, remember that meticulous preparation and transparency are key. Leveraging the platform’s capabilities can significantly improve your document handling, allowing you to focus on what truly matters — the robust growth of your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send crisil ratings limited for eSignature?

How do I fill out crisil ratings limited using my mobile device?

How do I edit crisil ratings limited on an Android device?

What is crisil ratings limited?

Who is required to file crisil ratings limited?

How to fill out crisil ratings limited?

What is the purpose of crisil ratings limited?

What information must be reported on crisil ratings limited?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.