Get the free RENOVATION OF FIXED INCOME

Get, Create, Make and Sign renovation of fixed income

How to edit renovation of fixed income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out renovation of fixed income

How to fill out renovation of fixed income

Who needs renovation of fixed income?

Renovation of fixed income forms: A comprehensive guide

Understanding fixed income forms

Fixed income forms are essential instruments in the financial world, serving as a stable source of income for investors while offering a lower risk compared to equities. These forms are primarily used for capital preservation, providing returns in the form of fixed periodic payments. Their importance lies in their ability to cater to both conservative investors seeking steady cash flows and those aiming to diversify their investment portfolios.

Commonly used fixed income forms include bonds, certificates of deposit (CDs), and treasury securities. Bonds are debt securities issued by corporations or governments, allowing investors to lend money in exchange for interest payments and return of principal. CDs, offered by banks, are time deposits that typically boast a higher interest rate than traditional savings accounts, rewarding investors for locking their funds for a specific term. Treasury securities, issued by the U.S. Treasury, are considered one of the safest investments as they are backed by the government.

Preparing for renovation of fixed income forms

Before undertaking the renovation of fixed income forms, it's crucial to thoroughly assess your current fixed income portfolio. This entails analyzing performance metrics—such as yield, duration, and credit quality—to determine how well your investments are performing against market benchmarks. Identifying areas for improvement can guide your strategy moving forward.

Setting clear renovation goals is equally important. Consider what you wish to achieve through this renovation—whether that’s higher returns, increased liquidity, or better diversification. Establish a time frame for your renovations, as this will influence both your investment decisions and risk tolerance.

Key considerations for renovating fixed income forms

Interest rates and current market conditions significantly impact fixed income investments. When interest rates rise, the value of existing bonds typically decreases, creating an environment where investors must navigate potential losses. Conversely, lower interest rates can bolster bond prices, making them more attractive when seeking to renovate your fixed income portfolio.

Risk assessment plays a vital role in renovation. Evaluating both credit risks—default probabilities associated with bond issuers—and market risks—volatility inherent in fixed income markets—will empower you to make informed decisions. Diversification strategies can mitigate risks as well, allowing you to spread investments across various fixed income instruments.

Deciding between short-term versus long-term investments also requires careful consideration. Short-term investments can provide quicker access to liquidity but may yield lower returns. In contrast, long-term investments generally offer higher yields but come with increased exposure to interest rate fluctuations.

Steps to renovate your fixed income form

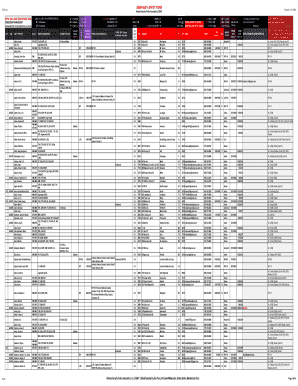

The first step in renovating your fixed income form is to review existing investments thoroughly. Create an inventory of your current holdings and perform a goal alignment check to ensure that your investments are in line with your renovation objectives.

Next, research alternative options. Utilizing online tools for comparison can facilitate your understanding of various fixed income products available in the market. pdfFiller’s document management features can assist in organizing this information seamlessly.

Once you have gathered sufficient research, it’s time to reallocate your assets. This might involve selling underperforming investments to free up capital for new opportunities that align more closely with your goals. Finalize the renovation process by filling out the necessary renovation documentation.

Using pdfFiller for efficient document creation and signing simplifies this process immensely. Key sections to include in your renovation form should encompass personal information, investment preferences, and signatures and authorizations, ensuring that everything is in order for your investments.

Using interactive tools for enhanced clarity

In today’s digital landscape, leveraging interactive tools can significantly enhance the clarity of your fixed income portfolio. pdfFiller’s graphical portfolio analysis allows you to visualize your investment strategy more effectively, making adjustments as necessary to stay on track with your renovation.

Additionally, pdfFiller’s document collaboration features enable seamless teamwork. This is particularly helpful if you’re working within a team or alongside a financial advisor. With cloud-based platforms, you can access your documents from anywhere, and the ability to make real-time updates and edits ensures that you are always looking at the most current information.

Common challenges and how to overcome them

Navigating complex regulations and compliance can be one of the more daunting aspects of renovating fixed income forms. It's vital to understand the legal considerations involved, as regulations can vary widely depending on your location and the specific types of investments involved. Staying informed and possibly engaging with a legal advisor when necessary can greatly ease this process.

Handling emotional investing decisions is another major challenge. During times of market volatility, it's common to experience knee-jerk reactions that can lead to poor investment choices. Developing a strong investment strategy beforehand can help you remain focused and disciplined during tumultuous market conditions.

Lastly, addressing market volatility through proactive strategies will help maintain stability in your portfolio. Developing a well-thought-out response plan will ensure you can react appropriately to fluctuations without jeopardizing your renovation goals.

Best practices for managing your renovated fixed income form

After renovating your fixed income forms, it's essential to have regular review and adjustment of investments. Set a personalized schedule for periodic portfolio check-ups, ideally, every six months to a year, depending on market conditions and your financial goals.

Additionally, consider whether to utilize financial advisors or manage your portfolio through a do-it-yourself (DIY) approach. Each method has its pros and cons; while professional guidance can provide expert insights, managing investments independently may offer more direct control over your financial strategy.

Being informed about ongoing market trends is critical for successful fixed income management. Engage with resources such as investment blogs, webinars, and financial news outlets to continuously educate yourself and adapt your strategy accordingly.

Frequently asked questions about renovation of fixed income forms

What are the most effective strategies for renovation? Effective strategies often involve a mix of thorough research into alternative fixed income products, regular portfolio reviews, and consideration of current economic conditions that may affect interest rates and credit risks. You can also employ tools like pdfFiller for document management to streamline this process.

How can I track performance after renovation? Tracking performance can be easily managed with appropriate online tools and platforms that provide analytics for fixed income investments. Regular check-ins on yield and maturity can help gauge investment health. pdfFiller can aid this process with its interactive features, granting regular access to updated investment documents.

What resources does pdfFiller provide for investors? pdfFiller offers robust document management solutions, including templates for renovation paperwork, e-signature capabilities, and collaboration features. These tools are designed to simplify the documentation process, allowing you to focus on making informed investment decisions.

Related topics and articles

Exploring investment strategies for fixed income can provide concise insights into managing your portfolio effectively. Understanding the role of fixed income assets within the broader context of your investment strategy is vital for long-term financial health. Additionally, keeping an eye on future trends in the fixed income market will ensure your renovated portfolio remains relevant and aligned with evolving economic landscapes.

Support and resources

Accessing the user guides and tutorials provided by pdfFiller can greatly enhance your experience when managing fixed income forms. These resources allow investors to familiarize themselves with the platform and learn how to utilize its features to their maximum potential.

Should you require further assistance, pdfFiller's customer support options are available for document-related queries. Additionally, engaging in community forums offers opportunities for interaction with other users, providing valuable insights and advice based on shared experiences.

Community insights

Community feedback reveals many users have successfully renovated their fixed income portfolios through the use of systematic strategies and efficient tools such as pdfFiller. Testimonials highlight how these document management solutions eased their transition and provided clarity in an otherwise complex investment landscape.

Highlighting specific case studies showcases the effectiveness of renovations when combined with proactive asset management strategies. From small-time investors adjusting their CD allocations to well-funded portfolios embracing diverse bond picks, success stories abound, demonstrating the broad applicability of effective renovation strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my renovation of fixed income in Gmail?

How can I edit renovation of fixed income from Google Drive?

How do I complete renovation of fixed income on an iOS device?

What is renovation of fixed income?

Who is required to file renovation of fixed income?

How to fill out renovation of fixed income?

What is the purpose of renovation of fixed income?

What information must be reported on renovation of fixed income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.