Get the free Business Credit Cards From Capital One

Get, Create, Make and Sign business credit cards from

How to edit business credit cards from online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business credit cards from

How to fill out business credit cards from

Who needs business credit cards from?

How to Guide to Business Credit Cards

Understanding business credit cards

A business credit card is a financial tool specifically designed for business expenses, allowing business owners to separate company spending from personal finances. These cards can help streamline expenses, manage cash flow, and even build a company’s credit profile. Unlike personal credit cards, business credit cards typically offer features tailored to business needs, such as higher credit limits and specialized rewards programs.

The primary difference between business and personal credit cards lies in their intended use and benefits. Business credit cards often come with features like expense tracking, employee spending limits, and the ability to earn rewards based on business-related purchases. These additional functionalities make business credit cards a vital component for companies seeking efficient financial management.

Benefits of business credit cards

Acquiring a business credit card offers various advantages that can significantly impact the success and management of a business. Firstly, having a dedicated business credit card helps build and manage business credit, crucial for securing loans and investment opportunities in the future. Secondly, separating personal and business finances simplifies accounting and tax processes, which can minimize stress during tax season.

Moreover, business credit cards can enhance cash flow management. For example, businesses can make purchases without immediately depleting cash reserves while gaining time to effectively manage cash inflows. This financial flexibility allows companies to seize growth opportunities as they arise, ensuring they have the necessary resources for expansion without jeopardizing operational stability.

Key features of business credit cards

Business credit cards come equipped with several key features that can be leveraged to enhance business performance. Most notable among these features is the rewards and incentives program. Business owners should look for cards that offer cashback or travel points based on their spending habits. For instance, a card that provides 2% cashback on office supplies can be particularly beneficial for businesses with high operational costs in that area.

Additionally, many business credit cards offer robust spending limits and controls. This allows business owners to set spending limits for employees, thus maintaining better control over company expenses. Integrated expense tracking tools help monitor business expenditures in real-time, making it easier for companies to stay within budget and analyze spending patterns.

How to choose the right business credit card

Choosing the right business credit card involves assessing your specific business needs. Start by analyzing your typical business expenses to understand what features will benefit you most. If your company frequently travels or entertains clients, a card that offers travel rewards might be ideal. For businesses focused on operational costs, a card with high cashback on office supplies could be more suitable.

Once you identify your needs, compare available business credit card options. Research popular cards and evaluate their fees, interest rates, and rewards programs. Pay special attention to costs associated with these cards, as annual fees and interest rates can vary widely. Some cards may offer enticing rewards but come with high fees that negate those benefits.

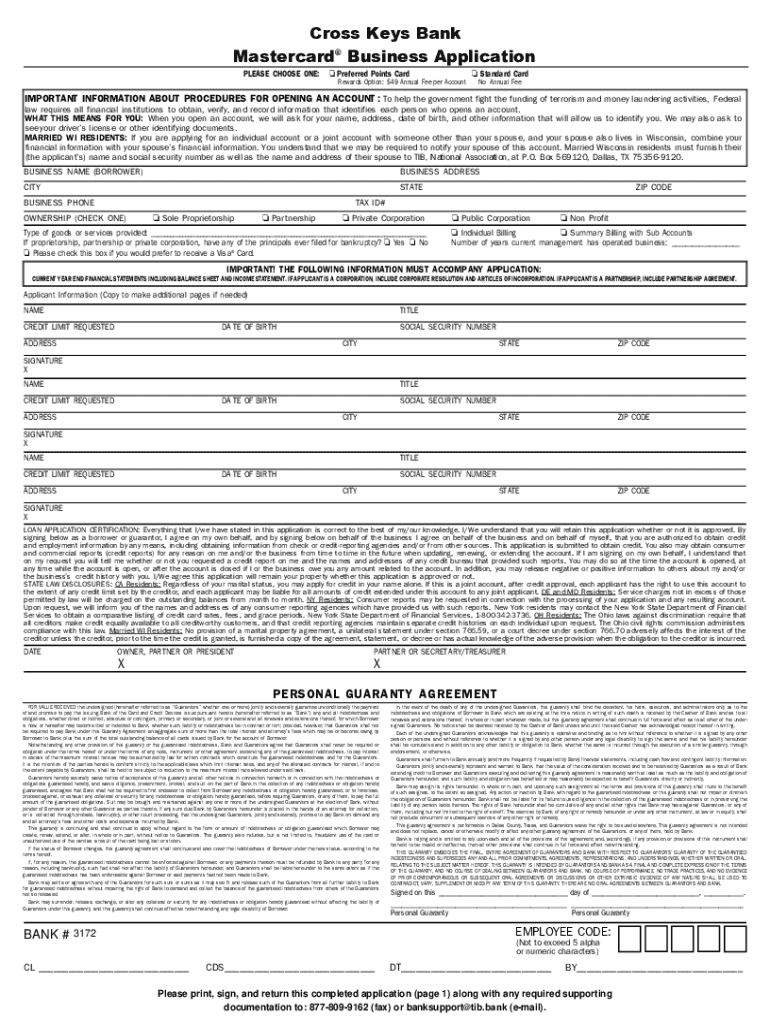

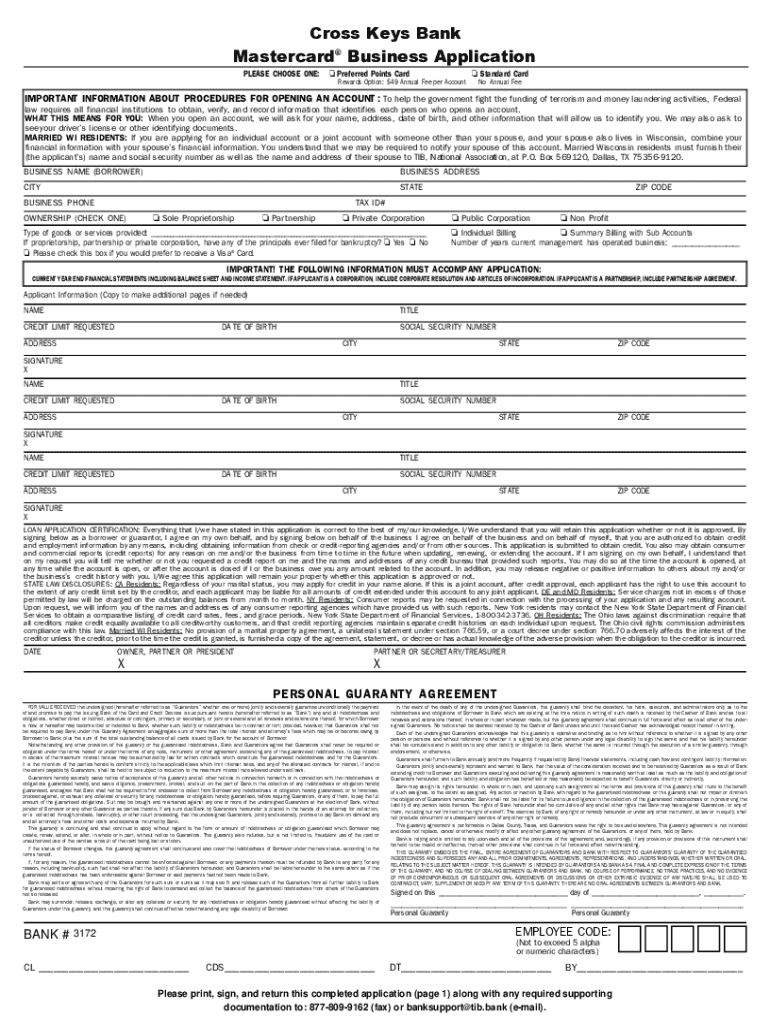

Application process for business credit cards

Before applying for a business credit card, it’s essential to determine who can apply. Typically, business credit cards are available to sole proprietors, partnerships, and corporations, but they often come with credit requirements that need to be satisfied. Understanding the eligibility criteria can save you time and increase your chances of approval.

When ready to apply, gather the necessary documentation, which usually includes business ownership details, estimated revenue, and sometimes financial statements. The application process typically involves filling out a form online or in person, providing all required information for a comprehensive review. To ensure success, double-check your application for accuracy and completeness before submission.

Managing your business credit card

Effective management of a business credit card is crucial for maximizing its benefits. To start, develop strategies for responsible spending and timely payments. Establishing a budget for credit card use helps avoid overspending and retaining financial control. Consider employing automatic payment methods to prevent missed payments and incurred interest, which can damage your business's credit profile.

Additionally, utilize reporting features provided by the credit card issuer to gain insights into your spending patterns. These features can help in tracking business expenses, identifying areas for cost reduction, and understanding overall financial health. By analyzing data these reports provide, businesses can make informed financial decisions and plan for the future effectively.

Special considerations for small businesses

Small businesses often face unique challenges when it comes to applying for business credit cards. One common question is whether a business current account is necessary to apply. While some credit card providers may require it, having a dedicated business account offers benefits such as clearer financial tracking and improved credibility with creditors.

For small business owners, knowing that you can access credit cards specifically designed for your category is beneficial. Options range from credit lines with low interest for those just starting or even rewards-oriented cards that cater exclusively to small business needs. With a strategic approach to choosing and applying for a card, small businesses can foster financial growth and stability!

Frequently asked questions (FAQs)

Often, individuals ask whether they can use personal credit cards for business purposes. While it is technically possible, it complicates financial management and can impact personal finances. This often leads to a tangled web of receipts and difficulties during tax time. Business owners are encouraged to keep these accounts separate for smoother cash flow management and reporting.

Another common concern is the use of personal guarantees. Many credit card providers may require a personal guarantee from business owners, which ties personal credit to the business card. This arrangement has implications for your liability and personal credit score, imposing additional risk should debts not be paid as agreed.

Conclusion on the value of business credit cards

Business credit cards represent a significant opportunity for companies to gain financial independence and operational efficiency. By effectively leveraging these cards, businesses can separate personal and business expenses, track spending, and utilize rewards that contribute to their growth objectives. With thoughtful management, business credit cards become more than just a payment method—they are tools for sustainable growth and success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the business credit cards from in Chrome?

Can I create an electronic signature for signing my business credit cards from in Gmail?

How do I fill out business credit cards from using my mobile device?

What is business credit cards from?

Who is required to file business credit cards from?

How to fill out business credit cards from?

What is the purpose of business credit cards from?

What information must be reported on business credit cards from?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.