Get the free united states - Investor Center

Get, Create, Make and Sign united states - investor

Editing united states - investor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out united states - investor

How to fill out united states - investor

Who needs united states - investor?

United States - Investor Form: A Comprehensive Guide

Understanding the investor form in the United States

The 'Investor Form' in the United States serves as a critical document for both individuals and entities involved in investment opportunities. Designed to collect essential information about potential investors, this form helps assess the suitability of various investment options. Furthermore, it plays a significant regulatory role, ensuring compliance with federal and state laws governing investments. Whether you are an individual looking to invest in new ventures or a company seeking funding, these forms are foundational.

Understanding this form is especially important as it informs various stakeholders of the investor's financial background, risk tolerance, and goals. By accurately providing information, investors not only meet legal requirements but also align their investment strategies with appropriate financial products.

Who needs to use this form?

The target audience for the investor form ranges widely, including individual investors, businesses, and investment firms. Each of these groups may have distinct requirements and situations necessitating the completion of an investor form. Specifically, individual investors might pursue this form when seeking to invest in mutual funds, stocks, or real estate. Meanwhile, businesses may need to file the investor form to attract venture funding or secure loans, providing potential investors insight into their financial health and business strategy.

Types of investor forms available

Various investor forms are available, each tailored to meet specific needs and circumstances in the U.S. The Securities and Exchange Commission (SEC) oversees many of these forms, such as Form D, which is essential for companies offering securities applicable to exemptions under Regulation D. Additionally, each state may have its own specific investor forms that must be completed, adding to the complexity of the investment landscape.

Selecting the correct investor form is paramount. Depending on the type of investment and whether it involves state or federal regulations, different forms will be appropriate. For example, venture capitalists will often rely on forms that gauge investor accreditation, while real estate investments may require entirely different documentation to comply with state property laws.

Step-by-step instructions for filling out the investor form

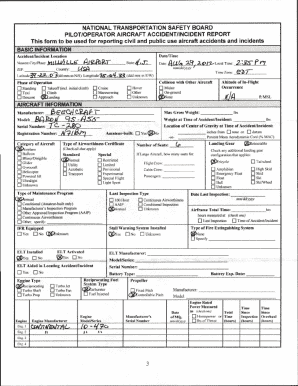

Filling out an investor form may seem daunting at first, but a systematic approach can simplify the process. Start by gathering the required information which usually includes identification details, proof of income, investment goals, and financial background. Organizing these documents in advance can save you a considerable amount of time and prevent errors.

When you initiate the form, pay close attention to the structure. Typically, investor forms will have sections outlining personal information, investment specifics, and legal acknowledgments. Each section is crucial. For instance, in the personal information section, errors on details like Social Security Number or address may lead to delays or rejections.

Common mistakes to avoid

In the investment landscape, filling out the investor form with inaccuracy can lead to consequences. Some common mistakes people make include leaving sections incomplete, providing outdated information, or failing to double-check their numbers. Each mistake can result in delays or a need for re-submission. To avoid these pitfalls, always review your form carefully and consider having a peer or advisor cross-check your answers.

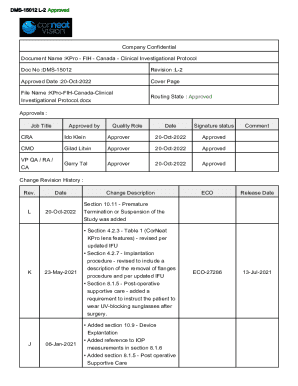

Editing and managing your investor form

Once you have completed your investor form, the capability to edit the document is essential. pdfFiller offers an easy-to-use interface for editing PDF documents, allowing users to make necessary amendments seamlessly. This includes adding or removing information, changing investment amounts, or even updating contact details.

To edit forms effectively, navigate to the section of the form needing changes and utilize editing tools available through pdfFiller. Features such as adding sticky notes or drawing tools can further enhance communication with advisors or partners reviewing the form.

Signing and submitting your investor form

Once your form is completed and edited, the next step is signing the document. pdfFiller provides a safe and secure platform for electronic signatures, which are legally recognized in the United States. This means you can sign your investor form online without the need for paper documents, streamlining the submission process.

After signing, the process of submission typically involves sending the form to the designated authorities or investment firms. It’s crucial to understand the submission guidelines specific to each organization, as some may require certified copies while others may accept electronically submitted forms. Tracking the submission can usually be done through platforms like pdfFiller, offering status updates on your document's progress.

Tools and resources for investor form management

Resources to assist in managing your investor form extend beyond mere editing. pdfFiller offers interactive tools that help streamline collaboration between teams or advisors, allowing multiple parties to view and comment on forms concurrently. This collaborative approach enhances understanding and reduces miscommunications.

Additionally, access to governmental resources related to investment regulations is invaluable. Familiarizing yourself with these guidelines can provide further context and clarity around what is required when completing any investor forms.

Latest updates and FAQs about investor forms

Staying informed about the latest developments in investor forms is crucial for compliance. Recent regulatory changes may impact what needs to be disclosed on investor forms or alter the forms themselves. For example, updates from the SEC could introduce new requirements for disclosures or specific fields that need completion.

In addition to changes in regulations, frequently asked questions (FAQs) provide essential insights into common concerns regarding investor forms—be it about how to properly fill them out or about particular legal considerations one should be aware of. Understanding these FAQs not only enhances compliance but also builds confidence in the investment process.

Stay informed

Engagement is essential for anyone involved in investing and the use of investor forms. By subscribing to updates through platforms like pdfFiller, you can ensure that you're kept in the loop about new tools, resources, and changes affecting the investor landscape.

Moreover, participation in community forums or webinars that focus on investor forms can foster deeper understanding and provide networking opportunities with professionals and peers alike. These spaces allow for discussions about best practices as well as shared experiences related to form management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my united states - investor in Gmail?

How do I complete united states - investor online?

How can I edit united states - investor on a smartphone?

What is united states - investor?

Who is required to file united states - investor?

How to fill out united states - investor?

What is the purpose of united states - investor?

What information must be reported on united states - investor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.