Get the free Routing number for LONE STAR NATIONAL BANK

Get, Create, Make and Sign routing number for lone

How to edit routing number for lone online

Uncompromising security for your PDF editing and eSignature needs

How to fill out routing number for lone

How to fill out routing number for lone

Who needs routing number for lone?

Understanding the Routing Number for Loan Form

Understanding routing numbers

A routing number, often termed an ABA routing number, is a unique nine-digit code assigned to financial institutions in the United States. This number plays a crucial role in the banking system, facilitating the transfer of funds and ensuring accurate identification of institutions during transactions.

The primary purpose of routing numbers is to identify the bank or credit union where an account is held, especially for automated transactions such as direct deposits and wire transfers. For loan forms, having the correct routing number is essential as it ensures that funds are disbursed correctly and efficiently.

The role of routing numbers in loan processing

Routing numbers are integral to the loan application process. When you apply for a loan, banks use this number to locate your financial institution and ensure that your funds can be processed promptly. During the underwriting process, your routing number helps verify your bank's details, thus expediting the assessment of your loan application.

Additionally, when the loan is approved and funds are disbursed, the routing number guarantees that the cash is wired to your account accurately. It's a common misconception that routing numbers are interchangeable between different banks; however, each institution has a specific routing number meant exclusively for their transactions.

Locating your routing number

Finding your routing number is straightforward. If you have a physical check, it is printed on the bottom left corner alongside your account number. Additionally, most banks provide this information on their websites within the customer service or FAQ sections. For those who prefer verification through online tools, numerous banking websites offer routing number lookup services.

FHA and other loan types: need for specific routing numbers

Different loan types have varied requirements, particularly concerning routing numbers. FHA loans, for instance, require your routing number to facilitate specific federal processes. Conventional loans and VA loans, while also needing routing numbers, may have additional checks that depend on the lender's policies.

Each loan type may demand unique routing number validations, reflecting the complexities of the respective loan processes. Understanding these nuances can significantly enhance your borrowing experience and minimize application delays.

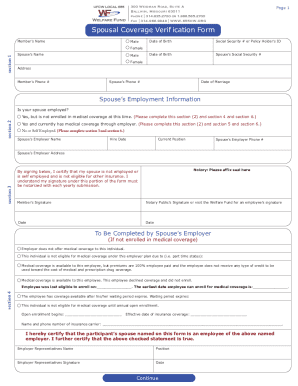

Creating and managing your loan form

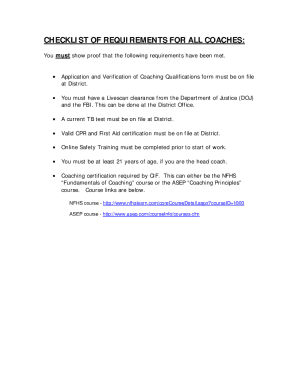

Filling out a loan form accurately is crucial for a smooth application process. Begin by gathering all necessary information, including your personal details, financial information, and the correct routing number. Ensure that you check all fields for accuracy; common pitfalls often include miswritten routing numbers or omitted details which can delay approval.

Using pdfFiller can greatly simplify the process. With its easy document editing features and cloud-based storage options, you can fill out your loan forms, store them securely, and retrieve them whenever necessary. This eliminates common paperwork stress and allows users to access their documents from anywhere.

Editing and signing your loan form

Editing loan forms requires a reliable tool. Online editing tools can help convert PDF files to Word format, making alterations easy. Additionally, eSignature features available on platforms like pdfFiller enable you to sign your loan forms digitally, streamlining the submission process significantly.

Collaborating on loan forms with others is seamless. You can invite team members to review and edit, ensuring that all details are correct before final submission. Tracking changes becomes effortless with pdfFiller, giving you peace of mind throughout the editing process.

Submitting your loan form

Once your loan form is complete, submission is the next critical step. You can choose between digital submission, which is often faster, or physical submissions that may require mailing. It is essential to include any additional documentation required by your lender, such as proof of income or employment.

To ensure a smooth submission process, tracking and confirmation methods can provide you with the confidence that your form has been received. Keep on top of follow-ups with your lender to monitor the status of your loan application.

Frequently asked questions about routing numbers and loan forms

Many borrowers have questions regarding routing numbers during the loan process. One pertinent question is how long it typically takes to get a loan approved once a routing number is provided. The answer can vary, but lenders often aim to expedite this process if all information, including the routing number, is accurate.

Another common query involves the repercussions of entering the wrong routing number. Entering an incorrect number can delay funds or even result in funds being directed to the wrong account, highlighting the importance of accuracy when dealing with routing numbers.

Troubleshooting common issues

Issues with routing numbers can arise during the loan process, but there are ways to troubleshoot effectively. If your routing number can't be verified, it could be due to an error in the number provided or it may not match the financial institution’s records. Always double-check your entries against official banking sources.

For ongoing problems, customer support resources are available through your lender or the bank associated with your routing number. Don’t hesitate to reach out for clarification or assistance to avoid delays in your loan processing.

Related topics and resources

In addition to routing numbers, there are other important identifiers in banking. For instance, account numbers are unique to individual accounts, while SWIFT codes are necessary for international transactions. Understanding these numbers can enhance your overall financial literacy.

For document creation and management, exploring additional tools within pdfFiller can offer numerous advantages. Their features cater to various financial forms, making your journey through paperwork smoother and more efficient.

Regulatory considerations

Routing numbers are subject to various banking regulations that ensure their proper use and security. These regulations help in protecting consumers while facilitating efficient banking operations. Knowing the compliance and security measures surrounding routing numbers and financial documents can safeguard against fraud and errors in handling financial transactions.

When submitting your loan forms, it is paramount to follow these regulations and best practices to ensure that all information is handled with the utmost care and diligence.

Tips for secure document management

Managing your routing number and account information securely is vital. Regular changes of your passwords and using two-factor authentication where available are essential practices. Retaining documents with sensitive information in secure locations prevents unauthorized access.

pdfFiller offers numerous security features to provide peace of mind. Users can take advantage of encryption and access controls to protect their documents while ensuring sensitive information is kept safe.

The future of routing numbers and fintech innovations

The landscape of banking is changing rapidly with the rise of fintech innovations. Digital payments and blockchain technology are evolving the way routing numbers are utilized, potentially leading to more streamlined processes that reduce manual errors and accelerate transactions.

As technology advances, understanding how routing numbers integrate with these changes will be vital for consumers and businesses alike, paving the way for more efficient financial transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify routing number for lone without leaving Google Drive?

How can I get routing number for lone?

Can I sign the routing number for lone electronically in Chrome?

What is routing number for loan?

Who is required to file routing number for loan?

How to fill out routing number for loan?

What is the purpose of routing number for loan?

What information must be reported on routing number for loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.