Get the free professional-indemnity-proposal-form-accountants.pdf

Get, Create, Make and Sign professional-indemnity-proposal-form-accountantspdf

Editing professional-indemnity-proposal-form-accountantspdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out professional-indemnity-proposal-form-accountantspdf

How to fill out professional-indemnity-proposal-form-accountantspdf

Who needs professional-indemnity-proposal-form-accountantspdf?

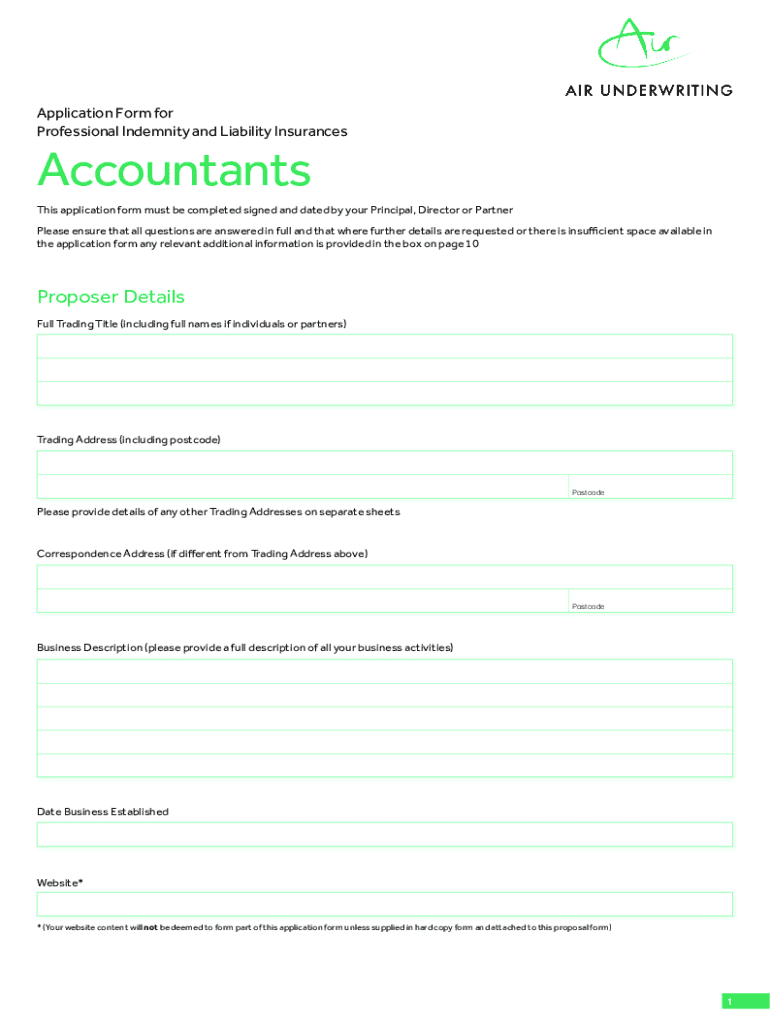

Comprehensive Guide to the Professional Indemnity Proposal Form for Accountants

Understanding professional indemnity insurance

Professional indemnity insurance is a critical element for accountants. It provides financial protection against claims made by clients for losses due to negligence, errors, or omissions in your professional services. For accountants, who often deal with clients’ financial data and provide advice that can significantly affect their clients' businesses, having this coverage is not just wise—it's essential.

The significance of this insurance cannot be understated. The stakes are high—client trust is paramount, and a single mistake can lead to significant financial repercussions. This insurance safeguards accuracy in your work and helps maintain client confidence.

The proposal form plays a crucial role in securing coverage by providing insurers with essential information about your business and the risks involved.

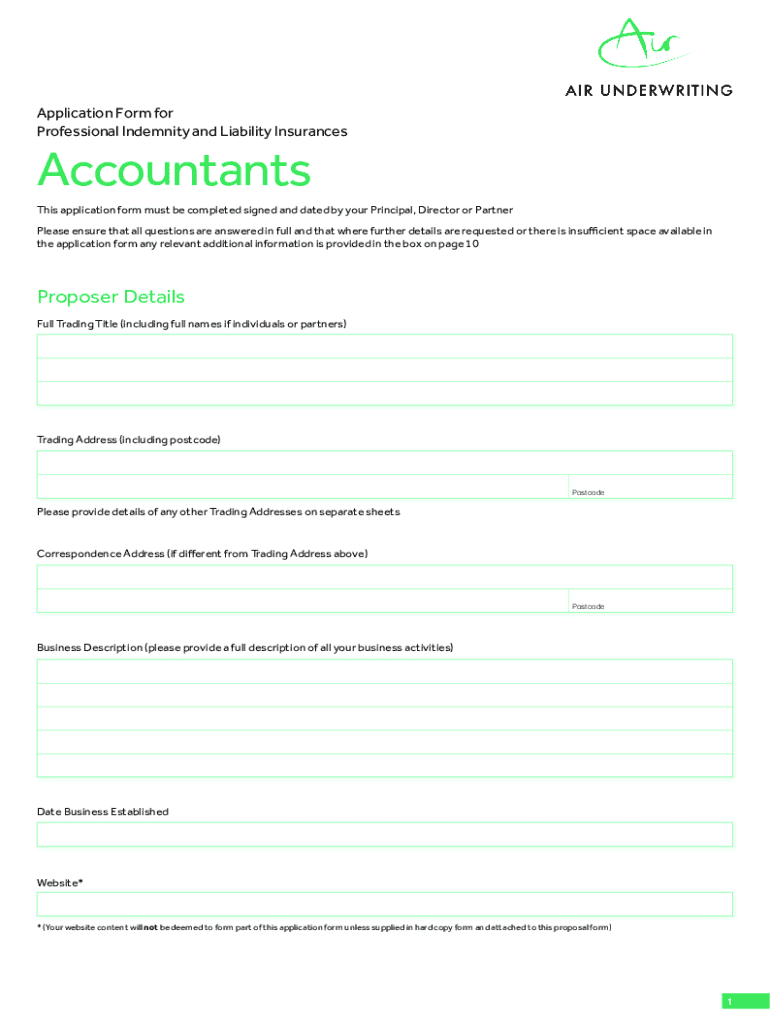

Overview of the professional indemnity proposal form

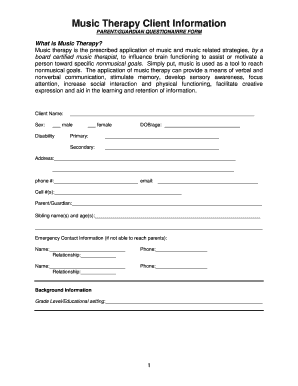

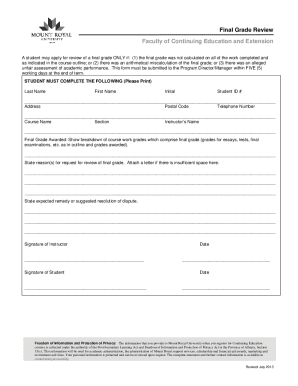

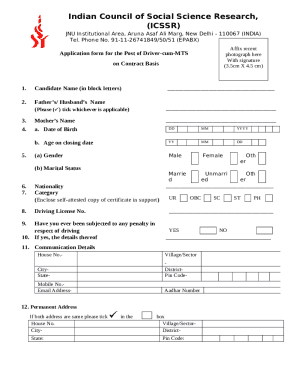

The professional indemnity proposal form is a formal document where accountants detail their services, experience, and risk exposures to insurers. Its purpose is not only for securing insurance but also for gaining insights into potential risks that can impact your practice. Completing this form accurately can simplify the underwriting process and lead to fitting coverage.

Key sections of the proposal form typically include personal and business information, details of previous insurance, a claims history, and a list of specific services offered. Each component provides a clearer picture of your practice's profile.

Step-by-step guide to filling out the proposal form

Before diving into the proposal form, it’s important to gather necessary materials. This step will mitigate delays caused by missing information. Start with your financial records—including statements and balances—as well as documentation related to previous insurance policies and any claims history. Reviewing this data ensures a comprehensive submission.

The first section usually asks for personal and business information. It's crucial to fill out this section accurately, including your business structure, years of operation, and relevant certifications. Common pitfalls include providing outdated addresses or incorrect contact numbers. Clarity in this section sets a positive tone.

Next, elaborating on the services you provide is vital. Describe your accounting services succinctly while also assessing the inherent risks associated with your offerings. Avoid jargon and focus on clarity to ensure the insurer fully understands what services you provide.

The claims history section is particularly important. Full disclosure of past claims is required, and presenting this information effectively can help in illustrating your reliability to insurers.

Editing and customizing the proposal form

Once you have a draft of your proposal form, utilizing pdfFiller tools can simplify the editing process. This cloud-based platform offers various features that allow for seamless additions, removals, or modifications of information in your PDF documents.

For example, you can insert notes for additional clarity without altering the original text, which can be beneficial for both you and the insurer. Common edits accountants may require include adding supplementary explanations or adjusting service descriptions based on feedback from prior submissions.

eSigning the proposal form

eSigning the proposal form not only streamlines the submission process but also enhances the overall efficiency for accountants. With pdfFiller, you can eSign your documents easily from any device, which is critical in today's fast-paced business environment.

The step-by-step eSigning process involves selecting the eSign option within the platform, positioning your signature, and confirming the signing. Security measures are integrated into the system to ensure that your digital signature remains confidential and protected, essential for maintaining the integrity of your submissions.

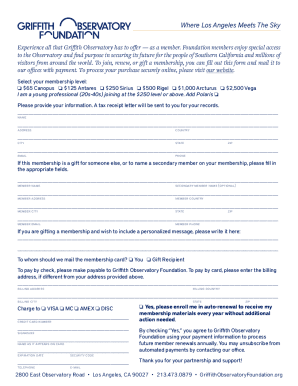

Submitting the proposal form

Once your professional indemnity proposal form is finalized and signed, the next step is submitting it to your insurer. Best practices for this process involve following specific instructions provided by the insurance company regarding submission formats and channels. This may include electronic submission via email or uploading through an insurer's online portal.

Additionally, it's prudent to maintain a follow-up checklist to ensure your submission was received successfully. Confirming acceptance can save you from potential coverage gaps or lapses that may arise from miscommunication.

Managing your professional indemnity insurance

Post-submission, managing your professional indemnity insurance is equally critical. Start by keeping thorough records of your proposal form and any documentation associated with your policy. This documentation will serve as your reference for understanding your coverage and responsibilities.

As your business evolves, it's essential to update your insurance policy accordingly. Regular reviews can help adapt your coverage to reflect new risks associated with expanding services or an increasing client base. Ignoring these updates may lead to insufficient coverage, at a time when you need it most.

Interactive tools for continued support with pdfFiller

pdfFiller not only facilitates the proposal form itself but also provides various interactive tools to enhance document management. Features like detailed document management capabilities allow users to store, search, and retrieve documents with ease.

Collaboration tools also enable team members to work together on documents, improving efficiency in collective proposals or reviews of client files. The platform also hosts a FAQ section that covers common issues account preparers may encounter, ensuring support is readily available.

Building a risk management strategy

Incorporating professional indemnity insurance into a broader risk management strategy is essential for accountants. Develop strategies that identify potential sources of risk within your practice—this includes evaluating client engagements, keeping abreast of regulatory changes, and maintaining open lines of communication with clients.

Tips for developing a robust strategy include establishing clear protocols for documentation, keeping every client engagement documented, and regular training for staff on compliance matters. Integrating professional indemnity insurance should act as a financial safety net—the essential layer protecting your practice from unforeseen challenges.

Feedback and getting help

Navigating the professional indemnity proposal form can be daunting, and accountants should not hesitate to seek assistance. When faced with complex sections or uncertainties, reaching out for expert guidance can clarify the process.

pdfFiller offers contact options including customer support via chat or email, providing tailored assistance that aligns with your specific needs. Utilizing available resources will help you better understand each aspect of the proposal form, ensuring a more seamless experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify professional-indemnity-proposal-form-accountantspdf without leaving Google Drive?

How can I get professional-indemnity-proposal-form-accountantspdf?

How do I edit professional-indemnity-proposal-form-accountantspdf on an Android device?

What is professional-indemnity-proposal-form-accountantspdf?

Who is required to file professional-indemnity-proposal-form-accountantspdf?

How to fill out professional-indemnity-proposal-form-accountantspdf?

What is the purpose of professional-indemnity-proposal-form-accountantspdf?

What information must be reported on professional-indemnity-proposal-form-accountantspdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.