Get the free Cyprus-Tax-Incentives-for-Investing-in-Innovative-Enterprises ...

Get, Create, Make and Sign cyprus-tax-incentives-for-investing-in-innovative-enterprises

Editing cyprus-tax-incentives-for-investing-in-innovative-enterprises online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cyprus-tax-incentives-for-investing-in-innovative-enterprises

How to fill out cyprus-tax-incentives-for-investing-in-innovative-enterprises

Who needs cyprus-tax-incentives-for-investing-in-innovative-enterprises?

Cyprus Tax Incentives for Investing in Innovative Enterprises Form

Overview of Cyprus tax incentives

Cyprus has developed a robust framework of tax incentives aimed specifically at fostering innovation and promoting investment in emerging enterprises. Tax incentives serve as critical mechanisms for stimulating economic growth, enabling startups and innovative companies to thrive. By reducing the financial burden on these enterprises, the government helps to catalyze research and development (R&D) initiatives that can lead to groundbreaking advancements across various sectors.

The innovation landscape in Cyprus is gradually transforming, supported by both public and private sector initiatives. This includes a focus on leveraging the island's strategic location between Europe, Africa, and Asia, allowing businesses to pilot innovative projects that have global implications. One key goal of these tax incentives is to position Cyprus as a prominent hub for technological development and entrepreneurial activity in the region.

Types of tax incentives available

Cyprus offers a variety of tax incentives that cater to innovative enterprises, and understanding these options is crucial for potential investors.

R& tax credits

Research and Development (R&D) tax credits are designed to foster innovation by allowing companies to claim back a proportion of their R&D spending. To be eligible, companies must demonstrate that their projects involve innovative technologies or methodologies. Benefits can be substantial, often providing a tax offset of up to 30% of eligible R&D expenditure.

Investment grants and subsidies

Investment grants and subsidies support specific projects that enhance innovation. This includes funding for new technologies, infrastructure, or training initiatives. The application process typically involves submitting detailed project proposals to the relevant government authority for review.

Reduced corporate tax rates

The corporate tax rate in Cyprus is one of the lowest in Europe. Companies engaged in innovative activities may qualify for reduced rates, enhancing their financial viability. Qualification often requires an assessment of the company’s business model and innovation strategy.

Understanding the investment process

Navigating the investment process to avail of tax incentives requires a structured approach. The initial decision should involve a thorough feasibility study, assessing the market potential and alignment with national innovation strategies.

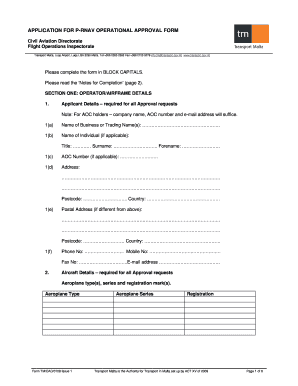

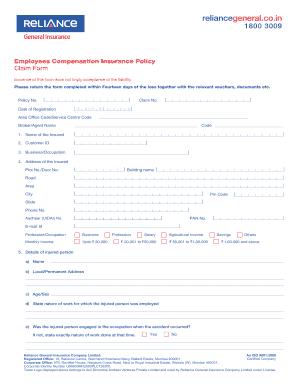

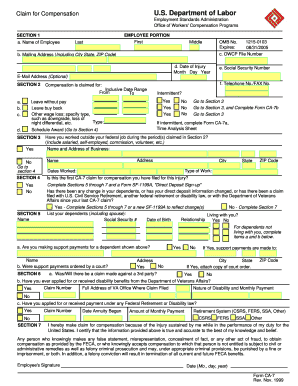

Steps to apply for tax incentives

When preparing an application for tax incentives, companies should follow these key steps: First, begin with preliminary research to understand the eligibility and requirements. Second, gather all necessary documentation to support your claims, including financial statements, project proposals, and innovative methodologies. Finally, submit the complete application to the appropriate governmental department.

Interaction with government agencies

Effective communication with government agencies is essential for successful applications. Familiarizing yourself with key agencies involved, such as the Ministry of Finance and Innovation and the Research and Innovation Foundation, can facilitate smoother interactions. Maintaining transparency and providing comprehensive documentation can enhance credibility in the eyes of these organizations.

Critical form: Cyprus tax incentives form

The Cyprus tax incentives application form is a pivotal document in the investment process. It serves to formalize requests for tax benefits and provides essential data to government bodies for evaluation.

Overview of the tax incentives application form

The application form comprises several sections, each requiring specific information. Key areas include personal details of the applicant, comprehensive investment descriptions, and supporting evidence such as financial forecasts and project feasibility studies.

Step-by-step guide to filling out the form

Common mistakes to avoid in this section include missing signatures and failing to provide complete supporting documents, which can result in application rejection, extending the approval process.

Editing and managing your tax incentives form

Utilizing tools like pdfFiller can significantly streamline the management of your tax incentives form. This platform offers various features that cater to editing, signing, and collaborating on forms, making it easy to manage document workflows efficiently.

Utilizing pdfFiller for form management

pdfFiller allows users to create, edit, and eSign documents seamlessly from any location. The collaborative features also enable teaming up with colleagues to finalize the application, improving the overall submission quality.

Best practices for document management in cloud

Cloud-based document management is crucial for keeping track of changes and ensuring compliance with data security regulations. Utilizing revision logs, setting access permissions, and ensuring backups are excellent practices to safeguard important applications.

FAQs around Cyprus tax incentives for innovative enterprises

Investors may have numerous questions regarding their eligibility and the application processes for the Cyprus tax incentives. Addressing these common queries is vital for smooth navigation through these systems.

Case studies of successful investments

Success stories stemming from tax incentives in Cyprus illustrate the tangible benefits to innovative enterprises. Companies that have utilized these incentives have reported impressive growth metrics, from increased revenue to expanded employee bases.

For instance, a tech startup specializing in artificial intelligence secured R&D tax credits, allowing them to enhance their product development, resulting in a 200% increase in market reach within two years.

Lessons learned from different enterprises

These success stories serve as valuable lessons for future investors. Enterprises have noted the importance of engaging closely with tax advisors and utilizing available resources strategically to maximize benefits.

Future of innovation and tax incentives in Cyprus

As Cyprus continues to evolve as a center for innovation, the future of tax incentives looks promising. Emerging trends point to increased government collaboration with private sectors to refine and expand these programs.

Government initiatives to enhance innovation will likely include more streamlined processes and expanded funding opportunities, encouraging even greater investment in innovative enterprises throughout the island.

Networking and further support

For potential investors looking to navigate the landscape of tax incentives in Cyprus, establishing a robust network is essential. This includes connecting with local innovation hubs and support organizations, which can provide guidance and assistance throughout the application process.

Useful links for potential investors

Importance of local networks and expertise

Building relationships with local experts can significantly enhance the likelihood of success in securing incentives. Local knowledge can provide insights into best practices, common pitfalls, and strategic approaches to innovation.

Engaging with the community

Engagement with the broader community is vital for sustainable growth. This includes participating in local tech conferences, workshops, and networking events aimed at fostering innovation.

Investors should also leverage social media and professional networking platforms to stay informed and connected to key stakeholders in the innovation ecosystem.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete cyprus-tax-incentives-for-investing-in-innovative-enterprises online?

How do I fill out the cyprus-tax-incentives-for-investing-in-innovative-enterprises form on my smartphone?

How do I complete cyprus-tax-incentives-for-investing-in-innovative-enterprises on an iOS device?

What is cyprus-tax-incentives-for-investing-in-innovative-enterprises?

Who is required to file cyprus-tax-incentives-for-investing-in-innovative-enterprises?

How to fill out cyprus-tax-incentives-for-investing-in-innovative-enterprises?

What is the purpose of cyprus-tax-incentives-for-investing-in-innovative-enterprises?

What information must be reported on cyprus-tax-incentives-for-investing-in-innovative-enterprises?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.