Get the free 8-15-24 New State Operating Funding for CCs

Get, Create, Make and Sign 8-15-24 new state operating

How to edit 8-15-24 new state operating online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 8-15-24 new state operating

How to fill out 8-15-24 new state operating

Who needs 8-15-24 new state operating?

Comprehensive Guide to the 8-15-24 New State Operating Form

Overview of the 8-15-24 new state operating form

The 8-15-24 new state operating form serves as a critical document for various entities operating within the jurisdiction. This form aims to streamline the regulatory compliance processes for businesses and organizations, ensuring that they meet the necessary legal obligations while effortlessly keeping records clear and organized.

This comprehensive format introduces several key features that distinguish it from older versions. The updated design not only enhances user-friendliness but also incorporates new data fields that cater specifically to recent legislative changes. Users need to prioritize compliance and adhere to submission deadlines to avoid unwanted penalties.

What’s new for 2024

For 2024, the 8-15-24 form will incorporate multiple updates reflecting the changing landscape of state regulations and operational standards. Newly introduced are sections for collecting comprehensive financial disclosures, which aim to provide a holistic view of an entity's economic activities.

Anticipated impacts include improved accuracy in reported data and enhanced transparency for state authorities. Users must familiarize themselves with the modifications to ensure that their submissions are complete and compliant.

Eligibility and who must use this form

The 8-15-24 form applies to a broad array of organizations, including corporations, partnerships, and sole proprietorships conducting business activities in the state. Exact eligibility criteria stipulate that entities with revenue exceeding defined thresholds must complete this form. Small businesses may find exemptions, particularly if their income falls below set figures.

Finding and accessing the 8-15-24 new state operating form

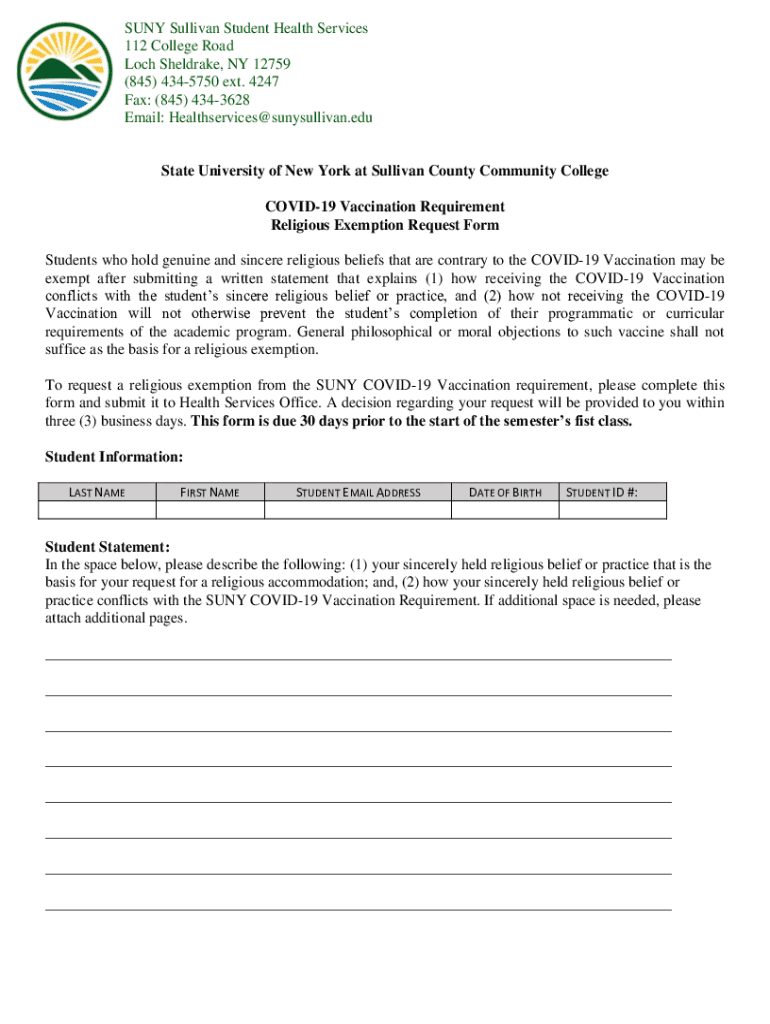

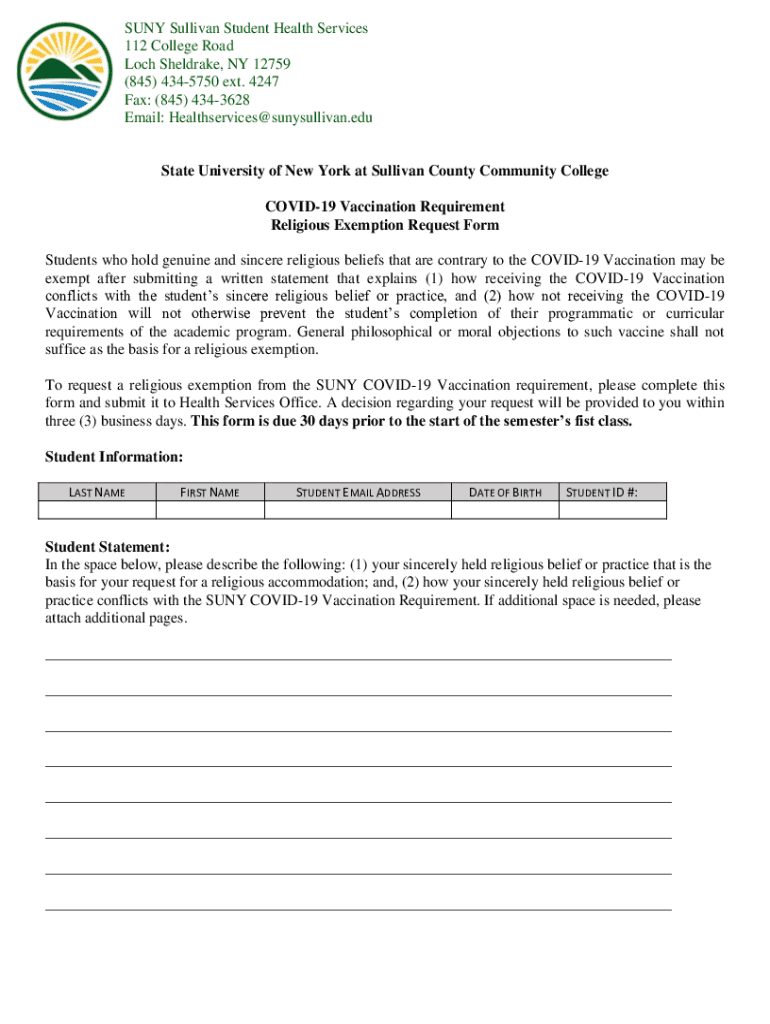

Accessing the 8-15-24 new state operating form is straightforward. Users can locate it on the official state website or through platforms such as pdfFiller, which provides an integrated solution for document management. To navigate through the process, follow these steps:

Step-by-step instructions for filling out the form

Filling out the 8-15-24 form requires attention to detail to ensure compliance. Here’s how you can navigate each section of the form efficiently:

Step 1: Complete the entity information section

Begin by entering your entity's name, address, and type of organization. Ensure that all required fields are filled out accurately. Be cautious about misrecording entity names, as this can lead to significant delays.

Step 2: Provide financial details

In this section, you'll report revenues and expenses for the fiscal year. Utilize your accounting software or financial statements to ensure that figures are precise. Accurate calculations protect you from potential audits or inquiries.

Step 3: Insert ownership information

Ownership details must reflect the current structure of your organization. Indicate what each owner brings to the table, including their percentage of ownership. Missing or incorrect information can delay processing.

Step 4: Review and verify information for accuracy

Before finalizing the submission, double-check your entries. Cross-referencing data against supporting documentation minimizes errors. Consider creating a checklist to ensure no detail is overlooked.

How to sign and submit the form

Signing and submitting the 8-15-24 form can be done electronically via pdfFiller. Follow these steps to complete your submission.

Common mistakes and how to avoid them

Avoiding simple errors on the 8-15-24 form can save time and potential rejections. Focus on the following common pitfalls:

If your form is rejected, promptly address the highlighted issues and resubmit as soon as possible. Utilize state resources for additional help if needed.

Managing your 8-15-24 form after submission

Once you've submitted the 8-15-24 form, managing your compliance becomes crucial. Tracking its status can be done easily through pdfFiller, which allows users to monitor submission progress.

If state authorities request further information, respond promptly with the necessary documents. Maintain organized records to ensure smooth audits or future submissions.

Resources for additional help

For any uncertainties regarding the 8-15-24 form, utilize state-specific FAQs that address common queries. Moreover, pdfFiller offers tutorials and webinars for further insights into completing the form effectively.

Interactive tools & features on pdfFiller for enhanced document management

pdfFiller stands out with its suite of interactive tools designed to enhance document management for the 8-15-24 form. Users can easily edit PDFs, collaborate with teams, and eSign documents, all from a single, user-friendly platform.

Case studies or user testimonials

Real-world experiences often illuminate the advantages of successfully utilizing the 8-15-24 form. Users report that leveraging pdfFiller's capabilities simplifies submission processes and minimizes errors.

Success stories highlight how users efficiently fill out and submit via pdfFiller, showcasing its extensive support features that cater to both individuals and teams. Testimonials praise the platform’s ease of use and effectiveness in staying compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 8-15-24 new state operating directly from Gmail?

How do I fill out 8-15-24 new state operating using my mobile device?

Can I edit 8-15-24 new state operating on an iOS device?

What is 8-15-24 new state operating?

Who is required to file 8-15-24 new state operating?

How to fill out 8-15-24 new state operating?

What is the purpose of 8-15-24 new state operating?

What information must be reported on 8-15-24 new state operating?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.