Get the free VAT - flat rate scheme ROSS-ON-WYE : Aubrey & Co

Get, Create, Make and Sign vat - flat rate

How to edit vat - flat rate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vat - flat rate

How to fill out vat - flat rate

Who needs vat - flat rate?

VAT - Flat Rate Form: How to Guide long-read

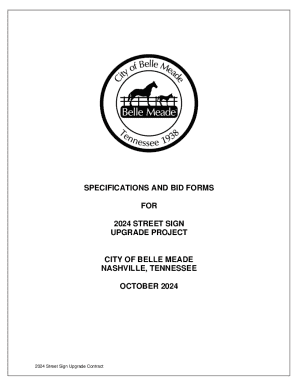

Understanding the VAT Flat Rate Scheme

Value Added Tax (VAT) is a consumption tax levied on goods and services. The VAT Flat Rate Scheme simplifies the VAT accounting process for eligible businesses. Instead of calculating VAT on every transaction, businesses pay a flat percentage of their turnover. This means less time spent on paperwork and more predictable tax liabilities.

Business owners often opt for the Flat Rate Scheme due to its simplicity. The standard VAT filing system can be cumbersome, especially for small business owners who may not have extensive accounting resources. By shifting to the Flat Rate Scheme, they reduce administrative burdens and often improve their cash flow management.

Eligibility criteria for the Flat Rate Scheme

To qualify for the VAT Flat Rate Scheme, businesses must meet specific eligibility criteria. Primarily, the business must be VAT registered and have a taxable turnover below a certain threshold, which is currently set at £150,000 in the UK. Various types of businesses, including sole proprietors and partnerships, can apply as long as they adhere to these conditions.

However, not all businesses can participate. Certain exclusions apply, such as businesses in specific sectors like finance and insurance, or those with substantial capital assets. It's crucial for potential applicants to review these exclusions carefully to avoid costly mistakes in their application.

Step-by-step guide to completing the VAT Flat Rate Form

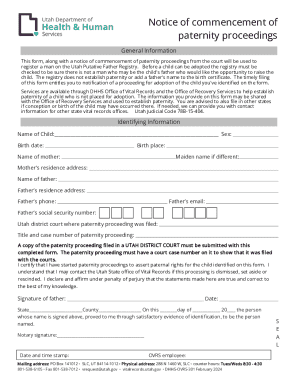

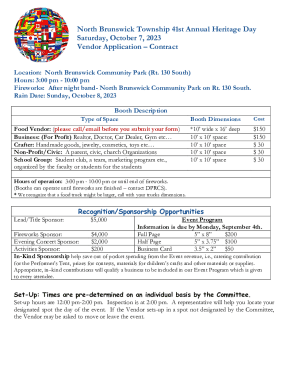

Completing the VAT Flat Rate Form is a crucial step for businesses enrolled in the Flat Rate Scheme. The first step is gathering all necessary information, such as your VAT registration details and relevant financial documents. This preparation ensures that you provide accurate data without unnecessary delays.

The form consists of several sections that need careful attention. Starting with Business Information, you will input basic details like your business name and registration number. In the Financials section, you declare your total turnover before selecting the appropriate flat rate percentage based on your business sector. Finally, the Declaration and Submission section finalizes your application, confirming that all information provided is accurate and truthful.

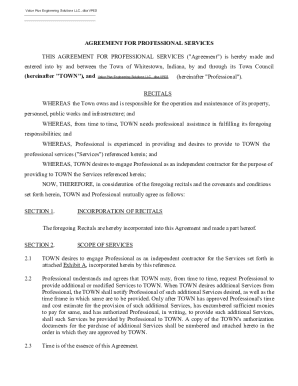

Editing and managing your VAT Flat Rate Form with pdfFiller

pdfFiller provides an intuitive platform to access and edit your VAT Flat Rate Form online. To begin, head to the pdfFiller website and use their user-friendly interface to upload your form. You can edit text, add necessary details, and make adjustments that suit your business needs.

Furthermore, eSigning the document within pdfFiller enhances your compliance. This process ensures that your submitted form has electronic validation, streamlining the submission process. Users can easily add their signature digitally, a convenience that reflects modern business practices.

Common mistakes to avoid when filling out the VAT Flat Rate Form

Filling out the VAT Flat Rate Form can be straightforward, however, many businesses make common mistakes that can lead to application rejection. One major mistake is misunderstanding eligibility requirements. It's crucial to fully understand whether your business qualifies before submitting the application.

Additionally, incorrect financial reporting can lead to significant issues. Make sure your reported figures are accurate and reflect your true turnover. Finally, maintaining detailed records throughout the year is vital. This practice not only helps in filling out the form accurately but can also be crucial if your submissions are called into question.

FAQs about the VAT Flat Rate Form

When participating in the Flat Rate Scheme, businesses often have questions about submission frequency and processes. Typically, businesses must submit their VAT Flat Rate Form alongside their regular VAT returns, depending on how frequently they are required to file. It's essential to stay aware of your submission deadlines to ensure compliance.

Moreover, businesses considering switching from the Flat Rate Scheme back to standard VAT accounting should be informed about eligibility transitions. Lastly, if mistakes are made on the form, such as reporting the wrong figures, it’s best to amend the form as soon as possible to avoid penalties.

Useful tools and resources

Utilizing interactive tools can significantly ease the VAT calculation process. pdfFiller offers a VAT calculator that helps ensure your figures are both accurate and compliant with current regulations. This tool can save time and minimize errors, making it a useful addition to your preparation process.

In addition, you can find further reading materials and related articles on the pdfFiller website, which cover various topics pertinent to VAT and document management. Having access to these resources can help you stay informed and prepared as compliance regulations evolve.

Join our community

Engaging with the community around VAT and the Flat Rate Scheme can provide valuable insights and updates. Staying informed about the latest tax regulations is crucial for any business owner. Subscribing to newsletters from pdfFiller ensures that you receive timely updates and information directly in your inbox.

Moreover, participating in online forums and discussions can help demystify complex tax matters. Sharing experiences and gaining wisdom from other business owners can be incredibly beneficial as you navigate your VAT obligations. Connecting with a community provides support and knowledge that enhances your document management journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify vat - flat rate without leaving Google Drive?

How can I send vat - flat rate to be eSigned by others?

How do I edit vat - flat rate straight from my smartphone?

What is vat - flat rate?

Who is required to file vat - flat rate?

How to fill out vat - flat rate?

What is the purpose of vat - flat rate?

What information must be reported on vat - flat rate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.