Get the free Employee Stock Options and Investment

Get, Create, Make and Sign employee stock options and

How to edit employee stock options and online

Uncompromising security for your PDF editing and eSignature needs

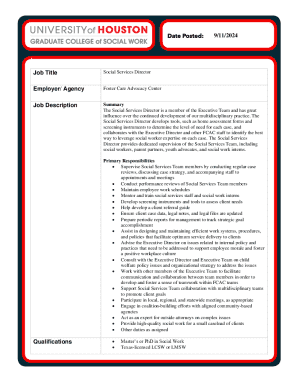

How to fill out employee stock options and

How to fill out employee stock options and

Who needs employee stock options and?

Employee Stock Options and Form: A Comprehensive Guide

Understanding employee stock options

Employee stock options (ESOs) represent a form of compensation that gives employees the right to purchase company stock at a predetermined price, known as the exercise price. This financial tool allows employees to benefit from the company's growth and profitability, aligning their success with that of the organization. Employee stock options have become integral to compensation packages, particularly in startups and tech companies where cash resources may be limited but growth potential is substantial.

Typically, employees who participate in stock option programs include executives, managers, and other key personnel. These options serve not only as a financial incentive but also as a means to foster loyalty among employees, encouraging them to remain with the company longer to realize the full benefits of their options.

Types of employee stock options

Employee stock options come in various forms, the two primary types being Incentive Stock Options (ISOs) and Nonqualified Stock Options (NSOs).

ISOs allow employees to buy shares at a fixed price and offer favorable tax treatment by not triggering taxation at the time of exercise, provided certain conditions are met. However, they come with specific eligibility requirements, including that they must be granted only to employees, not to consultants or board members.

In contrast, NSOs offer more flexibility—anyone can receive NSOs, including non-employees. However, NSOs are subject to different tax treatments that can lead to immediate tax consequences upon exercise.

How employee stock options work

The process of granting employee stock options begins with the company determining the number of options to provide to each employee, often outlined clearly in the employee's compensation agreement. Following the grant, a vesting schedule comes into play, meaning that employees must fulfill certain conditions or remain employed for a specific period before they can exercise their options. Typically, common vesting schedules involve either a cliff vesting structure, where workers receive all options after a certain time, or graded vesting, where options are distributed gradually over a set period.

Exercising stock options means the employee purchases the stock at the predetermined option price. This step may involve considerable consideration, including current market conditions and personal financial situations. Options may result in significant financial rewards, but they also require careful planning and evaluation.

Tax implications of employee stock options

To understand the tax implications, it’s essential to differentiate between ISOs and NSOs. ISOs are taxed favorably, meaning that if the employee meets holding requirements after exercising the options, gains may qualify for lower long-term capital gains tax rates. However, exercising ISOs can result in Alternative Minimum Tax (AMT) implications, which may increase tax liabilities.

NSOs, on the other hand, trigger ordinary income tax upon exercise, calculated based on the difference between the exercise price and the fair market value at the time of exercise. The company is responsible for withholding applicable income taxes, which can lead to immediate tax consequences.

Benefits of employee stock options

Employee stock options can create significant advantages for both employees and employers. For employees, stock options present a powerful opportunity for wealth accumulation, especially if the company's growth trajectory is strong. They are incentivized to contribute positively toward the company's success, ultimately benefiting from any increase in stock price. Moreover, stock options can foster a sense of ownership and belonging among employees as their interests align directly with the company's performance.

From an employer's perspective, offering stock options can significantly enhance employee morale and motivation. Employees who feel invested in the company's future are typically more committed and less likely to seek employment elsewhere, thereby improving retention rates. Offering stock options can also serve as an attractive incentive for recruiting top talent who are looking for more than just a paycheck.

Downsides and considerations of employee stock options

Despite their advantages, employee stock options also present potential challenges. Employees must be mindful of market volatility, which can significantly affect stock values and, consequently, the perceived value of their options. Moreover, failing to consider taxes, liquidity needs, and personal financial circumstances can lead to mismanagement of options and lost opportunities.

Employers must also navigate the complexities of creating stock option plans. Without thoughtful planning and clear communication regarding how the option grants work, misunderstandings can arise, leading to dissatisfaction among employees. A poorly structured stock option plan can result in administrative headaches and potential compliance issues, which can compromise the intended benefits.

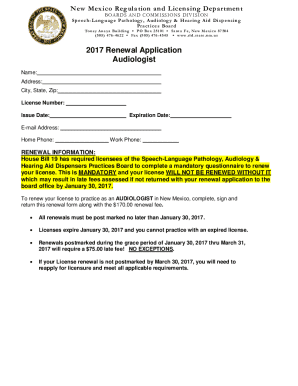

Filling out and managing employee stock option forms

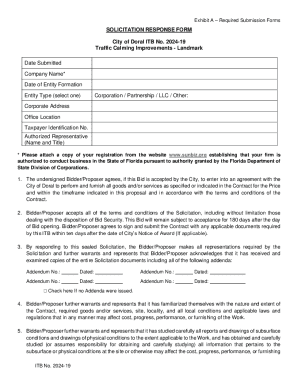

Managing employee stock option forms can be streamlined with the right approach. Various forms are essential in the process, each serving distinct purposes related to the exercise, purchase, and tax reporting of stock options. Understanding these forms is critical for both employees and employers.

The completion of Form 3921 and Form 3922 requires attention to detail. When filling out Form 3921, ensure that all relevant employee information is accurate and that the correct stock option details, such as exercise price and granted date, are provided. Similarly, Form 3922 must accurately reflect the purchase price and the discount received.

Frequently asked questions (FAQs)

Understanding employee stock options can raise many questions for employees. One common query is when to exercise stock options. Factors such as market conditions and personal financial goals should play a role in this decision, and employees must weigh the potential gains against the risks involved.

Another frequent question concerns stock options after leaving a company. Typically, employees have a limited time frame to exercise their options post-departure, often 90 days to make their moves. Lastly, individuals often ask if they can sell their stock options immediately after vesting, which generally depends on the specific plan details created by the employer.

Case studies and examples

Examining case studies of companies that have implemented employee stock option programs can offer insightful lessons. For instance, tech companies like Google and Amazon have effectively utilized stock options to foster commitment and engagement among employees, yielding high retention rates and strong employee satisfaction. When contrasted with companies that haven't incorporated stock options, the cultural and financial benefits of such programs become evident, showcasing how they can attract top talent and drive company growth.

The case of a tech startup that adopted stock options led to increased innovation and commitment among team members, whereas a more traditional firm that offered only standard benefits struggled with talent retention and overall employee morale.

Related insights and further learning

Diving deeper into employee stock options can enhance financial literacy among employees. Additional readings that explore the nuances of stock options can equip individuals with the tools needed to make informed decisions. Resources that outline choosing plans, managing stock options, and tax strategies are invaluable for anyone considering or currently holding stock options.

Interactive tools

To aid in evaluating stock option values, access to interactive calculators can be immensely beneficial. These tools enable employees to input various parameters, such as exercise prices and expected stock price growth, helping them gauge the potential financial outcomes of exercising their options. Moreover, resources to track stock options and provide guidance on informed decision-making are crucial in navigating the complexities of employee stock options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit employee stock options and in Chrome?

Can I edit employee stock options and on an iOS device?

Can I edit employee stock options and on an Android device?

What is employee stock options?

Who is required to file employee stock options?

How to fill out employee stock options?

What is the purpose of employee stock options?

What information must be reported on employee stock options?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.