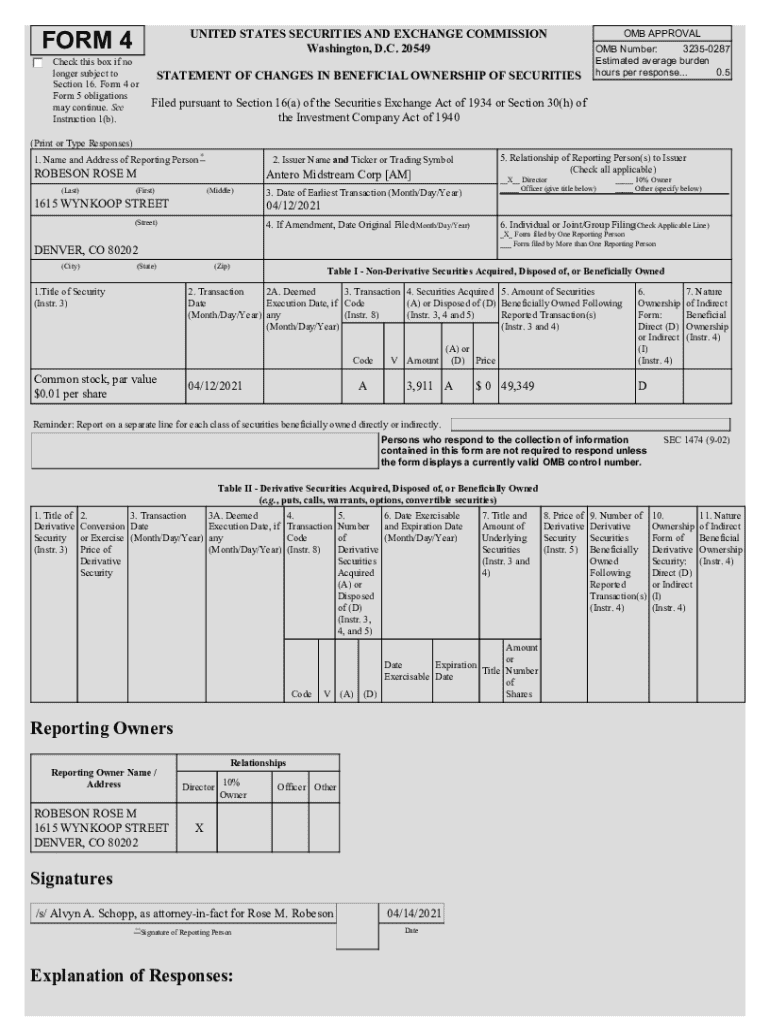

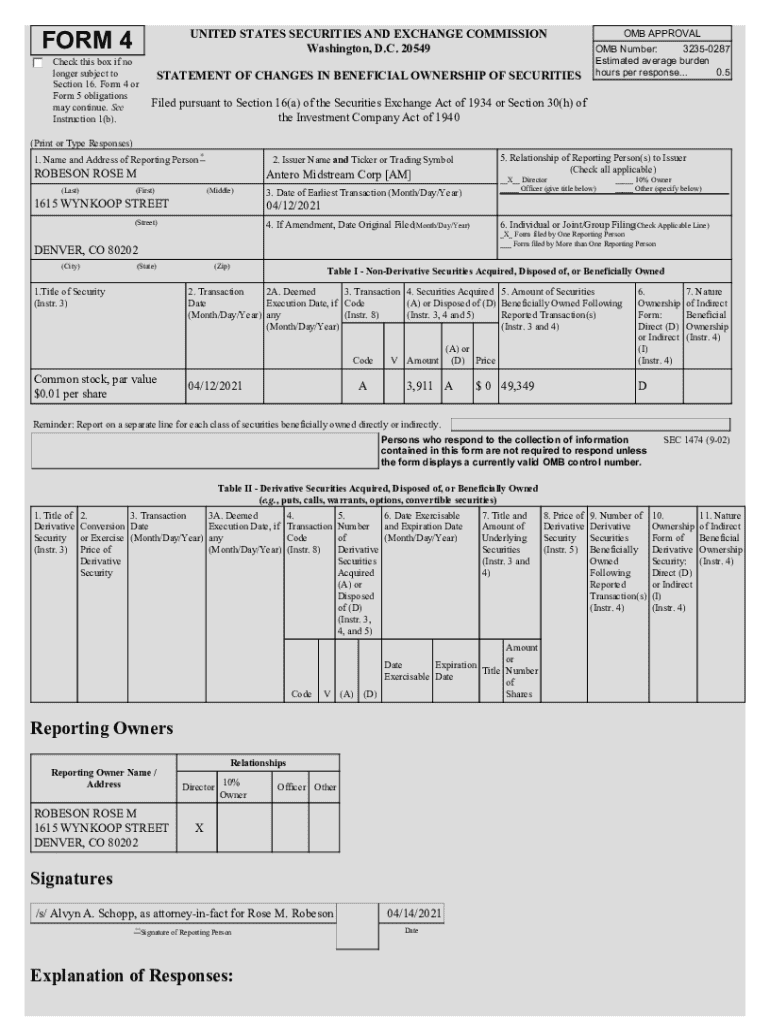

Get the free 3,911 A

Get, Create, Make and Sign 3911 a

Editing 3911 a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 3911 a

How to fill out 3911 a

Who needs 3911 a?

Understanding IRS Form 3911: Your Complete Guide

Overview of IRS Form 3911

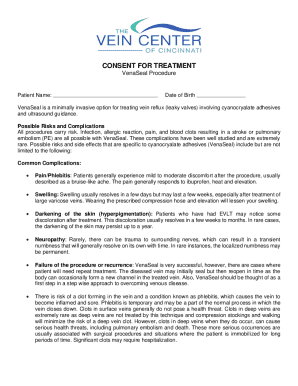

IRS Form 3911, officially titled 'Request for Refund Trace,' serves as the critical pathway for taxpayers seeking to track missing tax refunds. It's essential for individuals who have filed an income tax return but haven’t received their expected refund, providing a formal mechanism to follow up on the status of their payments.

Purpose of Form 3911

The primary purpose of IRS Form 3911 is to enable taxpayers to request the Internal Revenue Service (IRS) to trace a missing or lost tax refund. If taxpayers believe their refund has been lost in transit or delayed due to IRS processing issues, this form initiates an inquiry into the status, ensuring individuals can recover funds rightfully owed to them.

Who should use IRS Form 3911?

IRS Form 3911 is designed for any taxpayer who has not received their anticipated tax refund. Specific scenarios include situations where a refund check has been lost or damaged, changes in direct deposit accounts, or where the IRS has not issued a refund despite a filing confirmation. Additionally, individuals whose e-filed returns show as accepted but did not lead to a refund can also benefit from this form.

How to access and download IRS Form 3911

To access and download IRS Form 3911, head to the official IRS website. Begin by navigating to the 'Forms and Publications' section. You can also search for 'Form 3911' in the search bar. Once you locate the form, it can usually be downloaded in PDF format. pdfFiller also offers a user-friendly interface where you can fill out, edit, and sign the document electronically.

Detailed instructions on filling out IRS Form 3911

Filling out Form 3911 requires attention to detail to ensure all information is accurate. Below is the line-by-line breakdown that simplifies this process.

Common mistakes to avoid when completing IRS Form 3911

When filling out IRS Form 3911, several common mistakes often occur. One prevalent issue is entering incorrect personal information, leading to delays in processing. Additionally, failing to include a signature can halt the entire request process. Some individuals also forget to check for completeness before submission or neglect to provide adequate contact information, making it challenging for the IRS to reach them for follow-up.

How to file IRS Form 3911

Filing IRS Form 3911 can be done either by mail or electronically. For mail, send the completed form to the address specified on the IRS website, usually corresponding to your state of residence. E-filing the form may not be available, as it typically requires postal submission. Ensure to include any necessary documentation that supports your refund inquiry.

Follow-up after submission

After submitting Form 3911, you should initiate follow-up procedures. Typically, you can check the status of your refund request by contacting the IRS directly or through their official website. It’s advisable to wait at least four to six weeks after submitting the form before checking your status, as processing times can vary significantly. If you don’t receive a response or if more than six weeks pass without updates, it may be necessary to contact the IRS for additional assistance.

Video walkthrough: Filling out Form 3911

For a comprehensive visual guide, refer to the instructional video that walks you through the completion of IRS Form 3911. This resource can be incredibly beneficial for those who prefer a step-by-step video demonstration of the form-filling process.

Frequently asked questions about IRS Form 3911

If you have questions regarding IRS Form 3911, several common queries frequently arise. For example, how long does it take for the IRS to respond once the form is submitted? The average processing time can take several weeks, so patience is essential. Additionally, many taxpayers wonder whether they can use Form 3911 if they filed their return electronically. The answer is yes, you can trace your refund regardless of your filing method.

Related forms and resources for taxpayers

Taxpayers may have to refer to several other forms when dealing with refund inquiries. For instance, Form 1040, the standard tax return form, covers your income details, while Form 843 is used for requesting a refund or abatement. Familiarity with these forms can streamline your interactions with the IRS and enhance your understanding of tax documentation.

Tax planning tips for missing refunds

If you've found yourself in a situation where your refund is missing, it’s vital to understand your rights as a taxpayer. You are entitled to receive any refund due, and knowing the proper channels to address missing funds can save you time and stress. Additionally, if your issues persist, seeking help from a tax professional can be beneficial.

Reader engagement: What do you think?

We encourage readers to share their experiences with Form 3911. Have you had success tracing your refund using this form? Your insights could help others navigate their own queries more effectively.

Share your experience: Comments section

Feel free to leave your comments or questions below regarding IRS Form 3911. If you have a story or helpful tips, we’d love to hear from you!

Recent posts & articles on related topics

Stay updated with our latest posts discussing refund processes, tax management tips, and efficient document handling. These resources will assist you in managing your tax matters and maximizing your benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 3911 a without leaving Google Drive?

How can I get 3911 a?

How do I fill out 3911 a on an Android device?

What is 3911 a?

Who is required to file 3911 a?

How to fill out 3911 a?

What is the purpose of 3911 a?

What information must be reported on 3911 a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.