Get the free SA3 (LONG FORM )

Get, Create, Make and Sign sa3 long form

How to edit sa3 long form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sa3 long form

How to fill out sa3 long form

Who needs sa3 long form?

SA3 Long Form: Your Comprehensive How-to Guide

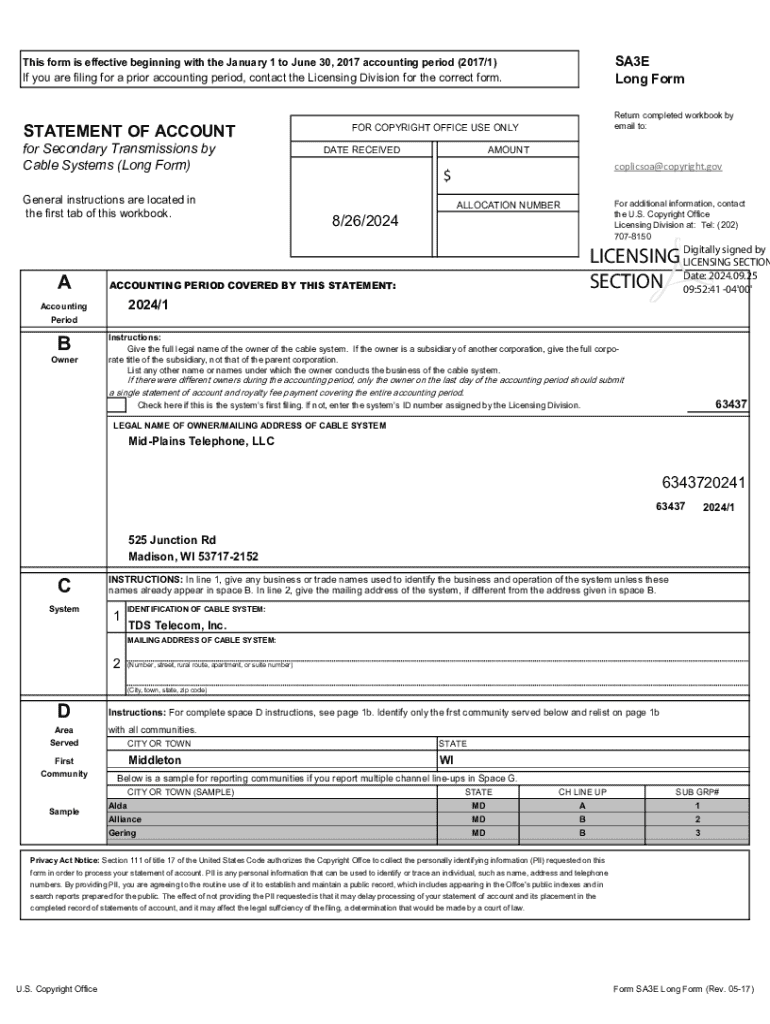

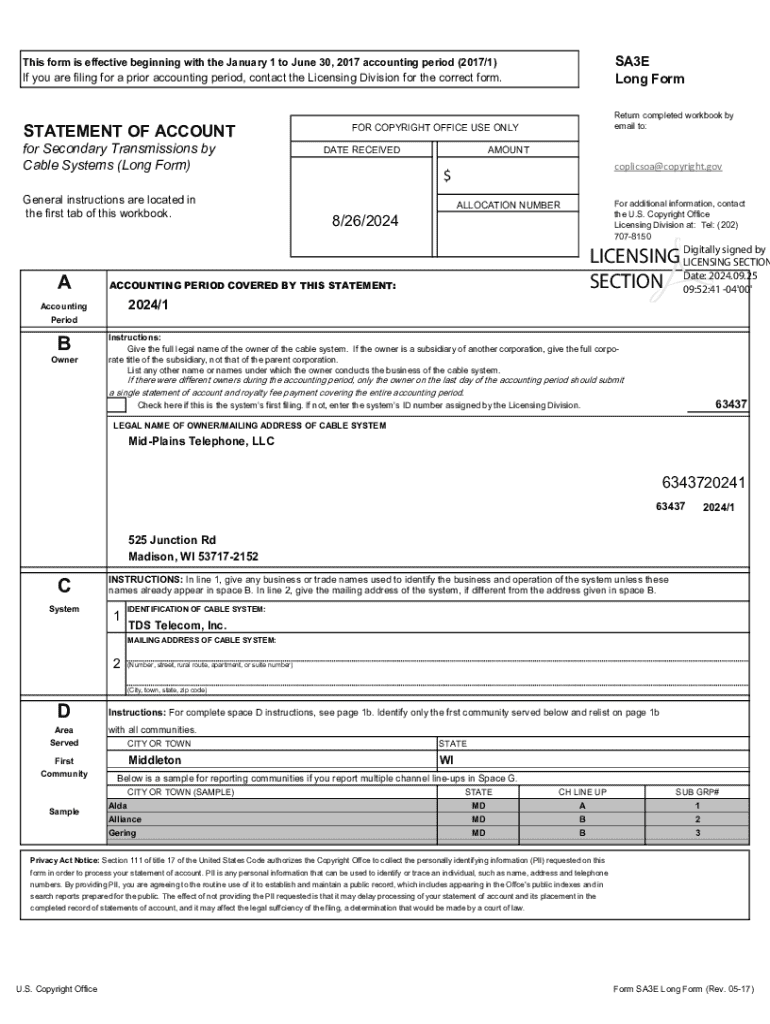

Understanding Form SA3

Form SA3 is a key document used primarily for the purpose of financial reporting, tax declarations, or compliance documentation. It serves a vital role in ensuring accurate tracking of necessary information for individuals and businesses alike, facilitating efficiency in document management. The need for such a form arises from the requirements set forth by regulatory bodies and organizations that demand standardized submissions. Without Form SA3, adherence to these guidelines could become chaotic.

The importance of Form SA3 cannot be overstated. It not only demonstrates compliance with financial standards but also provides a reliable method for organizing and retrieving essential data. Proper usage of this form can significantly reduce the hassle associated with documentation, making it an indispensable tool for both individuals and teams engaged in various sectors.

Preparing to use Form SA3

When preparing to fill out Form SA3, the first step is to gather all necessary information. This includes personal details such as name, address, and identification numbers, as well as financial data that accurately reflects your situation. Individuals should ensure they have statements from financial institutions, previous tax returns, and any other relevant documents at hand. Teams need to coordinate to pool information together, making sure that all contributors are clear on the data requirements.

Error-free documentation is crucial in this process. A helpful approach is to create a checklist of required details before beginning to fill out the form. Additionally, understanding submission guidelines is equally critical. Familiarize yourself with where you need to submit Form SA3, whether electronically or physically, and note any deadlines associated with these submissions.

Detailed instructions for filling out Form SA3

Filling out Form SA3 can initially seem daunting, but by breaking it down into manageable sections, this task becomes much simpler. Start with the personal information section; here, you must include all required fields such as name, address, and any identification numbers. It's essential to double-check this information as inaccuracies can lead to delays or possible rejections of your submission.

The next section typically requires documenting financial information. Ensure that all amounts reported are accurate and sourced from reliable financial statements. Moreover, include any relevant compliance and reference checks to confirm the authenticity of your submissions. While completing the form, anticipate common issues such as missing fields or mismatched data. Understanding potential obstacles beforehand can save a lot of time during the verification process.

Editing and modifying Form SA3

Editing your completed Form SA3 is simple, especially with tools like pdfFiller. The platform offers various editing features that allow users to revise their forms conveniently, whether you need to correct an error or update information. Once you’ve made necessary changes, save and export your edited form in your preferred format. This flexibility ensures that you can always keep your documents current.

Managing revisions is another crucial aspect of form handling. Keeping track of changes made to Form SA3 is important for audit purposes and ensuring that your latest version is accurately reflected. Utilize version control best practices such as date-stamping your documents or using unique file names for each iteration. These practices further aid in maintaining document integrity.

Signing and collaborating on Form SA3

Once Form SA3 is filled out, signing it securely is essential for authentication. Thanks to digital signature capabilities, platforms like pdfFiller allow you to eSign your documents without needing to print them. The steps to use digital signatures are straightforward, making the signing process efficient and environmentally friendly. Understanding the legality of eSignatures is also vital, as many jurisdictions recognize them as equivalent to handwritten signatures, provided they meet certain criteria.

Collaboration is another critical aspect of working with Form SA3. Sharing the document with team members for review can lead to improvements and ensure accuracy before final submission. Utilize integrated feedback tools on platforms like pdfFiller to facilitate collaborative editing and input from multiple stakeholders, resulting in a well-prepared final document.

Submitting Form SA3

After completing Form SA3, the next step is submission. Depending on the guidelines applicable to form SA3, you may have options for digital submission or need to submit physical copies. When submitting digitally, ensure that all files are correctly uploaded and that you receive a confirmation of receipt. If submitting physically, ensure that you follow all appropriate packaging and mailing guidelines to avoid delays.

Post-submission considerations should not be overlooked. Many submission systems allow you to track your submission status. Familiarize yourself with these tracking services, as they can provide crucial updates and peace of mind. Lastly, in the event of any issues arising, having a protocol in place for handling them can save you a lot of frustration and ensure a swift resolution.

Managing and storing your documents

Effective document management is crucial once your Form SA3 is submitted. Using cloud storage solutions can greatly enhance accessibility to important documents. Tools like pdfFiller provide best practices for organizing these files, such as categorizing by date or purpose, and employing robust search functionalities to locate documents effortlessly when needed.

Security must also be a high priority when managing documents. The platform provides various security measures to protect sensitive information, including encryption and access controls. Implementing these features ensures that your documents are safe from unauthorized access and breaches, thus safeguarding your personal or business information.

Troubleshooting and support for Form SA3

It's common to encounter issues when filling out Form SA3, from submission problems to editing errors. Knowing how to troubleshoot these issues can alleviate stress. Common problems include incomplete forms or discrepancies in the provided information. To resolve these, always double-check that all required fields are filled out correctly and that all entered information matches your documents.

PdfFiller offers various support resources that can aid in navigating these challenges. Accessing help guides, video tutorials, or forums can provide solutions to common queries. For more personalized assistance, reaching out directly to the support team ensures that you receive tailored help.

Related forms and resources

Form SA3 is just one among various forms often encountered in the realm of financial and regulatory compliance. Understanding how it relates to other forms, such as Form SA1 or SA2, can provide context on its specific requirements and uses. It can be beneficial to compare these forms to identify similarities and variances, helping users make informed decisions on their documentation needs.

In addition, there are numerous other tools and templates available on pdfFiller that can assist in document creation and management. Utilizing such resources enhances your efficiency and accuracy, providing a more streamlined workflow.

Key dates and regulatory information

Understanding the timelines associated with Form SA3 is critical for maintaining compliance. Keep track of important submission deadlines to avoid penalties. Depending on the local jurisdiction, these deadlines may vary. It’s advisable to create a calendar marking these dates to remain vigilant and ahead of potential issues.

In addition, staying informed about regulatory updates and changes to Form SA3 is crucial. Understanding the historical context and evolution of this form can provide insight into why certain requirements exist and how they may evolve in the future. Regularly checking for updates from regulatory authorities ensures that you remain compliant and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sa3 long form directly from Gmail?

How do I edit sa3 long form online?

How can I fill out sa3 long form on an iOS device?

What is sa3 long form?

Who is required to file sa3 long form?

How to fill out sa3 long form?

What is the purpose of sa3 long form?

What information must be reported on sa3 long form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.