Understanding the Monthly Giving Template Tax Letter Form

Overview of monthly giving and its benefits

Monthly giving is increasingly becoming a preferred donation method for many nonprofits. For organizations, it provides a reliable income stream that helps with budgeting and planning. Conversely, donors appreciate the convenience and its financial impact on charities. Monthly donations not only foster a deeper relationship between the donor and the organization but also encourage ongoing engagement.

Increased donor retention: Donors who contribute monthly are less likely to lapse, securing vital funding over time.

Predictable revenue stream: Organizations can forecast income, allowing for better financial planning.

Strengthening donor relationships: Monthly giving programs enhance communication and cultivate a sense of belonging within the donor community.

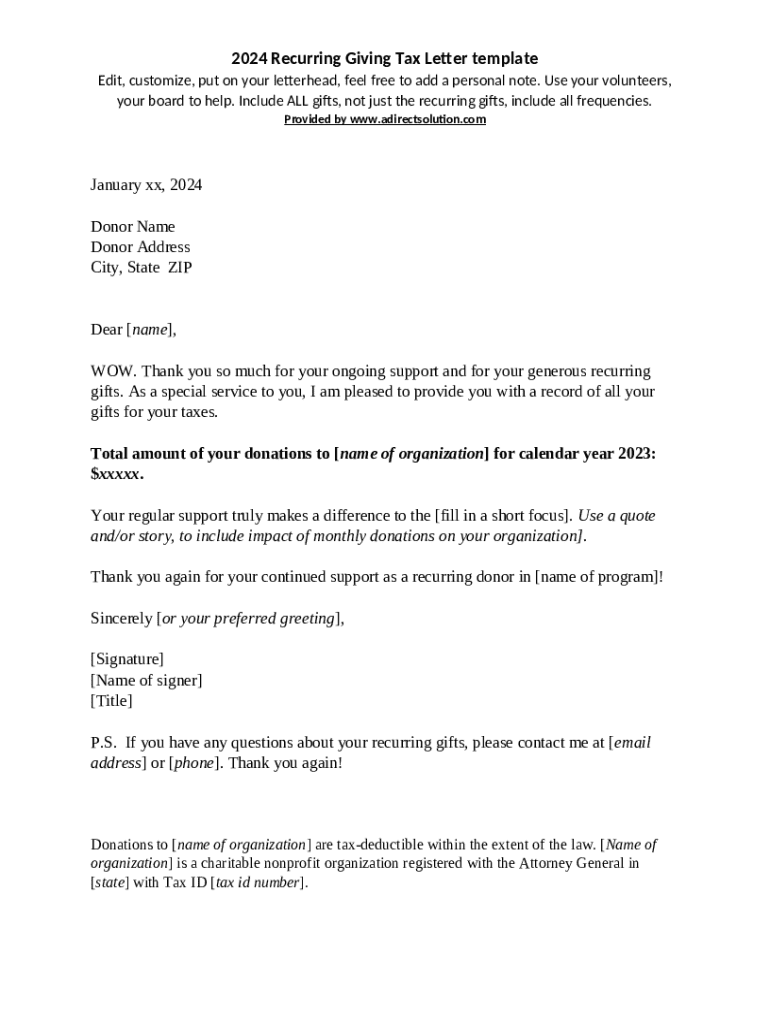

Understanding the monthly giving template tax letter form

The monthly giving template tax letter form serves as a record for donors to use when filing their tax returns. This form is essential not only for tax purposes but also for acknowledging the donor's support. It validates their contributions and ensures they maintain accurate records for their financial planning.

Tax letters are particularly important for monthly donors, as they typically make several contributions throughout the year. A well-structured tax letter outlines the total contributions made within a calendar year, providing a concise summary that aids in their tax preparation.

Definition: A formal acknowledgment of contributions made in a year.

Purpose: To assist donors in documenting their charitable contributions for tax deductions.

Key components: Donor information, organization details, contribution totals, and legal statements.

Preparing to fill out the monthly giving template tax letter form

Before filling out the monthly giving template tax letter form, it's crucial to gather the necessary information to ensure accuracy and compliance. Key elements include the donor's personal details, the amounts and frequency of their donations, and your nonprofit organization’s legal information. Having this information readily available streamlines the process and minimizes errors.

Understanding the significance of each donation not only enhances the quality of the letter but also reflects its impact on the organization’s mission. Providing a clear outline of how donations support various initiatives reinforces the importance of the donor's commitment.

Donor's personal details: Name, address, and contact information must be accurate.

Donation amounts and frequency: Document each contribution accurately for the entire year.

Nonprofit organization’s legal information: Include your tax-exempt status and IRS identification number for validation.

Step-by-step instructions to complete the monthly giving template tax letter form

Completing the monthly giving template tax letter form can be straightforward when you follow a structured approach. Here’s how to do it correctly:

Header Information: Include the organization name, contact details, and date of issue for the tax letter.

Donor Information Section: Fill in the donor's name, address, and any other necessary details accurately.

Donation History Verification: Summarize the donation history, ensuring accurate amounts and frequencies are reported.

Tax Exempt Status Disclosure: Clearly state the nonprofit’s tax-exempt status and include the IRS requirements.

Personalized Acknowledgment Message: Craft a thoughtful message that expresses gratitude for the donor's support and outlines how their contributions made an impact.

Editing and customizing the monthly giving template tax letter form

When it comes to creating personalized and polished tax letters, using tools like pdfFiller can make all the difference. With its intuitive interface, you can seamlessly edit PDFs to suit your organization's needs. Tailoring the letter to reflect the donor's specific contributions fosters a deeper connection and appreciation.

Customizing your letter can involve adding personal touches, such as the donor's name within the letter or specifics about how their donations have made a difference. This level of detail shows consideration and gratitude, enhancing donor engagement down the line.

Advanced features of pdfFiller for managing monthly giving template tax letters

pdfFiller provides a host of advanced features designed to streamline and enhance document management processes. Users can access interactive tools for editing, signing, and collaborating on documents, which are essential for nonprofits managing monthly giving template tax letters.

For remote teams or individuals, pdfFiller's cloud-based access allows for seamless adjustments, ensuring that all documents are up-to-date regardless of location. Additionally, its secure storage solutions help organizations keep donor letters organized without the risk of losing crucial financial documentation.

Interactive tools for document management: Easily edit and manage your tax letters.

E-signature capabilities: Facilitate faster approval processes.

Cloud-based access for remote adjustments: Update documents from anywhere.

Secure storage and organization of donor letters: Keep sensitive information protected.

Common mistakes to avoid when creating monthly giving template tax letters

While creating monthly giving template tax letters may seem straightforward, several common pitfalls can undermine the effectiveness of your communications. Avoiding these issues ensures that donors receive the recognition and tax documentation they deserve.

Inaccurate or incomplete donor information can lead to confusion and dissatisfaction. Always double-check details.

Failing to issue letters in a timely manner may frustrate donors, especially during tax season.

Ignoring tax compliance requirements could result in discrepancies. Stay updated with IRS regulations pertaining to charitable giving.

Enhancing donor communication with monthly giving template tax letters

Tax letters should not only serve a functional purpose but also be utilized as an opportunity for enhanced communication with donors. There are strategies to achieve this, ensuring donors feel valued and engaged.

Incorporating a personal touch and exciting language in tax letters reinforces the connection between the donor and the organization. Additionally, sharing insights into future initiatives or projects can create interest in continued giving.

Strategies for engagement: Use gratitude-driven language that resonates with donors.

Utilizing the letter as a tool for donor stewardship: Present opportunities for further involvement.

Incorporating future giving opportunities within the letter: Encourage donors to consider increased or additional support.

Conclusion: Efficiently managing your monthly giving program

Monthly giving tax letters are not just formalities; they play a crucial role in building lasting relationships between nonprofits and their supporters. They offer a clear path to maintaining effective communication and expressing gratitude for ongoing contributions. Utilizing pdfFiller for this purpose equips nonprofits with the tools to efficiently manage these documents while enhancing donor engagement.

By following the guidelines outlined here, organizations can ensure that their tax letters are both accurate and personalized, strengthening connections with donors and ultimately fostering greater support for their missions.

Related resources for nonprofits

Apart from tax letters, having access to various templates is crucial for effective donor communication and financial documentation. Resources such as templates for one-time donation receipts or guides on improving donor engagement can be extremely beneficial for nonprofit organizations aiming to maximize their outreach.