Get the free Non-Mandatory Central Provident Fund ...

Get, Create, Make and Sign non-mandatory central provident fund

How to edit non-mandatory central provident fund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-mandatory central provident fund

How to fill out non-mandatory central provident fund

Who needs non-mandatory central provident fund?

Non-mandatory Central Provident Fund Form How-to Guide

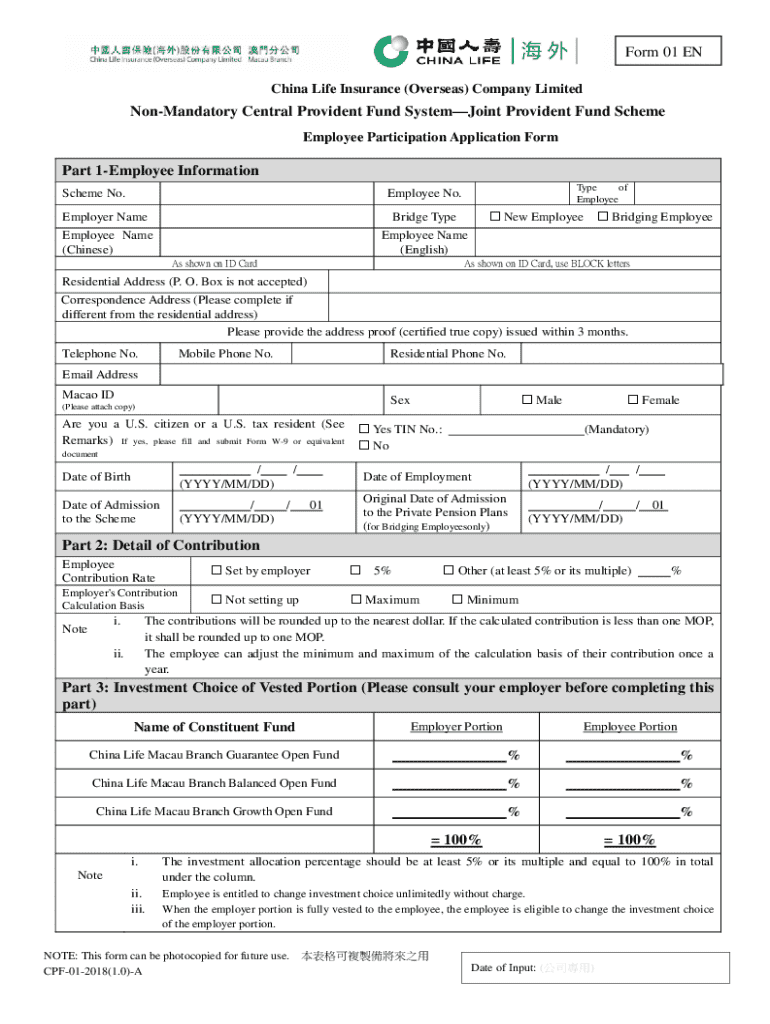

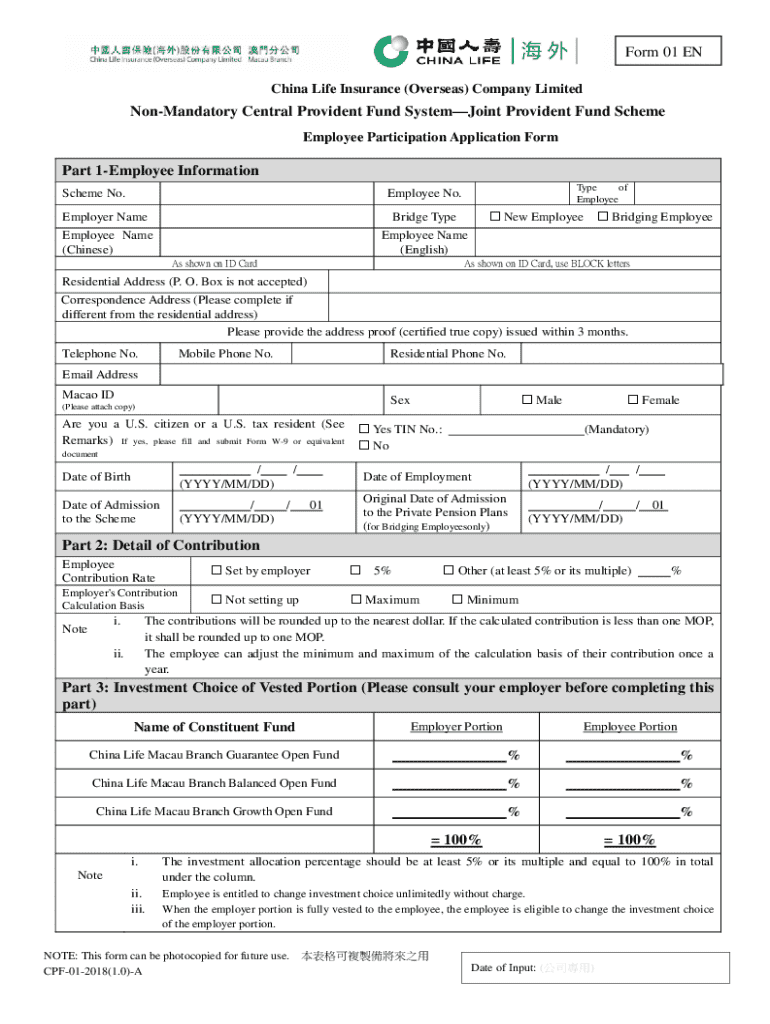

Overview of the non-mandatory Central Provident Fund

The non-mandatory Central Provident Fund (CPF) is an optional savings plan designed to help individuals save for their retirement, healthcare, and housing needs. Unlike the mandatory contributions required for employees under specific employment scenarios, the non-mandatory CPF allows individuals greater flexibility in how they save and manage their funds. This fund not only serves as a safety net but also empowers individuals to build their wealth over time.

Key features of the non-mandatory CPF include varied contribution rates, the ability to select investment options, and potential tax benefits. By participating in the non-mandatory CPF program, individuals can make personalized financial choices that suit their goals and circumstances. Utilizing the non-mandatory Central Provident Fund form is crucial as it facilitates their registration and sets up their account efficiently, ensuring that their contributions are tracked and managed appropriately.

Understanding eligibility criteria

Before enrolling in the non-mandatory CPF, it’s essential to understand the eligibility criteria for both individuals and employers. Generally, eligible participants include individuals looking to augment their retirement savings and employers who wish to offer their employees additional retirement benefits.

Specific requirements for participation often vary by jurisdiction, so it's important to check local regulations to ensure compliance. Documentation may be required for proof of income and identity, which can ease the enrollment process.

Accessing the non-mandatory Central Provident Fund form

To begin your journey with the non-mandatory CPF, you must first find the appropriate form. pdfFiller simplifies this process, allowing users to quickly locate and fill out the necessary documentation.

Navigating the pdfFiller interface is straightforward, with user-friendly buttons to guide you through the filling and editing processes.

Step-by-step instructions for filling out the form

Completing the non-mandatory Central Provident Fund form requires careful attention. Begin with the personal information section, which includes your name, address, and contact details. Ensure all information is accurate, as this section establishes your identity.

Editing and customizing your completed form

Once the non-mandatory Central Provident Fund form is filled out, pdfFiller provides several editing tools to enhance and customize your document further. Users can add text, highlights, and comments to ensure clarity of information.

Additionally, pdfFiller offers various saving and exporting options, allowing users to download the completed form in different file formats such as PDF, DOCX, or XLSX, and provides options for sharing with stakeholders, further enhancing its utility.

Common mistakes to avoid when completing the form

Completing the non-mandatory Central Provident Fund form can be straightforward, but certain common mistakes should be avoided to ensure your submission is approved without delays.

Submitting the form

After completing the non-mandatory CPF form, the next step is submission. Depending on your preference, you can choose online submission or traditional mail.

Upon submission, you should receive a confirmation of receipt, allowing you to track the processing status and expect any feedback or requests for additional information.

FAQs about the non-mandatory Central Provident Fund form

If you have questions about the non-mandatory CPF form, consult the frequently asked questions to find quick answers and solutions to common enrollment issues.

For further inquiries, you can find contact information on the pdfFiller platform or directly on the government agency’s CPF website.

Leveraging pdfFiller for document management

pdfFiller not only simplifies form completion but also enhances document collaboration. With real-time collaboration features, users can work together on forms, ensuring everyone is on the same page—literally and figuratively.

This feature is particularly useful for teams, ensuring seamless projects occur with clarity and accessibility.

Additional tools and resources on pdfFiller

To further assist users in financial management, pdfFiller provides various related forms and templates that can complement the non-mandatory CPF contributions.

These resources enhance user experience, allowing individuals to make informed decisions regarding their financial futures.

Feedback and continuous improvement of the non-mandatory Central Provident Fund form

To ensure that the non-mandatory CPF form remains effective and user-friendly, providing feedback after using the form is key. Feedback helps guide necessary updates and improvements that can transform the user experience.

By participating in this feedback loop, users can help create a more efficient future for everyone involved.

Get started today with pdfFiller

Utilizing pdfFiller for managing your non-mandatory CPF form opens up a world of ease and efficiency. The platform’s accessibility means you can complete and manage documents from anywhere, ensuring that your financial planning remains uninterrupted.

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform, making it the ideal choice for individuals and teams navigating their financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non-mandatory central provident fund in Gmail?

How can I send non-mandatory central provident fund for eSignature?

How do I complete non-mandatory central provident fund on an iOS device?

What is non-mandatory central provident fund?

Who is required to file non-mandatory central provident fund?

How to fill out non-mandatory central provident fund?

What is the purpose of non-mandatory central provident fund?

What information must be reported on non-mandatory central provident fund?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.