Get the free How ACH fraud works and how to prevent it

Get, Create, Make and Sign how ach fraud works

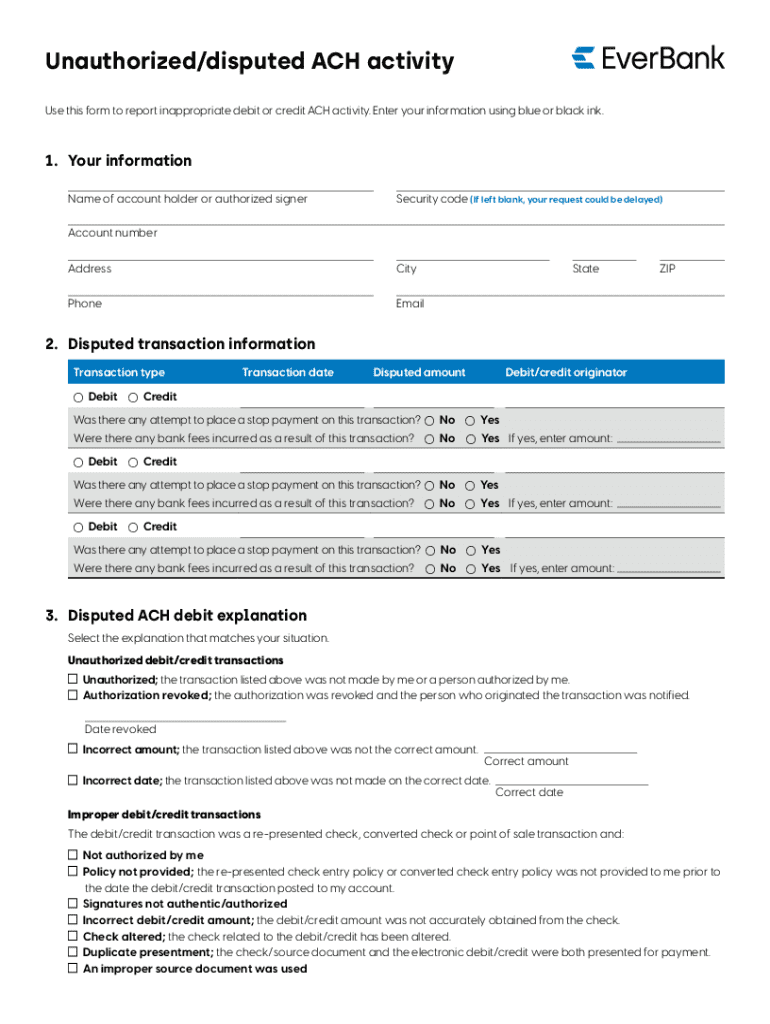

Editing how ach fraud works online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how ach fraud works

How to fill out how ach fraud works

Who needs how ach fraud works?

How ACH fraud works and how to protect yourself

Understanding ACH fraud

ACH fraud involves unauthorized transactions processed through the Automated Clearing House (ACH) network, which is a widely used system for electronic payments and money transfers in the United States. Recognizing ACH fraud is critical, as this type of fraud can lead to significant financial losses for businesses and individuals alike. The ACH network, known for its convenience and efficiency, also presents vulnerabilities that fraudsters exploit.

Types of ACH fraud

ACH fraud can manifest in several ways, each requiring different detection and prevention methods. Identifying these types of fraud is essential for safeguarding assets. The most common types include unauthorized transactions, altered checks, phishing scams, and insider threats.

How ACH fraud works

To understand how ACH fraud operates, it’s vital to grasp the underlying mechanics of ACH transactions. Normally, these transactions are initiated through user-authorized requests that pass through various banks and financial systems. Fraudsters exploit weak links in this process—often starting with social engineering tactics or technology-based attacks like malware to hijack account credentials.

Here’s how these methods are typically executed: a fraudster might send a phishing email to deceive a user into revealing their banking credentials. Once they have this information, they initiate unauthorized transactions. Alternatively, malware can be used to infiltrate a target's computer system, allowing cybercriminals to create fraudulent ACH entries without raising alarms. Over the past few years, numerous high-profile cases have illustrated these mechanics, showcasing the effectiveness of these fraud methods.

The impact of ACH fraud on businesses

The consequences of ACH fraud can be devastating. Financial losses often include not just stolen funds but also legal fees, chargebacks, and penalties imposed by banks for failing to manage transactions securely. In addition, the reputational damage can jeopardize customer relationships and drive away business, as clients may lose trust in organizations that fall victim to fraud.

Legally, organizations can find themselves in complex situations, potentially facing lawsuits from partners or clients. Compliance issues may arise if organizations are deemed to have neglected secure processing protocols. Thus, the ripple effect of ACH fraud extends far beyond immediate financial loss, indicating the need for vigilant monitoring and prevention tactics.

Identifying ACH scams

Recognizing early warning signs of ACH fraud can significantly mitigate threats. Businesses should remain vigilant for any sudden changes in transaction patterns or unusual requests from vendors. For example, if you notice a vendor suddenly attempting to change their payment details, that could indicate a phishing attempt.

There are also numerous tools designed to enhance detection capabilities. Software solutions can monitor transaction activity and identify irregularities, while regular internal audits can provide additional layers of scrutiny to ensure that fraudulent activities are caught early.

Prevention strategies for businesses and individuals

Preventative measures are vital for both individuals and organizations. Setting up account alerts can provide real-time notifications, allowing immediate reactions to unauthorized transactions. Communication protocols must be rigid, ensuring that sensitive information like bank details is exchanged securely. Employees should be trained to recognize phishing attempts, enhancing the organization’s defenses against fraud.

Moreover, implementing multi-factor authentication for sensitive transactions adds an extra layer of security, making it much harder for unauthorized users to succeed. These strategies, when combined, can create a robust defense against various types of ACH fraud, safeguarding both financial investments and business integrity.

How companies can prevent ACH fraud

Collaboration with financial institutions builds a strong foundation for combating ACH fraud. Businesses should engage with banks to understand the latest security measures available, integrating those into their own protocols. Additionally, regular reviews of payment processes can help detect vulnerabilities or outdated practices that foster fraud.

Developing incident response plans is crucial. These plans should outline procedures for immediate action upon identifying fraud and ensure all employees understand their role. This proactive stance can mitigate the impact of fraud incidents and reassure both employees and customers of the organization's commitment to security.

The prevalence of ACH fraud

Recent statistics indicate a rising trend in ACH fraud incidents, with reports showcasing substantial growth in fraudulent activities targeting electronic payment systems. Factors contributing to these increases include advances in technology which, while beneficial, also introduce new vulnerabilities. The ease of accessing information online has made it more straightforward for fraudsters to execute their scams.

Different sectors experience these threats in varying capacities. For instance, the finance and healthcare industries often bear the brunt of such scams due to the extensive amount of sensitive data they manage. By understanding these industry-specific impacts, organizations can better tailor their prevention strategies.

Detecting and preventing ACH fraud in real time

Real-time monitoring tools are instrumental in identifying potential fraud as it happens. By implementing these solutions, businesses can actively track transactions, alerting relevant personnel upon detection of anomalous activity. Immediate action upon detection is crucial, allowing organizations to mitigate losses before they escalate.

Successful prevention cases often showcase businesses that quickly employed their incident response plans to counter fraudulent activities, reflecting the importance of preparedness in the face of potential threats.

Insights and best practices

Expert opinions stress the importance of adopting a multifaceted approach to ACH fraud prevention. This includes staying informed about the latest fraud trends and following industry standards regarding payment security. Engaging in ongoing training for employees ensures that everyone is aware of emerging threats and knows how to respond.

Future trends indicate an increasing reliance on artificial intelligence and machine learning to identify fraudulent behaviors based on patterns in transaction data, enhancing detection capabilities significantly. As ACH fraud continues to evolve, the methods of prevention must likewise adapt.

Further learning and training opportunities

To effectively combat ACH fraud, ongoing education is vital. Training programs that focus on fraud awareness can be beneficial for teams seeking to bolster their defenses. Online workshops and webinars serve as excellent platforms for learning about the latest fraud techniques and discussing best practices among peers.

By investing in adequate training, organizations can empower their teams to be proactive in preventing ACH fraud. Staying up-to-date with evolving threats ensures that both individuals and companies remain a step ahead of fraudsters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit how ach fraud works on a smartphone?

How do I fill out the how ach fraud works form on my smartphone?

How do I complete how ach fraud works on an Android device?

What is how ach fraud works?

Who is required to file how ach fraud works?

How to fill out how ach fraud works?

What is the purpose of how ach fraud works?

What information must be reported on how ach fraud works?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.