Get the free 97 direct deposit form template word page 3

Get, Create, Make and Sign 97 direct deposit form

Editing 97 direct deposit form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 97 direct deposit form

How to fill out 97 direct deposit form

Who needs 97 direct deposit form?

Your Complete Guide to the 97 Direct Deposit Form

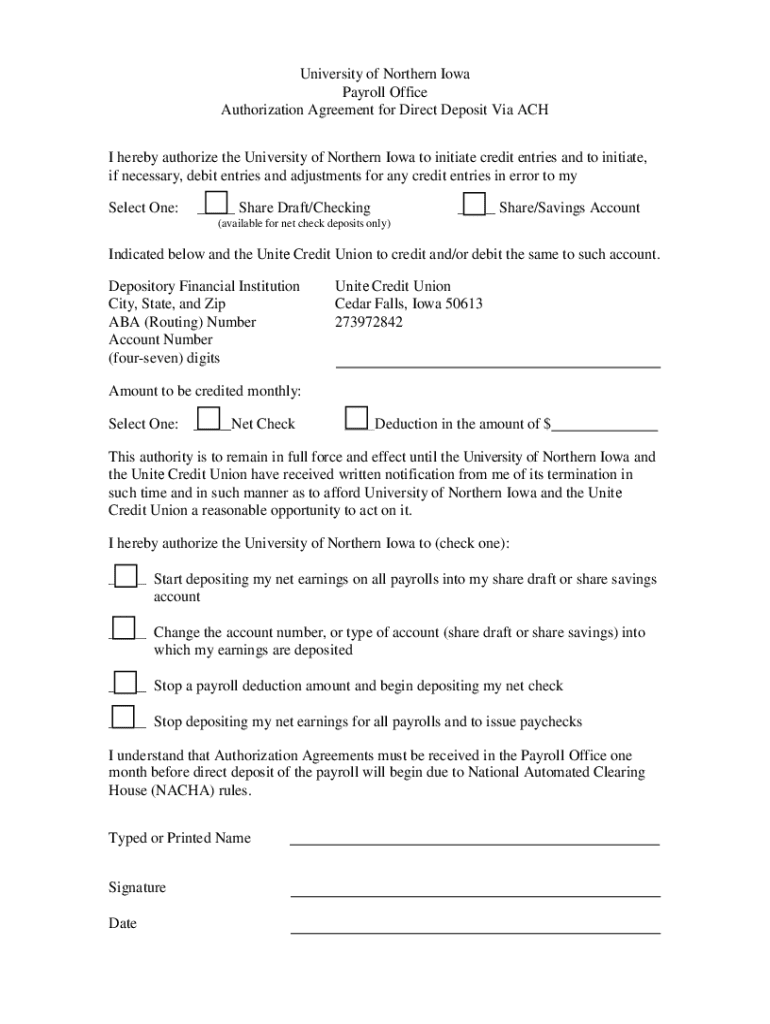

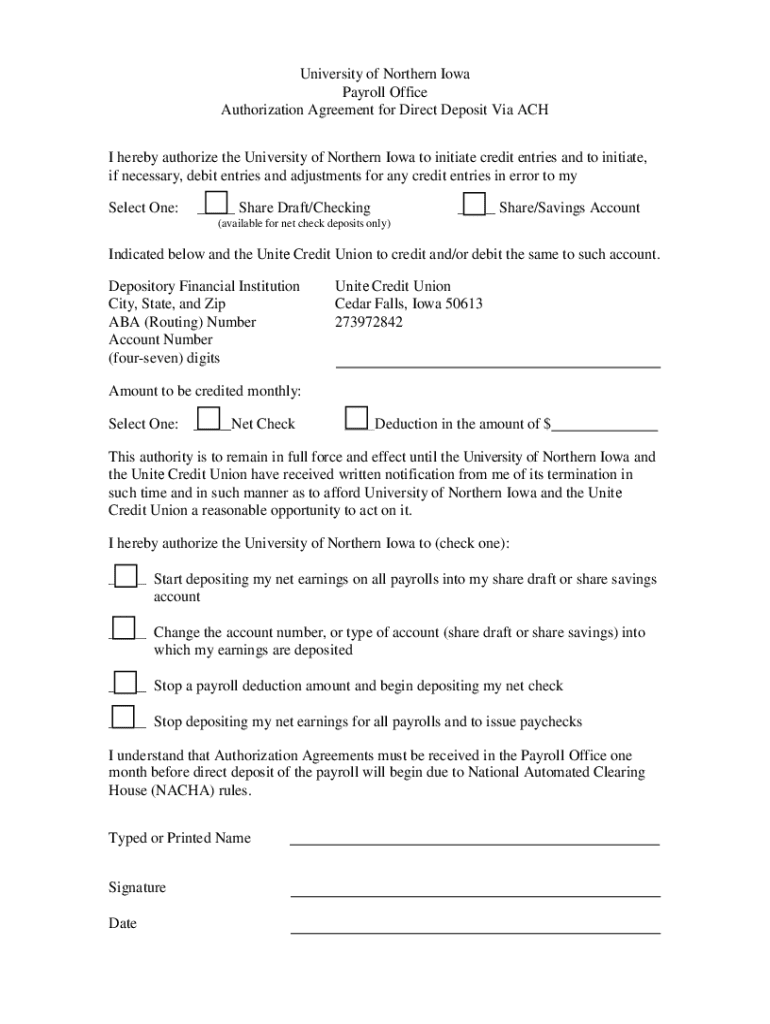

Understanding the 97 direct deposit form

The 97 direct deposit form is a crucial document in the world of electronic pay processing. It’s designed specifically to facilitate automatic payments directly into your bank account from your employer or any other entity that issues regular payments, like government benefits or retirement programs. The primary purpose of this form is to streamline the payment process, ensuring that funds are deposited seamlessly and securely into your account without the need for physical checks.

Direct deposit is essential not only for individuals but also for businesses managing payroll for their employees. For individuals, it means quicker access to funds, minimizing the risk of losing checks. For businesses, utilizing the 97 direct deposit form helps reduce administrative costs and improves cash flow management.

Preparing to fill out the 97 direct deposit form

Before diving into the details of filling out your 97 direct deposit form, it's essential to gather all the necessary information. Start with your personal details, which typically include your full name, home address, and Social Security number. These are crucial for verifying your identity and setting up your direct deposit successfully.

Next, you’ll need your bank information, specifically your bank account number and routing number. This information allows your employer or payment issuer to deposit your funds directly into your designated account. Always ensure that you have the most up-to-date bank information.

Gathering documentation like a valid ID and a recent bank statement will help confirm that the information you provide is accurate.

Step-by-step guide to completing the 97 direct deposit form

Filling out the 97 direct deposit form can seem overwhelming at first, but by following these clear steps, you’ll ensure that you get it done correctly.

Managing your 97 direct deposit form after submission

After submitting your 97 direct deposit form, it’s important to know how to track it and manage any future updates. Start by confirming with your employer or payment processor that the form has been received and is being processed. This can often be done through a quick email or a check-in with payroll.

If you need to change or update your bank details after submission, most employers will require a new form to be filled out. Using pdfFiller, you can easily edit and resubmit the 97 direct deposit form. Be proactive in maintaining your direct deposit status; ensure no changes occur, such as closing or switching bank accounts, without notifying your employer.

Benefits of using pdfFiller for your 97 direct deposit form

Using pdfFiller to manage your 97 direct deposit form offers numerous advantages that simplify the document handling process. One of the standout benefits is streamlined document management. By utilizing a cloud-based solution, you can access your forms anytime, from anywhere, which is especially useful for busy professionals and teams handling payroll matters.

Collaboration features allow multiple team members to work on the document simultaneously, ensuring that all necessary parties can review and sign the form with ease. Additionally, pdfFiller provides a secure eSigning process, ensuring that your signatures are valid and compliant with both federal and state regulations.

Frequently asked questions about the 97 direct deposit form

Many users have questions regarding the 97 direct deposit form, and it’s important to address common inquiries. For instance, what happens if you don’t have a bank account? Alternatives to direct deposit include prepaid debit cards or checks. It's crucial, however, to confirm with your employer what payment options are available.

Another question often asked is whether you can change your account details after direct deposits have started. The answer is yes, but it requires completing a new 97 direct deposit form and informing your employer of the change. Data security is also a prime concern; pdfFiller implements stringent measures to protect your information throughout the entire process.

Additional tips for using the 97 direct deposit form effectively

To ensure that you’re filling out your 97 direct deposit form accurately, it's beneficial to keep a checklist of critical details to verify before submission. These might include confirming your personal information matches your identity documents, double-checking your bank details for accuracy, and ensuring that your signature is clear and matches the one your bank has on file.

Common errors to avoid include entry mistakes in bank account or routing numbers, neglecting to sign the form, or using outdated information. For small businesses and teams dedicated to managing payroll documentation, utilizing a tool like pdfFiller can not only reduce errors but also enhance overall efficiency when collaborating on forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 97 direct deposit form for eSignature?

How do I fill out the 97 direct deposit form form on my smartphone?

How do I complete 97 direct deposit form on an Android device?

What is 97 direct deposit form?

Who is required to file 97 direct deposit form?

How to fill out 97 direct deposit form?

What is the purpose of 97 direct deposit form?

What information must be reported on 97 direct deposit form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.