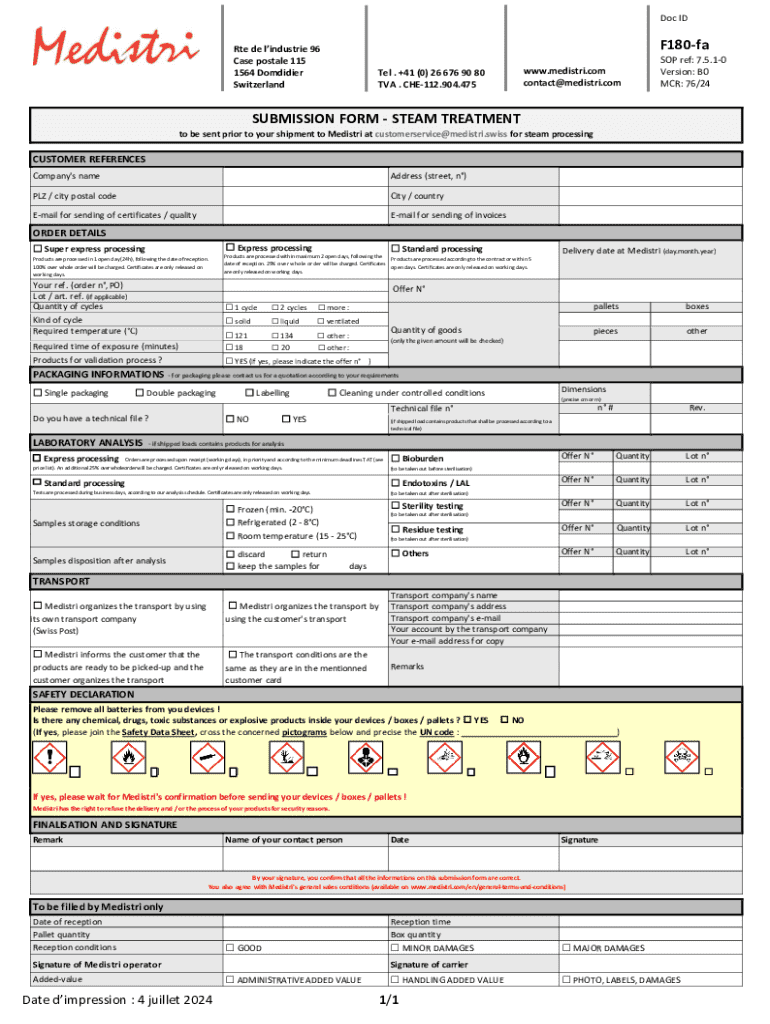

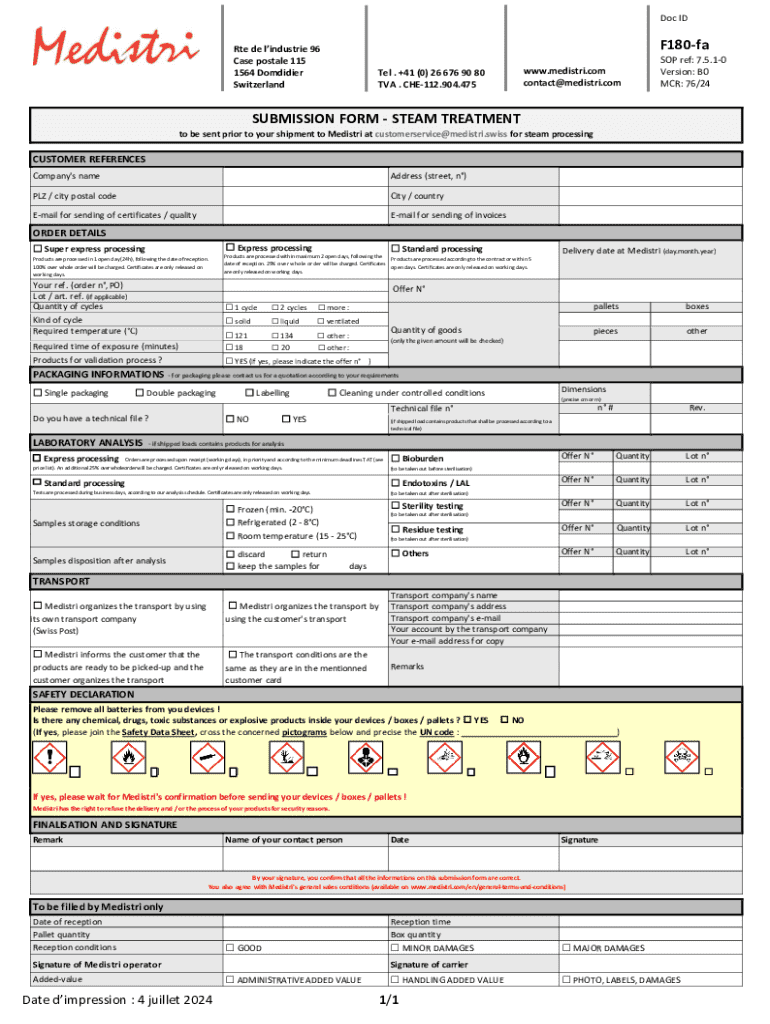

Get the free F180-fa

Get, Create, Make and Sign f180-fa

How to edit f180-fa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out f180-fa

How to fill out f180-fa

Who needs f180-fa?

f180-fa Form: A Comprehensive How-to Guide

Understanding the f180-fa Form

The f180-fa form is a crucial document used in various sectors, primarily for tax and legal purposes. Its primary aim is to facilitate accurate reporting and compliance with regulatory requirements. Understanding its relevance is key for individuals and businesses alike, as inaccuracies can lead to significant ramifications, including penalties and delays.

Beyond its immediate purpose, the f180-fa form serves as a standardization tool, ensuring that necessary information is reported consistently. This consistency is particularly important for audits and legal scrutiny, where every detail matters. Thus, gaining familiarity with this form is indispensable for effective compliance.

Preparing to fill out the f180-fa Form

The key to filling out the f180-fa form successfully lies in preparation. Gather all necessary documents ahead of time to streamline the process. Typical documents may include prior tax returns, financial statements, and legal identifiers – all of which are essential in providing the accurate information required on the form.

Organizing your paperwork is equally important. Use labeled folders or a digital document management system to ensure you can quickly access any pending details. This method not only saves time but also reduces stress during the submission process.

Online vs. offline completion

Using pdfFiller's web platform offers numerous advantages for completing the f180-fa form. It simplifies the process with interactive features, allowing users to fill, edit, and eSign documents seamlessly. Furthermore, the ability to access the platform from any device provides significant flexibility and accessibility.

On the other hand, offline methods may seem traditional and familiar, but they often result in logistical challenges such as printer setup, physical document handling, and increased margins for error. Given the ease and efficiency offered online, opting to use pdfFiller's system is highly recommended.

Step-by-step instructions for completing the f180-fa Form

Navigating the pdfFiller interface for the f180-fa form is designed to be user-friendly. After logging in, you’ll encounter a simple dashboard that presents your documents intuitively. Here you can easily locate the f180-fa form template to begin.

Key features of pdfFiller include auto-saving, which ensures that no changes are lost, and popup help icons that guide you through each section, making it easier to understand what information is required.

Filling out each section of the form

To ensure accuracy while completing the f180-fa form, break down the process into manageable sections. Start with personal information, where you'll input essential data such as your name, address, and identification numbers. These details are vital and must be verified as they can cause issues if entered incorrectly.

Next, focus on financial details. Gather your data carefully, as this section typically forms the crux of the submission and is heavily scrutinized by tax authorities. Be meticulous in detailing income sources and expenditures to avoid any discrepancies.

Lastly, submission information includes audit trails and confirmation of whether your form will be submitted electronically or via mail. Missing this crucial information can delay processing times significantly.

Common mistakes to avoid

While filling out the f180-fa form, it's easy to overlook certain fields, particularly those involving ancillary information like previous addresses or secondary income sources. Neglecting these fields can lead to incorrect submissions, resulting in delays or additional queries from tax authorities.

Another common mistake involves miscalculations. Always double-check numerical entries to ensure they correspond with your gathered financial documents. Simple errors in calculation can have significant implications during audits.

Editing and customizing the f180-fa Form

Once you have completed the f180-fa form, it's crucial to review it for any required modifications. pdfFiller offers easy-to-use tools for editing your form post-completion, including adding text boxes, highlighting, and sticky notes, allowing you to customize it efficiently.

Utilizing the drawing feature can be particularly helpful for annotating or suggesting changes, especially when working collaboratively. Ensure all changes are captured accurately to reflect your most current input.

Collaborating with team members

pdfFiller supports seamless collaboration by allowing you to share the f180-fa form with colleagues for joint review and approvals. Utilize the sharing feature to send documents via link or email, engaging team members in real-time discussions around the form's contents.

You can also use comments to highlight specific sections that need attention or feedback, facilitating a more productive review process. This inclusion enhances teamwork and contributes to a higher-quality final submission.

Signing the f180-fa Form

Securing an e-signature on the f180-fa form is straightforward with pdfFiller. Start by clicking the ‘Sign’ option which leads you through an uncomplicated process to create and embed your digital signature directly into the document.

The importance of secure e-signatures cannot be overstated—electronic signatures are legally binding and streamline the approval process significantly, making it easier for all parties involved. Ensure you keep records of all signed documents for future reference.

Collecting signatures from others

If your f180-fa form requires additional signatures, pdfFiller streamlines this process as well. Utilize the ‘Request Signatures’ feature to send a signature request to stakeholders. Include deadlines to emphasize urgency and utilize reminder features within pdfFiller to ensure the form is signed promptly.

This systematic approach prevents delays in the submission process, ensures that everyone is on board, and mitigates the chances of losing track of document status.

Managing and storing the f180-fa Form

After successfully completing and signing the f180-fa form, saving and managing it appropriately is crucial. pdfFiller allows you to save the finalized version securely to your account, ensuring you can easily locate it in the future.

When it comes to download options, users can choose various file formats from pdf to Word. This flexibility in format can be beneficial depending on how you plan to use the final document, whether for printing or sharing electronically.

Cloud storage and accessibility

Utilizing pdfFiller’s cloud storage offers significant advantages, including easy accessibility from any device with internet connectivity. This feature is particularly useful for individuals and teams on the go. Your important documents remain at your fingertips, eliminating the need for physical storage solutions that can often be cumbersome.

Moreover, you will always have the most recent version of your documents accessible, ensuring that you’re using up-to-date information for any follow-up or audit requirements.

Troubleshooting common issues

Despite the intuitive nature of pdfFiller, users may encounter occasional technical issues. Error messages can arise for a variety of reasons, from connectivity problems to incorrect formatting. Identifying and resolving these issues promptly ensures your workflow remains uninterrupted.

For anyone facing issues, pdfFiller provides a robust support system. Contacting their customer support team is straightforward and can often resolve issues quickly, restoring functionality when unexpected problems occur.

FAQ section for common concerns

Many users have questions about common concerns regarding the f180-fa form and pdfFiller. Topics include format compatibility, submission deadlines, and regulations associated with the form. Having a dedicated FAQ section enhances the user experience by providing quick and reliable answers.

These FAQs serve as a great starting point for individuals unfamiliar with the f180-fa form, making it easier for them to navigate their submission process confidently.

Best practices for future form management

To maximize efficiency in managing forms like the f180-fa in the future, organizing your forms within pdfFiller is essential. Use folders to categorize documents based on their purpose, compliance needs, or the timeline of submission. This organization leads to enhanced productivity and further reduces the chances of misplacement.

Staying updated with the regulations pertaining to the f180-fa form is equally important. Regularly check for any updates or changes to compliance requirements since these can evolve over time and impact how forms must be completed and submitted. Utilize reliable resources such as government sites and industry-specific updates to stay informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out f180-fa using my mobile device?

How can I fill out f180-fa on an iOS device?

How do I edit f180-fa on an Android device?

What is f180-fa?

Who is required to file f180-fa?

How to fill out f180-fa?

What is the purpose of f180-fa?

What information must be reported on f180-fa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.