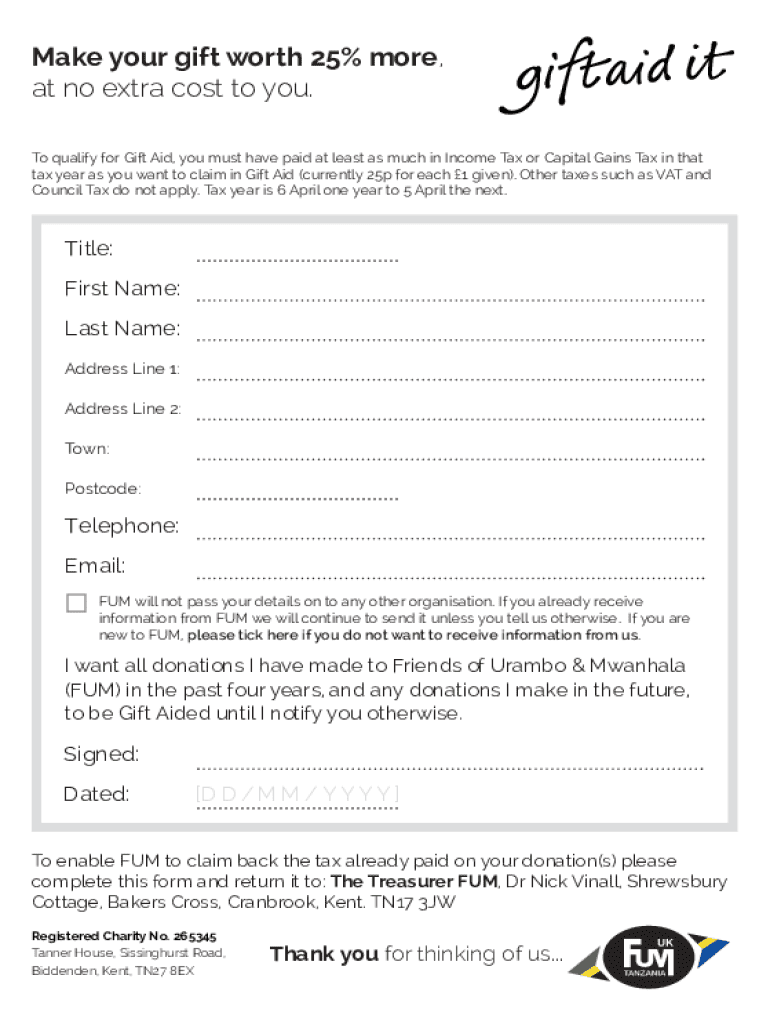

Get the free Make your gift worth 25% more,

Get, Create, Make and Sign make your gift worth

How to edit make your gift worth online

Uncompromising security for your PDF editing and eSignature needs

How to fill out make your gift worth

How to fill out make your gift worth

Who needs make your gift worth?

Make Your Gift Worth Form: A Comprehensive How-To Guide

Understanding the concept of gift forms

A gift form serves as a fundamental tool in both personal and charitable giving, allowing donors to articulate the intent, value, and specifics of their gifts. Essentially, it provides clarity to both the giver and the recipient, ensuring that the intentions behind gifts are accurately documented. Completeness and accuracy in a gift form are crucial; missing information can lead to misunderstandings, tax complications, or even invalidation of the gift, thus negating the generous spirit intended.

Different types of gift forms cater to various donation scenarios. Monetary gifts often come with straightforward cash forms while in-kind donations, such as furniture or electronics, require detailed descriptions to reflect their fair market value. Bequests, or gifts made through wills, necessitate paperwork that aligns with estate planning laws to ensure effectiveness. Understanding these nuances enables donors to choose the correct format, aligning their gifts with their personal or philanthropic objectives.

Getting started with your gift worth form

Before diving into the creation of your gift worth form, determining the value of your gift is essential. This often involves appraising items for in-kind donations—one might employ online valuation tools or consult professionals for accurate market assessments. Different factors come into play when valuing gifts: condition, age, and market demand can all influence worth. Moreover, the legal implications of valuing a gift correctly cannot be overstated; improper valuation might lead to tax penalties or complications during estate settlements.

Gathering necessary information forms the backbone of a complete gift worth form. You should be prepared with a list of required documents, including appraisals for high-value items or receipts for monetary gifts. Ensure you capture the following: donor details, recipient organization, a detailed description of the gift, and an estimated value. Having this documentation at hand before starting the form streamlines the process, minimizing the potential for errors or omissions later.

Navigating the gift worth form

Filling out a gift worth form can seem daunting, but a step-by-step approach simplifies the task. Start by entering the donor’s information, including name, address, and contact details. Next, specify the recipient organization and provide comprehensive details about the gift, including any distinguishing features that clarify its worth. If applicable, add information on how you determined the gift's value, which may include professional appraisals or market comparisons.

Challenges typically arise, such as handling partial gifts or joint donations. In those cases, make sure to clearly state the specifics of each donor's contributions. An interactive PDF form can enhance your experience by allowing for easy edits, thus accommodating changes as needed. Platforms like pdfFiller also support electronic signatures—essential for verifying agreements—along with collaborative features that enable others to review the form before submission.

Editing and managing your gift worth form

Once your gift declaration is submitted, life events may prompt updates to its contents. Understanding the process for editing submitted forms is critical. Many platforms, including pdfFiller, allow you to access previously submitted forms securely to modify details like recipient information or the value of the gift. It is advisable to always keep a record of your amendments, reflecting your ongoing relationship with the recipient organization.

Saving and sharing your completed forms can alleviate future complications. Utilize features that allow you to save forms directly in a cloud-based location for easy reference. When it’s time to share, ensure you use secure methods, especially when dealing with sensitive information. pdfFiller provides various sharing options, making it seamless to forward your form to recipients or organizations while maintaining data integrity.

Legal and tax considerations

Understanding the tax implications of gift forms is paramount for compliant charitable giving. If your gift exceeds a certain threshold, potential gift taxes may apply. Being aware of the deduction eligibility and limits ensures that you’re maximizing your gift’s impact while adhering to federal regulations. For instance, monetary donations to qualifying charities can often lead to a tax deduction, making record-keeping essential for tax filings.

Should you encounter issues during the gifting process, knowing how to troubleshoot effectively is crucial. Common problems might include discrepancies in valuation or submission issues related to the chosen platform. It is recommended to maintain open communication with the recipient organization, as they can guide you in resolving these matters swiftly. Additionally, tax professionals can assist in navigating more complex tax questions.

Real-life applications of making your gift worthwhile

Consider the success stories from individuals and organizations that have effectively utilized gift forms, illustrating the profound impacts they can have. For example, a local charity may have successfully hosted a fundraiser powered primarily by accurately documented in-kind donations that encouraged community participation. These stories not only highlight the practical benefits of well-structured gift forms but also inspire others to engage in philanthropy.

Testimonials from users of pdfFiller reinforce the platform’s value. Many indicate that the ease of editing and sharing forms has streamlined their donation processes, reducing the stress typically associated with gifting. The seamless document management provided by pdfFiller empowers individuals and teams to dedicate their energies toward causes they believe in, instead of getting bogged down by the logistics of form management.

Stay informed and updated

Staying informed about updates and features from pdfFiller can significantly enhance your experience in handling gift forms. Regularly subscribing to updates allows you to tap into recent advancements in document management technology, ensuring that you always have the latest tools at your disposal. By utilizing these resources, you can adapt efficiently to any changes in regulations or best practices in philanthropic giving.

Ultimately, your ability to navigate and manage your gift worth form not only reflects on the efficiency of your giving but also empowers you to cultivate meaningful relationships with charitable organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my make your gift worth directly from Gmail?

How can I modify make your gift worth without leaving Google Drive?

Can I create an electronic signature for the make your gift worth in Chrome?

What is make your gift worth?

Who is required to file make your gift worth?

How to fill out make your gift worth?

What is the purpose of make your gift worth?

What information must be reported on make your gift worth?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.