Get the free BOSP Payroll Preparation Manual: Volume V, Section 1

Get, Create, Make and Sign bosp payroll preparation manual

How to edit bosp payroll preparation manual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bosp payroll preparation manual

How to fill out bosp payroll preparation manual

Who needs bosp payroll preparation manual?

BOSP Payroll Preparation Manual Form: A Comprehensive Guide

Understanding BOSP payroll preparation

BOSP payroll refers to the Bureau of Services for People with Disabilities' payroll framework designed for organizations managing employees with varying needs. This payroll system emphasizes accuracy and accountability, ensuring that payroll-related tasks align with federal and state regulations while supporting those in need of care. The effective preparation of payroll in this environment is critical as it directly impacts the financial well-being of both the organization and the employees.

The importance of payroll preparation cannot be overstated; it ensures timely payment, correct tax withholding, and compliance with legal requirements. Yet, organizations face common challenges during payroll processing, such as mistyped numbers, missed deadlines, and lack of understanding of tax regulations, which can lead to costly errors.

Key components of BOSP payroll preparation manual

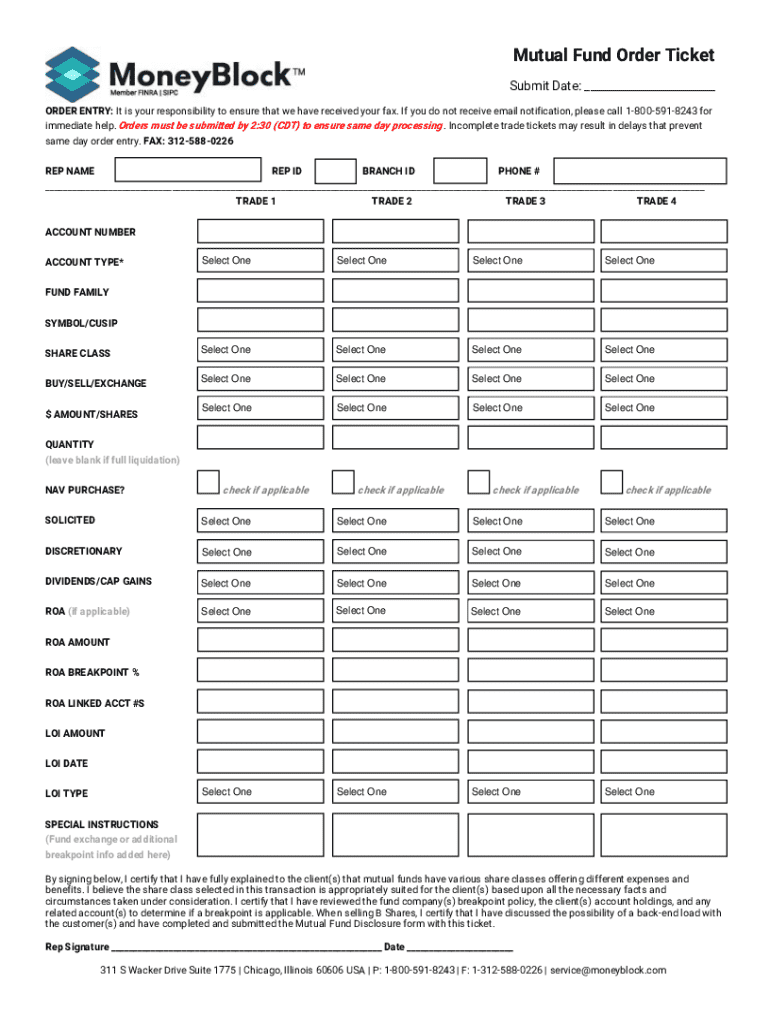

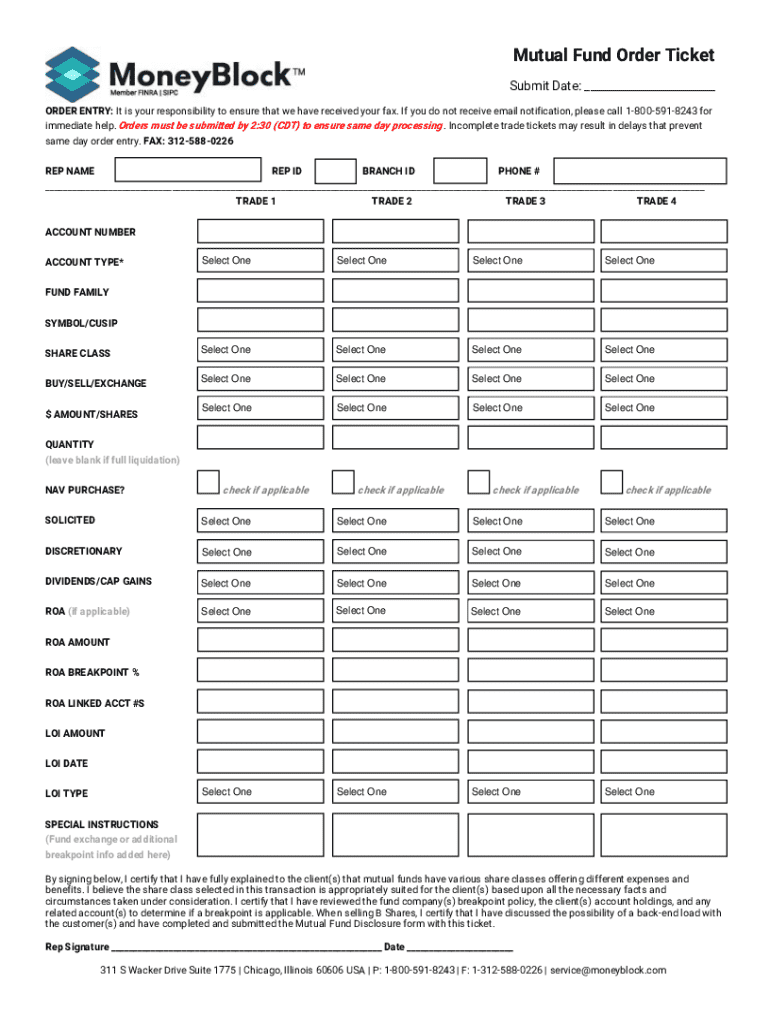

The BOSP Payroll Preparation Manual is a critical document that consolidates all necessary information to facilitate efficient payroll processing. This manual covers essential elements such as employee classifications, pay schedule, hours reporting, and various deductions applicable under federal and state law. Specific terms and concepts unique to BOSP payroll prep, like service hours and rate calculation, are also outlined for clarity.

Preparing to use the BOSP payroll preparation manual form

Prior to using the BOSP Payroll Preparation Manual Form, specific prerequisites must be met to ensure smooth processing. Essential documents like employee files containing identification and banking details, timesheets documenting hours worked, and pay rate agreements must be readily available. Furthermore, adopting software tools designed for payroll management can significantly streamline this process, as they enhance accuracy and efficiency.

Familiarizing oneself with the manual form's layout is also indispensable. The form typically includes sections dedicated to personal information, wage computations, and an overview of deductions. Understanding the difference between mandatory fields and optional fields can prevent unnecessary delays or errors when completing the form.

Step-by-step instructions for completing the BOSP payroll preparation form

Step 1: Gathering employee information

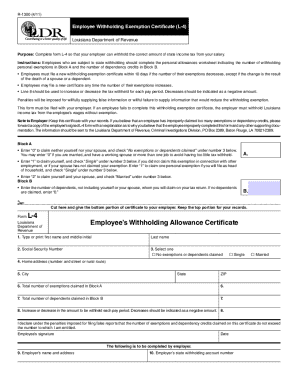

Begin by collecting vital employee data such as full names, Social Security numbers, and address details. Each employee record should be well-organized, ideally maintained within a centralized database that facilitates quick access and updates.

Step 2: Calculating gross pay

Calculating gross pay is fundamental to the payroll process. For hourly employees, the equation generally involves multiplying hours worked by the hourly rate. For salaried employees, typically, the annual salary is divided by the number of pay periods. It's crucial to ensure all calculations accurately reflect any overtime or bonuses due.

Step 3: Deductions & withholdings

Understanding deductions is essential to payroll preparation. Common deductions include federal income tax, state tax, Social Security, and Medicare. Be sure to differentiate between mandatory deductions and those that are employee-specified, like retirement contributions or health insurance premiums.

Step 4: Completing the payroll preparation manual form

With all information collected, proceed to fill out the BOSP payroll preparation manual form. Each section typically asks for specific details regarding personal data, earnings, and deductions. Double-checking entries against original documents or records can help reduce common errors.

Step 5: Reviewing and verifying information

Once the form is complète, it is crucial to review and verify all information. Best practices involve cross-checking figures against prior pay periods, utilizing checklists, and even having a second set of eyes review the document before finalizing.

Step 6: Finalizing and submitting the form

Final steps include submitting the completed form according to your organization’s payroll schedule and ensuring proper record-keeping. Proper archiving of payroll records is vital for future reference and compliance with auditing practices.

Advanced features of the BOSP payroll preparation manual form

Utilizing features within pdfFiller can significantly enhance the payroll preparation process. For example, seamless editing capabilities facilitate quick adjustments, while electronic signatures expedite approvals. Furthermore, collaborative tools allow team members to work simultaneously on payroll entries, improving workflow efficiency.

Managing and storing payroll documents effectively is equally critical. Employing best practices for cloud-based storage enhances security and compliance while ensuring easy access to important documents when needed.

Troubleshooting common payroll preparation issues

Identifying frequent mistakes is a proactive approach to improving payroll preparation. Common issues include incorrect employee classifications, miscalculated hours, and overlooking tax rates. Prevention strategies involve thorough training and ongoing education for staff involved in payroll processes.

If challenges arise, several resources are available for help and support. Organizations can consult local payroll experts or reference payroll communities online to troubleshoot specific issues or seek advice on best practices.

Best practices for efficient payroll management

Timelines are essential in payroll preparation. Establishing a payroll calendar aids in meeting deadlines and keeping payroll cycles consistent. Setting reminders for necessary actions will help all team members stay on track.

Engaging in continuous improvement within payroll processes ensures that your organization stays compliant and up-to-date with changing legislation. Regular training sessions and workshops can educate payroll managers and user teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute bosp payroll preparation manual online?

How do I edit bosp payroll preparation manual in Chrome?

How do I edit bosp payroll preparation manual straight from my smartphone?

What is bosp payroll preparation manual?

Who is required to file bosp payroll preparation manual?

How to fill out bosp payroll preparation manual?

What is the purpose of bosp payroll preparation manual?

What information must be reported on bosp payroll preparation manual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.