Get the free Residency For Tuition Purposes - Registrar's Office

Get, Create, Make and Sign residency for tuition purposes

Editing residency for tuition purposes online

Uncompromising security for your PDF editing and eSignature needs

How to fill out residency for tuition purposes

How to fill out residency for tuition purposes

Who needs residency for tuition purposes?

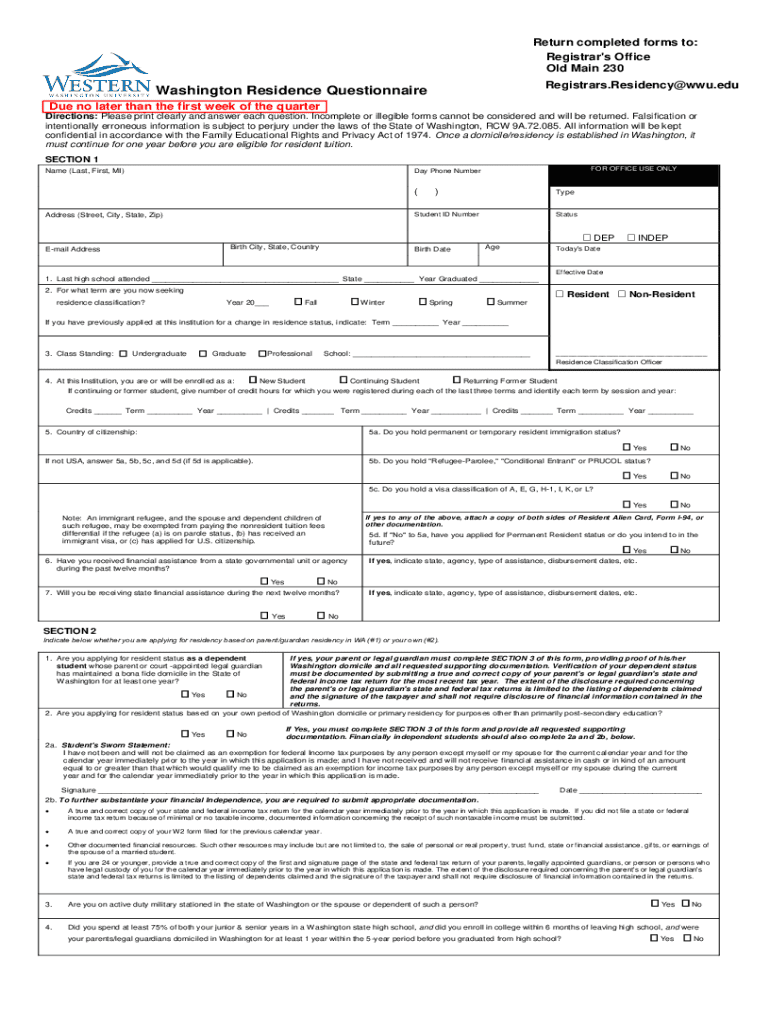

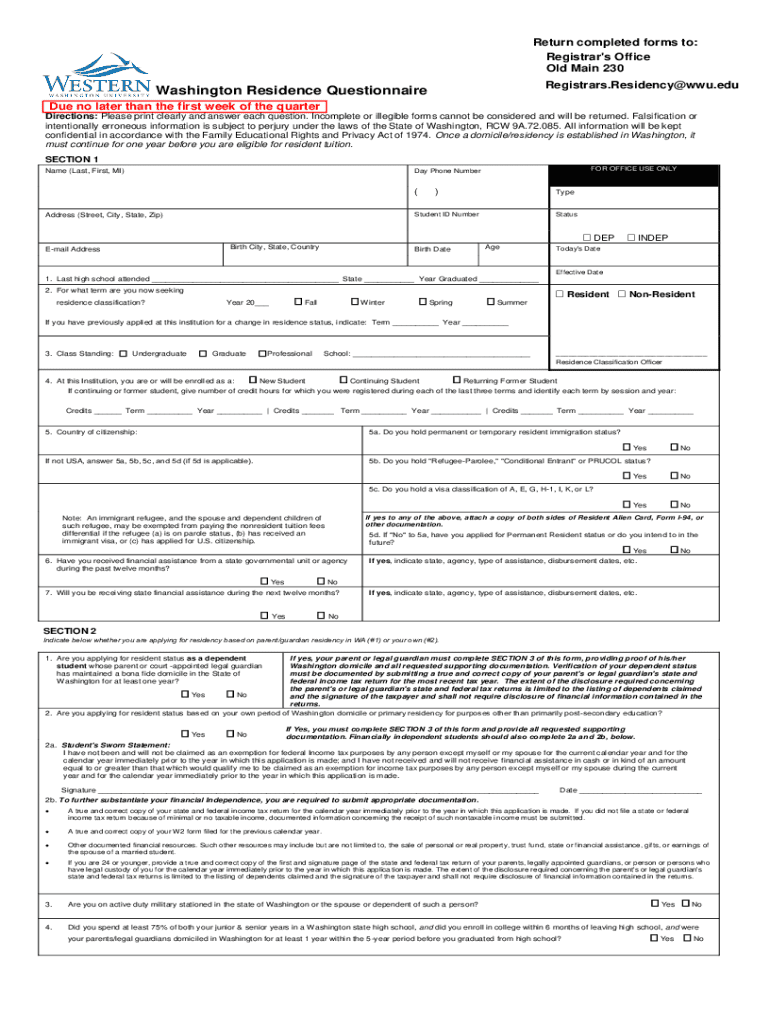

Understanding the Residency for Tuition Purposes Form

Understanding residency for tuition purposes

Residency for tuition purposes refers to the classification of students based on their state of residence when it comes to college tuition fees. This classification is crucial because it directly affects how much students must pay for their education. In many states, residents pay significantly lower tuition compared to non-residents, making the residency status a vital aspect of financial planning for prospective college students.

Moreover, understanding residency status is essential for educational institutions to enforce their tuition policies fairly. It allows schools to manage their resources adequately and provide state residents with priority access to public educational opportunities. Thus, grasping the nuances of the residency for tuition purposes form becomes central to both students and educational administration.

Types of students and their residency status

Students can generally be categorized into two distinct groups when discussing residency status: dependent and independent students. Dependent students are typically those who still rely on their parents or guardians for financial support, while independent students are responsible for their own financial affairs, including housing and tuition.

Understanding the distinction between these two student categories is essential because it influences how residency status is evaluated. Dependent students may need to provide documentation regarding their parents' residency, while independent students focus on their residency criteria.

Establishing residency

To establish residency in [State], students must navigate specific guidelines set forth by the local educational authority. While the detailed criteria might vary, generally, students are required to reside in the state for a predetermined duration, which, in many cases, is at least 12 continuous months prior to enrollment in a state-supported college or university.

Key factors that the educational institutions consider include the student's intent to remain in the state, the timing of their move, and their overall connection to the state, such as employment, family ties, or property ownership. Evidence demonstrating these connections is crucial for validating residency claims.

Required documentation for residency verification

When submitting the residency for tuition purposes form, applicants must prepare a set of documents that will act as proof of residency. Generally, the documentation includes proof of address, identification documents, and sometimes more specific records depending on the student's status.

Additionally, the required documentation may differ between dependent and independent students. For independent students, additional documents such as tax returns or pay stubs may be needed to establish financial independence. Dependent students might be asked for their parents' documents to establish residency claims through family support.

Completing the residency for tuition purposes form

Completing the residency for tuition purposes form requires attention to detail. The process begins with downloading the form from the educational institution's website, usually available in a PDF format. Once downloaded, students must fill out basic personal information including their name, date of birth, and address.

Submitting your residency information

Once the residency form is complete, students must submit it following the guidelines set forth by the institution. Most institutions offer various methods for submission, including online portals for ease of access. For those preferring traditional methods, hard copies can be mailed directly to the designated office.

It's also important for students to be aware of deadlines. Initial submissions usually have strict deadlines, while requests for reclassification might have different timelines depending on the institution's policies. Missing these deadlines could result in being classified as a non-resident, impacting tuition fees.

Exceptions and special cases

While most students follow standard residency guidelines, there are notable exceptions to these rules. For instance, some states may offer residency fee waivers for non-resident students under certain conditions. These exceptions often apply to military families, providing them with unique considerations regarding residency status due to frequent relocations.

Residency appeals process

If a student’s residency status is denied, they have the right to appeal the decision. The appeals process typically involves submitting a formal appeal letter to the designated office, along with any supporting documentation that may strengthen the case for residency.

Timelines for the appeal process can vary, so it’s essential to act promptly to seek out important dates and requirements to avoid unnecessary delays in getting a resolution.

Tuition fee waiver information

For students who may not meet residency guidelines, exploring tuition fee waivers can provide an avenue for financial relief. Fee waivers might be available to certain eligible students, including veterans, dependent students of veterans, or others with specific financial needs.

Frequently asked questions (FAQs) about residency for tuition purposes

Prospective students often have many questions about residency determination. Addressing these questions can clarify concerns and improve understanding regarding residency for tuition purposes.

Resources for further assistance

For students seeking additional guidance, several resources are available. Many institutions have dedicated financial aid offices that can offer personalized advice related to the residency for tuition purposes form and the application process. Additionally, students are encouraged to refer to their state’s educational department website for detailed information on residency policies.

Navigational links and tools

PDFfiller provides excellent resources to assist users in managing forms and documents related to residency for tuition purposes. Whether you need to complete, edit, or e-sign your residency forms, dedicated tools are available to support you throughout the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my residency for tuition purposes in Gmail?

How can I modify residency for tuition purposes without leaving Google Drive?

How do I fill out residency for tuition purposes on an Android device?

What is residency for tuition purposes?

Who is required to file residency for tuition purposes?

How to fill out residency for tuition purposes?

What is the purpose of residency for tuition purposes?

What information must be reported on residency for tuition purposes?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.