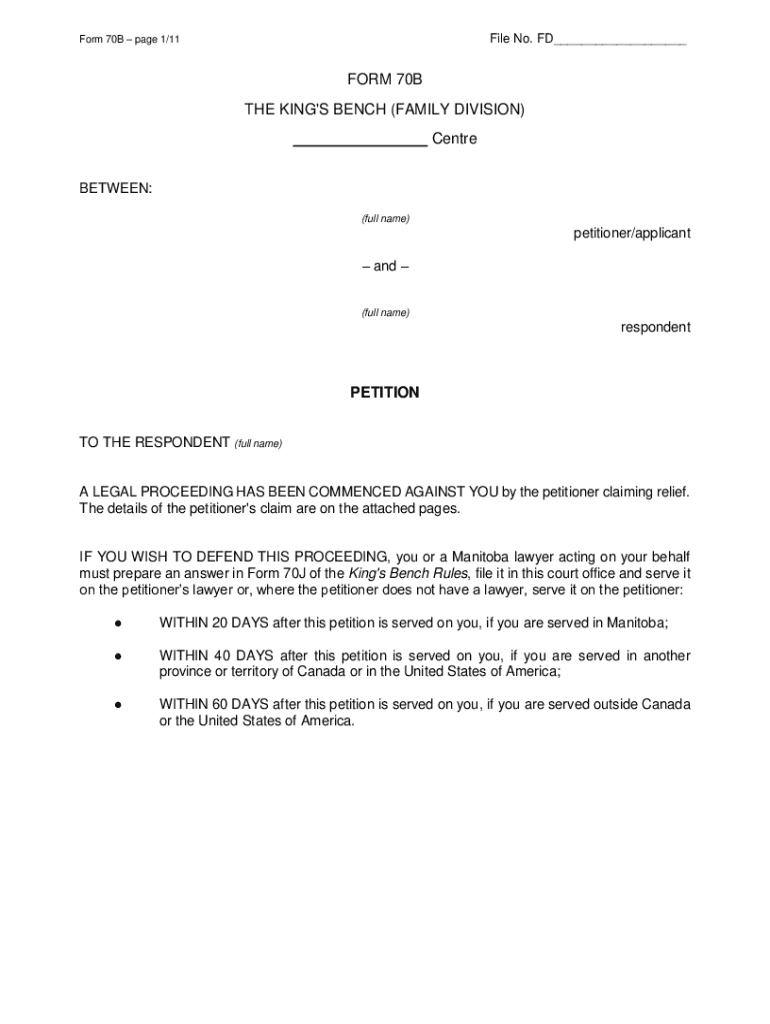

Get the free Form 70B page 1/11

Get, Create, Make and Sign form 70b page 111

How to edit form 70b page 111 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 70b page 111

How to fill out form 70b page 111

Who needs form 70b page 111?

Your Comprehensive Guide to Filling Out Form 70B Page 111

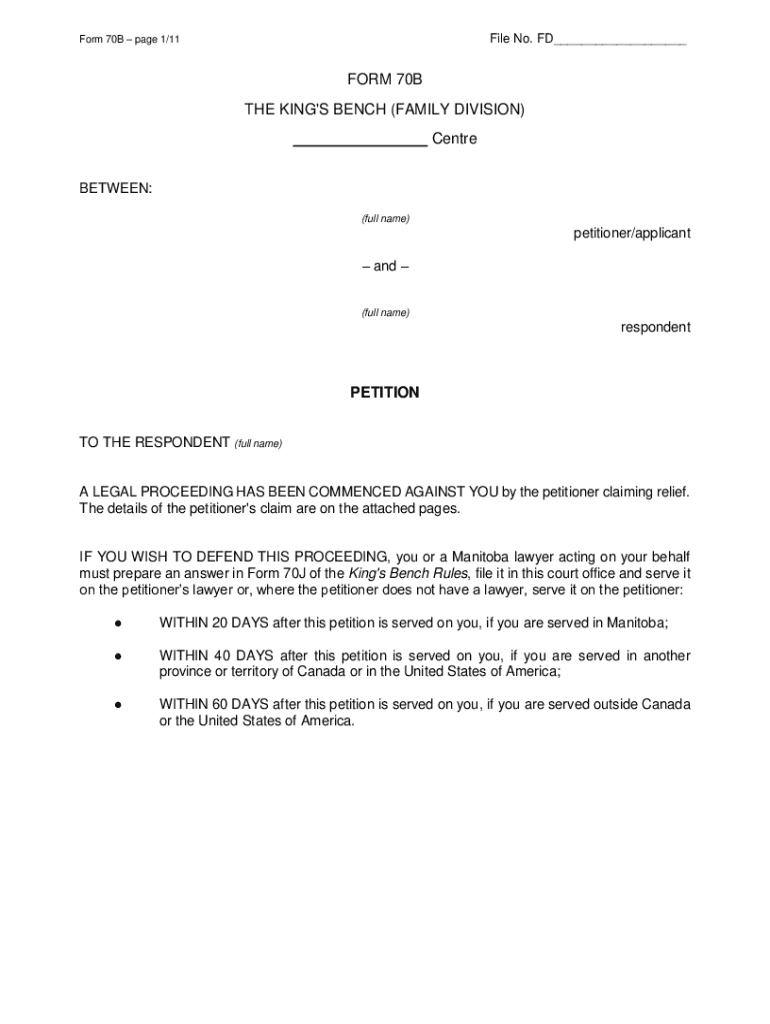

Understanding Form 70B

Form 70B is a critical document in the tax compliance landscape, primarily focused on providing necessary income details to ensure correct tax assessments. It serves various purposes, including reporting taxable income, deductions, and credits, and is essential for anyone engaged in income-generating activities. The accurate completion of Form 70B is crucial for individuals and businesses alike, as it directly impacts the amount of tax owed or refunded.

The importance of Form 70B cannot be overstated, especially given the continuous updates and changes in tax regulations. Being well-acquainted with this form helps ensure that taxpayers remain compliant, avoid penalties, and benefit from lawful tax deductions. Furthermore, understanding its key features is paramount for effective completion.

Navigating the income tax portal

Accessing Form 70B through the income tax portal is designed to be a user-friendly experience. Start by visiting the official income tax website relevant to your jurisdiction. Once you're on the portal, you'll typically find a login or registration option, depending on whether you already have an account.

After logging in, navigating to Form 70B can usually be achieved by searching the document list or using the designated search bar. Many taxpayers appreciate the interactive tools embedded within the portal that streamline the access process, guiding them towards the forms they require.

Detailed guide to filling out Form 70B

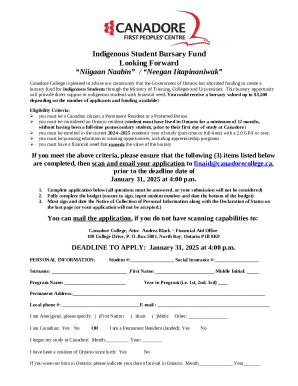

Completing Form 70B involves various sections that require specific information. It begins with personal details, such as your name, address, and Social Security number. Ensure that this information matches your official documents to prevent discrepancies.

In addition to personal data, the form requires accurate financial figures including total income, applicable deductions, and additional credits. Collecting this information in advance simplifies the filling process. It's recommended to have all relevant financial documents easily accessible.

Section 1: Identifying the key information required

The first section is primarily focused on personal information. Here's a quick checklist of what you need to include:

Section 2: Completing specific sections of the form

After entering your personal information, you will move to completing the financial data sections A, B, and C. Make sure to break down your income sources accurately, and list deductions succinctly. Here are some tips for avoiding common mistakes:

Section 3: Ensuring accuracy and completeness

Once filled out, it’s essential to double-check your entries for accuracy. Automatic calculations can lead to errors, so having a best practices strategy is vital. Consider using an interactive checklist to verify every entry and confirm that you've completed all required fields before submission.

Editing and modifying Form 70B

In the event you need to edit your Form 70B, utilizing tools like pdfFiller offers a streamlined solution. This platform allows for easy editing of PDFs, making corrections a breeze. When corrections are necessary, you can use the editing features to adjust figures or add supplementary information.

Moreover, pdfFiller facilitates the addition of signatures and initials, which can be done electronically on the platform. If collaborating with a team on Form 70B, the collaborative features enable multiple users to make changes and comment in real time, enhancing the document management experience.

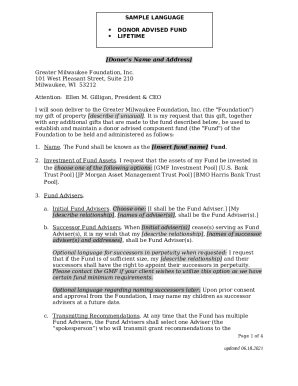

Signing and submitting Form 70B

Once Form 70B is completed and edited, the next step is signing it. The platform offers various eSigning options that make your signature official without the need for printing. After you've applied your signature, you must choose between digital submission or mailing a physical copy to the appropriate tax authority.

Keep in mind that when submitting digitally, you will receive an electronic confirmation that your form has been successfully submitted, providing peace of mind. Prepare to keep this confirmation for your records.

Frequently asked questions

When dealing with Form 70B and its completion, many users have common inquiries that often arise. Addressing these questions effectively can help alleviate confusion and streamline the filling process.

Some of the most frequently asked questions include:

Finding solutions to these inquiries can greatly assist those preparing their form and contribute to a smoother filing experience.

Related forms and documents

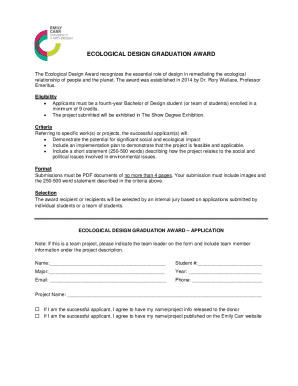

Filling out Form 70B may require familiarity with other related forms like Form 70A and Form 70C. Understanding the similarities and differences between these forms is beneficial for effective tax reporting. These forms each serve different purposes, yet they often overlap regarding information required and filed timelines.

For individuals transitioning from one form to another, or those needing to account for multiple tax scenarios, understanding how to access and fill in these forms using pdfFiller can enhance your filing process significantly. Tasks such as switching between forms or managing multiple tax-related documents can easily be done on the pdfFiller platform.

Accessibility considerations

Accessibility is a key component in the documentation process. Many individuals may require additional support when filling out forms like Form 70B, and resources available through pdfFiller cater specifically to those needs. Should you encounter challenges, numerous online help sections and community forums can offer tailored assistance.

Furthermore, pdfFiller is designed to support diverse users with multi-language options, making it accessible for individuals who may not be fluent in English. This commitment to accessibility widens user engagement and helps ensure that everyone can meet their tax obligations effortlessly.

Optimizing the document management process

Using pdfFiller’s tools can drastically improve how you manage Form 70B and related documents. With options to organize, categorize, and retrieve documents quickly, users can reduce time spent searching for forms or entering repetitive data. The platform’s emphasis on streamlined document management alleviates many of the burdens traditionally associated with paperwork.

Implementing document management best practices, including regular organization and archiving, can transform your approach to handling forms. This systematic organization enables a more efficient workflow, allowing individuals and teams to focus on more critical tasks.

Community feedback and involvement

User experiences can provide valuable insights into effectively utilizing Form 70B and the associated guidelines. Engaging with the community allows individuals to share tips, tricks, and suggestions that can lead to improved practices in filling out tax documents.

Gathering insights about what works and what doesn’t is essential for continuous improvement, whether it’s through forums, social media, or direct feedback through the pdfFiller platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 70b page 111?

How do I edit form 70b page 111 on an iOS device?

Can I edit form 70b page 111 on an Android device?

What is form 70b page 111?

Who is required to file form 70b page 111?

How to fill out form 70b page 111?

What is the purpose of form 70b page 111?

What information must be reported on form 70b page 111?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.