Get the free Payment Auth (self pay)

Get, Create, Make and Sign payment auth self pay

Editing payment auth self pay online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payment auth self pay

How to fill out payment auth self pay

Who needs payment auth self pay?

Payment Authorization Self-Pay Form: How-to Guide

Understanding payment authorization

Payment authorization is the process by which a service provider verifies that a customer has sufficient funds or credit available to make a payment. For individuals opting to self-pay, this verification is crucial. A payment authorization self-pay form is a tool that allows patients or customers to provide their payment details for services rendered without relying on third-party payers, ensuring that payments are processed efficiently and securely.

The importance of payment authorization cannot be understated, especially in today’s healthcare and service sectors, where transparency and financial accountability are paramount. By using a self-pay method, clients have more control over their transactions and can often benefit from direct payments that may lead to lower prices or convenient payment plans.

Self-pay forms essentially serve to document this authorization process, enabling users to outline the payment details while confirming their understanding and acceptance of any applicable terms. A clear understanding of self-pay forms and their significance is vital for all individuals navigating this aspect of transactions.

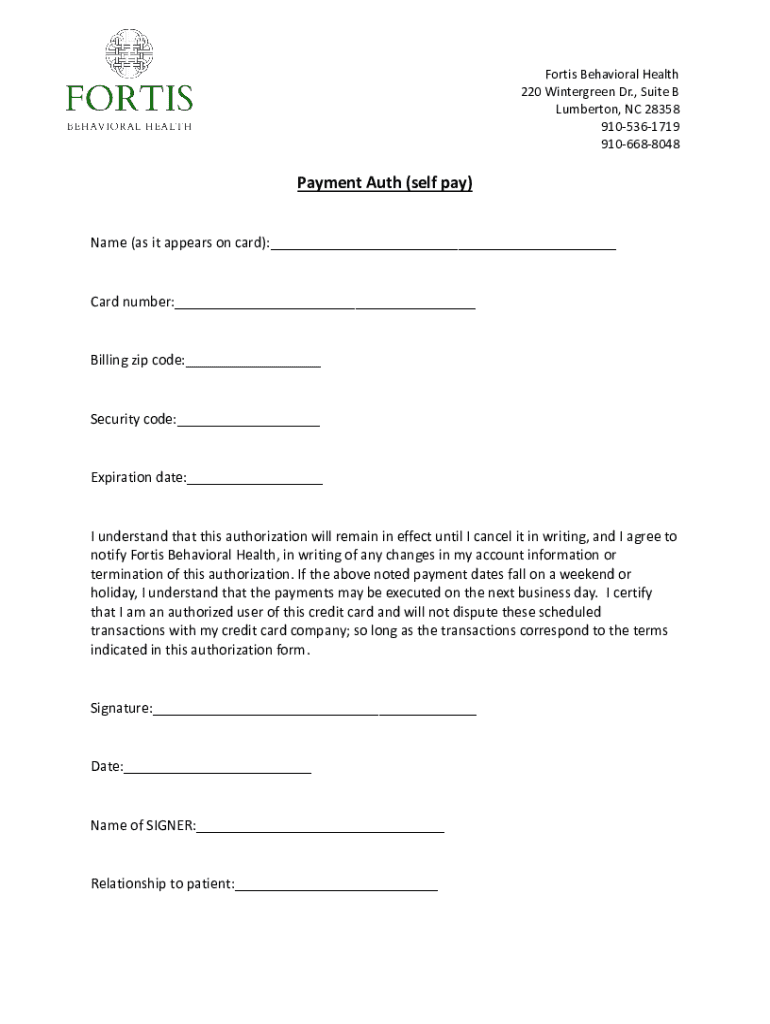

Key features of a self-pay form

A payment authorization self-pay form typically contains several key components. The first section focuses on personal information fields. This includes the individual's name, contact information, and sometimes an identification number, which is essential for verification purposes. This information must be precisely filled out to avoid any delays in processing.

Next comes the payment method options. Here, users can select from various payment channels like credit or debit cards, bank transfers, or other accepted payment methods. Each option will usually come with specific requirements or details that must be filled out accordingly.

Authorization terms and conditions follow, providing the user with crucial information regarding what exactly they are agreeing to with their payment. This may include cancellation policies, service expectations, and disputes handling. It's essential for individuals to read and understand these terms before completing the form.

Accurate information is critical for effective transaction processing. Inaccuracies can lead to payment failures, misunderstandings, or unnecessary delays. Additionally, form design plays a significant role in user-friendliness. Clear layouts and easy navigation can help individuals complete the form with ease.

Steps to fill out a payment authorization self-pay form

Filling out a payment authorization self-pay form involves a series of important steps. First, collect all necessary information. This typically includes personal identification documents, payment details, and any specific information required by the service provider. Tips for gathering accurate details include reviewing statements and confirming with the service provider regarding the required fields.

Next, you can access the payment authorization self-pay form through pdfFiller, where it can be found easily along with additional resources that can aid in filling it out. After retrieving the form, complete it diligently, supplying accurate information in each section. Be mindful to avoid common mistakes, such as skipping required fields or entering incorrect payment information.

After filling out the form, reviewing and verifying information is critical. Ensure that every detail is accurate; errors at this stage can create complications later on. When satisfied that the form is correct, you can submit it through the methods provided by the service provider, commonly via email or direct upload through the pdfFiller platform.

Editing and managing self-pay forms with pdfFiller

After the initial completion of a payment authorization self-pay form, you may need to edit the document for various reasons. pdfFiller offers robust editing tools that allow users to make changes easily. This flexibility is particularly useful for teams working collaboratively, as it allows for team input on document modifications.

Managing revisions is a crucial part of the document lifecycle. With pdfFiller, users can keep track of changes made to the self-pay form, ensuring that they have a record of all adjustments. This feature not only enhances organization but also boosts transparency among team members who may need to refer back to earlier versions.

eSigning the payment authorization self-pay form

The importance of eSignatures in transaction authorization cannot be overlooked. They provide a secure and verifiable method to confirm a user’s consent to the terms outlined in the payment authorization self-pay form. eSignatures increase efficiency and eliminate the need for physical document exchanges.

To add an eSignature using pdfFiller, you will typically find a dedicated option within the document interface. Following simple steps, users can draw, type, or upload their signature. Furthermore, pdfFiller employs multiple security measures to ensure that eSignatures remain safe and tamper-proof, thus providing peace of mind during transactions.

Frequently asked questions (FAQs)

Legal implications associated with a payment authorization self-pay form can be significant. Legal terminology must be understood fully by the signatory. In the event of errors in form submission, users should contact the service provider immediately to rectify misunderstandings.

When payments are authorized or declined, users should expect immediate feedback regarding the transaction status. If one needs to cancel a payment authorization, understanding the conditions surrounding cancelations is crucial. Many service providers will have specific protocols for such requests.

Finally, security remains a prime concern in payment transactions. Using a self-pay form through reliable platforms like pdfFiller is often safe, as it adheres to industry-standard security measures to protect user data.

Additional tips for successful payment management

To maintain accurate payment records, implementing best practices is essential. Creating a process for regularly updating payment information, note-taking during every financial transaction, and using structured templates can go a long way in preventing discrepancies. Keeping your information fresh can additionally help in avoiding complications down the line.

Tools and resources for managing finances related to self-pay transactions are available. Utilizing platforms like pdfFiller not only simplifies form completion but also aids in tracking changes and payments efficiently, integrating all payment processes into a single, user-friendly interface.

Real-life applications of payment authorization self-pay forms

Payment authorization self-pay forms are commonly utilized in various real-life scenarios, particularly in healthcare settings. Patients opting for services ranging from elective surgeries to consultations often use self-pay forms to streamline billing processes and ensure direct payments. This system can also benefit businesses in sectors such as retail or education, where immediate payment is required.

Case studies demonstrate how businesses implement self-pay systems successfully. For instance, clinics with established self-pay models report improved cash flow and reduced administrative burdens. Such implementations show how effective management of self-pay forms can enhance operational efficiencies.

Downloads and templates

For convenience, pdfFiller provides editable templates for payment authorization self-pay forms. Users can download the template and customize it according to their specific needs. Accessing additional related document templates is also straightforward via the pdfFiller platform, offering a comprehensive library of document management resources.

Join our community

Engagement with our community is encouraged. Subscribing for updates on document management tips keeps users informed and connected. Social media platforms also offer a space for sharing insights and experiences related to payment authorization self-pay forms.

We value feedback, and users are invited to share their experiences with payment authorization forms. This communal input can help refine practices and provide support to others navigating similar processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my payment auth self pay directly from Gmail?

Can I create an eSignature for the payment auth self pay in Gmail?

How can I edit payment auth self pay on a smartphone?

What is payment auth self pay?

Who is required to file payment auth self pay?

How to fill out payment auth self pay?

What is the purpose of payment auth self pay?

What information must be reported on payment auth self pay?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.