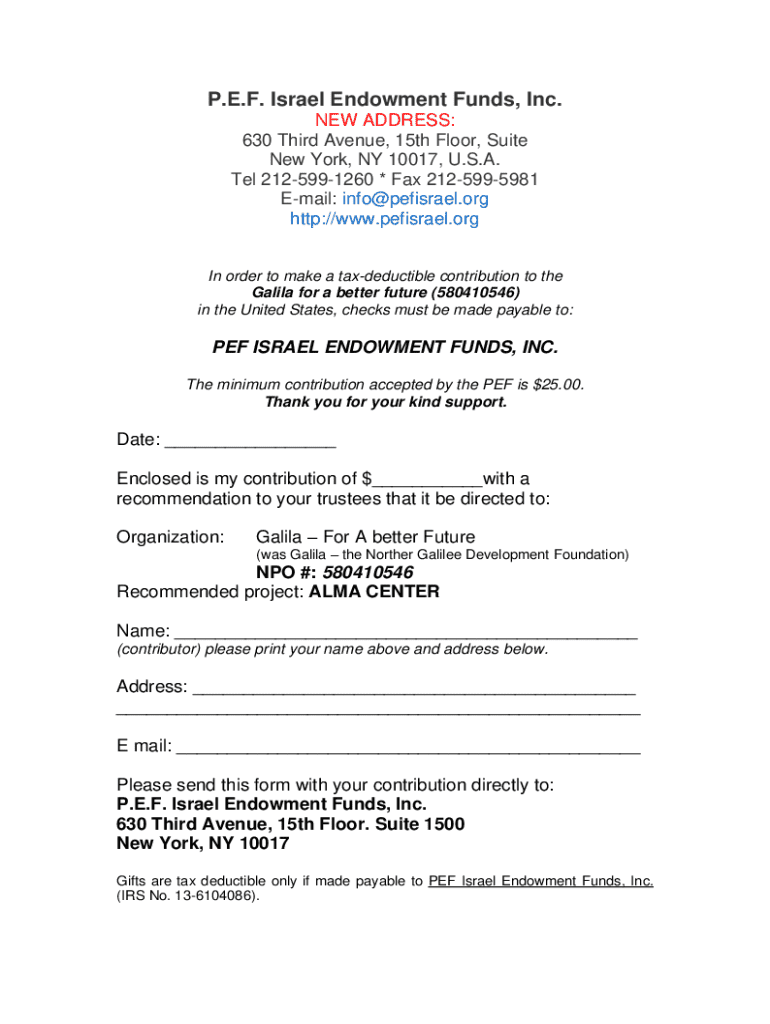

Get the free P.E.F. Israel Endowment Funds, Inc. NEW ADDRESS

Get, Create, Make and Sign pef israel endowment funds

Editing pef israel endowment funds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pef israel endowment funds

How to fill out pef israel endowment funds

Who needs pef israel endowment funds?

PEF Israel Endowment Funds Form: A Comprehensive How-to Guide

Understanding the PEF Israel Endowment Funds Form

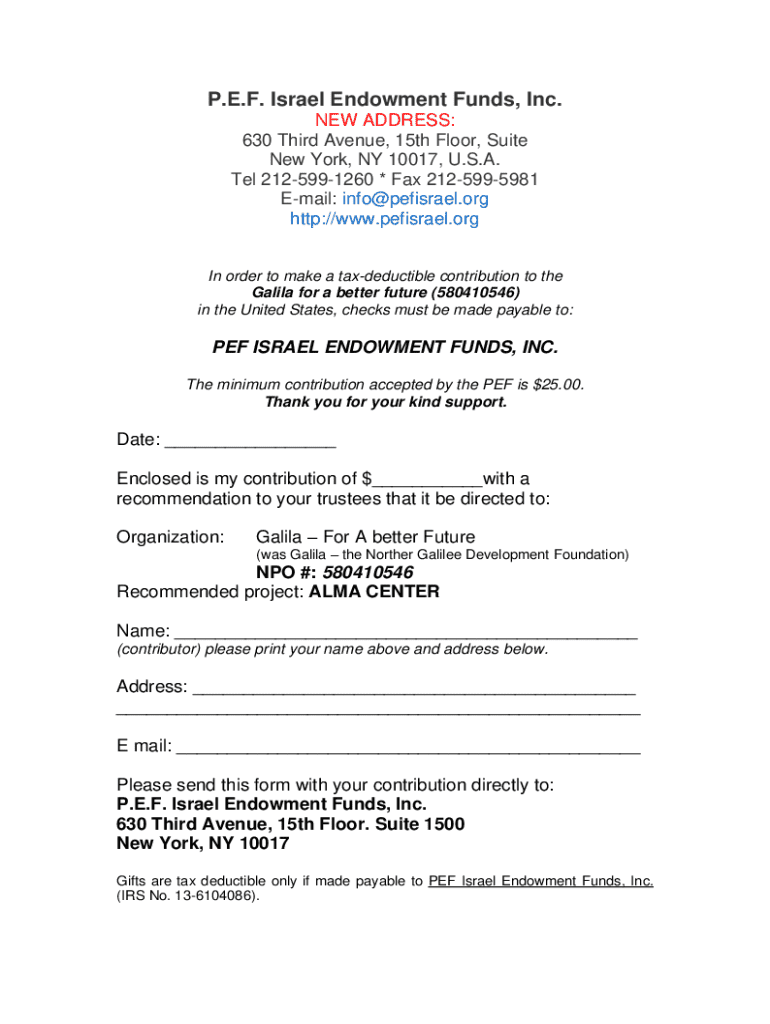

The PEF Israel Endowment Funds Form is an essential document that plays a key role in the management of endowment funds designated for various charitable purposes in Israel. This form serves as a formal application for establishing or contributing to an endowment fund, helping to ensure that funds are properly allocated and utilized according to the intentions of the donor.

The importance of the PEF Israel Endowment Funds Form cannot be overstated, as it formalizes a donor's wishes and ensures compliance with local regulations governing charitable contributions. Whether you are an individual donor, a representative of an organization, or part of a larger foundation, this form is crucial for effective fund management.

Key features of the PEF Israel Endowment Funds Form

The PEF Israel Endowment Funds Form consists of several key sections that gather vital information needed to evaluate and process requests. Each section may include fields such as donor details, fund specifications, financial information, and the intended purpose of the funds. Understanding these sections is crucial to ensuring that the information you provide is complete and accurate.

Preparing to fill out the PEF Israel Endowment Funds Form

Before starting to fill out the PEF Israel Endowment Funds Form, it's essential to gather all necessary documents and information. This preparation not only streamlines the process but also minimizes the chances of errors that could delay the submission.

Understanding the terminology used in the PEF Israel Endowment Funds Form can help demystify the process. Terms like 'endowment', 'restricted funds', and 'donor intent' are commonly used but can lead to confusion if not clearly understood. Having clarity on these terms will facilitate a smoother filling experience.

Step-by-step guide to completing the PEF Israel Endowment Funds Form

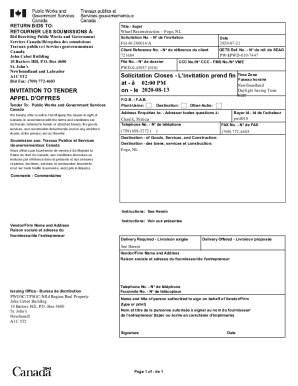

Accessing the PEF Israel Endowment Funds Form can be conveniently done through pdfFiller. To start, simply navigate to the PEF section on pdfFiller's website. Users are required to create an account if they do not have one, followed by logging in to access various forms and templates.

Filling out the form

Once you have access to the PEF Israel Endowment Funds Form, it’s time to fill it out accurately. Each section of the form is designed to elicit specific information essential for processing your request, and attention to detail is critical.

Utilizing pdfFiller’s interactive features, you can collaborate with other stakeholders in real-time, making the process more efficient and less prone to mistakes. These tools enable you to highlight sections needing attention and provide comments for clarification.

Reviewing your form

Once you've completed the form, it is imperative to review it thoroughly to catch any errors or omissions. Common errors can include incorrect financial figures, missing information, or unclear descriptions of purposes. Careful proofreading can save time and resources on potential re-submissions.

Editing and signing the PEF Israel Endowment Funds Form

After filling out the form, you may find that you need to edit certain sections. pdfFiller offers robust editing tools, allowing users to easily add notes, delete unnecessary information, or clarify points that may confuse reviewers.

Signing the form electronically is both simple and secure. pdfFiller allows users to add electronic signatures that meet legal standards, ensuring that your submission is valid and binding.

Managing your PEF Israel Endowment Funds Form after submission

After submitting the PEF Israel Endowment Funds Form, it’s essential to manage your documentation properly. pdfFiller provides several options for saving and storing your form, making it easy to revisit whenever necessary.

Tracking the status of your submission is equally important. While many submissions are processed promptly, keeping tabs ensures you can address any issues that may arise swiftly. In case of submission errors, promptly reach out to the appropriate channels for resolution.

Troubleshooting common issues with the PEF Israel Endowment Funds Form

Users of the PEF Israel Endowment Funds Form may encounter various issues during the filling or submission process. Common problems range from technical glitches on the pdfFiller platform to misunderstandings about required information.

Knowing when to seek help can also streamline the process. If you encounter persistent issues, don’t hesitate to contact pdfFiller's support team for professional assistance.

Tips for effective use of pdfFiller with PEF Israel Endowment Funds

To make the most out of your experience with the PEF Israel Endowment Funds Form on pdfFiller, consider the following best practices. These strategies will enhance your document management capabilities and ensure that your forms are organized and compliant.

Maintaining compliance with relevant guidelines is crucial for the successful management of your endowment contributions. Regular reviews of your records and details about the funds can help ensure accuracy over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pef israel endowment funds?

Can I edit pef israel endowment funds on an iOS device?

How do I complete pef israel endowment funds on an Android device?

What is pef israel endowment funds?

Who is required to file pef israel endowment funds?

How to fill out pef israel endowment funds?

What is the purpose of pef israel endowment funds?

What information must be reported on pef israel endowment funds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.